When Grant Blackley delivered the first-half earnings for Southern Cross Austereo on Thursday last week there was a line in the results about the impending renewal of the affiliation deal SCA has with Nine to carry its TV signals into regional areas around Australia.

Radio is the major source of revenue at SCA, with $173.3m in H1 FY21 compared to $84.9m from TV. Losing the Nine signal for 10’s channels would put further pressure on those SCA TV dollars.

When asked by Mediaweek last week if SCA might have to continue negotiations with a new CEO at Nine, SCA CEO Blackley said, “No, it is something we should be able to do before that happens.”

Some think that is an overly confident SCA chief executive. There has been speculation for some time that Bruce Gordon’s WIN TV would replace SCA at the next possible opportunity. How WIN TV was replaced by SCA in the first place puzzles some, given that Gordon is the biggest shareholder at NEC. He lost the affiliation deal for his troubles and doesn’t even get board representation.

SCA also has an affiliation deal with Seven, but for the smaller markets of Tasmania, Darwin and Central Australia.

That affiliation deal is one of many things Blackley is juggling in what most media companies are hoping will be a comeback year after the disruption of 2020.

Just days before the half year results, Blackley revealed the rebrand of PodcastOne and the new consumer app to stream SCA podcasts, live radio and streamed music. Speculation had been that one of the driving forces behind the move to introduce the LiSTNER brand was to save money on the PodcastOne licence. “That amount is immaterial,” Blackley told Mediaweek. “We had a long and successful relationship with PodcastOne (US) and we represent their interests as they do for us.”

SCA is investing $5m in the launch of LiSTNR, noting last week its digital audio revenues, including podcasting, grew from $3.3m to $5.2m in the YOY six month periods.

Revenue recovery

Blackley is a little more confident about radio revenues recovering in 2021 than some in the sector. “TV often takes the hit first when we go into any economic crisis. But it also tends to be the first to recover, followed by other media. Radio is close behind though despite having to suspend surveys last year. That didn’t assist the industry, but it was a necessary outcome. I am hoping of course for a return to normality at the earliest possible moment. We have given guidance this week that we believe our total revenues be about 6-8% below last year in the January-March quarter. That is TV and radio.

“What we are seeing is a lift from national advertisers and we have a bit of delayed recovery in the SME market. SCA does a lot of business with the SME community. To that end we are expecting a strong national recovery and there is no question we will get back to where we were before.”

Impact of new breakfast shows

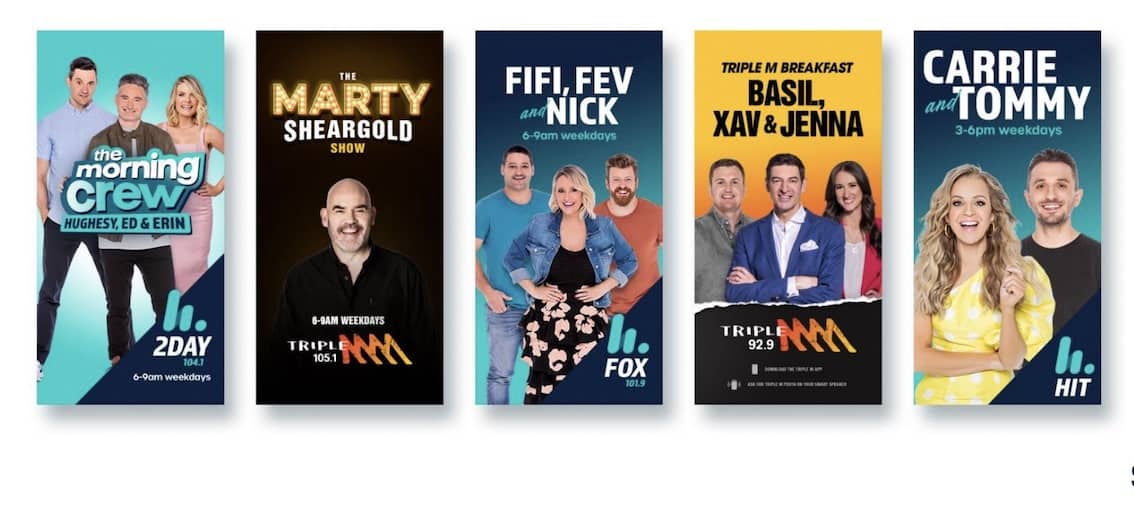

Part of the revenue story at SCA is linked to the new breakfast line-ups at 2Day FM, Fox FM and Triple M Melbourne.

“There is a shorter booking cycle in audio versus other media and you can see a return on an investment pretty quickly. When we get the positive result we expect, [SCA chief sales officer] Brian Gallagher and his team will be able to monetise that very quickly.

“We would be getting a double win from network results and cap city improvement. There is a positive impact on network buys from a key station that looks and performs better.”

See also: Southern Cross Austereo’s leaner model sees half year profit lift despite revenue drop