Monday August 12, 2019

Nine takes total control of 2GB, 3AW and all Macquarie stations

Nine inherited the majority shareholding in Macquarie Media following its merger with Fairfax Media in December 2018.

“The acquisition of Macquarie Media consolidates Nine’s position as the leading provider of news and current affairs content across all of the key platforms – television, digital, print and now radio,” said Hugh Marks, CEO of Nine.

“We are big believers in the power of Macquarie’s talk radio network and in its people. A team who together drive debate and speak up so often for so many Australians. We look forward to the future growth of the business with the full backing of Nine and to ensuring that the Macquarie Radio team have the support, infrastructure and clarity to be able to do what they do best.

“Together across our businesses we will be investing more than $400 million per year in providing Australians with premium news and editorial content. Entrenching Nine as the go-to place for all news needs for all Australians, across all platforms.”

The offer values Macquarie Media at $275.4 million and will see Nine pay $113.9 million (at $1.46 per share) for the remaining 45.5 per cent stake in the leading talk radio business, which owns stations 2GB, 3AW, 4BC, 6PR and Macquarie Sports Radio, provided enough shareholders accept the offer to lift Nine to 90 per cent (and we can then acquire the remainder).

The acquisition will be 100 per cent financed from cash reserves and existing debt facilities and is expected to see cost synergies of more than $10 million, mainly from combining support and administrative functions, and taking out some corporate costs such as ASX listing fees. Subject to getting sufficient Macquarie Media shareholder acceptances, the transaction is due to complete by December 2019.

Boomtown: SCA’s Brian Gallagher on $1m that will make a difference

Regional media players launched their Boomtown campaign in a blaze of publicity in April this year. Most media covered the plea from publishers and broadcasters for media agencies to rethink advertising in regional Australia.

Mediaweek alone has run eight separate features covering the Boomtown initiative including several features around the launch, the response of agency heads who might have been getting their regional strategy wrong and a report that Lou Barrett was jumping on board with News Corp’s considerable regional assets.

The latest part of the 2019 Boomtown initiative was launched two weeks ago with a competition offering an advertiser $1m worth of regional advertising on the Boomtown partners – SCA, WIN, Prime, TRSN, ACM, Imparja and News Corp.

As to how Boomtown had been progressing since launch, Brian Gallagher, chief sales officer SCA, told Mediaweek:

“It’s a little early [to measure any revenue impact], we are very much taking the long view about the impact o the campaign.

“There has been an increased level of briefing and discussion though since we launched.”

Within SCA, which Gallagher said monitors new business very carefully, there has been new business filtering in across various assets. “That’s great to see at this early stage.”

Brian Gallagher with Boomtown regional advocate Dave Hughes

Although Gallagher told Mediaweek about the $1m dollar ad campaign prize earlier this year, media agencies received the detail at a lunch event and through a trade media campaign recently.

“As we’d been telling the story about Boomtown for some time this year, I was unsure how good the roll up to the lunch would be,” said Gallagher. “It ended up being a packed house and it was great to see agencies bringing key clients with them. Quite a few clients have subsequently downloaded the competition details from the Boomtown website.

“There has generally been an extraordinary amount of website traffic downloading the competition details and we are subsequently expecting a good volume of competition entries.”

Boomtown is offering a considerable package to the competition winner.

Gallagher: “It is a prize that will move the needle for the advertiser who wins. It will make a difference to the winner’s P&L in the fiscal year they run that inventory.”

The $1m on offer from the Boomtown partners will all be spent on media. Any production costs will be at the expense of the winner. The $1m offered will be at rate card – no additional special deals! The winner also needs to agree in a case study that will be used the publicise the result.

Gallagher added he expects the Boomtown competition to prove a few things. “One thing we will prove, and something that all in the media world should appreciate, is that it is a high-profile opportunity to prove that advertising works. We will also prove the power of advertising in regional markets and what it can do for a company financially, which is obviously the core objective.”

When asked about the disparity between metro and regional ad spend, Gallagher noted there is two ends of the spectrum. “There are clients you could classify as people with very direct sales data – auto dealers, supermarkets and quick service restaurants for example. They all spend the exactly the right amount of money…because they know. At the other end of the spectrum there are people spending nothing, or just spending 4% and having a dip at Newcastle. They think they are covering regional in buying an underweight campaign in Newcastle. Which is fine and we accept the money gratefully and respectfully.”

People underweight in regional ad spend according to Gallagher include some banking, insurance and finance clients.

“Some FMCG clients have specific issues we have to help them with. The issues are basically access to data that breaks down metro versus regional sales.”

Since we last spoke in detail with Gallagher, News Corp’s regional news brands have joined the Boomtown campaign. “It is great to have regional press represented right across the board,” he said. “The News Corp regional and Australian Community Media (ACM) story is about providing local journalism on the ground where it is needed. Something that radio and TV also does.”

ACM was taken over by Antony Catalano since Boomtown was launched. Gallagher noted the new owners are “absolutely” behind the initiative.

“They have just as much, and maybe even more, motivation than anybody to be looking for awareness of the market places they are in. ACM mastheads like The Newcastle Herald and Canberra Times are big newspapers.”

—

Top Photo: Brian Gallagher onstage at the Boomtown agency launch

ABC’s Anne Connolly named Journalist of the Year at Kennedy Awards

Connolly, a senior ABC Investigations journalist, was at the fore when ABC News last year launched a major crowd-sourced investigation into aged care, with 4,000 people responding in just a few weeks.

Connolly, who for the past two years has covered the aged care beat relentlessly across ABC News digital, television and radio, working with the broadcast teams at Four Corners, 7.30, ABC News and Background Briefing, led a small team as they spent three months sifting through highly sensitive material.

The stories Connolly uncovered in the “Who Cares?” series shocked Australia and are widely credited as having sparked the Royal Commission into Aged Care Quality and Safety – announced by the Prime Minister the day before the first episode of the Four Corners programs aired.

Connolly, who also shared the coveted Outstanding TV Current Affairs gong with Four Corners ABC-TV colleagues, Mary Fallon and Patricia Drum, had her catalogue of work judged ahead of former multiple Kennedy Award winner, The Australian newspaper’s Greg Bearup, and Al Jazeera’s Peter Charley.

The Nine Network’s news legend Brian Henderson was the recipient of The Daily Telegraph and The Sunday Telegraph Lifetime Achievement Award while the Sydney Morning Herald’s Sports Editor, Ian Fuge, was awarded the Cliff Neville Award for Outstanding Team Player.

The ABC was a major winner with journalists and investigations teams taking out eight awards including Journalist of the Year, Outstanding Crime Reporting, Outstanding Regional Broadcast Reporting, Outstanding Radio Journalism, the $5,000 Young Journalist of the Year, Outstanding TV Current Affairs, Outstanding Nightly TV Current Affairs and Outstanding Online News Breaking.

News Corp, through The Daily Telegraph, The Sunday Telegraph and The Australian, were big winners taking a total seven awards, including Outstanding Turf Reporting, Outstanding Podcast (The Australian), Outstanding Portrait, Outstanding Illustration (The Australian), Outstanding Sport Reporting, Outstanding Columnist and Outstanding Reporting on the Environment (The Sunday Telegraph).

The Sydney Morning Herald was again a major player, taking out Racing Writer of the Year, the Cliff Neville Award for Outstanding Team Player, Outstanding Travel Writing, Outstanding Feature Writing and Outstanding Foreign Correspondent in that award’s inaugural year.

And The Australian Financial Review team of Jonathan Shapiro, Angus Grigg and Lisa Murray took out the Outstanding Finance Reporting Award.

The Nine Network took out major awards – Outstanding TV News Reporting and Outstanding Consumer Affairs Reporting – while Nine News senior sport journalist Danny Weidler won Scoop of the Year.

The Seven Network collected the Outstanding Online Video gong and took out the Outstanding TV News Camera Coverage Award.

The Newcastle Herald was again a major regional player, collecting the $5,000 Outstanding Regional Newspaper Reporting Award, which also comes with a $7,000 grant from the Judith Neilson Institute for Journalism and Ideas for the journalist to develop a major story, or series of stories, on regional issues. The Newcastle Herald also won the Outstanding Court Reporting Award.

The Guardian Australia’s Lorena Allam won the Outstanding Indigenous Affairs Reporting Award while, in a breakthrough win, photographer Simon Bullard took out the prestigious Outstanding Sports Photo Award with a sensational shot for Australian Consolidated Press.

And in a breakthrough win, Peter Charley, Al Jazeera, took out the prestigious Outstanding Investigative Reporting Award from Anne Connolly and Greg Bearup while Sky News Australia won the coveted Outstanding Political Journalism Award.

Kennedy Foundation chairman Simon Dulhunty said more than 130 nominees from a record field of 640 entries were judged in all 35 competitive categories to finally decide winners in the 2019 NRMA Kennedy Awards for Excellence in Journalism.

Dulhunty said the deserving winners had come out on top in an absolutely fiercely competitive news year, which included finalists from interstate and all major metropolitan newspapers and television and radio networks, international journalists and photographers as well as artists and photographers from regional newspapers and radio networks throughout NSW.

“In a bumper news year the standard of submissions was exceptional in every category. As in previous years, in some categories it took judges long hours to finally sort out the winners from absolutely talented fields, some of which had more than 50 entries,” Dulhunty said.

“From investigative journalism to news breaking, superb feature writing, incredible pictorial entries and wonderful art work, a class field emerged to take out the coveted Spirax Trophies.”

News Corp reports: News Aust full year revenue drops 6%

• Revenues were $10.07 billion, a 12% increase compared to $9.02 billion in the prior year, reflecting the consolidation of Foxtel for the full year and growth at the Digital Real Estate Services segment

• Net income of $228 million compared to a net loss of ($1.44) billion in the prior year

• Total Segment EBITDA was $1.24 billion compared to $1.07 billion in the prior year

• The Wall Street Journal subscribers reached a record of 2.6 million with digital-only subscribers accounting for approximately 69% of the total subscriber base

• Subscribers for Foxtel’s over-the-top services grew over 90% since the beginning of the calendar year with approximately 777,000 paid OTT subscribers, including approximately 331,000 paid subscribers at Kayo

See separate post for details of Foxtel/Kayo

News Corporation has reported financial results for the three months and fiscal year ended June 30, 2019.

Commenting on the results, chief executive Robert Thomson said:

“News Corp completed fiscal 2019 robustly, with revenues rising 12 percent and profitability 16 percent higher compared to the prior year, reflecting the consolidation of Foxtel, strength in digital real estate and substantial progress in the successful digital transformation of our news businesses.

“We are acutely focused on simplifying the structure of the company and making clear the full value of the sum of our parts. To that end, we recently announced a strategic review of News America Marketing, including a sale of the business; we have received material interest and the process is progressing well.

“Significantly, we posted higher Segment EBITDA at our News and Information Services segment, thanks to a rapid rise in digital paid subscribers, particularly at Dow Jones. The Wall Street Journal recorded a notable increase in digital-only subscribers, who now account for over 69 percent of the total subscriber base. The Risk & Compliance business is also flourishing, with revenue expanding 24 percent, the fourth consecutive year of growth well above 20 percent.

“For the Digital Real Estate Services segment, both REA and realtor.com® strengthened their competitive positions through strategic acquisitions and product enhancements, despite headwinds in housing markets. We note with interest the recent signs of improvement in the U.S. housing environment, with lead volume improving, record traffic to realtor.com® and an uptick in pending home sales.

“At Foxtel, paying subscribers for the Kayo sports streaming service more than doubled between the third and fourth quarters to 331,000, while average churn among sports subscribers to the Foxtel broadcast service actually fell during the same period. Clearly, Kayo is adding significantly to the total number of sports viewers in Australia prepared to pay for premium content.”

FULL YEAR RESULTS

The company reported fiscal 2019 full year total revenues of US$10.07 billion, a 12% increase compared to $9.02 billion in the prior year period, reflecting the impact from the consolidation of Foxtel’s results following the combination of Foxtel and Fox Sports Australia (the “Transaction”) into a new company in the fourth quarter of fiscal 2018 and growth in the Digital Real Estate Services segment. The growth was partially offset by a $311 million negative impact from foreign currency fluctuations, lower print advertising and News America Marketing revenues at the News and Information Services segment, and $72 million of lower revenues as a result of the adoption of the new revenue recognition standard. Adjusted Revenues (which exclude the foreign currency impact, acquisitions and divestitures as defined in Note 1) increased 1%.

Net income for the full year was $228 million as compared to a net loss of ($1.44) billion in the prior year.

FOURTH QUARTER RESULTS

The company reported fiscal 2019 fourth quarter total revenues of $2.47 billion, an 8% decline compared to $2.69 billion in the prior year period, primarily due to the $105 million negative impact from foreign currency fluctuations, lower revenues at the Book Publishing segment, which includes the absence of the one-time contribution from the sublicensing agreement for J.R.R. Tolkien’s The Lord of the Rings trilogy, lower broadcast subscriber revenues at the Subscription Video Services segment, lower advertising revenues at the News and Information Services segment and $18 million of lower revenues as a result of the adoption of the new revenue recognition standard. Adjusted Revenues decreased 5%.

Net loss for the quarter was ($42) million as compared to a net loss of ($355) million in the prior year.

News and Information Services

Full Year Segment Results

Fiscal 2019 full year revenues declined $163 million, or 3%, compared to the prior year, including the $154 million, or 3%, negative impact from foreign currency fluctuations. Within the segment, Dow Jones revenues grew 3%, while revenues at News UK declined 4% and revenues at News Corp Australia and News America Marketing both declined 6%.

Adjusted revenues for the segment were flat compared to the prior year.

Advertising revenues declined 7% compared to the prior year, reflecting weakness in the print advertising market, a $74 million, or 3%, negative impact from foreign currency fluctuations and lower revenues at News America Marketing.

Circulation and subscription revenues increased 1% compared to the prior year, reflecting continued strength at Dow Jones, partially offset by a $61 million, or 2%, negative impact from foreign currency fluctuations.

Other revenues increased 3% compared to the prior year, primarily due to the $38 million net benefit related to News UK’s exit of the gaming partnership with Tabcorp for Sun Bets.

Fourth Quarter Segment Results

Revenues in the quarter decreased $67 million, or 5%, compared to the prior year, reflecting a $40 million, or 3%, negative impact from foreign currency fluctuations.

Within the segment, Dow Jones revenues grew 4%, while revenues at News America Marketing declined 6%. News Corp Australia and News UK declined 7% and 10%, respectively, primarily driven by foreign currency headwinds. Adjusted Revenues for the segment were 2% lower compared to the prior year.

Advertising revenues declined 8% compared to the prior year, of which $18 million, or 2%, was related to the negative impact from foreign currency fluctuations. The remainder of the decline was driven by weakness in the print advertising market and lower home delivered revenues, which include free-standing insert products, at News America Marketing, partially offset by growth in digital advertising revenues. Advertising revenues at Dow Jones were flat in the quarter as growth in digital advertising offset the decline in print advertising. Digital revenues represented 40% of total Dow Jones advertising revenues in the quarter.

Circulation and subscription revenues were flat compared to the prior year, including a $17 million, or 3%, negative impact from foreign currency fluctuations. Circulation and subscription revenues again benefited from a healthy contribution from Dow Jones, which again saw a 7% increase in its circulation revenues, reflecting digital paid subscriber growth of 14% and subscription price increases at The Wall Street Journal, as well as the continued growth in its Risk & Compliance products.

Digital revenues represented 33% of News and Information Services segment revenues in the quarter, compared to 30% in the prior year. For the quarter, digital revenues for Dow Jones and the newspaper mastheads represented 37% of their combined revenues, and at Dow Jones, digital accounted for 55% of its circulation revenues. Digital subscribers and users across key properties within the News and Information Services segment are summarized below:

• The Wall Street Journal average daily digital subscribers in the three months ended June 30, 2019 were 1,818,000, compared to 1,590,000 in the prior year (Source: Internal data)

• Closing digital subscribers at News Corp Australia’s mastheads as of June 30, 2019 were 517,300, compared to 415,600 in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers as of June 30, 2019 were 304,000, compared to 256,000 in the prior year (Source: Internal data)

• The Sun’s digital offering reached approximately 113 million global monthly unique users in June 2019 (Source: Google Analytics; prior year comparable statistic unavailable due to source change)

News Corp video segment: 744,000 Kayo & Foxtel Now customers

Subscription Video Services

Full Year Segment Results

Revenues and segment EBITDA for fiscal 2019 increased US$1.20 billion and $207 million, respectively, compared to the prior year, primarily due to the consolidation of Foxtel’s results for the full year. Adjusted revenues and adjusted segment EBITDA, which exclude the impact of foreign currency fluctuations, acquisitions and divestitures, declined 2% and 19%, respectively.

On a pro forma basis, reflecting the Fox Sports transaction, segment revenues for fiscal 2019 declined $342 million, or 13%, compared with the prior year, of which $181 million, or 7%, was due to the negative impact from foreign currency fluctuations.

The remainder of the revenue decline was driven by the impact from lower broadcast subscribers and changes in the subscriber package mix, partially offset by higher revenues from Foxtel Now and Kayo.

Segment EBITDA for fiscal 2019 decreased $165 million, or 30%, compared with pro forma Segment EBITDA for the prior year, primarily due to the lower revenues discussed above, $95 million of higher sports programming and production costs, mainly related to Cricket Australia and National Rugby League rights, as well as higher marketing costs related to the launch of Kayo. The decline was partially offset by the $150 million positive impact on expenses from foreign currency fluctuations and lower entertainment programming and non-programming costs.

Fourth Quarter Segment Results

Revenues in the quarter decreased $74 million, or 12%, compared to the prior year, of which $44 million, or 7%, was due to the negative impact from foreign currency fluctuations. The remainder of the revenue decline was primarily due to lower broadcast subscribers and changes in the subscriber package mix, partially offset by higher revenues from Foxtel Now and Kayo. Adjusted revenues for the segment decreased 5% compared to the prior year.

Foxtel subscriber numbers

As of June 30, 2019, Foxtel’s total closing subscribers were 3.144 million, which was 12% higher than the prior year, primarily due to the launch of Kayo, subscriber growth at Foxtel Now and the inclusion of commercial subscribers of Fox Sports Australia beginning in the first quarter of fiscal 2019, partially offset by lower broadcast subscribers.

Approximately 2.4 million of the total closing subscribers were broadcast and commercial subscribers, and the remainder consisted of Foxtel Now and Kayo subscribers. Following its launch in November 2018, Kayo grew over 8 months to reach 382,000 subscribers, of which around 331,000 were paying subscribers as of June 30, 2019.

Foxtel Now totalled 460,000 subscribers as of June 30, 2019, of which approximately 446,000 were paying subscribers, up 32% compared to the prior year. Broadcast subscriber churn in the quarter was 14.7% compared to 12.5% in the prior year, reflecting the impact of the price increase implemented in October as well as increased volume of churn from lower-value customers who were on a no-contract basis. Broadcast ARPU for the quarter declined 1% compared to the prior year to more than A$78 (US$55).

Segment EBITDA in the quarter decreased $12 million, or 12%, compared with the prior year, primarily due to the lower revenues discussed above, $20 million of higher sports programming costs, primarily related to Cricket Australia, higher marketing costs related to Kayo and the $8 million negative impact from foreign currency fluctuations.

News Corp losing Liz Deegan to NRL for corporate affairs role

CEO Todd Greenberg said the NRL was delighted to welcome Deegan to the executive team to guide the reputation and engagement activities of Australia’s most watched sport.

In this role, Deegan will be responsible for developing and leading the strategic communication strategies which will work collaboratively across all core areas of the business, especially in relation to brand, people, broadcast, content and media.

“Liz brings a wealth of experience in media, corporate communications, and reputation and commercial relationship management, combined with a deep understanding of our culture and the value of NRL to our fans and our partners,” Greenberg said.

“She is a communications and media professional of the highest calibre with an exceptional reputation and work history. I look forward to her joining our team as we focus on the continued growth of our game.

Deegan will report to Greenberg and will work closely with the ARLC, and key internal and external stakeholders.

She joins the NRL from News Corp Australia, where she is the current General Manager, Corporate Affairs and Relationships. Prior to this she held the national role of Group Editorial Commercial Director for News Corp, following an extensive career in senior editorial roles within the company, including editor of The Sunday Mail in Brisbane, and deputy editor of The Sunday Telegraph. She will commence in her role later this year.

In a note to staff after the announcement of the move, News Corp Australia executive Michael Miller said: “She leaves with my very best wishes and thanks for the contribution she has made to News as a journalist, foreign correspondent, editor and executive.”

Deegan said she was looking forward to further enhancing the NRL’s brand across the country.

“This is an exceptional opportunity to lead the corporate affairs and communications strategy for Australia’s most loved sport. I know this game and understand and value the role it holds in our communities. I look forward to working with Todd and his team as we grow and evolve the role of the NRL,” she said.

In addition to Deegan’s appointment, the NRL has also recently welcomed Daniel Meers as General Manager Media & Communications. Most recently, Meers was a senior adviser to former Prime Minister Malcolm Turnbull and prior to that, spent more than 10 years as a journalist, firstly as respected sports writer and later, a national political reporter in Canberra. Meers will report to Deegan.

Other recent changes to the NRL’s media and communications function, include Glenn Jackson’s promotion to Senior Media and Communications Manager and Tom Gallimore’s promotion to Senior Corporate Affairs Manager effective from July. They will both report to Meers.

Week 32 TV Ratings: Seven #1 primary, Nine #1 network, 10 hot under 50

Most-watched shows (Metro audiences – total people)

• Seven News Sunday 1,059,000

• Seven News M-F 6pm 996,000

• Nine News Sunday 992,000

• The Block Sunday 993,000

• Australia’s Got Talent 819,000

• Seven News Saturday 802,000

• SeaChange 787,000

• The Ashes First Test, Day 5, Session 1: 764,000

• A Current Affair 727,000

• Home And Away 619,000

Most watched (Metro audience 25-54)

• The Block (all four episodes)

• Australian Survivor (Tuesday)

• Have You Been Paying Attention?

• The Bachelor (Wednesday)

Ratings champs

Total People

• Primary: Seven 19.3%

• Network: Nine 30.9%

• Multichannel: 9Gem 6.7%

People 25-54

• Primary: Nine 19.7%

• Network: Nine 33.8%

• Multichannel: 9Gem 7.2%

Nine Network

The channel’s 7.30pm strategy kicked another goal this week with the successful launch of season 15 of The Block. While the audiences are down a little year-on-year, the show is winning the ratings, much like Nine has done all year in the timeslot with Married At First Sight, Lego Masters, The Voice and Australian Ninja Warrior.

Nine got a massive boost too from the first Ashes Test, which pushed 9Gem higher and secured a winning Nine network share of 31% all people and 34% in the key demos.

Without revealing the numbers, Nine also reported the average VOD VPM for The Block is up 16% year-on-year.

Network 10

The channel continues to focus on two things – under 50 audiences and the size of its seven-days audience. The network reported the July 30 episode of Australian Survivor recorded the highest-ever 7-day BVOD audience on 10 Play (81,000).

As noted above, 10 had four shows and six episodes in the 10-most programs in key demos under 50.

The change of programming strategy at 10 Bold continues to be successful with 28 consecutives weeks now with YOY share growth.

Seven Network

Seven’s best news was just that – the Sunday, Saturday and weekday news bulletins were all timeslot winners. Sunrise was also a ratings champ.

Australia’s Got Talent did reasonable business last week, ranking Seven #2 in the timeslot all people.

Seven continues to lead in the survey year-to-date all people share. But its margin ahead of Nine is the smallest possible – 29.7% to 29.6%.

ARIA Chart : The Teskey Brothers debut #2 + Northlane & Holy Holy

Singles

Tones And I has stopped the one-week-at-the-top pattern of the three previous weeks as she enjoys a second week at #1 with Dance Monkey. Meanwhile Never Seen The Rain from Tones And I hit a new peak of #24 after three weeks on the chart, while Johnny Run Away gives her a third song in the top 30 as it drifts lower from #14 to #17 after 20 weeks with a peak at #12.

The sole new arrival to the top 10 was also the chart’s highest debut this week – Ariana Grande and Social House with Boyfriend at #4. Social House is producers/writers Michael “Mikey” Foster and Charles “Scootie” Anderson who are long-time Ariana Grande collaborators – Thank U, Next and 7 Rings – who have also just released their own EP Everything Changed which includes Boyfriend.

Two other singles that debuted top 50 this week both feature the F word:

#37 Fuck, I’m Lonely from US singer/songwriter/producer Lauv featuring UK singer Anne-Marie. The song also features on the soundtrack album for the third season of the Netflix hit series 13 Reasons Why.

#48 I.F.L.Y. from Bazzi. The abbreviation stands for “I fuckin’ love you” and the track features on his recently released mixtape Soul Searching.

Albums

The top 10 got a major overhaul this week with three top 10 debuts and three top 10 chart re-entries. None of this activity worried Ed Sheeran though as No 6 Collaborations Project spends a fourth week at #1.

The second album from the blues and soul-inspired Melbourne band loved by Chris Hemsworth, The Teskey Brothers, created the biggest impact on the chart this week with a debut at #2. Their album Run Home Slow is the follow-up to Half Mile Harvest in 2017, which peaked at #18. Half Mile Harvest re-entered the chart this week at #27. Their new set is well worth repeated listens and favourite track early on is the Neil Young-flavoured San Francisco.

Also debuting in the top 50 this week:

#3 Northlane with Alien – the fifth album from the Sydney metalcore band.

#7 Drake with Care Package – his first compilation album with tracks not previously available recorded between 2010 and 2016.

#14 Holy Holy with My Own Pool Of Light – the third album in four years from the prolific Aussie indie band.

#32 Skillet with Victorious – 10th album from the US Christian rockers.

#36 Descendants 3 soundtrack – music from the Disney Channel’s TV movie.

#43 Tool with Opiate. The first chart appearance of the EP from 1992 that preceded the band’s first album. The chart is Tool crazy this week as the US hard rockers release their catalogue on streaming services for the first time. The move coincides with the impending release of their fifth studio album, Fear Inoculum, at the end of August.

The other Tool albums to re-enter the chart this week:

#6 Aenima

#8 Lateralus

#9 10,000 Days

#21 Undertow

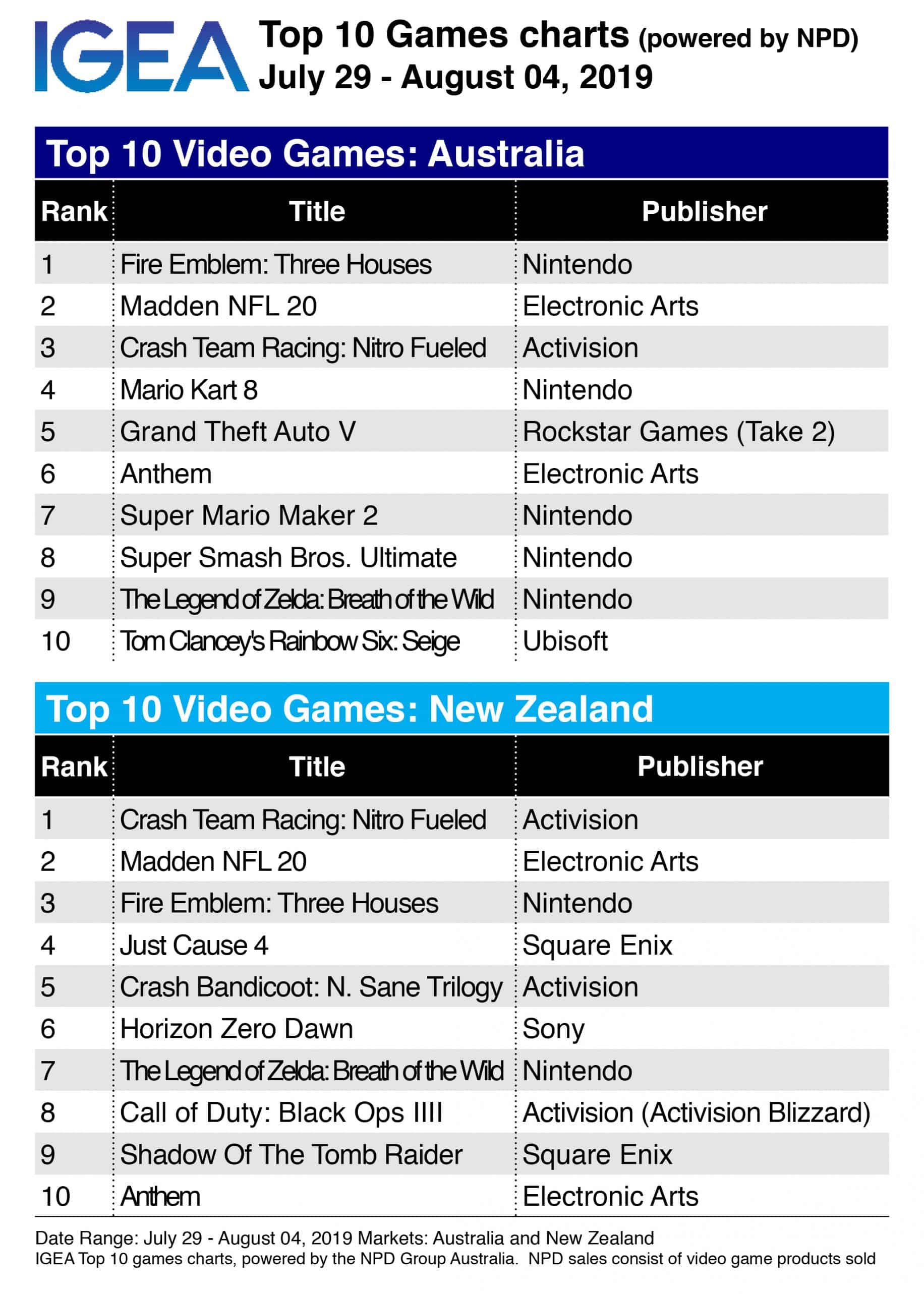

Top 10 Game Charts: Madden 20 fails to score in week 1 finishing #2

With hundreds of hours of gameplay and excellent storytelling, Three Houses couldn’t have come at a better time for Switch owners, as it’s slim pickings for new releases at the moment. Well, aside from an arguably even more niche game (for an Australian audience) – Madden NFL 20, which comes in at the number two spot and is the only other new release to make the charts this week.

Significant releases will continue to be few and far between for the time being, with only the mind-bending Control from Remedy Entertainment (the studio behind Max Payne and Alan Wake) and the similarly creative action title Astral Chain from PlatinumGames (the studio behind Bayonetta and Nier: Automata) still to be released in August.

TV Ratings Analysis: August 11

Sunday Week 33 2019

By James Manning

• Seven News 1,231,000

• Nine News 1,014,000

• ABC News 638,000

• The Project 239,000/376,000

• Insiders 240,000

• 10 News First 232,000

• Offsiders 162,000

• SBS World News 147,000

Breakfast TV

• Sunrise 283,000

• Today 190,000

Seven

The Sunday afternoon AFL match between Richmond and Carlton helped Seven News at 6pm push above 1.23m with 322,000 in Melbourne.

The combo of the news and then Australia’s Got Talent kept Seven very competitive, narrowly trailing Nine in primary and combined channel share. AGT’s Sunday audience was 823,000 after 819,000 a week ago.

Sunday Night then did 439,000 after 556,000 a week prior. The reports last night included Alex Cullen with Penthouse model Simone Starr on Sydney’s underworld.

Nine

The Block started its second week with the reveal of the ensuites. The judge’s scores saw Andy and Deb narrowly in front of Mitch and Mark. The episode was just short of 1m, which was the biggest episode so far with 996,000 after 993,000 watched the launch episode a week ago.

60 Minutes also managed to have a story on a Sydney Penthouse model with underworld connections. The Liam Bartlett report managed to attract the biggest audience in the timeslot with 626,000. The audience for the ONJ feature hour a week ago was 687,000.

10

The Project was on 376,000 for its Sunday episode with actor/singer Ben Mingay a special guest and Tommy pranked Hamish on the autocue.

Australian Survivor had plenty of surprises including the wettest ever Australian Survivor challenge during an incredible rainstorm. After much wheeling and dealing, it was revealed there would be no elimination, but one of the tribes got to vote on whom they would like to steal. The audience was the best Sunday episode this season with 693,000. The episode was #2 under 50 behind The Block and ahead of AGT.

Two episodes if Instinct then did 234,000 and 127,000.

ABC

The early evening Climate Change doco introduced by David Attenborough did 522,000.

The second episode of Les Norton then did 436,000 after launching with 525,000 a week ago.

No final season of Poldark on Sundays, the new season starts on Saturday night on the channel.

SBS

The 8.30pm screening of the recent PBS Woodstock doco attracted the biggest audience with 173,000. The researchers did great work uncovering many festivalgoers, but the music was a little neglected during the two hours of interviews.

Week 32-33 TV: Friday-Sunday

| FRIDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 8.8% | 7 | 23.4% | 9 | 17.5% | 10 | 9.6% | SBS One | 4.5% |

| ABC KIDS/ ABC COMEDY | 2.6% | 7TWO | 3.8% | GO! | 4.3% | 10 Bold | 3.0% | VICELAND | 0.8% |

| ABC ME | 0.6% | 7mate | 4.9% | GEM | 2.4% | 10 Peach | 2.3% | Food Net | 1.3% |

| ABC NEWS | 1.6% | 7flix | 4.9% | 9Life | 2.0% | NITV | 0.1% | ||

| 7Food | 0.7% | SBS World Movies | 1.0% | ||||||

| TOTAL | 13.7% | 37.7% | 26.1% | 14.9% | 7.7% | ||||

| SATURDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 11.6% | 7 | 19.4% | 9 | 14.8% | 10 | 9.9% | SBS One | 5.5% |

| ABC KIDS/ ABC COMEDY | 2.6% | 7TWO | 3.5% | GO! | 5.7% | 10 Bold | 2.9% | VICELAND | 1.1% |

| ABC ME | 0.7% | 7mate | 5.2% | GEM | 3.3% | 10 Peach | 2.1% | Food Net | 1.2% |

| ABC NEWS | 1.9% | 7flix | 4.0% | 9Life | 2.2% | NITV | 0.1% | ||

| 7Food | 0.8% | SBS World Movies | 1.3% | ||||||

| TOTAL | 16.8% | 32.2% | 26.1% | 14.9% | 9.3% | ||||

| SUNDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 10.5% | 7 | 21.3% | 9 | 22.6% | 10 | 11.9% | SBS One | 4.5% |

| ABC KIDS/ ABC COMEDY | 2.1% | 7TWO | 2.8% | GO! | 3.6% | 10 Bold | 3.3% | VICELAND | 0.5% |

| ABC ME | 0.5% | 7mate | 3.0% | GEM | 3.1% | 10 Peach | 2.5% | Food Net | 1.1% |

| ABC NEWS | 1.2% | 7flix | 1.8% | 9Life | 1.9% | NITV | 0.3% | ||

| 7Food | 0.5% | SBS World Movies | 0.8% | ||||||

| TOTAL | 14.3% | 29.4% | 31.3% | 17.8% | 7.2% | ||||

| SUNDAY REGIONAL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | |||||

| ABC | 11.0% | 7 | 20.3% | 9 | 20.5% | WIN | 8.6% | SBS One | 3.9% |

| ABC KIDS/ ABC COMEDY | 3.3% | 7TWO | 3.5% | GO! | 4.3% | WIN Bold | 3.5% | VICELAND | 0.6% |

| ABC ME | 1.1% | 7mate | 3.8% | GEM | 5.1% | WIN Peach | 2.4% | Food Net | 1.1% |

| ABC NEWS | 1.2% | 7flix (Excl. Tas/WA) | 2.1% | 9Life | 2.5% | Sky News on WIN | 0.8% | NITV | 0.2% |

| 7food (QLD only) | 0.3% | ||||||||

| TOTAL | 16.6% | 30.0% | 32.4% | 15.3% | 5.8% | ||||

All People Ratings

Friday Top 10

- Seven News Seven 867,000

- Seven News / Today Tonight Seven 831,000

- Nine News Nine 823,000

- Nine News 6:30 Nine 758,000

- A Current Affair Nine 565,000

- Better Homes And Gardens Seven 551,000

- ABC News ABC 550,000

- Seven’s AFL: Friday Night Football Seven 528,000

- The Chase Australia Seven 526,000

- Hot Seat Nine 455,000

Saturday Top 10

- Seven News – Sat Seven 802,000

- Nine News Saturday Nine 731,000

- ABC News ABC 550,000

- Agatha Christie’s And Then There Were None ABC 519,000

- Father Brown ABC 494,000

- Rugby: 2019 Wallabies V New Zealand Test Live 10 390,000

- Seven’s AFL: Saturday Night Football Seven 349,000

- Border Security – Australia’s Front Line (R) Seven 311,000

- Rugby: 2019 Wallabies V New Zealand Post-Match 10 304,000

- Seven’s AFL: Saturday Night Football – Pre Match Seven 287,000

Sunday FTA

- Seven News Seven 1,231,000

- Nine News Sunday Nine 1,014,000

- The Block Nine 996,000

- Australia’s Got Talent Seven 823,000

- Australian Survivor 10 693,000

- ABC News Sunday ABC 638,000

- 60 Minutes Nine 626,000

- Seven’s AFL: Sunday Afternoon Football Seven 569,000

- Climate Change: The Facts ABC 522,000

- Sunday Night Seven 439,000

- Les Norton ABC 436,000

- The Sunday Project 7pm 10 376,000

- Weekend Sunrise Seven 283,000

- Sunday Afternoon NRL Live Nine 279,000

- Manson: The Lost Tapes Nine 269,000

- Landline PM ABC 258,000

- What The Killer Did Next Seven 253,000

- Insiders AM ABC 240,000

- The Sunday Project 6.30pm 10 239,000

- Instinct 10 234,000

Sunday Multichannel

- Midsomer Murders 9Gem 149,000

- Bluey AM ABCKIDS/COMEDY 147,000

- Ben And Holly’s Little Kingdom AM ABCKIDS/COMEDY 136,000

- Bananas In Pyjamas AM ABCKIDS/COMEDY 135,000

- Top Gun 9GO! 135,000

- Play School AM ABCKIDS/COMEDY 132,000

- Peppa Pig AM ABCKIDS/COMEDY 130,000

- Dinosaur Train ABCKIDS/COMEDY 124,000

- Kiri And Lou PM ABCKIDS/COMEDY 123,000

- Nella The Princess Knight AM ABCKIDS/COMEDY 122,000

- Border Security – Australia’s Front Line 7TWO 122,000

- Chris Tarrant’s Extreme Railways PM 7TWO 121,000

- Insiders AM ABC NEWS 121,000

- School Of Roars AM ABCKIDS/COMEDY 120,000

- Bing AM ABCKIDS/COMEDY 119,000

- Motorsport: 2019 Motogp Live 10 Bold 117,000

- Floogals ABCKIDS/COMEDY 116,000

- Border Security – Australia’s Front Line 7TWO 115,000

- Bondi Rescue Ep 3 (R) 10 Bold 115,000

- Andy’s Prehistoric Adventures ABCKIDS/COMEDY 114,000

Sunday STV

- Live: NRL Eels V Knights FOX LEAGUE 248,000

- Live: The Rugby C’ship: Aus V Nz FOX SPORTS MORE 248,000

- Live: NRL Bulldogs V Wests Tigers FOX LEAGUE 198,000

- Live: NRL Super Saturday FOX LEAGUE 169,000

- Live: NRL Dragons V Titans FOX LEAGUE 160,000

- Live: AFL Brisbane V Gold Coast FOX FOOTY 146,000

- Bohemian Rhapsody Foxtel Movies Premiere 143,000

- Live: AFL Melbourne V Collingwood FOX FOOTY 140,000

- Live: The Rugby Championship Post Game FOX SPORTS MORE 140,000

- Live: AFL Essendon V Western Bulldogs FOX FOOTY 138,000

- Live: NRL Post Game Super Saturday FOX LEAGUE 96,000

- Live: The Rugby Championship Pre Game FOX SPORTS MORE 82,000

- Live: AFL Geelong V North Melbourne FOX SPORTS 503 76,000

- Live: AFL Port Adelaide V Sydney FOX SPORTS 503 73,000

- Live: Saturday Stretch FOX FOOTY 55,000

- The Professor’s Late Hit FOX LEAGUE 53,000

- Live: Super Saturday FOX FOOTY 47,000

- Live: NRL Pre Game Super Saturday FOX LEAGUE 46,000

- Live: Raceday Saturday Sky Racing 42,000

- Paw Patrol Nick Jr. 37,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2018. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Business of Media

Regional broadcasters 'doing better' than metros: Peter Horgan

Television advertising spend was down 0.2 per cent in June 2019 compared to June 2018, but down 4.7 per cent for the full financial year, the latest Standard Media Index figures show. The majority of industries reliant on advertising have faced a tough 12 months, but Horgan said regional networks were likely to have performed better.

“I think the regions are doing slightly better than the metros at the moment,” he said, adding the regional broadcasters typically perform better than the SMI data suggests as this dataset looks at agency bookings and these networks often write business outside of agencies.

Nothing special about SBS staff retention levels

Internal board documents and reports presented to the most senior ranks of SBS – obtained by The Australian under freedom of information laws – reveal long-running concerns over the ability of the taxpayer-funded specialist broadcaster to retain talent, especially among Generation Y.

A paper presented to the board in June outlined in part a three-year strategy to keep a lid on voluntary turnover at 15 per cent this year and to reduce it to 13 per cent by the end of 2022.

In the year to May, SBS lost 14.4 per cent of its staff. At the same time, employees who left SBS after less than a year accounted for more than 28 per cent of all staff leaving.

A spokeswoman for SBS said the broadcaster operated “in a highly competitive and rapidly changing sector so we are pleased that our overall staff turnover is often better than industry” and noted that employee engagement was higher than the national average.

Aunty vows to lift regional focus, for all Australians

The broadcaster’s new director of regional and local operations also dismissed claims of left-wing bias by the ABC, saying presenters were “very keen to open all sides of arguments”.

The ABC, which has had its annual budget of $1 billion cut in recent years, has invested an additional $15 million into regional bureaus over the past two years.

Whelan believes the ABC is serving all Australians, despite criticism the broadcaster only serves the left-leaning.

Streaming future: Disney, Nine talk Stan-Hulu tie-ups

The talks between the two companies are ongoing and no announcement is imminent. But, Disney is known to be looking at how it can expand the Hulu platform globally, although the rollout is not as simple as its upcoming Disney+ service.

A partnership between Stan and Hulu could be focused on bundling opportunities for Disney+ and Stan, although there are a number of conversations about a range of commercial relationships over different time periods. Whether any deals are done remains to be seen.

News Corp’s pay TV business Foxtel is also believed to be talking to Disney to get Disney+ integrated into its new user interface in the same way it recently did with Netflix.

News Brands

Nine grapples with making money from 60 Minutes’ YouTube videos

A major investigation by The Age, The Sydney Morning Herald and 60 Minutes in July into allegations that Crown Casino was used in money laundering reached almost 700,000 views on YouTube in its first week online.

But, despite the large audience, the amount of revenue delivered to Nine from putting the show onto the video website was substantially smaller than would have been earned from advertising through the broadcaster’s own channels. This includes free-to-air and catch-up apps.

The show reached 100,000 views on catch-up app 9Now and had a traditional free-to-air TV audience of 780,000, 60 Minutes executive producer Kirsty Thomson said.

Nine managing director of partnerships Lizzie Young said the free-to-air broadcaster and Google are now working together to find a solution to ensure views are more lucrative on the video platform after the issue was first raised 18 months ago.

Facebook offers US publishers millions to license news content

Representatives from Facebook have told news executives they would be willing to pay as much as $3 million a year to license headlines and previews of articles from news outlets, the people said.

The outlets pitched by Facebook on its news tab include Walt Disney Co.’s ABC News, Wall Street Journal parent Dow Jones, The Washington Post and Bloomberg, the people said.

Facebook’s plans come as the company is facing growing criticism for its role in the news industry’s struggles by sucking up much of the advertising revenue that used to go to newspapers. Combined, Facebook and Alphabet Inc.’s Google earned 60% of all digital advertising revenue in the U.S. last year, according to eMarketer.

The news-licensing deals between Facebook and news outlets would run for three years, some of the people said. Facebook is planning to launch the section sometime in the fall, the people said. It isn’t known whether any news outlets have formally agreed yet to license their content to Facebook.

Radio

2GB pays tribute to Malcolm T Elliott who has died aged 73

The former 2GB, 2UE and 2UW host started in radio in 1967 and went on to star on television shows like Blankety Blanks.

He is credited by many for revolutionising breakfast radio in Australia, making it fun and edgy, well before FM radio even existed.

Malcolm T underwent five heart by-passes in 2004 and was in poor health at his Lismore home in recent years but his passing is being described as a “tragic event”.

Alan Jones paid tribute to his old friend, saying it’s “a sad note in the world of broadcasting”.

“He had an impact on a lot of people and made a very significant contribution.”

Ray Hadley was an avid listener to Malcolm T as a young man before they became colleagues at 2UE and then 2GB.

He heaped praise on the radio legend and his impact on the industry.

“I know in latter years his contribution was mired in controversy, but he revolutionised breakfast radio in Australia back in the 1970s.

“He turned breakfast radio into a formula of fun and satire, aided by the late Tony Dickinson and Peter Shanahan.

“The three of them made radio madcap, cutting edge and fun to listen to.

“He was zany, he was crazy but it was successful.”

[Read the original and listen to tributes from Alan Jones and Ray Hadley]

Photo: 2GB

Legal setback for Hadley over defamation action by Josh Massoud

Massoud is suing Hadley’s employer, 2GB, along with KIIS 106.5FM, The Daily Telegraph, Nine Network, and Fox Sports over reports published in May 2018, which resulted from a blistering attack by Hadley on Massoud which featured on his radio show.

John Stanley wants to bring 'Zemanek's spirit' to nightly talkback gig

“Stan turned night time into primetime,” says Stanley, who as a station manager at 2UE during Zemanek’s popular reign helped craft the shock-jock’s on-air persona. “He’d go right out on a limb to get the audience fired up and calling in. It was very entertaining radio; lots of energy and fun.

“Now, we’re different characters and I wouldn’t call myself a shock-jock in the slightest, but in a laid-back way I think I can be quite provocative and encourage debate,” he adds.

Despite the evocative nod to “the man radio listeners loved to hate”, Stanley’s soft-spoken presence eschews the bluster typically associated with talkback radio, says Macquarie Media CEO Adam Lang.

“He has an incredible bank of knowledge and a quirky sense of humour, and he’s an almanac when it comes to events,” Lang says of Stanley.

“I think there’s a misconception that everyone [at 2GB] is marching to the same political tune or has the same cookie-cutter approach on all issues,” Stanley says, “[but] my views are probably in the centre, because I’m a journalist, basically, who’s doing talkback.”

Television

Reality TV: Abbie claims Monique called The Bachelor a c**t

In a moment that will go down as one of the more memorable showdowns in what is a showdown heavy series, femme fatale Abbie “I’m a Gemini” Chatfield pulls out the rudest of words on Wednesday night during a confrontation with would-be beau Matt Agnew.

She doesn’t call Agnew the C-word, it must be clarified.

Instead she relays that it was her fellow Queenslander and love rival Monique Morley who used the word when describing Matt.

“Yes, she said it,” Chatfield told Sunday Confidential this week.

“I just thought that it was something Matt should have been aware of … so I decided to confront him about it. If people were saying stuff like that about me … I’d want to know.”

How noble.

Andrew Hornery: Lack of originality is the reality of TV

All those clever minds being paid oodles of money to deliver ratings winners and yet all we are delivered is an endless supply of copycat television.

Last week it emerged Channel Seven was developing a new reality television series and has applied to trademark the phrase “The Honeymoon Crashers”, with casting currently underway.

“This is your chance to be part of Seven Studio’s new reality shows,” the notice on a casting website read. “We’re looking for real people with unreal personalities.”

Yes, well the emphasis here has to be on “unreal”.

Yep, it sounds awfully similar to Nine’s ratings blockbuster Married At First Sight, and comes just a few months after Seven’s Bride and Prejudice series was on our screens, another reality show that followed a very similar path to MAFS, in all its ugly, cringe-worthy glory.

Over the next three months all of Australia’s commercial television networks are hatching plans and coming up with concepts they hope will become 2020’s big ratings winners.

But if the last few years is anything to go by, sadly we may have seen them all before.

Sports Media

FTA versus STV: Rugby faces dilemma in next broadcast deal

Delany told The Australian Financial Review that Super Rugby, which has been on Foxtel since 1996, is an important sport to its subscribers and the News Corp-controlled pay-TV business has been a dedicated supporter of the code.

“Rugby has only ever been on Fox, Super Rugby was invented by Fox, it has always been on Fox,” he said.

But Delany said Super Rugby’s problem was that it produces fewer good games that Australians care about than more popular codes such as AFL and the National Rugby League do.

“That’s fine, if they want to put some on free-to-air, that’s fine, but it changes the whole value equation for us.”