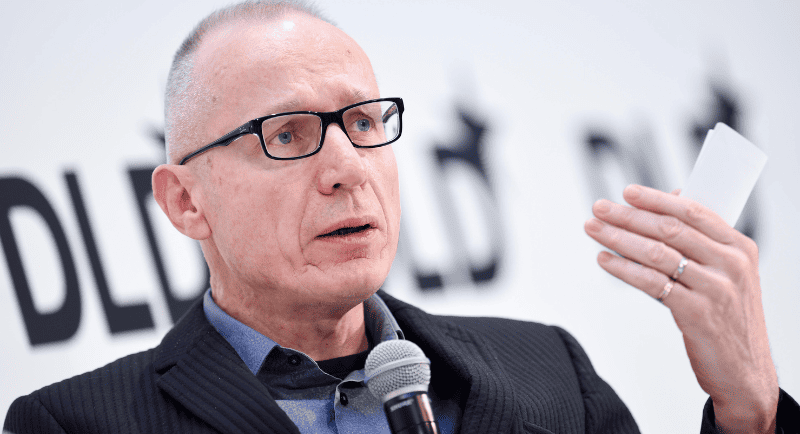

News Corp chief executive Robert Thomson and chief financial officer Susan Panuccio have delivered the company’s third-quarter results for three months ending March 31, 2023. Revenues in the quarter were $2.45 billion, a 2% decrease compared to $2.49 billion in the prior year, reflecting a $98 million, or 4%, negative impact from foreign currency fluctuations. Adjusted revenues were flat. (All amounts US$)

News Corp earnings highlights:

• Net income in the quarter was $59 million compared to $104 million in the prior year

• Total Segment EBITDA in the quarter was $320 million compared to $358 million in the prior year

• Foxtel Group exceeded 3 million total streaming subscribers and achieved the lowest broadcast churn since fiscal 2016

• Australian digital ad sales revenue down, but print ad revenues up

• Digital subscribers to news media in Australia now over 1 million

• News Corp expects to achieve at least $160 million in annualized savings from the previously announced headcount reductions, up from the prior estimate

Commenting on the results, Robert Thomson said:

“These results demonstrate the fundamental differences in the character of News Corp compared with other media companies. In a period in which advertising was clearly insipid in certain parts of the world, our core non-advertising revenue has been particularly robust, highlighted by a 38 percent increase in revenues at the Dow Jones professional information business.

“The cost reduction drive includes taking the difficult but necessary step of reducing headcount by an expected five percent, and we now anticipate that program will yield at least $160 million in annualised savings by the end of this calendar year.

“We also want to highlight that today marks the 44th day in captivity for Wall Street Journal reporter Evan Gershkovich, who has been wrongfully, wilfully detained in Russia. We trust that justice and common sense will prevail, and that Evan will soon be released.”

Digital Real Estate Services

Revenues in the quarter decreased $53 million, or 13%, compared to the prior year, reflecting a $13 million, or 3%, negative impact from foreign currency fluctuations. Segment EBITDA in the quarter decreased $35 million, or 26%, compared to the prior year, primarily due to the lower revenues, a $5 million, or 4%, negative impact from foreign currency fluctuations and higher costs related to REA India, partially offset by lower costs at Move. Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note 2) decreased 10% and 24%, respectively.

In the quarter, revenues at REA Group decreased $24 million, or 10%, to $222 million, driven by a $13 million, or 6%, negative impact from foreign currency fluctuations, lower Australian residential revenues due to the decline in national listings, most notably in Sydney and Melbourne, and lower financial services revenues due to declines in settlement activity. The decline was partially offset by price increases, increased penetration of Premiere Plus, increased depth penetration in the Australian residential business and higher revenues from REA India. Australian national residential buy listing volumes in the quarter declined 12% compared to the prior year, with listings in Sydney and Melbourne down 20% and 18%, respectively.

The Last Of Us helped drive Binge subscription numbers higher

Foxtel Group results

Revenues of $477 million in the quarter decreased $17 million, or 3%, compared with the prior year, due to a $28 million, or 5%, negative impact from foreign currency fluctuations. Adjusted revenues of $505 million increased 2% compared to the prior year. Higher revenues from Kayo and Binge, driven by increases in both volume and pricing, were partially offset by the impact from fewer residential broadcast subscribers. Foxtel Group streaming subscription revenues represented approximately 26% of total circulation and subscription revenues in the quarter, as compared to 20% in the prior year.

As of March 31, 2023, Foxtel’s total closing paid subscribers were over 4.5 million, a 6% increase compared to the prior year, primarily due to the growth in streaming subscribers driven by Binge and Kayo, partially offset by lower residential broadcast and commercial subscribers. Broadcast subscriber churn in the quarter improved to 12.3%, the lowest level since Fiscal 2016, from 14.3% in the prior year. Broadcast ARPU for the quarter increased 2% year-over-year to A$84 (US$57).

Segment EBITDA in the quarter decreased $11 million, or 14%, compared with the prior year, reflecting a $4 million, or 5%, negative impact from foreign currency fluctuations. The decline was primarily due to higher sports programming rights costs, driven mainly by contractual increases across AFL, NRL and Cricket Australia, partially offset by lower marketing spend for Kayo and Binge and lower transmission costs.

Dow Jones/The Wall Street Journal

Revenues in the quarter increased $42 million, or 9%, compared to the prior year, which includes $27 million and $19 million contributions from the acquisitions of OPIS and CMA, respectively. Adjusted Revenues at the Dow Jones segment were flat compared to the prior year, as the growth in circulation and subscription revenues from continued growth in Risk & Compliance products and digital subscription gains was offset by lower advertising revenues. Digital revenues at Dow Jones in the quarter represented 79% of total revenues compared to 76% in the prior year.

Circulation and subscription revenues increased $49 million, or 13%, which includes the contributions from the acquisitions of OPIS and CMA. Circulation revenue declined 1%, primarily due to lower print volume and lower revenues from IBD, partially offset by the continued growth in digital-only subscriptions, primarily at The Wall Street Journal.

Digital circulation revenues accounted for 69% of circulation revenues for the quarter, compared to 68% in the prior year.

During the third quarter, total average subscriptions to Dow Jones’ consumer products reached over 5.1 million, a 6% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 10%. Total subscriptions to The Wall Street Journal grew 5% compared to the prior year, to nearly 3.9 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 9% to 3.3 million average subscriptions in the quarter, and represented 85% of total Wall Street Journal subscriptions.

Advertising revenues decreased $14 million, or 14%, primarily due to 17% and 8% declines in digital and print advertising revenues, respectively, driven primarily by continued weakness in the technology and finance categories. Digital advertising accounted for 59% of total advertising revenues in the quarter, compared to 62% in the prior year.

Book Publishing

Revenues in the quarter were flat with the prior year, as higher sales in Christian books were offset by the $11 million, or 2%, negative impact from foreign currency fluctuations. Key titles in the quarter included The Courage to Be Free by Ron DeSantis, Demon Copperhead by Barbara Kingsolver and Never, Never by Colleen Hoover and Tarryn Fisher. Adjusted revenues increased 2%. Digital sales declined 3% compared to the prior year due to lower e-book sales. Digital sales represented 23% of consumer revenues for the quarter and were in-line with the prior year. Backlist sales represented approximately 60% of total revenues in the quarter.

News Media

Revenues in the quarter decreased $17 million, or 3%, as compared to the prior year, driven by a $42 million, or 7%, negative impact from foreign currency fluctuations, partially offset by higher circulation and subscription and advertising revenues in constant currency.

Within the segment, revenues at News Corp Australia and News UK decreased 5% and 4%, respectively, as both were impacted by negative foreign currency fluctuations. On a constant currency basis, revenues at News Corp Australia and News UK increased 1% and 6%, respectively. Adjusted revenues for the segment increased 4% compared to the prior year.

Circulation and subscription revenues decreased $11 million, or 4%, compared to the prior year, primarily due to a $21 million, or 8%, negative impact from foreign currency fluctuations and lower print volume. The decline was partially offset by cover price increases and digital subscriber growth.

Advertising revenues decreased $11 million, or 5%, compared to the prior year, primarily due to a $15 million, or 7%, negative impact from foreign currency fluctuations, lower digital advertising at News Corp Australia, and lower print advertising at News UK. The decline was partially offset by growth in digital advertising at News UK and higher print advertising at News Corp Australia.

In the quarter, Segment EBITDA decreased $5 million, or 13%, compared to the prior year, driven by lower revenues, as discussed above, and reflects a $4 million, or 10%, negative impact from foreign currency fluctuations. The decline was also due to a $14 million negative impact from higher newsprint prices and approximately $13 million of higher costs related to TalkTV and other digital investments, primarily at News Corp Australia.

The segment EBITDA decline was partially offset by cost-saving initiatives. Newsprint, production and distribution costs are expected to be higher in fiscal 2023 than the prior year due to supply chain and inflationary pressures, partially offset by the company’s continued transition to digital products. Adjusted Segment EBITDA decreased 5%.

Digital revenues represented 36% of News Media segment revenues in the quarter, compared to 35% in the prior year, and represented 34% of the combined revenues of the newspaper mastheads.

Digital subscribers and users across key properties within the News Media segment:

• Closing digital subscribers at News Corp Australia as of March 31, 2023 were 1,043,000 (937,000 for news mastheads), compared to 946,000 (876,000 for news mastheads) in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of March 31, 2023 were 494,000, compared to 421,000 in the prior year (Source: Internal data)

• The Sun’s digital offering reached 199 million global monthly unique users in March 2023, compared to 171 million in the prior year (Source: Google Analytics)

• New York Post’s digital network reached 147 million unique users in March 2023, compared to 155 million in the prior year (Source: Google Analytics)

See also: Full coverage of News Corp Australia’s 2023 D_Coded event

Main photo: Robert Thomson (Tobias Hase/Alamy)