Australia’s media agency market has kicked off 2018 in spectacular fashion, with significantly higher advertising demand from a swathe of large product categories delivering a record level of February ad spend and the best ever start to a calendar year, reports Standard Media Index (SMI).

SMI’s agency data shows demand lifted 7.6% in February to a record level of $544.8 million, which in turn pushed agency bookings for the first two months of CY2018 5% higher, ensuring ad spend for the two-month period broke through $1 billion for the first time. (SMI measures only media agency spending.)

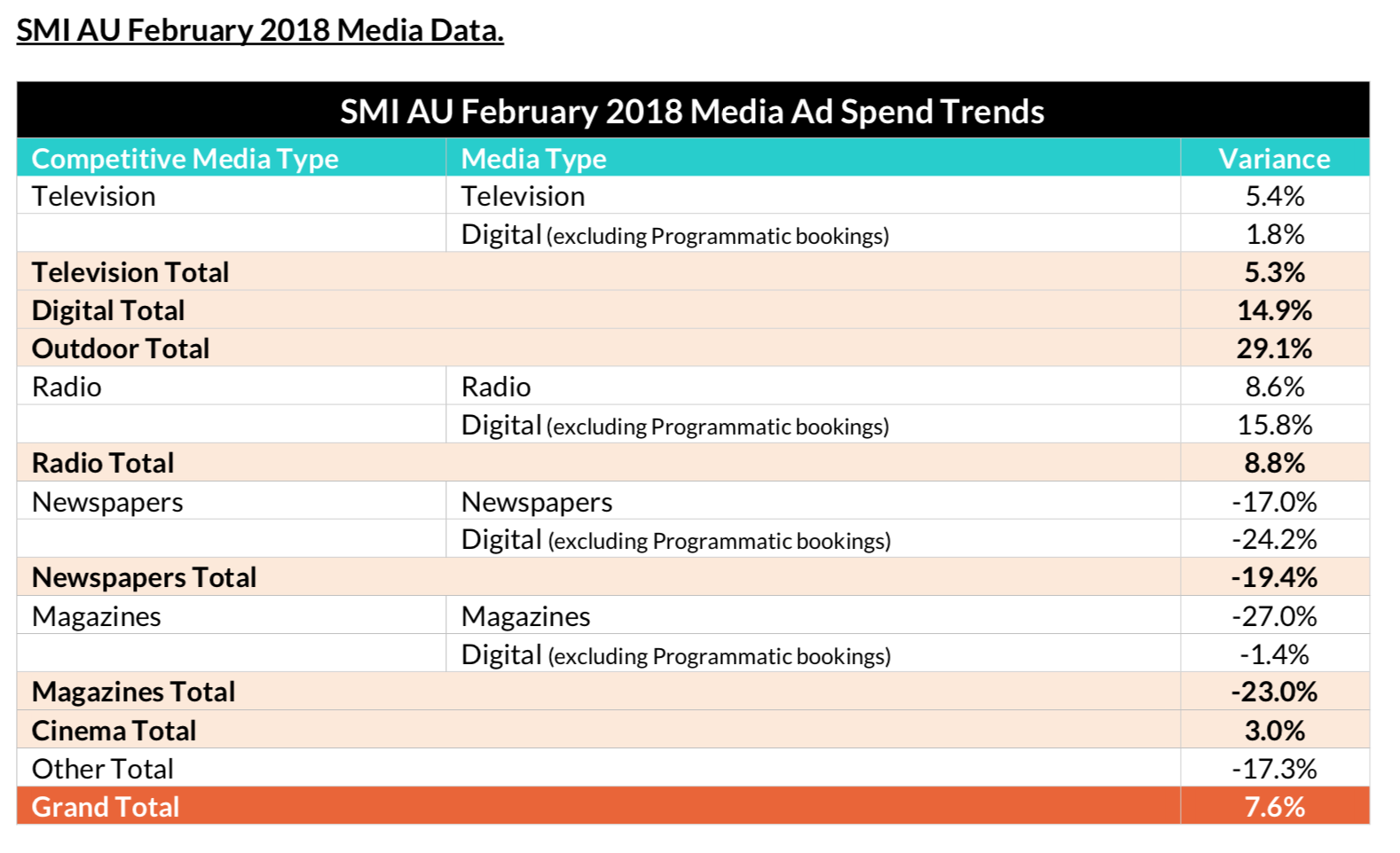

In February the digital, outdoor and radio sectors all recorded record levels of agency ad spend for the month, with outdoor delivering by far the largest growth (+29.1% year-on-year without any lunar month issues). Television grew ad spend by 5.4% to its best February result since 2015.

The higher demand came from a broad range of advertisers, with eight of the market’s 10 largest product categories reporting double digit growth in February. The highest growth came from the domestic banks category, which grew ad spend by 56.6% year-on-year as they seek to mitigate the impact of the Financial Services Royal Commission.

Other large categories reporting double digit gains include retail (+11.8%), food/produce/dairy (+16.5%), insurance (+23.4%), government (+26.9% in a month that included SA and Tasmanian elections), toiletries/cosmetics (+27.7%) and restaurants (+21.1%).

SMI AU/NZ managing director Jane Ractliffe said this was by far the best start to a calendar year since SMI bookings began in 2007.

“Breaking through the $1 billion ad spend level so early in the year augurs well for continuing demand, especially as we’re yet to see the extra ad spend related to the Commonwealth Games or other major sporting events due this year,’’ she said.

“It’s also pleasing to see such widespread support from many varied advertiser groups as even at the smaller end of the spectrum we’re seeing categories such as analgesics lifting spend by 73% and real estate agents growing ad spend by 85% from February 2017.”

Australia’s agency market is also reporting record ad bookings for the first eight months of this financial year, with the total up 3.1% to a record level of $4.8 billion.

More detail on the latest February ad spend trends is shown below.

Peter Miller, CEO of NewsMediaWorks, said:

“SMI data represents less than half the total advertising revenue for news media. The data does not capture the large proportion of direct advertisers that news media attracts, which represent more than 56% of ad revenue for publishers and grew by 13.5% in the December 2017 quarter alone.

“The News Media Index, with data collated by SMI, provides a more accurate picture of news media ad revenue because it represents print and digital ad revenue and also includes revenue from direct advertisers.

“In 2017, total ad revenue for the news media sector was $2.02 billion. News media brands deliver targeting at scale in the most trusted environment for both readers and advertisers.”

According to the latest News Media Index data, with data collated by SMI, the sector’s advertising revenue hit a year high in the fourth quarter of 2017 at $519.8 million, buoyed by advertising related to the Queensland election and the Marriage Equality debate.

The result was underpinned by digital news media revenue that grew 8.5% to $134 million. Digital spend from direct advertisers jumped by 31.8% to $85 million in the quarter.

Programmatic ad revenue also continued to grow strongly, rising by 26.5% to $9.9 million, while digital classifieds rose by 21.6% to $61 million in the quarter.