In streaming, everyone wants clean lines of sight. And as Netflix wraps season three of its ads business and kicks off season four, the company has pinned its flag to a viewer-based metric, declaring 4 million Monthly Active Viewers (MAVs) in Australia and more than 190 million globally.

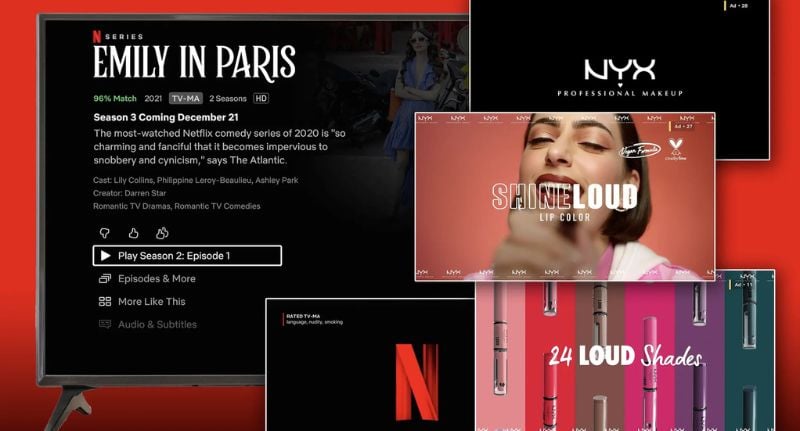

“We’re instituting a more complete metric,” Netflix said, noting the shift from profile counts to MAVs aligns ad reach with actual people in the room – whether they’re watching Stranger Things, Emily in Paris, WWE or next month’s NFL Christmas Gameday.

The company defines a MAV as someone who watches at least one minute of ads per month, multiplied by estimated household audience size from first-party research.

It’s Netflix-speak for an old truth: impressions only matter if there are eyeballs attached.

From profiles to people

Advertisers have been pushing for transparent, interoperable streaming metrics, something that mirrors the way third-party firms measure popularity, but can scale as inventory grows across live sport, tentpoles and everyday streaming.

Netflix says the MAV framework does that job.

The pivot comes after conversations with partners who wanted “an accurate, clear, and transparent representation of who their ads are reaching.”

Australian buyers will read it as Netflix staking out a middle ground, more person-based than household account models, less niche than pure device counts, and signposting an industry gap that hasn’t closed since streaming unbundled TV measurement.

Ad tech muscle and Australian pipelines

On the tools side, Netflix says its Ads Suite has now rolled out across all 12 ad-supported markets, offering programmatic access via Amazon, AJA, Google Display & Video 360, The Trade Desk and Yahoo DSP.

For Australian clients, LiveRamp support remains a meaningful unlock, with audience onboarding now available locally alongside Brazil, Canada, France, Germany, Italy, Japan, Mexico, Spain and the UK.

The platform is also testing a planning API designed to plug into media agency tools and serve real-time demographic forecasting.

That API is live in the US now and will land globally in 2026, timed neatly to rising local spend cycles and the next round of sports rights heating up here.

Add in-market audiences, covering categories like luxury vehicles, travel and dining, and Netflix is signalling it wants to sit deeper in performance and brand hybrids, not just premium reach buys.

Creative formats: more modular, more interactive

Format innovation is another swing.

Netflix confirmed interactive and modular ads are now being tested in the US and Canada, letting creative adapt based on viewing behaviour. Early results are “encouraging,” with global rollout slated by Q2 2026.

That’s a subtle but important marker.

Creative flexibility has historically been where streaming bumps up against TV convention, tight timelines, templated assets, variable compliance rules. If Netflix can scale interactivity elegantly, it shifts expectation for everyone.

Proof points and live-event heat

Measurement partnerships continue to widen: Médiamétrie in France, Macromill in Japan, Amplified Intelligence and Alter Agents in Latin America, and expanded Brand Lift via Kantar and iSpot in the US, plus AudienceProject across EMEA.

Live ad insertion – tested with WWE titles – is now set for NFL Christmas Gameday across the US, Canada, UK, Germany, Mexico and Brazil, with wider rollout through 2026. It’s hard not to see that as a pre-read for the evolving Australian sports landscape too.

Closer to home, buyers will be watching whether MAV grows beyond 4 million as Netflix sharpens live event ambitions, leans into gaming IP, and banks on franchise heat from Stranger Things and Emily in Paris.

The bottom line

It’s Netflix saying: we’re past proof-of-concept. We’re building for scale, accountability and creative elasticity – and we want your planning dashboards to speak our language.

And yes, 4 million AVOD Australians is officially the number to file away for Q4 planning decks.