If there was one unifying theme across Australia’s 2025 radio ratings, it was this: habit beats hype.

From Sydney to Perth, the winners were stations that knew exactly who they were and stuck to it, while brands chasing reinvention or short-term spikes struggled to convert flashes of momentum into year-long gains.

Talk continued to punch above its weight – 2GB in Sydney and 3AW in Melbourne proved that fewer listeners, listening longer, still wins the share game – while music brands split cleanly between scale and loyalty.

smoothfm and Nova dominated reach where predictability paid off, while Triple M franchises quietly cleaned up on time spent listening in Brisbane and Adelaide.

The flip side was brutal.

KIIS underperformed, 2Day FM continued its slide, and several stations found that mid-year surges don’t count for much if they fade by Survey 7.

The 2025 takeaway was clear: in a fragmented audio landscape, clarity, consistency and habit were the real growth strategies.

Everything else was just, well, noise.

The Sydney market

Sydney’s radio market in 2025 split neatly into winners who consolidated power and brands that simply couldn’t arrest decline.

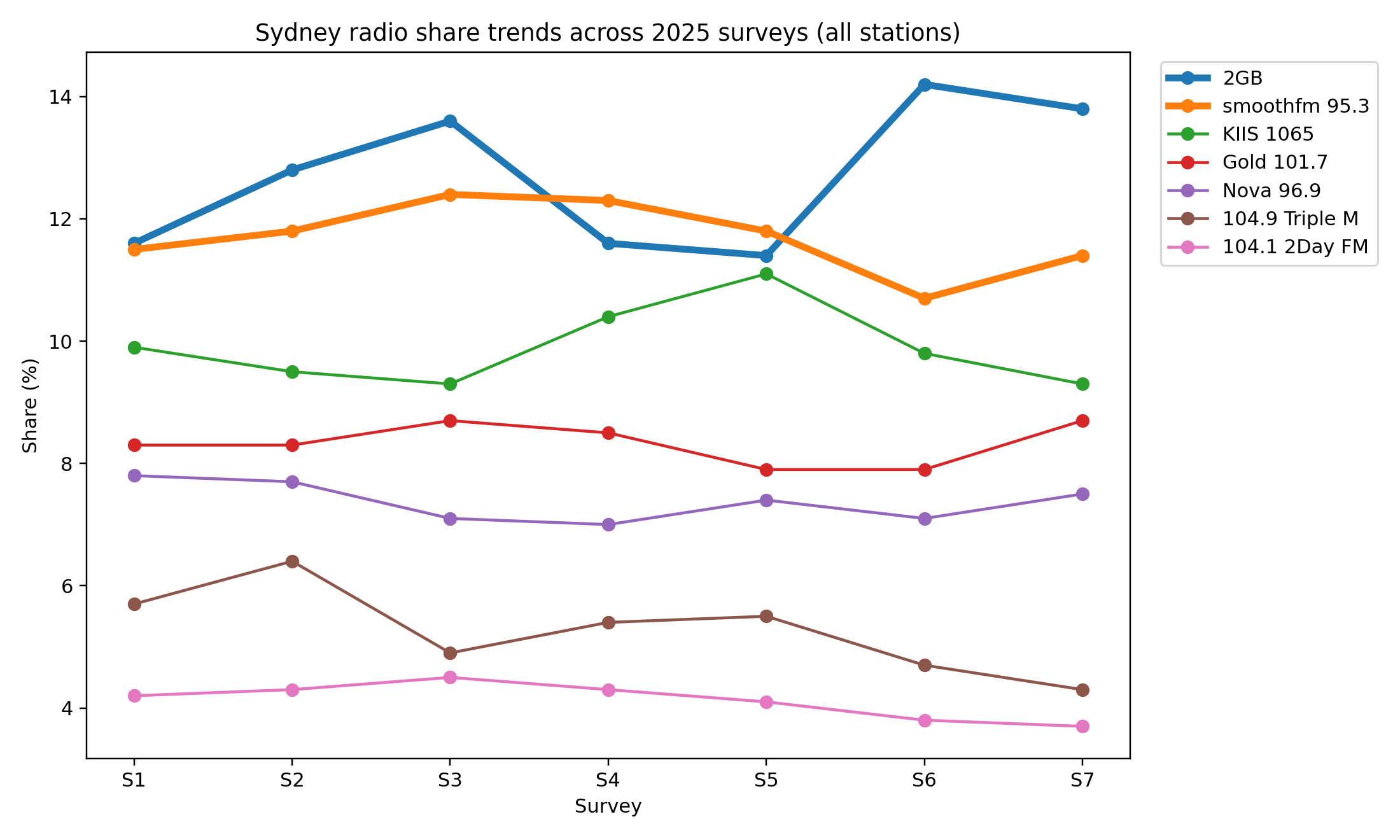

Across seven surveys, 2GB controlled the share narrative, smoothfm 95.3 owned reach, KIIS 1065 flashed moments of momentum without fully converting, and 2Day FM slid deeper into irrelevance.

2GB was the year’s most consistent share performer, finishing #1 in five of seven surveys and peaking at a market-leading 14.2% in Survey 6.

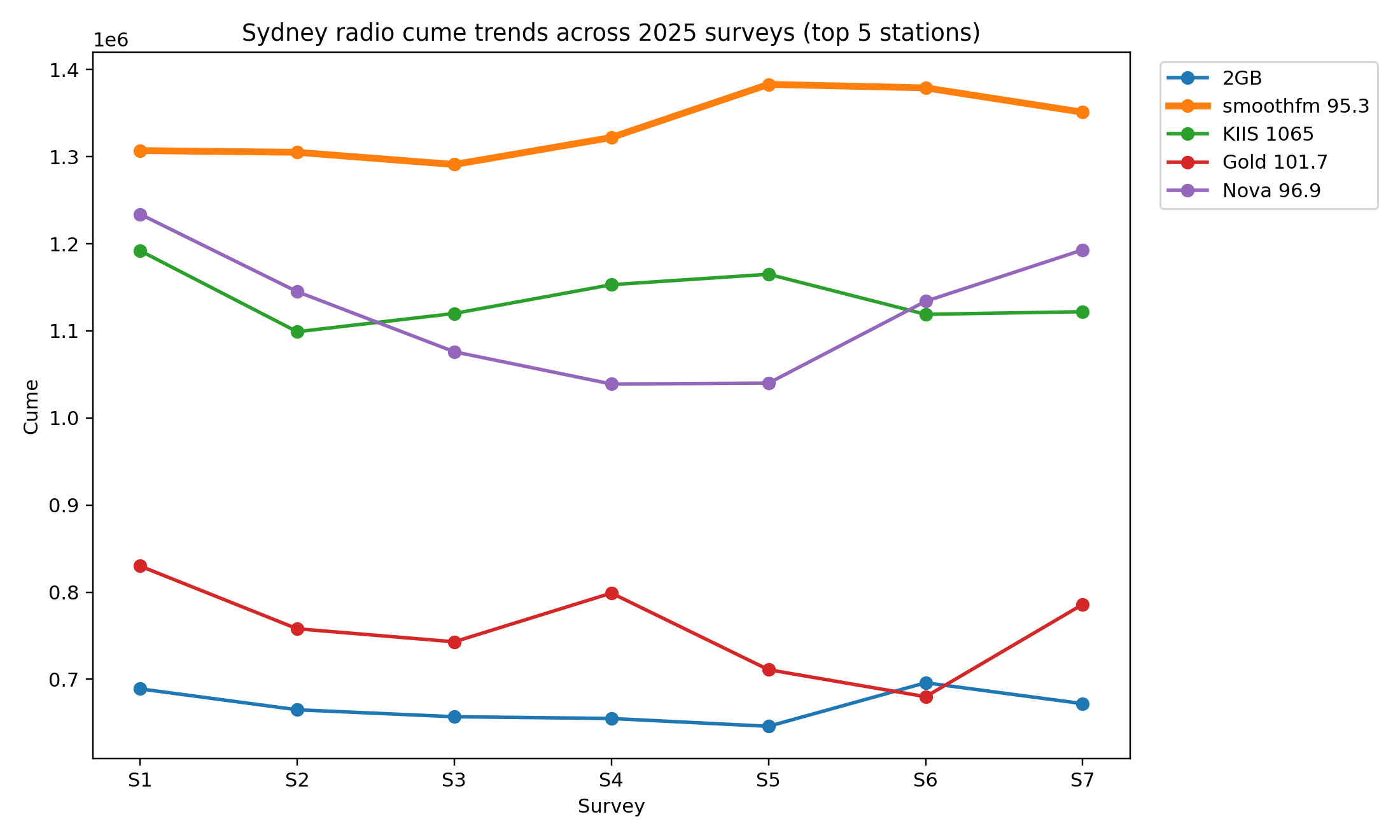

While its cume softened across the first half of the year – dropping from 689,000 in Survey 1 to 646,000 in Survey 5 – the station rebounded late, closing 2025 at 672,000.

The story here wasn’t growth, but loyalty: fewer listeners overall, staying longer, driving share dominance in a fragmented market.

2GB’s Ben Fordham

If 2GB won on engagement, smoothfm 95.3 won on sheer scale.

Smooth topped cume in every single survey, finishing the year with 1.35 million listeners, up 44,000 year-on-year – the only major Sydney station to post net growth across 2025.

Its share held stubbornly in double digits all year, peaking at 12.4% in Survey 3.

In a year where most stations ‘ reach leaked, smoothfm benefited from predictable programming and an ageing-but-faithful audience that showed up every survey, every time.

KIIS 1065 had a more uneven year, but not an uninteresting one.

Share climbed sharply mid-year, hitting 10.4% in Survey 4 and 11.1% in Survey 5, before drifting back below 10 by year’s end.

Cume followed a similar arc -dipping early, then rebounding to 1.165 million in Survey 5, before settling at 1.122 million in Survey 7.

KIIS clearly found traction mid-cycle, but couldn’t sustain it long enough to challenge smooth on reach or 2GB on consistency.

2Day FM’s Jimmy & Nath with Emma Breakfast Show

At the other end of the dial, 2Day FM’s 2025 was brutal.

Share slid from 4.2% in Survey 1 to 3.7% by Survey 7, while cume fell a sharp 118,000 listeners across the year.

There was no meaningful recovery point, no sustained spike – just a steady erosion that left the station well behind even its FM peers.

In a market increasingly rewarding habit and brand clarity, 2Day struggled to give listeners a reason to stay.

Winner: smoothfm 95.3

If 2025 was about holding your ground, smoothfm didn’t just hold, it grew.

The station topped cume in every single survey, finished the year with 1.35 million listeners, and was the only major Sydney station to post net audience growth. Double-digit share all year sealed it.

In a volatile market, smooth was the safest bet on the dial.

Loser: 104.1 2Day FM

There’s no soft way to land this. 2Day FM bled listeners and share all year, finishing 2025 down 118,000 in cume and sliding to 3.7% share.

No rebound surveys, no momentum spike – just steady decline. In a market that rewarded clarity and consistency, 2Day never found either.

The Melbourne market

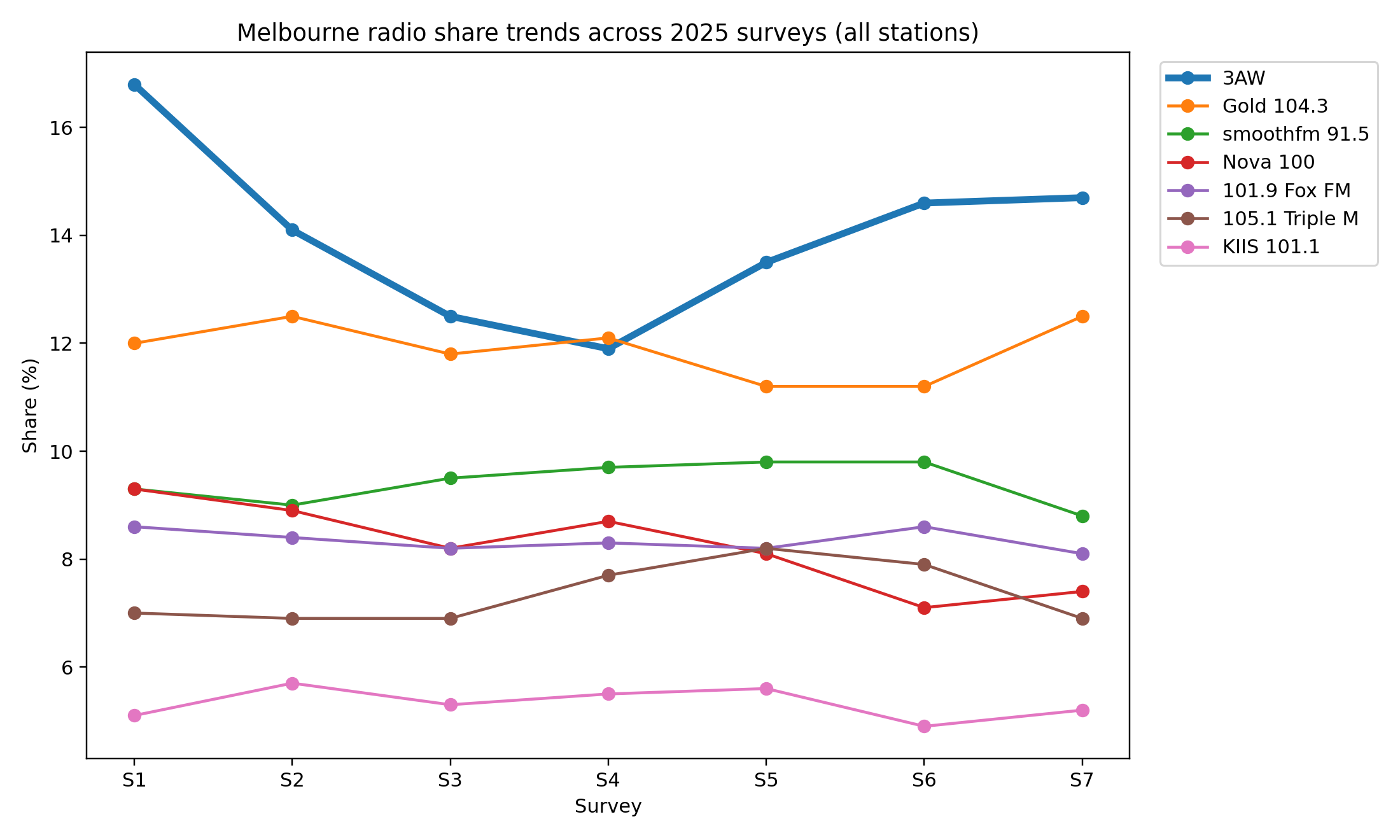

Melbourne’s radio market in 2025 remained firmly 3AW’s to lose.

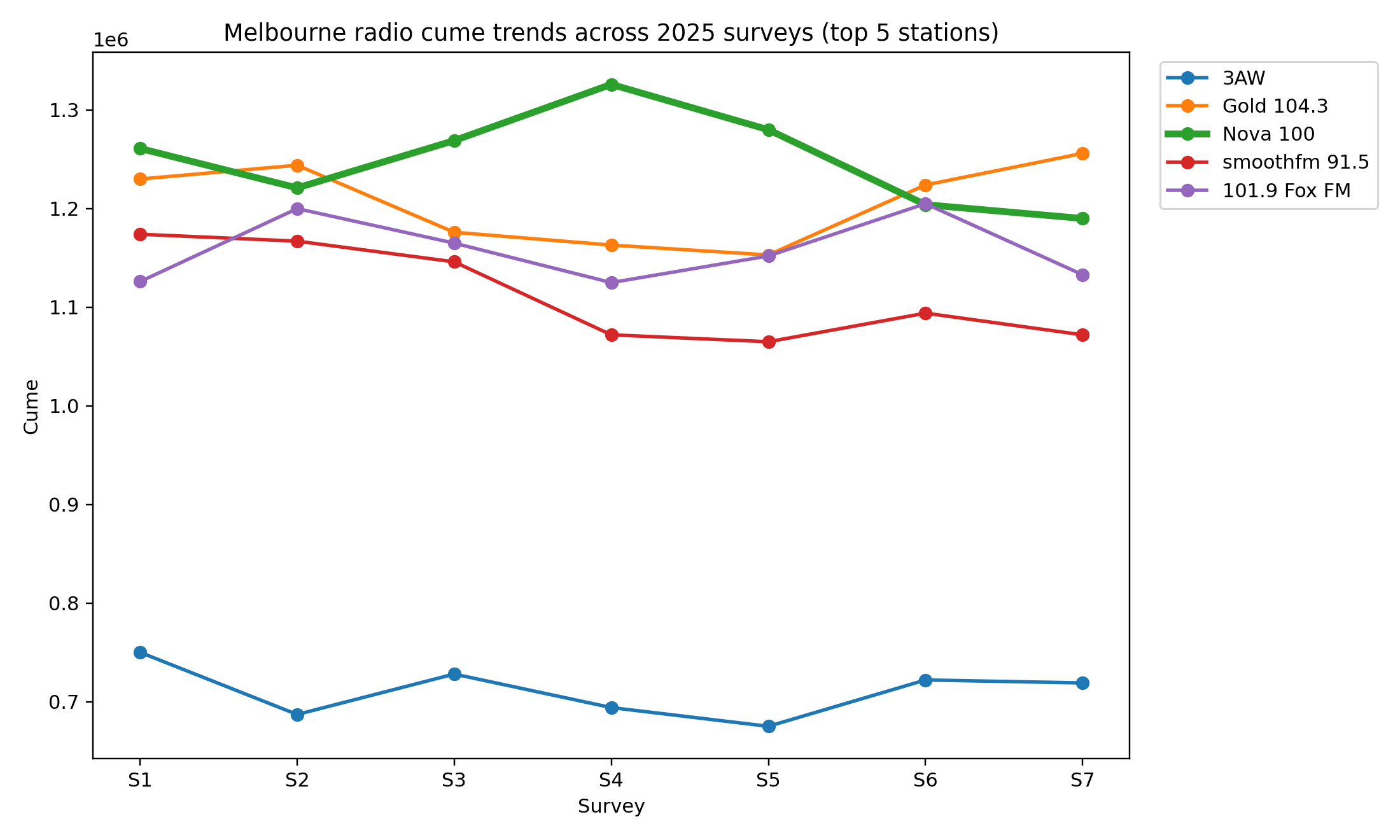

The station topped share in six of seven surveys, finishing the year on 14.7%, and reasserted its dominance after a mid-year dip. While its cume softened overall – sliding from 750,000 in Survey 1 to 719,000 by Survey 7 – 3AW’s strength lay in engagement, not reach.

Fewer listeners, staying longer, delivered another year of clear market leadership.

Below talk, the contest was tighter. Gold 104.3 emerged as the year’s most reliable music performer, winning share in Survey 4 and finishing 2025 on 12.5%, equal to its Survey 2 peak.

More importantly, Gold posted net cume growth, rising from 1.23 million to 1.256 million, making it one of the few major Melbourne stations to end the year up on reach.

In a volatile music landscape, Gold quietly did what many others couldn’t – hold an audience and add scale.

Gold 104.3’s Christian O’Connell

Nova 100 remained Melbourne’s reach powerhouse, claiming the #1 cume position in four surveys and setting the year’s high-water mark with 1.326 million listeners in Survey 4.

But that scale proved difficult to sustain.

By Survey 7, Nova’s cume had slipped to 1.19 million, and share fell from 9.3% in Survey 1 to 7.4% at year’s end, underscoring the challenge of converting broad reach into consistent listening.

For KIIS 101.1, 2025 was another year of underperformance.

Share hovered stubbornly in the mid-5s, finishing at 5.2%, while cume declined by 75,000 listeners across the year.

Despite small mid-year lifts, KIIS never found the momentum required to challenge Melbourne’s established FM brands in any sustained way.

KIIS 101.1’s Kyle and Jackie O

Triple M, meanwhile, was the quiet improver. While it remained well off the top tier in share, the station delivered the strongest cume growth in the market, lifting from 778,000 in Survey 1 to 816,000 by Survey 7.

It wasn’t enough to shift the competitive order, but in a year where many brands went backwards, Triple M at least moved in the right direction.

Winner: 3AW

Once again, 3AW proved Melbourne is still a talk town.

The station claimed the #1 share position in six of seven surveys, finishing 2025 on 14.7%, well clear of the field. While cume edged down across the year, loyalty more than made up for it.

Loser: KIIS 101.1

For KIIS, 2025 was another year stuck in neutral.

Share remained anchored around the mid-5s, closing at 5.2%, while cume fell by 75,000 listeners year-on-year.

There were no breakout surveys, no sustained momentum – just incremental drift in a market that increasingly rewarded clarity and consistency.

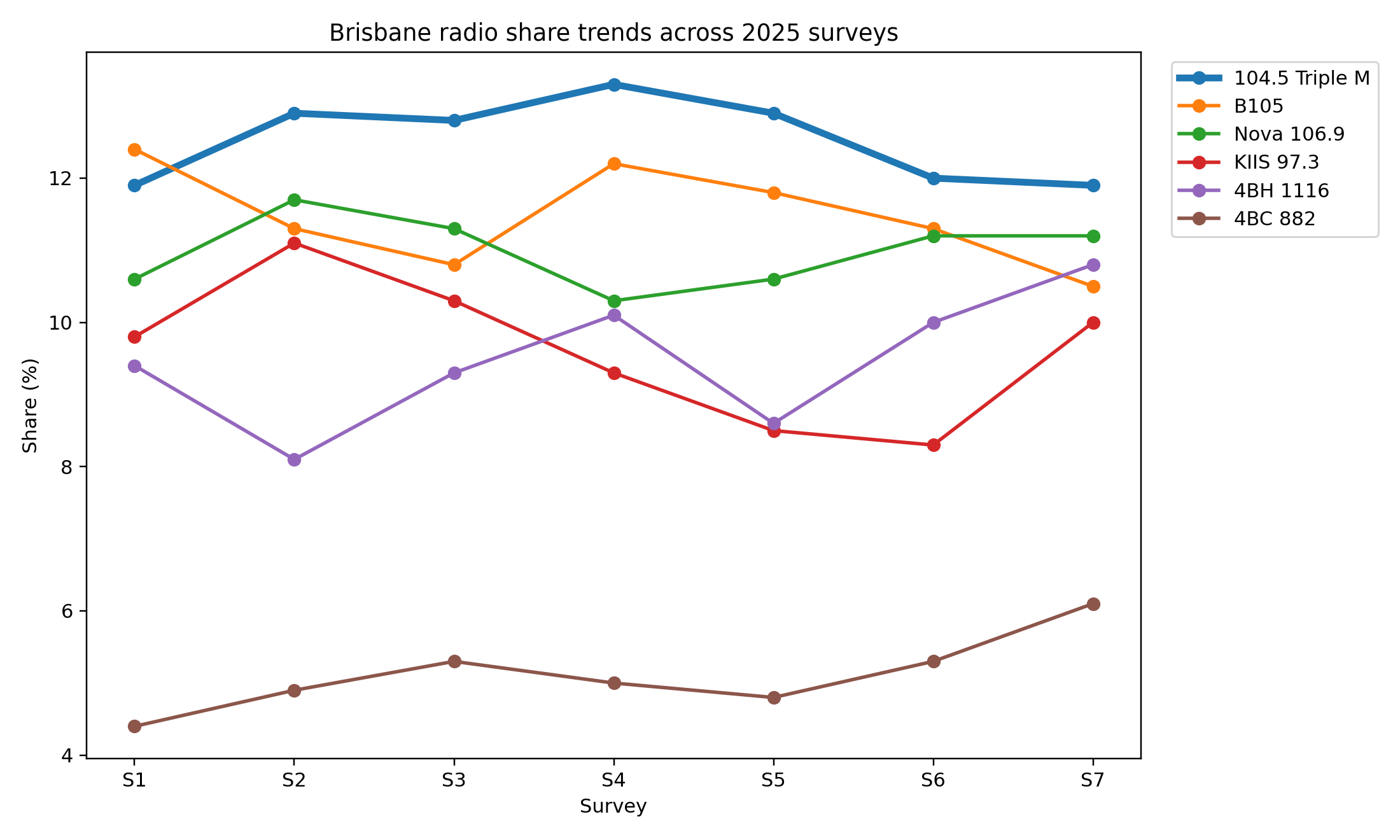

The Brisbane market

Brisbane’s radio market in 2025 was defined by share dominance at the top and a surprisingly competitive chase underneath.

Across seven surveys, 104.5 Triple M emerged as the clear share leader, finishing #1 in six of seven surveys and peaking at 13.3% in Survey 4.

While its cume eased slightly across the year, Triple M’s strength was loyalty – a stable audience listening longer, more often, and delivering the year’s most consistent performance.

In reach terms, the picture was more fragmented. Nova 106.9 and B105 split cume leadership throughout the year, with Nova leading early surveys and B105 finishing strongest.

Nova began 2025 as Brisbane’s largest station, topping cume in the first three surveys, but gradually ceded ground, ending the year at 613,000.

B105, by contrast, quietly consolidated, closing 2025 on 631,000, slightly above where it started – a rare outcome in a market where most brands went backwards.

KIIS 97.3’s Robin, Kip, and Corey

KIIS 97.3 struggled to find sustained momentum.

Despite a strong Survey 2 spike in both share and cume, the station faded mid-year before a modest recovery in Survey 7. It finished 2025 broadly flat on reach and well off the pace on share, unable to translate short-term lifts into structural gains.

Further down the dial, 4BH was one of the year’s more interesting improvers.

While its share remained modest, it steadily climbed across the back half of the year, finishing at 10.8% in Survey 7 and posting net cume growth – one of the few Brisbane stations to do so.

By contrast, the loser of the year was KIIS, which ended 2025 largely where it began, but with fewer clear strategic wins than its rivals.

Winner: 104.5 Triple M

Triple M owned Brisbane in 2025. It finished #1 on share in six of seven surveys, never dropped below 11.9%, and peaked at 13.3% mid-year.

While cume softened slightly, audience loyalty more than made up for it.

Loser: KIIS 97.3

KIIS couldn’t convert opportunity into momentum.

After a promising early-year spike, share slid back to the low-to-mid 8s before a late lift, finishing 2025 broadly flat.

Cume ended almost where it started, but without any sustained run of leadership or growth. In a market rewarding clarity and consistency, KIIS spent the year treading water.

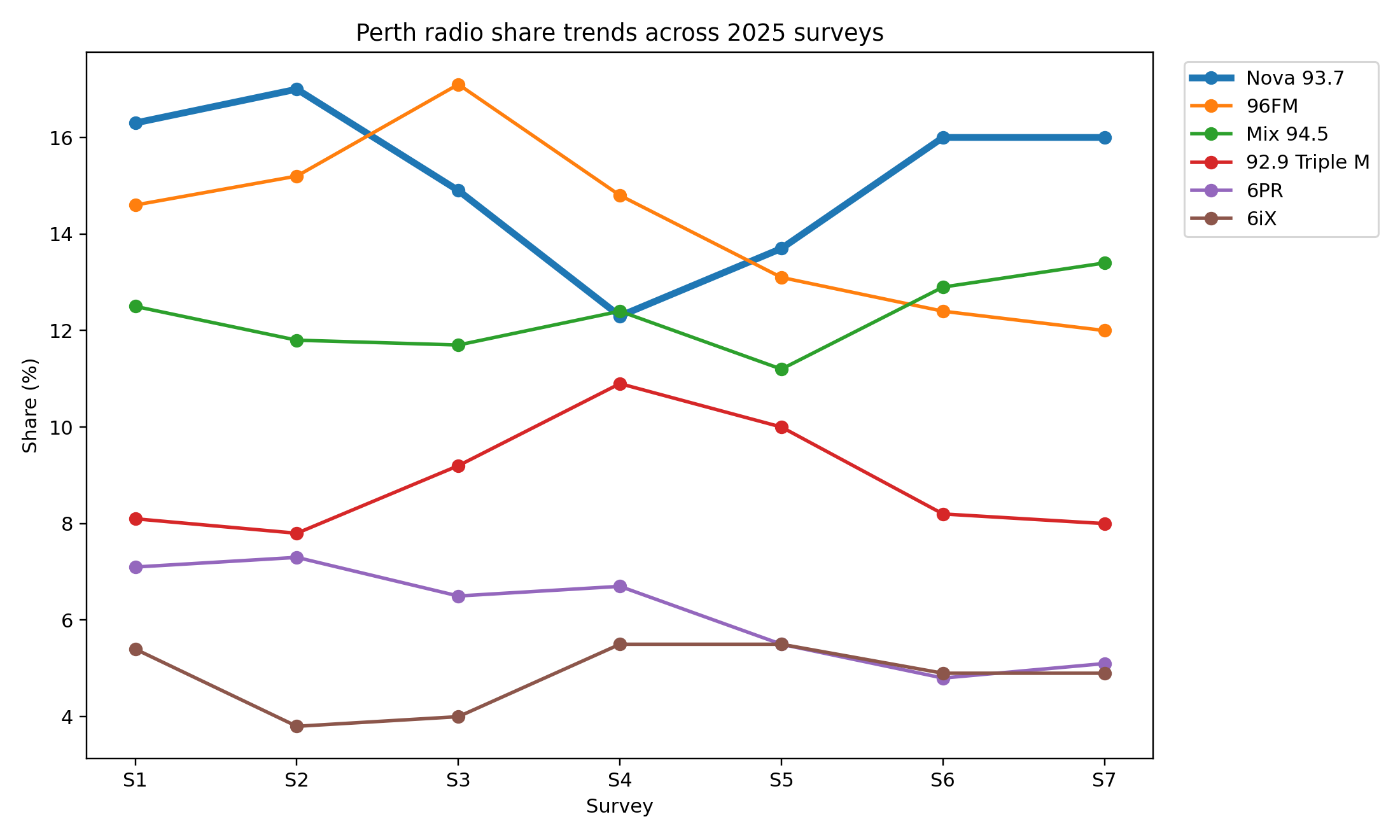

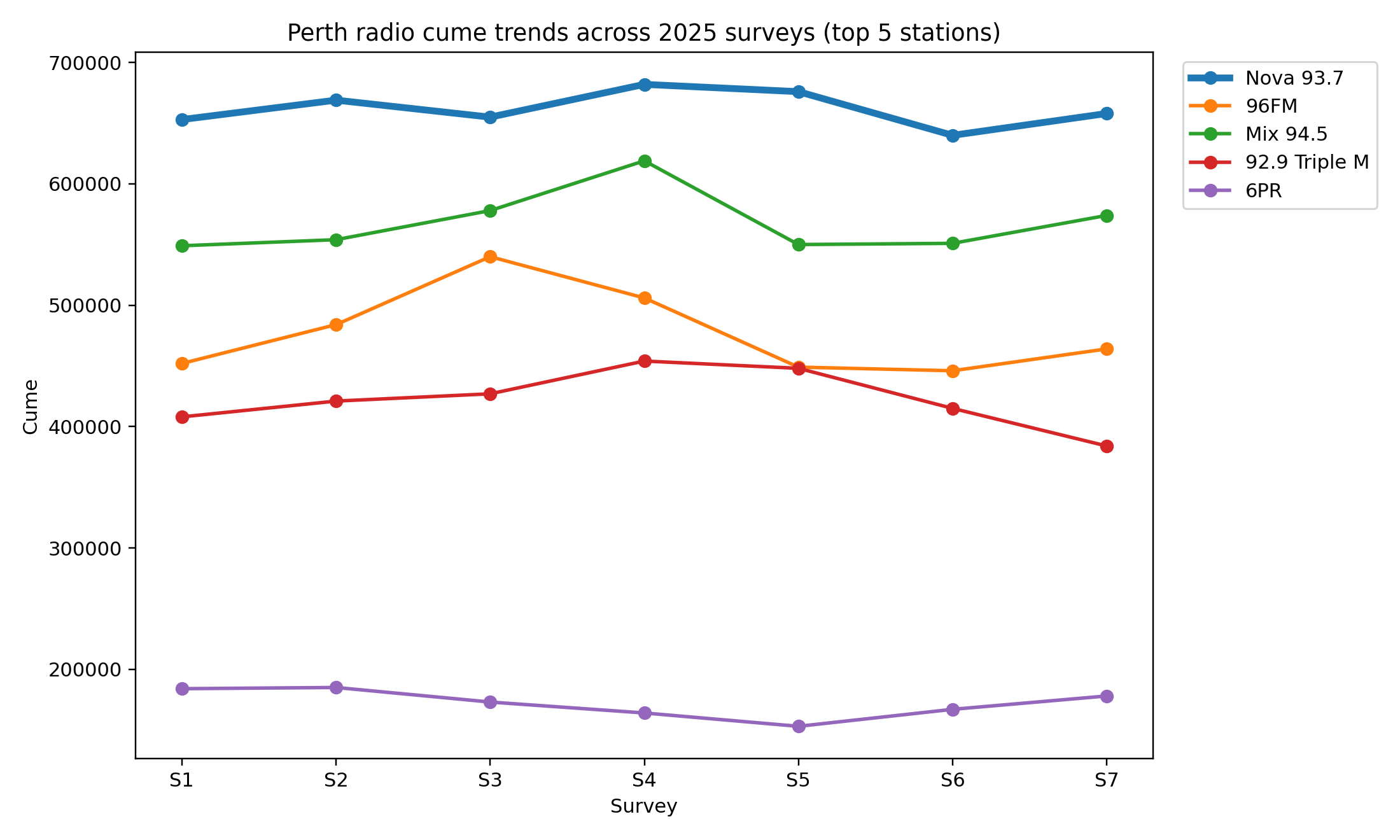

The Perth market

Perth’s radio market in 2025 was defined by Nova 93.7’s sustained dominance and a competitive second tier that reshuffled throughout the year.

Nova finished #1 on share in the majority of surveys and owned reach almost end-to-end, peaking at 682,000 listeners in Survey 4 – the highest cume recorded in the market this year.

96FM was the most credible challenger, briefly overtaking Nova on share mid-year and delivering the strongest single-survey share result of 2025 at 17.1% in Survey 3.

But that momentum faded as the year progressed, with both share and cume softening into the back half, leaving the station firmly in second place overall.

Mix 94.5 quietly emerged as the year’s growth story.

While it never topped share or cume, Mix was the only major FM music station to post meaningful net audience growth, adding 25,000 listeners across the year and finishing on 574,000. In a mature market, that upward curve stood out.

Nova 93.7’s Nathan, Nat & Shaun

Below the music pack, Triple M and 6PR struggled for traction.

Triple M’s mid-year surge proved temporary, while 6PR continued to lose relevance on both share and reach despite a modest late recovery.

In contrast, Nova’s ability to balance mass reach with consistent listening left little doubt about the pecking order.

Winner: Nova 93.7

Nova didn’t just win Perth – it owned it. The station topped share in five of seven surveys, led cume in six, and closed the year back at 16% share with 658,000 listeners.

Even when 96FM briefly surged mid-year, Nova quickly reasserted control.

Loser: 92.9 Triple M

Triple M struggled to hold momentum.

After a promising climb to 10.9% share in Survey 4, both share and cume trended down, finishing the year with 384,000 listeners, down 24,000 on Survey 1.

The brand never collapsed, but it never converted its mid-year gains into a sustained position either.

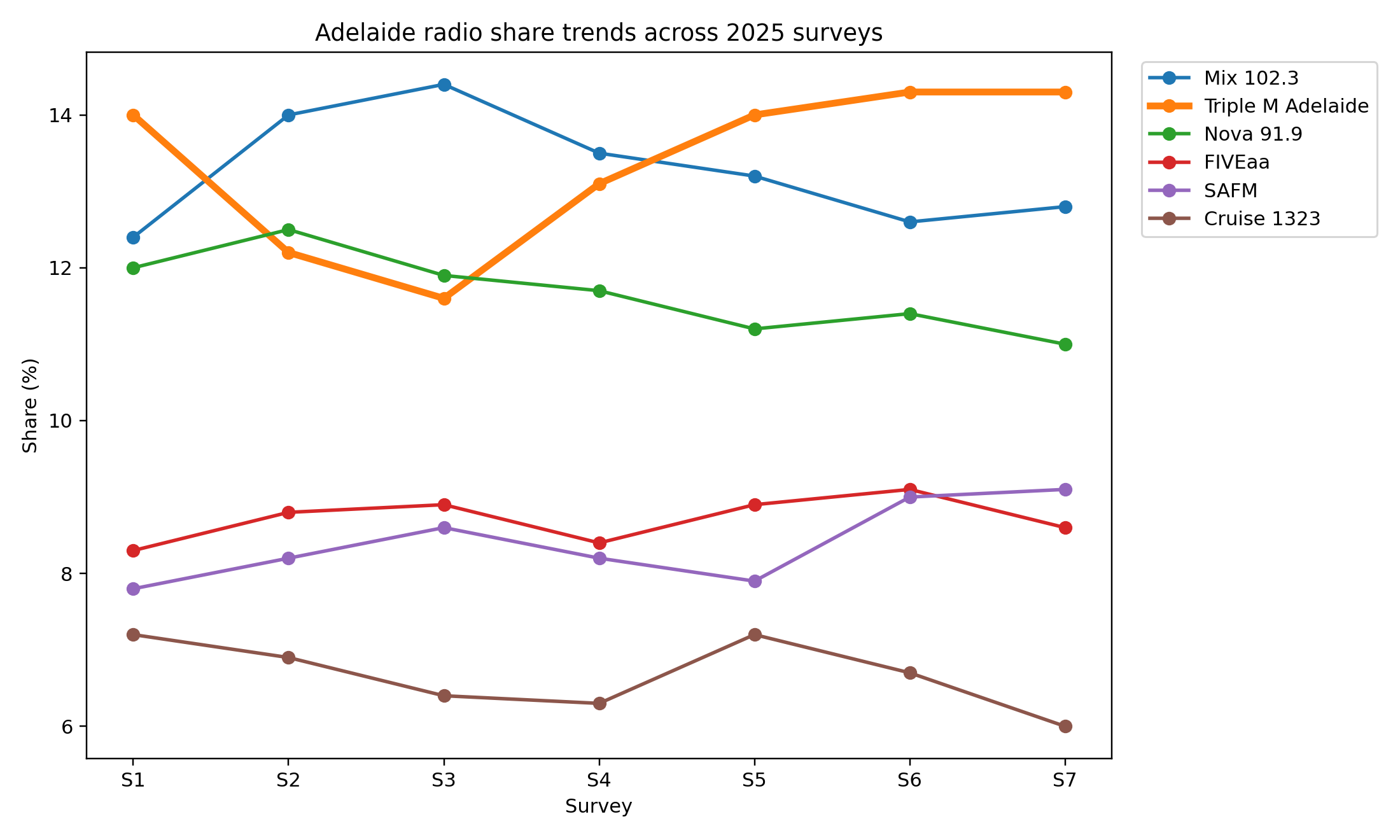

The Adelaide market

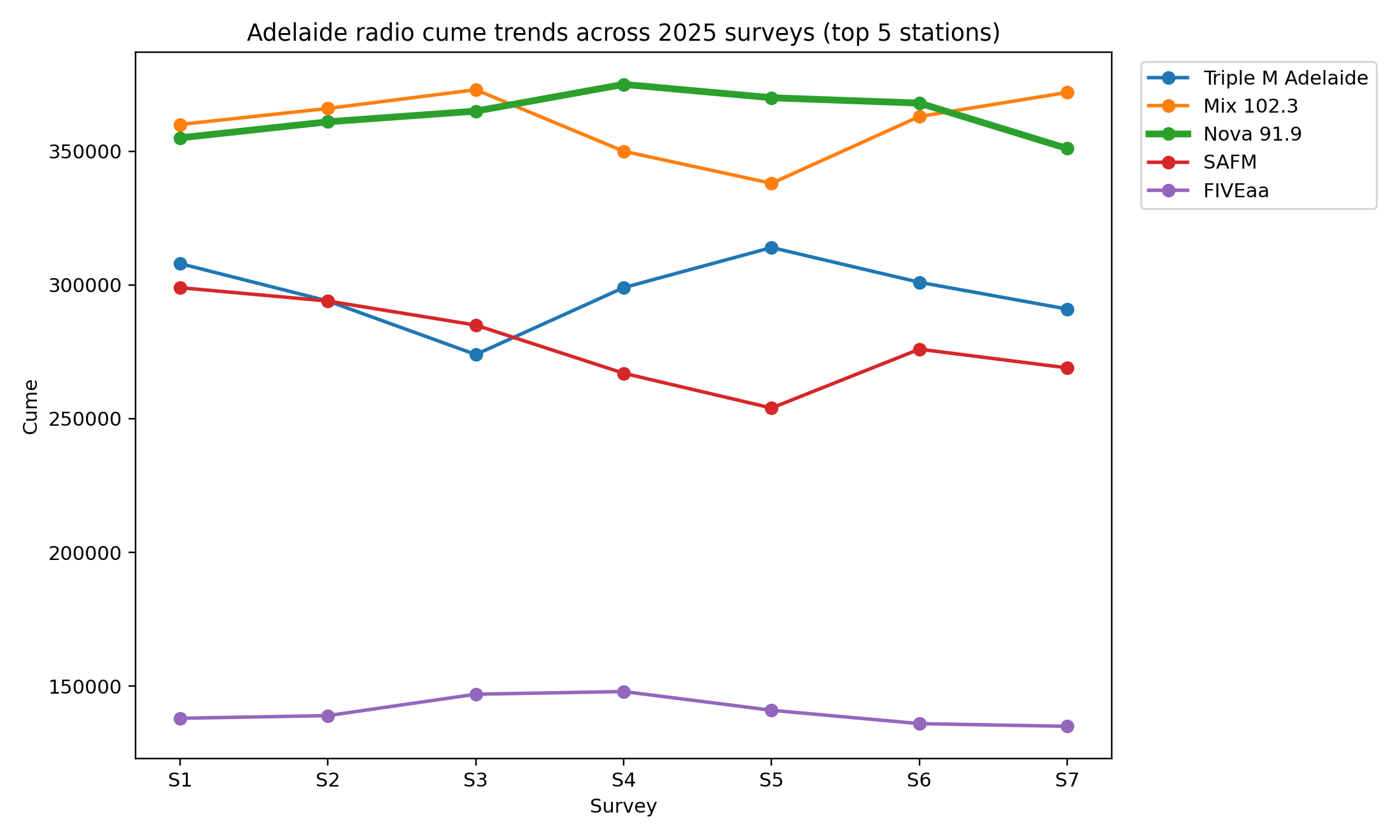

Adelaide’s radio market in 2025 split neatly between share leadership and reach leadership. Triple M Adelaide emerged as the year’s dominant share performer, gradually overtaking Mix and tightening its grip from Survey 5 onwards.

Its late-year consistency – two straight surveys above 14% – cemented its position as the city’s most listened-to station by time spent listening.

Mix 102.3 remained the early-year pace-setter, winning share in three consecutive surveys and finishing as the only major station to post net cume growth across the year.

While its share eased slightly in the back half, Mix ended 2025 with 372,000 listeners, reinforcing its role as Adelaide’s broad-appeal music brand.

In reach terms, Nova 91.9 was Adelaide’s cume powerhouse, leading audience in five of seven surveys and peaking at 375,000 in Survey 4.

Triple M Adelaide’s Breakfast with Roo, Ditts & Loz

However, its share slowly drifted downward, highlighting the challenge of converting scale into deeper listening as competition intensified.

Further down the dial, FIVEaa and SAFM traded modest gains and losses, but neither meaningfully shifted the competitive order.

The net result was a market that rewarded consistency over reinvention – with Triple M’s late-year momentum proving decisive.

Winner: Triple M Adelaide

Triple M finished 2025 as Adelaide’s most powerful station on share.

It claimed the top spot in four of seven surveys, dominated the back half of the year, and closed with 14.3% share in both Survey 6 and Survey 7.

While cume softened slightly, audience loyalty clearly strengthened – and in Adelaide, that mattered more.

Loser: SAFM

SAFM struggled to hold reach as the year wore on. Despite modest share improvement late in the year, cume fell sharply from 299,000 in Survey 1 to 269,000 by Survey 7.

The station finished stronger on share than it started, but not strongly enough to offset sustained audience erosion.

Consistency still wins

By the end of Survey 7, the scoreboard told a simple story. The stations that respected habit were rewarded, and those that mistook noise for momentum were not.

In a year obsessed with change, the safest bet turned out to be discipline: know your audience, serve them relentlessly, and resist the urge to chase every new idea. In radio, 2025 proved that consistency is not boring. It is still the hardest thing to beat.