Radio broadcaster HT&E has reported its full year results for calendar 2018.

Highlights:

• Revenue from continuing operations up 5% to $271.8 million

• EBITDA of $71.8m up 7% on prior year and in line with expectations

• ARN revenue growth of 3% to $235.5m, EBIT up 3% to $80.5m

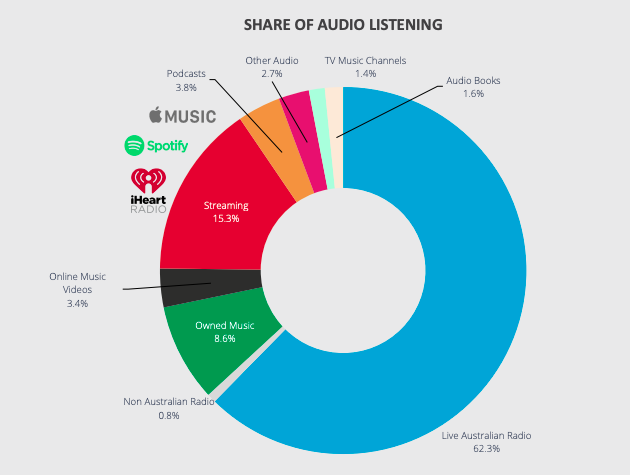

• Group claims well positioned to exploit the future of audio entertainment

Highlights from the earnings statement:

Statutory revenue from continuing operations post Adshel sale was up 5% to $271.8m, and EBITDA on the same basis was up 2% to $72.7 million, largely in line with expectations.

Net cash of $128.4m provides HT&E with a strong balance sheet post the successful sale of Adshel to oOh!media for $570 million in September 2018.

There has been significant board renewal during 2018 including the appointment of a new chairman and highly credentialed, media experienced directors have joined the company.

Following another year of transformational change at HT&E, the board is taking a methodical and balanced approach in their assessment of the company that includes understanding both the opportunities and risks sitting before them.

HT&E CEO and managing director Ciaran Davis said: “ARN implemented a strategy focused on ratings growth and commercial success in 2018 and ended the year experiencing growth across a number of FM stations, culminating in the highest average ratings in the history of the company.

“We saw some growth at the EBITDA line in ARN to $84.6 million and importantly saw a strong EBITDA margin maintained at 36%, highlighting the strength of the business even despite a softer market at the end of 2018.

“It has never been a better time to invest in audio and 2019 will see HT&E focus on ARN’s broadcast, digital, social and streaming suite of assets with a clear vision to create the future of audio entertainment. We have put plans in place to deliver increasing value for shareholders by driving and delivering operational performance across the group.”