Fresh numbers from TrinityP3 show Australia’s new-business market has tipped into a full-blown barbell economy, where global holding companies and sharp-edged independents are hoovering up the work, while mid-sized generalists are quietly being squeezed out.

The 2025 TrinityP3 New Business Report finds agencies are no longer fighting over the same patch of ground.

Instead, they’re clustering at the extremes: scale at one end, specialisation at the other – with not much oxygen left in the middle.

And that’s not accidental.

“We’ve been doing this for years, but we’ve got another one coming out closer to Easter,” TrinityP3 CEO Darren Woolley told Mediaweek. “We felt there was significant activity, and we’ve been working primarily with independent agencies.”

But what finally pushed Woolley to formalise the reporting was the sheer volume of untracked movement across the market.

“There was a lot of pitching going on, and it just never gets reported. And that’s what I wanted to do,” he said.

“I wanted to start working towards the most comprehensive report on the pitch market. And not just pitching, new business generally, because the other thing that’s happening is there are also agencies winning business without actually having to go through a competitive pitch. I want to understand that as well and start recording it and analysing it. And it’s been really interesting.”

Big networks and independents are winning

The numbers paint a stark picture.

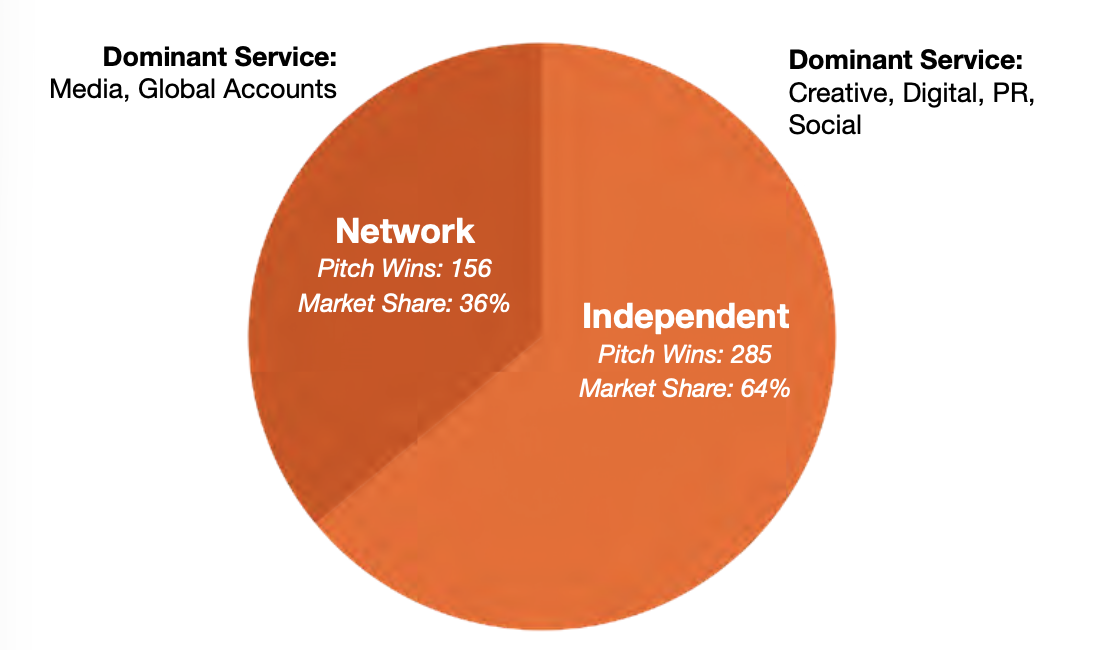

Large holding companies have doubled down on scale – with some now winning more than 20% of all media tenders – while independent agencies captured 64% of all pitch wins by volume, compared with 36% for networks.

That creates a classic barbell: big agencies at one end, small specialists at the other, and a thinning centre where mid-tier, do-it-all agencies once thrived.

Woolley sees that structural tension hardening.

“I don’t think anyone can say that the advertising market is stagnant,” he said.

What’s quietly reshaping the market isn’t just who’s pitching, but what they’re being asked to pitch for.

Woolley says one of the strongest signals inside the 2025 data is how far the industry has drifted from traditional, all-in media briefs toward a much more fragmented, platform-led economy.

“The other big insight for me was that people talk about paid media more than media, but there is a big shift this year with lots of social media specialty pitches, activations, and PR – it’s showing up in the pitch reports for advertising and marketing,” he said.

In practice, that means marketers are no longer just shopping for reach – they’re shopping for capability. TikTok, creators, and experiential and cultural moments are increasingly carving out their own competitive tenders, pulling spend and strategic weight away from the old, monolithic agency model.

That’s where the barbell really tightens.

“We’re seeing the marketplace shift toward either large agencies offering marketers a data platform or plug-and-play solutions,” Woolley said. “Publicis has been talking about it. Omnicom talked about it. WPP are talking about it. Who survives, who disappears, right?”

At one end sit the global holding companies, selling scale, technology and integration. At the other end are specialist independents, winning on speed, creativity, and fluency within specific platforms and disciplines.

The middle, meanwhile, is being quietly eroded.

“So they’ll be the big players in the industry,” Woolley said – a line that now reads less like a prediction and more like a verdict.

But that’s only half the story.

Layered on top of the barbell effect is another structural shift that’s quietly changing how agencies compete: more marketers are bringing capability back in-house.

That’s removing entire layers of work from the open market – and raising the bar for whatever remains.

“Additionally, many marketers are bringing agency services in-house,” Woolley said. At the same time, the agency landscape is expanding rapidly, with hundreds of new independent shops entering the market.

The risk, he argues, is that too many of those independents get flattened into a single, unhelpful category.

“The market risk is that it treats them as all just creative agencies, which they’re not,” Woolley said.

In reality, many of these businesses are built around very specific commercial problems – not broad creative briefs.

“They’re specialists. There are small agencies out there that are experiential,” he said. “They are, let’s say, smaller, because some of them are 50, 60, 80 people.”

In a world where marketers are slicing work ever more finely – pulling some in-house and sending the rest to best-in-class partners – that kind of focused scale is no longer a disadvantage. It’s the point.

Who’s actually winning the work

• Atomic212 emerged as the most successful agency overall and topped the media category.

• Hero led the creative agencies.

• Apparent was the strongest non-media performer.

Across the Top 10 lists, the pattern repeats: either scaled networks with platform muscle, or focused independents with a clearly defined niche.

Trying to straddle both is where agencies run into trouble.

“Now we’re talking; we’re forcing ourselves to discuss media and non-media,” Woolley said.

“It is that niche, very, very, very specific offering. What is the thing we’re really, really good at? What are we better at than most other people? Because that’s where they’re going to thrive.

“Trying to be a small general agency against these big platforms is only going to work with very small clients. So what you need to do is develop a speciality. What is your speciality? What’s the thing you’ll be known for that clients are going to want you to come and fill the gaps that they identify in their marketing?”

Social-only pitches are rewriting the rules

One of the most disruptive shifts in the dataset is the explosion of social-only tenders – with more than a dozen run by major brands over the past year.

These aren’t add-ons. Their entire mandates are built around TikTok, Instagram, Snap and creators, demanding speed, cultural fluency and platform-native thinking.

And they sit squarely inside the barbell logic.

“It’s becoming a very complex market,” Woolley said.

“And that’s another reason for doing this: to really start to understand how the market’s moving and the shape it’s taking year on year.”

Where the money is moving

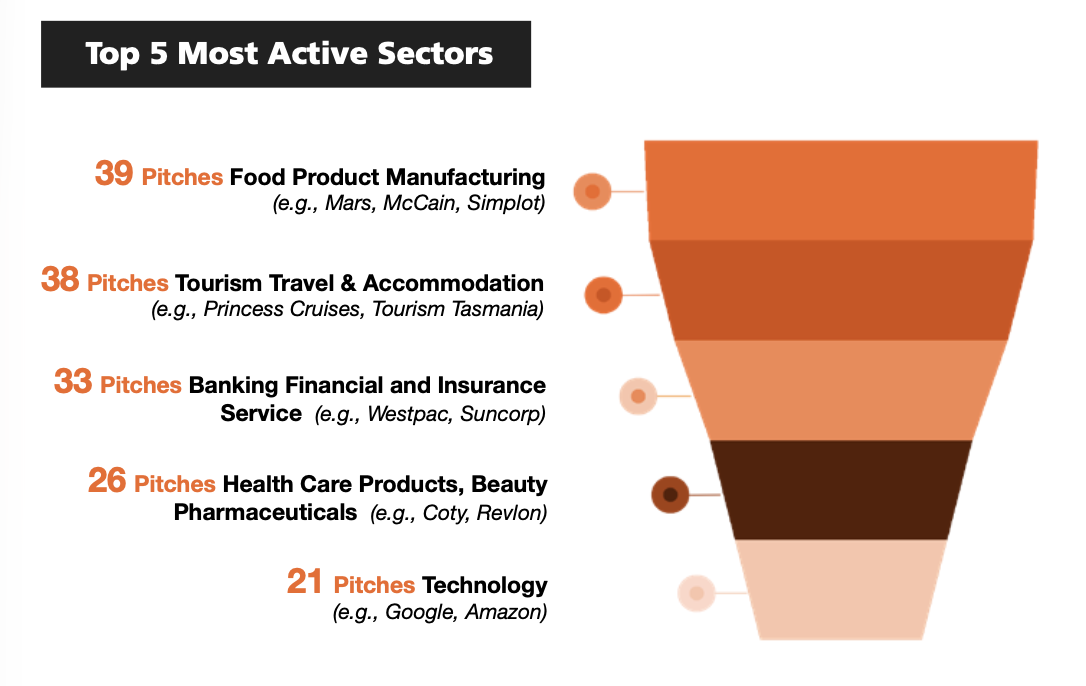

The most contested categories in 2025 were:

• Food and product manufacturing

• Tourism and travel

• Banking and financial services

• Healthcare and beauty

Each saw between 30 and 40 pitches during the year – a level of churn that reflects how aggressively marketers are reassessing agency rosters.

“For marketers and procurement, they’ll be able to track which agencies are highly successful and in which categories they’re becoming known for,” Woolley said.

“If you’re appointed for a particular skill set, then you become known for that. And so from that perspective, for the market, there’s also quite a bit around which are the categories that are more involved in pitching this year, because that’s interesting as well.”

What’s already catching Woolley’s eye is how quickly the mix is shifting again.

“That changed significantly between 2024 and 2025, and already at 2026, just the beginning of it, it feels to me like that’s completely changed or at least has changed remarkably.”

Why TrinityP3 built this and why it matters

The 2025 dataset is the first Woolley believes truly reflects what’s happening under the hood.

“The data we collected in 2024, when we started this, wasn’t as comprehensive as I hoped,” he said.

“In 2025, we went into overdrive, engaging agencies to share with us the business that they’d won. We now have a dataset that we believe is sufficiently robust and insightful for our audience. So that’s why we released it this year rather than last year.”

The bottom line for 2026

The 2025 numbers don’t just show who won. They reveal how the industry is being structurally rewired.

• Big platforms are consolidating power.

• Specialists are carving out defensible niches.

• Generalists in the middle are losing relevance fast.

And the longer that barbell stretches, the harder it will be to pretend the old agency model still fits.