Seven West has announced two strategic initiatives that it claims will transform the company and position the network as the leading wholly-owned commercial premium broadcast, video and news network across Australia, reaching over 18 million people each month. Seven West Media will:

• Merge SWM with Prime Media Group Limited (Prime) through a 100% scrip-based Prime scheme of arrangement

• Divest SWM’s Western Australian radio assets (Redwave) to Southern Cross Media for cash consideration of $28 million, representing an FY19 Enterprise Value/EBITDA multiple of 8x.

SWM and Prime have entered into a Scheme Implementation Deed under which it is proposed that SWM will acquire all Prime’s issued shares through a Scheme of Arrangement (Scheme) under which Prime shareholders will receive 0.4582 SWM shares for each Prime share that they hold (Proposed Transaction). Following completion of the Proposed Transaction, existing SWM shareholders will own 90% of the combined entity, with Prime shareholders holding the remaining 10%.

The combined business will be led by James Warburton, SWM Managing Director and Chief Executive Officer, and will be chaired by Kerry Stokes, Chairman of SWM.

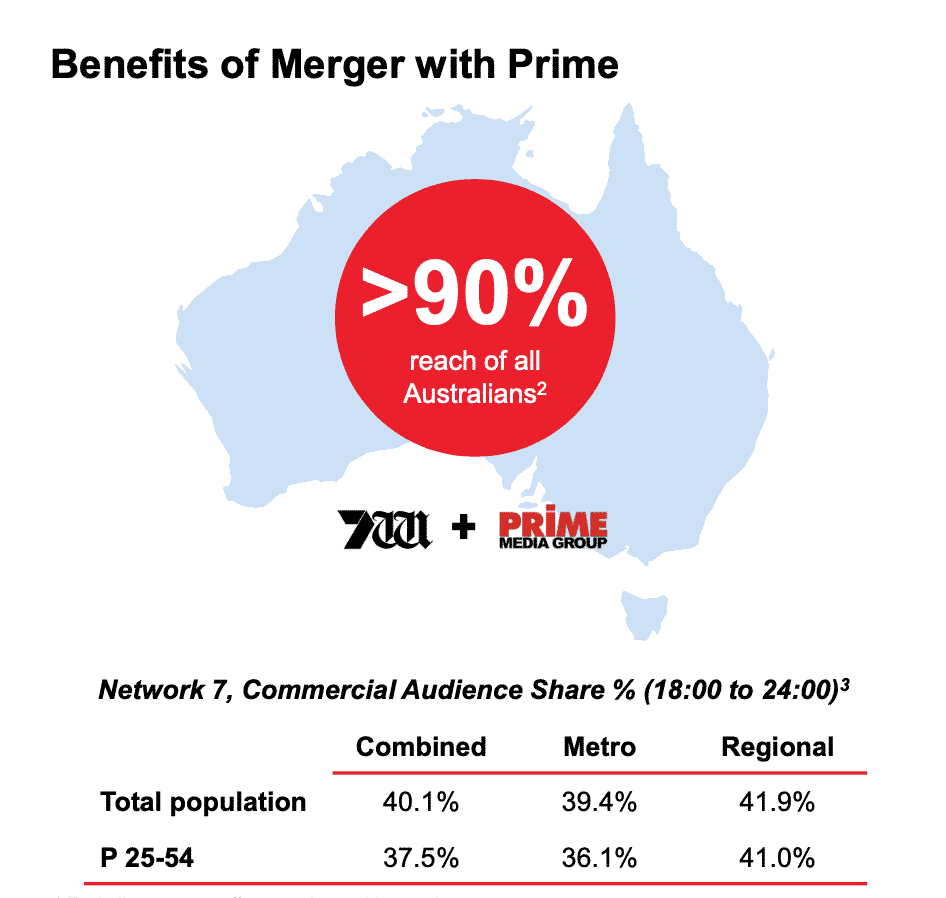

Seven West Media said the merger will deliver significant value creation by:

• providing advertisers with a single platform that will deliver superior audience reach across metropolitan and regional markets;

• unlocking the revenue potential of regional audiences;

• enhancing the audience proposition through re-investment in content and expanding the digitaldelivery of SWM’s offering in regional markets

• generating expected cost synergies of $11 million on an annualised basis and potential revenue upside. The costs savings are expected to be fully realised within 12-18 months from completion of the Proposed Transaction.

The directors of Prime have unanimously recommended that Prime shareholders vote in favour of the Scheme, in the absence of a superior proposal and subject to an independent expert concluding that the Scheme is in the best interest of Prime shareholders. Subject to those same qualifications, each Prime director has indicated that he or she intends to vote all Prime shares held or controlled by them in favour of the Scheme.

Commenting on the Proposed Transaction, SWM’s Chairman Kerry Stokes said: “SWM and Prime have had a longstanding relationship and are key partners in the industry. The combined group will cement our position as Australia’s leading content provider and presents excellent value to shareholders.”

Prime’s Chairman John Hartigan commented: “The Prime Board has carefully considered the Proposed Transaction and believes it is in the best interests of Prime shareholders. It represents an exciting opportunity for Prime shareholders to maintain their exposure to the broadcast television industry in a stronger and larger combined group that is more relevant and resilient.”

SWM’s Managing Director and Chief Executive Officer James Warburton said: “The Proposed Transaction is a game changer for advertisers and media buyers and cements SWM’s position as the superior advertising offering. Overnight, SWM will be the leading wholly-owned commercial premium network that amasses a monthly Australian audience reach of 18 million people.”