The full-year results of ARN offer the best chance to look under the hood and judge immediate past performance.

While that remained important this week, there were also a number of other pressing matters at the audio business. In order…what is happening to the ARN and Anchorage play for SCA radio and TV assets? And what is the latest update on the bold move to network a Sydney breakfast show into Melbourne?

State of audio

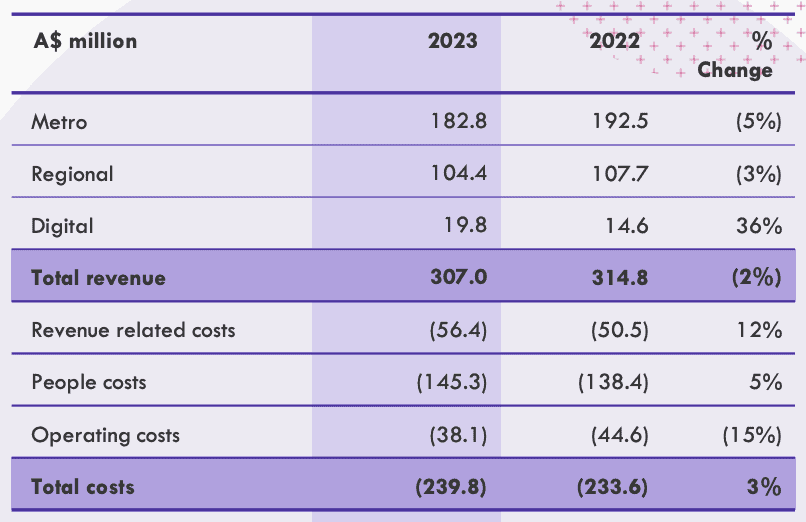

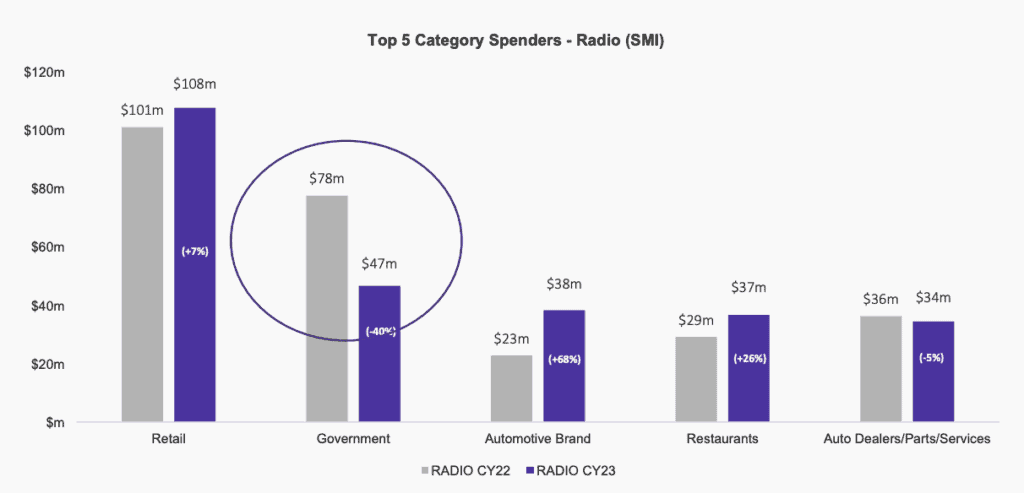

Net profit was down 23% at ARN in the 2023 full-year results. That fall came despite revenue remaining flat (-2% YOY). Chief executive Ciaran Davis explained to Mediaweek the change was linked to lower government spend after a robust dip into the till by politicians during the election year 2022. (See SMI radio category ad spend chart.)

“One of the things I am trying to get across is the resilience of the sector. There is certainly no structural problem with radio. Audiences continue to grow – we were up 4%. Spend in three of the top five categories was up.

“Radio is still as strong as ever when it comes to building brands, its reach and frequency, and campaign effectiveness are all still as strong as ever. It is performing pretty well in a tough environment.

“We have announced a $10m cost out program over the next two years. We have started that already.”

While admitting the market is tight with low visibility, Davis was optimistic. “January was up [YOY] and we are taking share. We are looking at reporting slight growth for the quarter.”

Other pressures on the 2023 P&L included finishing the investment on the Grant Radio regional acquisition including sales capability, training, systems development etc. “We have also put a lot of investment into digital audio.” Davis has forecast that digital business will be cash-flow positive by the second half of calendar 2024.

ARN 2023 revenue: Metro, regional, digital

Advertising upside

When looking at ad revenues, Davis pointed to success in the regional direct market. “That accounts for 70% of our regional revenue and it has performed exceptionally well. After we bought the [regional] business it was already performing well. But it has continued to grow.

“Government spend was the big drop and we hope they are still big believers in radio. Hopefully that returns. It has been good to see categories like auto and retail still valuing what retail can do.”

See also:

Ferrier: Radio is undervalued, should be “quadruple the price”

Ritson on radio as the ultimate sidekick, “shithouse” CMOs, and injecting “bogan humour” into ads

Is the market spooked about ARN selling Gold and WSFM?

Davis was asked if any advertisers this year might be sitting back and waiting to see how the proposed ARN Triple M network will take shape. “No, I wouldn’t think so,” he replied.

“There is still a bit to do there with regulatory confirmation.”

Full steam ahead for Triple M acquisition and disposal of Gold and WSFM

Despite some recent concern about the progress surrounding the breakup of SCA, Davis said it is getting closer to realisation.

“We believe it is a very compelling proposition for both SCA and ARN shareholders. We are quite confident on our ability to transact and to complete the transaction.”

Anchorage Capital went on the record in the ARN full-year release this week, commenting publicly on the deal for the first time:

“Anchorage Capital Partners [ACP] has reaffirmed its commitment to the consortium with ARN Media to acquire a strong, independent portfolio of media assets across metro and regional radio, regional TV, and an equal interest in the to be formed digital audio joint venture audio platform.

“ACP has been actively participating in the due diligence process, believes the transaction remains compelling and would deliver the foundation of a private, independent and well-capitalised national media company owned by ACP.”

Did this mean the takeover has reached a significant moment? Davis: “Anchorage remain as firm about [their support] of this since they were at the very start. We were trying to get across that they are as equally committed as we are.”

What’s next on the road to a new Triple M network owner?

“We believe we can complete and execute a binding transaction by late March. There is a bit of information still to be exchanged and we take it from there.”

As to what has delayed the process in the past four months, Davis said: “A lot of diligence work has gone on for both sides.”

The ARN results were full of glowing praise for the performance of the Gold and WSFM assets in addition to the KIIS network and regional stations. Yet in just a matter of months these will be ripped out of the business. How are the impacted staff feeling about the changes?

“We inform staff and keep them updated as much as we can. Most people continue to be focused on their own jobs and what they can control. It’s a practical view that the staff have and it’s good to see.”

ARN and Anchorage Digital JV

One thing that became a little clearer this week was the desire to build for a digital JV between ARN and Anchorage. That business would house the iHeartRadio and LiSTNR assets in what would be some sort of super digital play covering most FM radio stations except for those held by Nova Entertainment. It would also be home to the massive podcast libraries from iHeart and LiSTNR.

As to the upside from a combined digital monster, Davis said: “There is a very large part of the market we don’t talk to. Any network would struggle to ramp up their sales and training capability to talk to it. We think the opportunity for the JV Co is for the two digital assets to come together. It would be a well-funded enterprise that would invest in training and data technologies. Also contextual and geo targeting.

“It would really focus its sales efforts on the side of the digital market that is currently being pulled by Instagram, by search, by social. There is a significant opportunity there.”

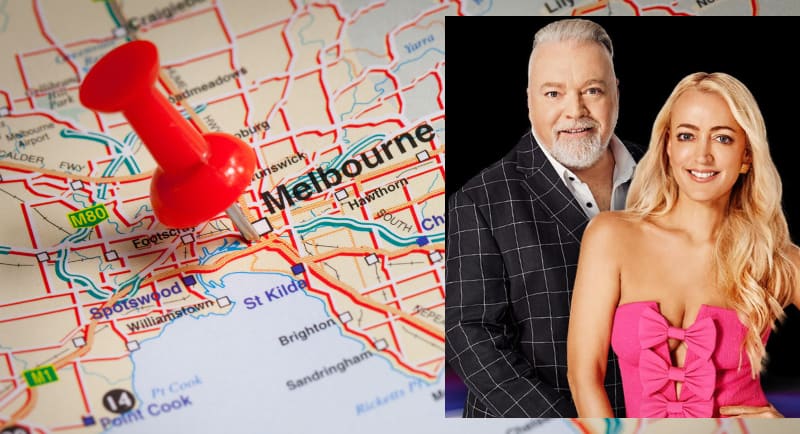

Kyle and Jackie O’s clever PR campaign

If ARN and its biggest breakfast show wanted to stoke discussion about its impending arrival in Melbourne it has certainly worked a treat. Just when it will launch in Melbourne has been a hot topic, in Sydney and Melbourne, since the first day of survey in January this year.

And the mystery continues. “Radio likes to have a bit of secrecy every so often,” explained Davis. “The anticipation about their arrival demonstrates the power that they have. We can tell that about 11% of all their podcast downloads are coming from Victoria. The numbers for their Hour of Power [highlights program] are also pretty good. They are now motivated from a commercial perspective to perform in Melbourne which is actually a bigger radio market than Sydney. [$220m revenue vs $200m.]

So when will K&J launch in Melbourne?

“It’s imminent,” is all Davis would offer. “Waiting for the finish of the new studios is one [of the factors].”

With the final 2023 survey of KIIS 101.1 so strong in Melbourne, is there concern that Kyle and Jackie O might arrive with lower ratings before they start to trend back up?

“I tend not to look at one survey,” said Davis. “I look for the trends and this is a long-term plan for us. Books can go up and down in one survey based on the vagaries of the diary measurement system. We believe they have the ability to power ahead in Melbourne and we will look at this over the medium term.”