Tuesday December 8, 2020

Radio Ratings 2020, Survey 8: Highlights + Full Results

Sydney

• Ben Fordham grows share to 17.1% as 2GB ranks #1 again

• Kyle and Jackie O climb and finish 2020 as #1 FM, bonus guaranteed

UP: KIIS 106.5 +1.0

DOWN: WSFM -1.0

Read more: Sydney Radio Ratings 2020: Survey 8

Loading...

Loading...

Melbourne

• 3AW share dips, but Ross and Russ still double next best

• Gold 104.3 and Christian O’Connell maintain 2020 FM winning streak

UP: 101.9 Fox FM +1.5

DOWN: 3AW -1.0

Read more: Melbourne Radio Ratings 2020: Survey 8

Loading...

Loading...

Brisbane

• Nova 106.6 with Kip, Ash, Luttsy & Susie unbeatable combo

Read more: Brisbane Radio Ratings 2020: Survey 8

Loading...

Loading...

Adelaide

• Mix 102.3 #1 station, Fiveaa’s David & Will #1 breakfast

UP: SAFM +0.9

DOWN: Mix 102.3 -1.7

Read more: Adelaide Radio Ratings 2020: Survey 8

Loading...

Loading...

Perth

• Nova 93.7 with Nathan, Nat & Shaun close off the year at #1

UP: Nova 93.7 +1.8

DOWN: 96FM -1.9

Read more: Perth Radio Ratings 2020: Survey 8

Loading...

Loading...

Radio’s highest paid: How team Kyle negotiates a new deal with ARN

Wednesday: Our final instalment in Kyle Sandilands week with his thoughts on syndicated breakfast, the arrival of Hughesy, Ed and Erin into the Sydney market and keeping radio simple.

Listen to the unedited and uncensored Kyle and Bruno podcast here.

Radio contract negotiations

Who sits at the table when Sandilands renews a deal?

KS: “Ciaran Davis and Duncan Campbell from ARN, and myself with [manager] Bruno [BB] and Greg Sitch, our lawyer and one of the best entertainment lawyers in the world. I will go to the first meeting where it is all just cakes and smiles. I will leave and tell Greg and Bruno what I want and how I want it.

“They will then argy-bargy back and forth because I can’t put up with it. My demands are always fair, never outrageous. A lot of other people will think it is outrageous.”

Sandilands said he is right at the end of the first deal he and Jackie signed with ARN. He starts a new deal next year with three years remaining.

Sandilands said fewer radio surveys in 2020 meant less bonus payments for ranking #1 FM. He also noted he gets a ‘share of profit’ bonus.

ARN pay Sandilands and Jackie O an amount they need to get back from advertisers. “It’s going to be hard to get that back,” said Sandilands in a reference to the big payday the breakfast hosts negotiated.

Staying on air until 10am and later is not part of earning his salary.

“They want me off air at 9am,” he stressed.

BB: “I’ve had management say they’ll buy me a car if I can get Kyle off air at 9am.”

Sandilands then explained his ad load strategy, but it’s complicated…listen to the podcast!

Kyle and Bruno: He’s not heavy, he’s my manager

He also mentioned the ARN contract with the stars which runs to 300 pages. Sandilands can’t be fired for any reason. “That’s right,” he explained. “It’s always somebody else’s fault, not mine.”

Sandilands doesn’t have to have a censor, although he’s happy for it as it acts as a safety net. One that is used quite often!

Sandilands signs off on every KIIS employee that comes and goes, “including senior management”. He added: “They can’t sell the place and have some loser show up. I have to agree.”

The next big radio deal

Do you have a big radio deal left in you?

“Sure. We’ve been with ARN for seven years. When Bruno was brought into my company he realised the sort of money I was earning. He knew roughly, but didn’t know the detail. I told him I was well and truly at the ceiling of what I was going to get in Australia. But I am always trying to broaden the reach and get more money.

Kyle and Jackie O with Sophie Monk

“I have already had a conversation with the head of Spotify in the US. A very informal chat about radio and what we do on our show. Also Amazon have asked where are we at with contracts. I have said I am really happy on radio at the moment. iHeartRadio is doing well for us and gets the reach out around the world which I love. I am really happy with ARN, but I don’t know what the future holds. The show may stay with ARN, iHeartRadio might turn into something different, or Amazon may come along and say we’ll give you all this.

“[Any new deal] won’t be just money driven. I don’t want it to be too hard or for people to have to pay to hear us. We should always be free. I don’t mind if it was on a platform. If iHeartRadio said they want to film it like TV and then charge people to watch it, I’d say that’s OK.”

The dream of success in the US

“I was reading an article one day and Tracy Johnson, one of the world’s biggest radio consultants ever, said there was only two radio shows worth listening to – The Howard Stern Show and The Kyle and Jackie O Show. I nearly fell of my chair. I was so excited.

“There has been some discussion in the past about the US. One of the networks wanted to syndicate our show in the US on FTA FM. But when they sent back the edited version of how they could legally broadcast the show, I thought it was way too sanitised. There was no edginess and all the smut was gone.

“Sirius XM has also made contact. Every year Howard Stern says he is going to leave and they wonder what they will do. Their ‘Break Glass in the Case of an Emergency’ is to ask ‘What is Sandilands doing?’

“I have said to Bruno, let’s not chase that. If we ever did that, we would have to reimagine everything for a worldwide audience, not just Australia.

“We are happy where we are and we are committed to ARN for at least three more years.”

See also: 10 Reasons Kyle & Jackie O Are One of The World’s Best Morning Shows

They’re not just the best show in Australia. They may be the best radio show in the world.

See also: Inside King Kyle Group – Nueva Sangria, investment strategy, developing a cartoon series

—

Top Photo: Kyle and Jackie O celebrate 20 years in radio with ARN’s chief contract negotiators Ciaran Davis and Duncan Campbell

Zenith adspend forecast: Ecommerce and video fuel faster recovery

The global ad market has recovered more rapidly than expected from the severe slump in Q2 caused by the coronavirus pandemic and is now forecast to shrink by 7.5% to US$587bn across 2020 as a whole, according to Zenith’s Advertising Expenditure Forecasts. This is a marked improvement on Zenith’s forecast of a 9.1% decline in July.

Zenith predicts that global adspend will grow by 5.6% to US$620bn in 2021, boosted by the favourable comparison with 2020, as well as the delayed Summer Olympics and UEFA Euro football tournament. Despite this bump, spending will remain below the US$634bn spent in 2019. In 2022, adspend will grow by 5.2% to reach US$652bn, exceeding 2019 by US$18bn, though it will be about US$70bn lower than it would have been if it had remained on its pre-pandemic track.

In Australia, the estimated decline is forecast to be 12% in 2020. It’s not expected that 2021 will represent a bounce back to pre-COVID levels at a total market level. Zenith is forecasting an 8% growth in 2021.

By 2022, Zenith anticipates the overall market being back to 2019 levels, although this will vary by channel and will be largely driven by digital revenues. BVOD will continue to see exponential growth and will account for 10% of TV network revenue by 2022, although it will not negate the losses linear TV experienced in 2019.

The channels that have been directly impacted by COVID-19 restrictions – cinema and OOH – will see double-digit increases next year, as will linear radio. However, ad spend in these three channels may not fully return to pre-COVID levels until 2023.

Zenith Australia’s national head of investment Elizabeth Baker said: “We’re expecting that the New Year will start showing growth across most media, as the market starts to claw back on this year’s losses. However, we don’t expect the 2020 drop to be fully mitigated before 2022 at best. Digital investment will lead the growth, with consumption accelerated throughout this pandemic.”

Commenting on the outlook, Seven’s network sales director Natalie Harvey said: “The shape of the categories that make up the ad spend market in Australia will change. Big international travel brands will be replaced by state-based tourist organisations and local operators. E-commerce will continue to fire really hard and we will also see some tradition bricks and mortar retailers going very hard as well as Australian’s look to improve their homes they are going to be spending a lot of money to do that.

“Cinemas and outdoor should rebound very well considering the base they are coming off.”

Zenith said its forecasts assume that the global economy will start a sustained recovery as Covid-19 vaccines are introduced in 2021, and are subject to the wide uncertainty over how rapid this recovery will be.

Digital transformation is rapidly shifting budgets to digital advertising

Zenith predicts that global digital adspend will rise 1.4% in 2020, and increase its share of total adspend to 52%, up from 48% in 2019. The pandemic has forced brands to step up their digital transformation, as ecommerce has proved a vital tool for maintaining relationships with existing customers, mitigating the loss of in-store sales, and even finding new customers.

The growth of ecommerce is not expected to reverse once the world starts to recover from the coronavirus pandemic. Now that brands have proved the value of digital transformation under stress, they are likely to press ahead with it enthusiastically, devoting even more of their budgets to digital advertising. Zenith forecasts that digital advertising will account for 58% of global adspend by 2023.

Advertising on connected TV is compensating for the rise of SVOD

Consumers’ viewing habits have been evolving for years, but 2020 saw a real step change as online video platforms benefited from a long-term boost to awareness and demand. Forced to spend much more time at home, consumers flocked to existing SVOD platforms like Netflix, which added 25 million new subscribers in the first half of the year, and new ones like Disney+, which achieved its five-year growth target in just nine months.

Importantly for advertisers, who are locked out of SVOD platforms, demand for ad-funded video on demand (AVOD) has been even stronger, especially on connected TV sets. Between January and April 2020, the reach of SVOD services on connected TV in the US rose by 5%, but the reach of AVOD services rose by 9% to 58.5 million households, or 48% of the total.

GroupM’s global forecast reports advertising weathered the storm

This is a much better expectation than its June forecast of an 11.9% decline for 2020, but still a sharp fall from 2019’s 8.7% growth rate. Based on the resiliency of digital advertising through the pandemic, GroupM updated its 2021 outlook for the global advertising market from our June forecast of 8.2% to 12.3% growth.

Digital advertising is expected to grow by 8.2% during 2020, excluding US political activity. This follows nearly a decade of double-digit growth, including the last six years, when it was better than 20% globally.

• Digital advertising for pure-play media owners like Amazon, Facebook, Google, etc., should be 61% of advertising in 2021. This share has doubled since 2015 when it was only 30.6%.

• By 2024, GroupM estimates digital advertising will have 66% share globally.

Television advertising will decline by 15.1% excluding US political advertising, before rebounding to grow 7.8% next year.

• Digital extensions and related media, including advertising associated with traditional media owners’ streaming activities (primarily on connected environments), will grow 7.8% this year and 23.2% next year.

Outdoor advertising is estimated to decline by 31% during 2020, including digital out-of-home media. Next year should see a partial rebound, with 18% growth.

• Beyond 2021, GroupM expects outdoor advertising to grow by low or mid-single digits and generally lose share of total advertising; however, expect larger brands generally to allocate more of their budgets to the medium.

Print advertising, including newspapers and magazines, is expected to decline 5% for the year, a significant acceleration over the high-single-digit declines of recent years. However, those single-digital declines should resume following an economic recovery.

Audio advertising is likely to decline by 24% during 2020 as advertisers disinvest, in part, because of the medium’s dependence on away-from-home activities, such as driving. Digital extensions, including streaming services from terrestrial stations and their digitally oriented competitors and podcasts, still attract relatively small audiences of a few billion, but help make the broader medium more appealing to marketers.

Mark Lollback (pictured), GroupM Australia CEO says: “Locally we saw the acceleration of trends like E-commerce which has drawn closer ties between marketing activity and purchasing as well as growth in BVOD audiences. Despite the challenges, within the disruption of this year there have been many opportunities to connect with consumers in different ways. Understanding the role media channels play overall in delivering objectives and enabling clients to maximise flexibility around consumer consumption trends in the short term, alongside long-term marketing goals are necessary as we move out of 2020. We have a sense of optimism going into 2021 and if we continue to lean into technology and the talented specialists in our agencies, and work closely with our media partners, we can continue to deliver outcomes for or clients and help drive the Australian economy forward.”

Box Office: The War with Grandpa fights its way to #1

This was more than double any other film in Australia over the weekend but the total was not enough to stop the domestic box office from declining by 2% after making a $3.28m total.

The film was the only new entry in the top five this week and bumped out Trolls World Tour which slipped to #6 after 15 weeks of release after making $8.57m.

#1 The War with Grandpa $942,015

After being filmed in 2017 the family comedy has finally made it to theatres across the globe. Despite mixed reviews, the movie has had a dominant first week of release averaging $2,962 on 318 screens.

#2 Tenet $426,936

After 15 weeks the sci-fi blockbuster continues to find itself in the top five after being the most notable release since cinemas re-opened. The film averaged $2,737 on 156 screens.

#3 Happiest Season $419,939

The holiday flick has slipped from #1 to #3 in its second week of release. The ensemble cast managed to garner an average of $1,609 on 261 screens as it continues to be the most prominent release of 2020.

#4 Let Him Go $201,750

The neo-western starring Kevin Costner and Diane Lane continues to stay in the top five for a second week after averaging $820 on 246 screens.

#5 Rams $150,191

The Australian comedy-drama has made a total of $4.01m over the last six weeks as it continues to drive fans into theatres after averaging $653 on 230 screens.

TV ratings: Summer survey, Monday Week 50 2020

Nine ranked #1 with its combo of Nine News, A Current Affair and Gold Coast Cops helping attract the biggest audience. Much of the rest of the night on Nine was taken up with 1984’s Indiana Jones and the Temple of Doom.

Seven’s only entries in the top 20 were for Seven News and the 7pm’s Better Homes and Gardens Summer.

10’s best were The Project and a replay of All Aussie Adventures later at 8.30pm.

Making the list of the top 10 programs was the final episode of ABC’s Media Watch for the year with 445,000 watching as the program finished with a summary of word of the year nominees. Another season final on the ABC was Australian Story with 526,000.

Week 49: Monday

| MONDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 14.4% | 7 | 15.3% | 9 | 16.9% | 10 | 8.7% | SBS One | 6.5% |

| ABC KIDS/ ABC COMEDY | 3.7% | 7TWO | 4.3% | GO! | 3.1% | 10 Bold | 5.3% | VICELAND | 1.8% |

| ABC ME | 0.7% | 7mate | 2.8% | GEM | 3.2% | 10 Peach | 3.6% | Food Net | 0.8% |

| ABC NEWS | 1.7% | 7flix | 1.5% | 9Life | 2.7% | 10 Shake | 0.5% | NITV | 0.1% |

| 9Rush | 1.6% | SBS World Movies | 0.9% | ||||||

| TOTAL | 20.5% | 23.9% | 27.5% | 18.0% | 10.0% | ||||

| MONDAY REGIONAL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | |||||

| ABC | 13.9% | 7 | 18.6% | 9 | 14.3% | WIN | 8.6% | SBS One | 5.4% |

| ABC KIDS/ ABC COMEDY | 2.5% | 7TWO | 5.7% | GO! | 3.1% | WIN Bold | 6.7% | VICELAND | 2.2% |

| ABC ME | 0.9% | 7mate | 3.4% | GEM | 3.9% | WIN Peach | 2.6% | Food Net | 0.5% |

| ABC NEWS | 1.3% | 7flix (Excl. Tas/WA) | 1.4% | 9Life | 2.7% | Sky News on WIN | 1.9% | NITV | 0.1% |

| SBS Movies | 0.8% | ||||||||

| TOTAL | 18.6% | 29.2% | 24.1% | 19.8% | 9.1% | ||||

| MONDAY METRO ALL TV | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FTA | STV | ||||||||

| 80.4% | 19.6% | ||||||||

Monday FTA

- Seven News Seven 926,000

- Seven News At 6.30 Seven 922,000

- Nine News 6:30 Nine 886,000

- Nine News Nine 882,000

- A Current Affair Nine 646,000

- ABC News ABC 639,000

- 7.30 ABC 546,000

- Australian Story ABC 526,000

- The Chase Australia Seven 491,000

- Media Watch ABC 445,000

- The Project 7pm 10 432,000

- Hot Seat Nine 419,000

- Countdown To Disaster ABC 405,000

- Better Homes And Gardens Summer Seven 398,000

- Gold Coast Cops Nine 396,000

- 10 News First 10 337,000

- The Chase Australia-5pm Seven 316,000

- All Aussie Adventures (R) 10 298,000

- Hot Seat -5pm Nine 293,000

- The Project 6.30pm 10 285,000

Demo Top Five

16-39 Top Five

- Nine News 6:30 Nine 112,000

- Seven News Seven 100,000

- Seven News At 6.30 Seven 98,000

- Nine News Nine 97,000

- The Project 7pm 10 86,000

18-49 Top Five

- Nine News 6:30 Nine 212,000

- Nine News Nine 197,000

- Seven News At 6.30 Seven 189,000

- Seven News Seven 186,000

- The Project 7pm 10 166,000

25-54 Top Five

- Nine News 6:30 Nine 260,000

- Nine News Nine 250,000

- Seven News At 6.30 Seven 249,000

- Seven News Seven 238,000

- The Project 7pm 10 211,000

Monday Multichannel

- NCIS (R) 10 Bold 195,000

- NCIS Ep 2 (R) 10 Bold 192,000

- NCIS Ep 3 (R) 10 Bold 177,000

- Bluey AM ABCKIDS/COMEDY 163,000

- Doc Martin PM 7TWO 159,000

- Bluey ABCKIDS/COMEDY 158,000

- Love Monster AM ABCKIDS/COMEDY 145,000

- Hey Duggee ABCKIDS/COMEDY 137,000

- Spicks And Specks Ep 2 ABCKIDS/COMEDY 135,000

- Peppa Pig AM ABCKIDS/COMEDY 135,000

- Spicks And Specks ABCKIDS/COMEDY 133,000

- Dog Loves Books ABCKIDS/COMEDY 133,000

- Neighbours 10 Peach 131,000

- Coming To America 9GO! 126,000

- Peppa Pig PM ABCKIDS/COMEDY 123,000

- Go Jetters PM ABCKIDS/COMEDY 122,000

- The Big Bang Theory Ep 3 10 Peach 120,000

- Book Hungry Bears AM ABCKIDS/COMEDY 118,000

- The Big Bang Theory Ep 2 10 Peach 116,000

- Andy’s Wild Adventures ABCKIDS/COMEDY 116,000

Monday STV

- Live: F1: Sakhir Race FOX SPORTS 506 63,000

- Credlin Sky News Live 60,000

- Paul Murray Live Sky News Live 58,000

- Chris Smith Tonight Sky News Live 58,000

- Inside The News Sky News Live 42,000

- The Third Day FOX SHOWCASE 41,000

- Coronation Street UKTV 36,000

- Live: AUS A V IND A Tour Match FOX CRICKET 34,000

- Peppa Pig Nick Jr. 33,000

- Peppa Pig Nick Jr. 33,000

- Peppa Pig Nick Jr. 33,000

- NCIS FOX Crime 33,000

- Border Security: Australia’s Front Line FOX8 32,000

- 24 Hours In Emergency Lifestyle Channel 32,000

- Peppa Pig Nick Jr. 31,000

- Peppa Pig Nick Jr. 31,000

- Peppa Pig Nick Jr. 31,000

- The Kenny Report Sky News Live 31,000

- Peppa Pig Nick Jr. 30,000

- Selling Houses Australia Lifestyle Channel 29,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2018. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Business of Media

Backbenchers ask if Twitter and YouTube should pay media too

A group of about 20 Coalition backbenchers signed-off on the final version of a new media bargaining code after receiving a private briefing by Josh Frydenberg and Communications Minister Paul Fletcher on Monday.

Attendees at Monday’s backbench committee meeting told The Australian the legislation included the public broadcasters – SBS and the ABC – and would have a compulsory arbitration mechanism to compensate media companies for their content used by the two tech giants. Facebook and Google will also be permitted to count the monetary worth of online readers they deliver to news websites in order to help calculate how much they owe.

Village Roadshow takeover marks the end of an era

Tonagh’s success at Village comes less than six months after he was heavily involved in the rescue of AAP, the 85-year-old newswire. He was the public face of a successful takeover of AAP by a group of business people and philanthropists.

In the Village deal, Tonagh provided much-needed independent governance as the 66-year-old company founded by Roc Kirby moved into the ownership of private equity.

Tonagh, a former News Corp executive and former CEO of Foxtel, has witnessed plenty of disruption in his career. But he would never have seen an industry turned on its head in the space of nine months as happened with cinemas.

Refreshed theme for Village parks after BGH takeover

The takeover comes after years of infighting, and then peacemaking, among the founding Kirby family, which started receiving overtures from private equity suitors in the middle of last year before the pandemic struck.

Melbourne-based BGH, led by Ben Gray, knocked out rival bidder Pacific Equity Partners, but then slashed its own bid as the pandemic swept the globe. Investors revolted against its low-ball offer and forced it to sweeten it to get the deal done.

Universal Music Group acquires Bob Dylan’s entire songwriting catalogue

UMPG Chairman & CEO Jody Gerson said, “To represent the body of work of one of the greatest songwriters of all time – whose cultural importance can’t be overstated – is both a privilege and a responsibility. The UMPG global team is honoured to be Bob Dylan’s publishing partner and I especially want to acknowledge Marc Cimino whose passion and perseverance were instrumental in bringing this opportunity to us. We look forward to working with Bob and the team in ensuring his artistry continues to reach and inspire generations of fans, recording artists and songwriters around the world.”

It has been estimated the deal is valued at as much as $400m.

Sir Lucian Grainge, Chairman and CEO of Universal Music Group, said, “As someone who began his career in music publishing, it is with enormous pride that today we welcome Bob Dylan to the UMG family. It’s no secret that the art of songwriting is the fundamental key to all great music, nor is it a secret that Bob is one of the very greatest practitioners of that art. Brilliant and moving, inspiring and beautiful, insightful and provocative, his songs are timeless—whether they were written more than half a century ago or yesterday. It is no exaggeration to say that his vast body of work has captured the love and admiration of billions of people all around the world. I have no doubt that decades, even centuries from now, the words and music of Bob Dylan will continue to be sung and played – and cherished – everywhere.”

UK music streaming startup backed by Kylie secures £13m funding

The investment puts the firm on track for a potential £200m flotation on London’s stock market.

Roxi touts itself as the world’s first “made for TV” music experience, offering products including karaoke and a 55m song catalogue, and is currently available on Sky’s Q service and Google’s Android TV.

Last month it announced Minogue as an investor in a three-year deal that includes fronting its advertising campaigns.

The funding round, the first to bring on an institutional investor, includes figures such as Henrik Holmark, the former finance chief at the music service Pandora, and Chris Wright, the founder of Chrysalis Records. Other backers include Lorna Tilbian, the chairman of Dowgate Capital and a former board member at the ad group M&C Saatchi, and Roxi’s chairman, Rupert Howell, a former senior executive at ITV and the publisher of the Mirror.

Existing investors include the McLaren Group founder, Ron Dennis, and Paul McGuinness, the former manager of U2.

News Brands

AFR’s columnist Joe Aston defends calling businesswoman a cretin

Elaine Stead, former managing director of venture capital at the now-defunct fund manager Blue Sky Alternative Investments, is suing the Financial Review and its columnist Joe Aston over two columns in February and October 2019, the first of which labelled her a “cretin”.

The US-based Aston returned to Australia to give evidence in the proceedings on Monday and agreed he was fearless in his use of language. He disagreed he was shocking or offensive, preferring the term “colourful”.

Asked if he needed to push boundaries to sell papers, he responded: “No, it’s not an imperative of mine, no.”

Elaine Stead defamation trial: I’m Joe Aston and she’s clearly a cretin

“Not a very popular one,” he cheerfully replied.

It was a nice, light quip, one of several to punctuate the evidence being given at a Federal Court defamation trial involving The Australian Financial Review’s star columnist and the venture-capitalist, reports The Australian’s Caroline Overington.

Aston has come halfway around the world – he lives and works in Los Angeles these days – to defend what he says is his right to publish an honestly held opinion about Dr Stead, who says her reputation was irreparably damaged when Aston called her, among other things, stupid, and a cretin.

And yes, he told the court, he knows that’s a tautology.

The New Daily loses $2.8m, Industry Super to inject fresh worker funds

The site was $2.8m in the red in 2019-20 – believed to be its worst-ever result – bringing total deficits over the past four years to nearly $11m.

Revenue fell to just $225,000 last financial year while expenses increased to more than $3m.

The website’s financial performance is disclosed in the accounts of parent company Industry Super Holdings Pty Ltd (ISH), chaired by former ACTU boss and Labor federal cabinet minister Greg Combet.

Keeping The New Daily afloat since 2011 appears to have cost as much as $28m, although ISH wouldn’t give an exact figure.

Television

AFTRS partners with producers/broadcasters for 2020 Graduate Program

AFTRS has announced the five recipients of its expanded 2020 AFTRS Graduate Program, an industry partnership between AFTRS, Australia’s leading screen and broadcast school, and the ABC, Endemol Shine Australia, Fremantle Media, SBS and Sky News Australia.

The Graduate Program creates employment pathways for the most creative, skilled and motivated AFTRS graduates from the Bachelor of Arts (Screen). In a fiercely competitive industry, the program gives them exposure, training and a chance to experience roles in everything from development and production to marketing and programming during a 13-week paid engagement with a participating host organisation.

In 2020, five AFTRS graduates have secured places in the Graduate Program. Belinda Parry will join the ABC, Jaimie Conlon will join Endemol Shine, Grace Anderson will join Fremantle Media, Danielle Abou Karam has joined SBS, and Otto Khoo will join Sky News Australia’s Sydney bureau.

Nell Greenwood, AFTRS CEO, said: “AFTRS is so delighted with the expansion of the graduate program this year and the commitment and generosity of our partners. Internships are critical to building robust pipe-lines for Australian talent, and this program is an exciting opportunity for some of our most talented graduating students to hone their professional skills and creativity with the support of world-class production leaders.”

Previous host organisations supporting and fostering emerging talent from AFTRS have included Discovery Networks, Disney Channel, Foxtel, Fox Sports, TVSN, BBC Worldwide Australia, ESPN, Nickelodeon and Aurora Community Channel.

Photo: Top (L-R): Grace Anderson, Belinda Parry, Danielle Abou Karam; Bottom (L-R): Otto Khoo, Jaimie Conlon

Sports Media

Indian tour of Australia smashes more ratings records for Fox Cricket

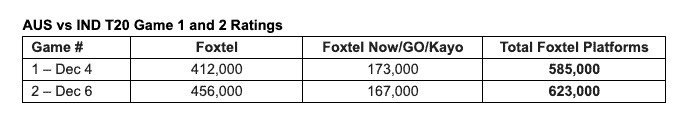

Australia’s second T20I vs India on Sunday night attracted an audience of 623,000.

With a live audience of 623,000 across all Foxtel platforms, the second Australia vs India T20I bettered previous record STV audience set just last weekend with Australia’s second ODI vs India. The opening two games of the T20I series are up 49% for total viewing, and 18% for TV only against the 2018 T20I series played on India’s 2018/19 Tour of Australia.

A consistent audience tuned in for Sunday’s game two with session one averaging 624,000 and session two averaging 622,000 across all Foxtel Group platforms.

Steve Crawley, executive director Fox Sports, said: “The summer of cricket is in full swing and we couldn’t be happier. After a cracker ODI series it went down to the wire last night, and our audiences are loving it.

“More white ball has proven to be a hit with the fans, and we’ve got plenty more cricket to come. Test team spots are up for grabs in the Australia A vs India A tour match this week, we’ve got one more T20 on Tuesday night, the Big Bash beginning on Thursday and the First Test on December 17 with a day-night game at Adelaide Oval – bring it on.”

India’s tour of Australia continues with the final T20I match on Tuesday from 6.30 pm AEDT, leading into Australia A v India day-night Tour match on December 11 and the first Test on December 17.