Tuesday March 2, 2021

SCA’s Grant Blackley: TV affiliation, radio and podcast revenue, new breakfast shows

When Grant Blackley delivered the first-half earnings for Southern Cross Austereo on Thursday last week there was a line in the results about the impending renewal of the affiliation deal SCA has with Nine to carry its TV signals into regional areas around Australia.

Radio is the major source of revenue at SCA, with $173.3m in H1 FY21 compared to $84.9m from TV. Losing the Nine signal for 10’s channels would put further pressure on those SCA TV dollars.

When asked by Mediaweek last week if SCA might have to continue negotiations with a new CEO at Nine, SCA CEO Blackley said, “No, it is something we should be able to do before that happens.”

Some think that is an overly confident SCA chief executive. There has been speculation for some time that Bruce Gordon’s WIN TV would replace SCA at the next possible opportunity. How WIN TV was replaced by SCA in the first place puzzles some, given that Gordon is the biggest shareholder at NEC. He lost the affiliation deal for his troubles and doesn’t even get board representation.

SCA also has an affiliation deal with Seven, but for the smaller markets of Tasmania, Darwin and Central Australia.

That affiliation deal is one of many things Blackley is juggling in what most media companies are hoping will be a comeback year after the disruption of 2020.

Just days before the half year results, Blackley revealed the rebrand of PodcastOne and the new consumer app to stream SCA podcasts, live radio and streamed music. Speculation had been that one of the driving forces behind the move to introduce the LiSTNER brand was to save money on the PodcastOne licence. “That amount is immaterial,” Blackley told Mediaweek. “We had a long and successful relationship with PodcastOne (US) and we represent their interests as they do for us.”

SCA is investing $5m in the launch of LiSTNR, noting last week its digital audio revenues, including podcasting, grew from $3.3m to $5.2m in the YOY six month periods.

Revenue recovery

Blackley is a little more confident about radio revenues recovering in 2021 than some in the sector. “TV often takes the hit first when we go into any economic crisis. But it also tends to be the first to recover, followed by other media. Radio is close behind though despite having to suspend surveys last year. That didn’t assist the industry, but it was a necessary outcome. I am hoping of course for a return to normality at the earliest possible moment. We have given guidance this week that we believe our total revenues be about 6-8% below last year in the January-March quarter. That is TV and radio.

“What we are seeing is a lift from national advertisers and we have a bit of delayed recovery in the SME market. SCA does a lot of business with the SME community. To that end we are expecting a strong national recovery and there is no question we will get back to where we were before.”

Impact of new breakfast shows

Part of the revenue story at SCA is linked to the new breakfast line-ups at 2Day FM, Fox FM and Triple M Melbourne.

“There is a shorter booking cycle in audio versus other media and you can see a return on an investment pretty quickly. When we get the positive result we expect, [SCA chief sales officer] Brian Gallagher and his team will be able to monetise that very quickly.

“We would be getting a double win from network results and cap city improvement. There is a positive impact on network buys from a key station that looks and performs better.”

See also: Southern Cross Austereo’s leaner model sees half year profit lift despite revenue drop

HT&E’s Ciaran Davis: ARN recovery, iHeartPodcast strategy and revenues

“It has been a very challenging year,” is how most CEOs started their earnings calls in the past few days. This time it was HT&E chief executive Ciaran Davis talking to Mediaweek about how the ARN radio business had been buffeted by Covid-19.

“Halfway through the year who knew what was going to come,” continued Davis. “We had some scenarios that were for a lot worse than what we achieved. We have emerged a stronger business operationally and financially when you look at our balance sheet.

See also: HT&E full year results – after 22% revenue drop, recovery as radio market improves

“Our ARN broadcast radio continues to do well. We spend a lot of time talking about the strength of broadcast radio because it can get forgotten amongst new digital shining lights.

“Radio has never been healthier – the number of listeners continues to increase, and engagement is better than ever and the number of devices is growing. We are starting to see a recovery in the ad market.”

Davis noted that the TV ad market is recovering faster than radio. “People have been home a lot more and watching more TV. The [radio] direct market which is largely SMEs who have been hit hard and some of them are still not open yet or if they are their cash flow has been reduced, but that is starting to change.”

He suggested ARN will be unlikely to recover to former revenue levels during 2021. “We might not be as fast-growing as TV, we are certainly on the right road.”

Sector to get new audio sales advocate

Davis is looking forward to the recruitment of a chief commercial officer for Commercial Radio Australia. “That is an incredibly exciting role as CRA starts to focus more on the commercial side as well as the regulatory and legal side it does very well.

“We will be working with major brands and agencies and promoting radio’s strengths and to make it easier to trade with us, ultimately to grow radio’s share of ad spend. We hope that appointment is made by the end of Q1.” [CRA’s chief executive Joan Warner told Mediaweek the trade organisation has received some great applicants for the new role and preliminary interviews are underway.]

Radio v Podcasting

One thing that didn’t slow during Covid was the aggressive move by major broadcasters to expand their podcast offerings.

“Things like catchup podcasts of our shows are incredibly popular and growing enormously over the year,” said Davis.

“The strength of radio has been fuelled by people who like a sense of routine, some normality, they want to hear from local talent who they like and trust. Last year we saw people switch from in-car listening to at-home listening on smart speakers on iHeartRadio and they kept doing it at their regular times when the breakfast shows are on.”

Podcasting revenues are growing from both ARN catchup and original podcasts.

“We shouldn’t lose sight that podcasting from a revenue perspective remains in its infancy. It is going to grow – there’s no doubt about that. But let’s not lose sight that radio is live, local, connected, community, trusted – all attributes that advertisers really, really want.”

iHeartPodcast share

ARN’s iHeartPodcast Network has just celebrated if first birthday, quoting Podcast Ranker metrics that rank it Australia’s #1 podcast publisher for all that time.

“We have a way to go until we understand the most effective way to advertise on podcasts and have integration on shows,” admitted Davis. “We are learning as we go along. Our strategy has been to partner with local and international publishers to drive more awareness and more advertising into the market. We are taking time to learn where we need to invest more and where our capability needs more fine tuning.

“From an iHeart perspective we are very fortunate to have a relationship with iHeartMedia and we have the license exclusively until 2036. What it does for us is give us access to a global platform and we have a depth of content we couldn’t afford to create on our own.

“There is so much we could do in the creation of new digital brands, but we have to weigh that up with what the return is at the moment. We could launch something very shiny and maybe get 5,000 to 10,000 people listening, but that is very hard to monetise.

“Our sales strategy is merging the strength of our radio assets and our radio audience with our digital capability. That is helping us win share in radio and we are starting to see improved digital revenues coming through as well.”

iHeartPodcast Network strategy

Davis: “What we bring to partnerships is scale and an expertise in monetisation. Something that smaller operators couldn’t do. It is an area where you could spend a lot of money developing content and not have a success. That can be tricky because the margins in your own creations are much better than partnerships. As the market matures, we feel the partnership approach is the best way to learn from.”

Radio Ratings next week

There is just over a week until the first survey results of 2021. ARN has three of its four Sydney and Melbourne stations well positioned, but there are also some challenges around the network.

“I get nervous every ratings day when the results come out. Radio is so dynamic and so changing that the audience will shift quickly if you are not continuing to provide a product they like. We are very pleased with the stable of talent we have. Content-wise we are very happy how we have started 2021.”

ARN spent less on marketing in 2020 without a major impact on its ratings. But Davis noted that all broadcasters reduced their marketing spend during Covid.

10’s co-leads on the future, what ViacomCBS merger means & sales growth

In March of last year, ViacomCBS Networks International announced the resignation of Paul Anderson as chief executive officer of Network 10 and executive vice president of its operations in Australia and New Zealand.

This led to Network 10 chief content officer Beverley McGarvey being promoted to the new role of chief content officer and EVP, ViacomCBS Australia and New Zealand and taking control of all content and creative activities related to the company’s networks and digital properties in Australia and New Zealand.

Then in November Jarrod Villani was named as chief operating and commercial officer and co-lead with McGarvey, Villani is now responsible for all the combined company’s commercial activities and operations in both markets.

Mediaweek spoke with both co-leads of the business about the new company structure and what to expect from ViacomCBS Australia and New Zealand in 2021.

How do co-leads work?

The pair explained that they both lead different parts of the business in an executive capacity.

Villani: “The way that we look at the role is not dissimilar to a CEO and chairperson type relationship. The CEO role for Bev is across the content and mine is across the operational and commercial side. When there are large decisions in either one of those areas then one will consult with the other.”

While the workload is pretty evenly divided, they also stated that there is plenty of parts where there is shared decision-making.

McGarvey: “Jarrod and I have very different but complementary skills. Our perspective is that we are quite fortunate that running a business this size, two people to drive that and make decisions is a really good thing.”

While this appears to be a fairly unique structure in the Australian media industry the pair pointed to other examples such as Louis Vuitton, where this structure is being utilised.

McGarvey: “It feels like a first for free-to-air TV in Australia but it’s not a first globally and it’s not unusual outside media.”

Villani: “If you have the right people with complementary skill sets who have a pragmatic attitude to the way they make decisions you end up with far better outcomes. With this, you have somebody you can talk to about things and appropriately challenge processes. The saying its lonely at the top didn’t come from nowhere.”

Jarrod Villani’s history with 10

Villani was at his previous employer KordaMentha when it was appointed administrator of Network 10 in June 2017, when the company went into voluntary administration that led to 10’s sale to CBS.

Villani: “I got to know a number of people including Bev very well and it gave me a very good insight into some of the workings of what the business looked like at that point in time. Following the acquisition by CBS and then the merger with Viacom it is a very different business, so I have some insights, but still learning what the new company is like.”

Changes to Network 10 and ViacomCBS Australia and New Zealand

With Villani commencing the role earlier this year and the ViacomCBS team in Australia now working out of the Saunders street office, there has already been a sizeable amount of change, but Villani said that the change isn’t over.

Villani: “All businesses evolve all of the time, irrespective of the industry, will there be change? I hope so, I hope the company continues to evolve. We are going to work really hard on our BVOD strategy this year, and we have Paramount+ launching later this year.

“As to the commercial side of the business, Rod Prosser is doing a phenomenal job leading the team. They grew our commercial share by 24% linear, 38% in BVOD revenue growth and that has continued into this year, January was up 34% year-on-year, so they are really heading in the right direction.”

More to come from the ViacomCBS merger?

After previously being bought by CBS, 10 had enjoyed a new pipeline of content from the broadcasting giant, but this has increased significantly from the merger with Viacom and McGarvey said that people will continue to see the benefits.

McGarvey: “We have access to even more great content from a global parent company which is a unique position to be in. We work as part of a company now that has Showtime, Nickelodeon, and MTV along with the CBS brands that we were already familiar with. And we are relaunching a streaming service (Paramount+) this year with a phenomenal content pipeline.

“On linear services, Australian content really drives the free-to-air business and BVOD business, but there are lots of great international content on the multi channels and SVOD services. I think we are uniquely positioned to maximise our local content and international content across a range of platforms.”

Content plans

While Villani’s arrival has been impactful, McGarvey said that it has not had much of an impact on content, yet.

McGarvey: “At this point, we are basically set up for the rest of the year, with Jarrod’s arrival allowing us to think more strategically and be more forward-looking. Some of the content stuff is reactionary, but there is nothing that we will change immediately but I am sure we will make some changes over the next 18-24 months.”

Network strengths and improvements

McGarvey: “Our strength is that blend of fantastic local content with our pipeline of international content. You really need to have both of those things and we have a unique pathway to billable content. We are also quite nimble and flexible which is important moving forward.”

Villani: “It is important we continue to maintain and strategically grow our linear footprint, which is a critical part of our business and the way we leverage our growth story into BVOD and SVOD. There is a lot of discussion around movement into BVOD and streaming services which is important, but equal to that is the growth of our free-to-air.”

SMI releases January end of month ad spend data

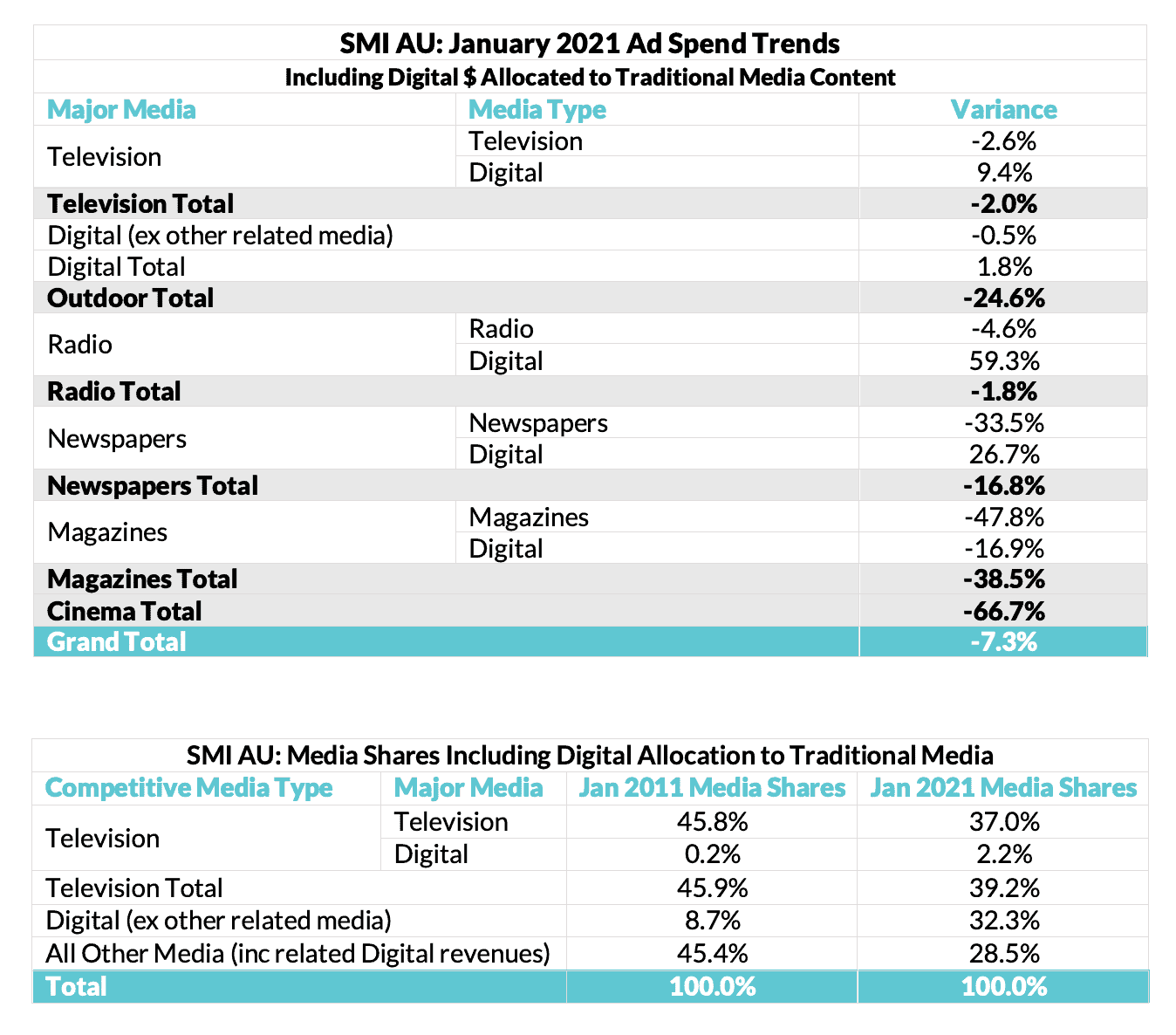

SMI has found that Australia’s media Agency market has reported softer advertising demand in January as the delayed Australian Open and the continued impact of COVID 19 briefly interrupted the market’s COVID recovery.

Total media Agency ad spend was back 7.3% in January as the Metropolitan TV market reported a 5.3% fall in bookings due to the delay of the Australian Open broadcast.

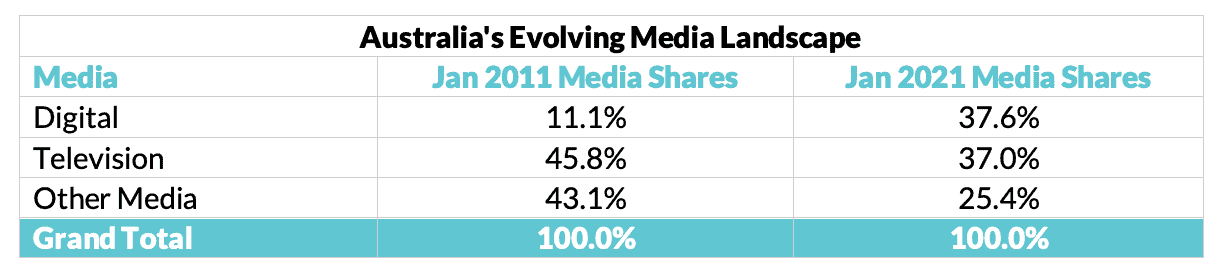

This month it was only the Digital media delivering year-on-year growth (+1.8%) as the Social Media, Programmatic and Video Sites sectors all continued to report double digit percentage growth. And that growth has seen Digital emerge as the largest media in national marketer ad spend for the first time.

SMI AU/NZ managing director Jane Ractliffe said the strength of Australia’s Television industry meant it has taken far longer than elsewhere for pure Digital media agency bookings to overtake that of Television.

“Given the likely return to Television growth for the rest of Q1 it will be interesting to see if this trend lasts beyond a single month, but at least for now the lack of the Australian Open combined with continued Digital gains has seen the Digital media emerge as Australia’s largest this month,” Ractliffe said.

SMI is reporting pure Digital bookings – which includes all Digital advertising also bought against the Digital assets of traditional media – grew from 11.1% in January 2011 to 37.6% in January 2021.

“Digital media has forever changed Australia’s advertising landscape and has been on a strong growth trajectory for more than ten years. But it’s worth noting that when Digital revenues sold against traditional media content is excluded from this top-line analysis, Digital’s share of the total falls back to 32.2%,” Ractliffe said.

She also said that the lower overall market demand reported in January after three months of consecutive growth was disappointing, but mostly timing related.

“The delay of the Australian Open broadcast was clearly a one-of factor but had a significant impact, and beyond that the market seemed to be pausing for breath after all the marketing activity in the last quarter of 2020,” she said.

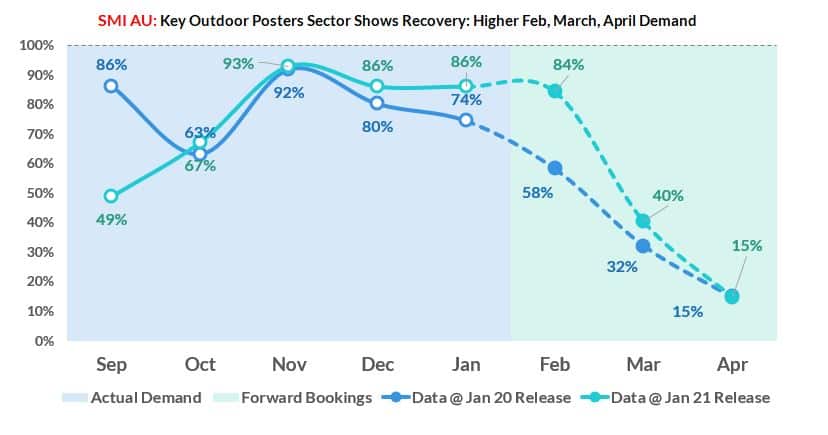

“But we can see that February demand is already in line with that evident before the start of the COVID pandemic last year, while for March the total demand is running at four percentage points above the same time last year while for April demand is already seven percentage points higher.”

Ractliffe also said the data suggested a more consistent recovery was underway, as the Posters/Billboards market – the largest sector within the most affected COVID media of Outdoor – was already reporting far higher future ad demand than for the same time last year.

“Outdoor was clearly the media most affected by COVID and future bookings fell away quickly from February 2020, but the sheer quantum of the current uplift with the data showing there’s a 26 percentage point differential in future February bookings suggests this key media is on its way to recovery,” she said.

“Prior to COVID, Outdoor ad spend was almost 16% of the market total so its recovery is key to ensuring more consistent advertising growth in the future. And already we can see some strong indications this media is returning with the Retail Outdoor sector reporting another good increase in bookings in January with the total up 21.3% for the month.”

She said other media sectors also continued to do well in January with SMI finding both the National Newspapers and Regional Radio sectors reporting their third consecutive month of growth in January.

For the seven months of the financial year the market is now back 6.8% with Digital continuing to lead the rebound in ad spend with the value ofthat media’s total bookings up 7.9% in this period.

Most sizable product category trends remain mostly COVID-related with Government bookings up 54%, Health Care category ad spend up 170% and the increase in Food/Produce/Dairy ad spend now at 21% over the previous seven month period.

Screen Australia announces development funding for 21 projects

Screen Australia has announced over $730,000 of development funding for six feature films, 12 television dramas and three online projects.

The projects include a television adaptation from Bunya Productions of the 2018 film Ladies In Black; a feature film from Bryan Brown called Dead Certain; and The Family Doctor, a television drama from one of the creators of Offspring.

Screen Australia’s Head of Content Sally Caplan said, “We are impressed by the rigorous creativity of Australian creators and are thrilled to support so many novel ideas coming through the pipeline as the industry continues to rebound from COVID-19. It’s great to see a number of engaging stories set around iconic milestones in Australian history, from the building of the Sydney Harbour Bridge, to the social change that took place in the 60s or the recession in the 80s, and I look forward to seeing these projects develop further.”

Of the 21 projects Screen Australia is funding, 10 have been supported through the Generate fund and 11 through the Premium fund.

The Latest Projects Funded For Development Include:

1989: A feature film which follows a hard-working Vietnamese refugee family in Sydney during Australia’s major recession in 1989. When 10-year-old Tram, her brother Anh and their mother Hien lose everything, the family make one last trip to Newcastle to seek refuge on the family’s struggling duck farm where they discover friendship, hope, and one giant turtle. This family comedy will be written, directed and produced by Khoa Do, whose credits include feature film The Finished People and SBS drama series Better Man.

Blood In The Sky: An eight-part television drama set during the building of the Sydney Harbour Bridge in the 1930s. The series follows the arrival of UK company man Alex Rendell and his wilful daughter Rose, who plunges them both into the melting pot of the bridge workforce and a web of intrigue, corruption and murder during the desperate times of the Great Depression. Created by Alexa Wyatt (Janet King) and Karl Zwicky (Underbelly) with a pilot script by Wyatt, Blood In The Sky will be directed by Jocelyn Moorhouse (Stateless) and Zwicky. Other writers include Andrew Anastasios (Jack Irish), Larissa Behrendt (After the Apology), Michelle Law (Homecoming Queens) and Jess Paine (The Heights). It will be produced by Zwicky and Wyatt in partnership with Beyond Entertainment and David Ogilvy as executive producer.

Dark Matter Don’t Matter: An online science-fiction comedy set in the near future when the world’s population have evacuated Earth, and a small Aboriginal community is left behind. The last to leave, they take matters into their own hands and launch themselves towards the stars in a homemade spaceship. This five-part series will be written by Tamara Whyte (Jemima To Jeremy), Isaac Lindsay (Konya) and country music artist Warren Milera. They are joined by writer/producer Philip Tarl Denson (Mining Boom).

Dead Certain: A feature film from acclaimed actor and producer Bryan Brown and writer Joanna Murray-Smith, who recently collaborated on Palm Beach. This drama centres on successful crime writer Harry King, who gives up on life after his adored wife Georgia is killed in an accident. When Harry unexpectedly falls for Maya, a self-help writer, the ghost of Georgia is a constant companion and Harry knows he must confront his own demons to embrace a new chance at life.

Ladies in Black: A television adaptation of the book and 2018 film of the same name. The series takes place in Sydney in 1961, six months after the events of the novel and film and follows the lives of the “ladies in black” during a time of great change and upheaval. This series will be written by Sarah Bassiuoni (The Heights), Joan Sauers (Wakefield), Greg Waters (Riot) and Randa Sayed, and is produced by Greer Simpkin and Sophia Zachariou of Bunya Productions (Mystery Road). The executive producers are Sue Milliken and Allanah Zitserman who produced the feature film.

Rainbow Girls: A 12-part television drama set in 2045, when the Australian Republic’s first President Rachel Radford, a Ngunnawal woman, is sworn in and 24-year-old Abigail Bread becomes the first woman to enter into the Freemasons. Feminism and white nationalism collide in this dark comedic drama about the spectacular ways women negotiate power. The creative team features writer/directors Willoh Weiland and Beck Cole (Redfern Now), writers Jane Allen (Janet King) and Jada Alberts (Cleverman), and producers Mat King (Pine Gap), Tam Nguyen and Elisa Argenzio (Lambs of God).

The Family Doctor: A six-part television series created and written by Offspring co-creator Debra Oswald, with Michael Lucas (Five Bedrooms). This drama follows dedicated GP Paula who, desperate to protect women and their children from violent partners, is driven to use her medical skills to commit murder. It will be produced by Joanna Werner (Riot).

Top Image: Bryan Brown, Willoh Weiland, Tam Nguyen

Weekly listeners for DAB+ radio stations climb to 2.35 million

Australia’s DAB+ digital radio-only stations attracted a weekly audience of 2.35 million people in 2020, an increase of 15% from 2.04 million in 2019, according to GfK data released by Commercial Radio Australia.

The weekly audience for all DAB+ stations, including AM and FM stations simulcasting on DAB+, reached 4 million*.

CRA chief executive officer Joan Warner said 11 commercial DAB+ stations each ended the year with a national weekly audience above 100,000 listeners^.

“DAB+ audiences have grown as a result of broadcasters enhancing their digital radio formats and car manufacturers continuing to add DAB+ radios to their vehicle ranges.

“Car sales recovered strongly in the last two months of last year as a result of consumers buying new vehicles for domestic road trips. This contributed to a total of 700,000 new vehicles with DAB+ on the road during 2020,” Warner said.

The figures compiled by automotive business intelligence group Glass’s Information Services show that 77% of new vehicles sold during the year were equipped with DAB+.

GfK’s point of sales report estimates that consumers purchased 129,000 DAB+ receivers in 2020, bringing total DAB+ receiver sales to 2.8 million since the broadcasting technology was launched in Australia.

Top rating commercial DAB+ stations nationally include Coles Radio, ARN’s The 80s and The 90s, OldSkool Hits, Triple M Classic Rock, Smooth Relax, Edge Digital, Urban Hits, Triple M Country, 2CH and Buddha Hits^.

For more information on DAB+ visit www.digitalradioplus.com.au.

See also: SEN launches another radio brand with launch of WA DAB+ station

Sources: GfK Radio Ratings, SMBAP S1-2 & 6-8 2020 Cume (000), Mon-Sun I2mn-I2mn, All People I0+, unless otherwise stated, comparisons made with SMBAP, S1-2 & 6-8 2019. *GfK Radio Ratings, SMBAP S1-2 & 6-8 2020 & Canberra S1 2020. ^GfK Radio Ratings, SMBAP S8 2020.

Glass’s Information Services Report, December 2020

GfK Point of Sales DAB+ Fusion report, inclusive of market coverage extrapolation to represent 100% sales coverage, includes product categories such as audio home systems, clock radios, portable radios and boomboxes.

Janie Carroll wins first Holey Moley Junior

On Monday night nine-year-old Janie Carroll putted her way into history as the world’s first Holey Moley Junior Champion, on Seven and Seven Plus.

In this special edition of Holey Moley, the eight junior golfers took the putts while their adult caddies took the hits on the supersized obstacles, including a Distractor Duel featuring crawling huntsman spiders.

A nine-hole champion on the junior Gold Coast circuit, Janie outplayed eight-year-old Oscar and nine-year-old Aahan in the grand final putt off on Uranus to clinch the coveted title, golden putter, plaid jacket and a massive $10,000 golf shopping spree.

When asked by host Sonia Kruger about her win Janie admitted she was feeling “emotional.” Janie’s dad and caddy for the night, Garry, was also overwhelmed by the evening’s excitement: “I’m so proud, it’s fantastic.”

Janie plans to spend part of her prize on a new golf buggy and a special gift for her dad, who she says aced all the obstacles. “He was amazing. He was really good. He’s the best!”

This follows Celebrity Holey Moley where Barry Hall added another prize to his trophy case when he pushed aside NRL star Mat Rogers and Olympic speed skating gold medallist Steven Bradbury to take first place in Celebrity Holey Moley, on Seven and 7 Plus.

Garbo Mark Duncan was also crowned Australia’s first Holey Moley champion last week, bagging $100,000 in prize money.

Greg Norman’s top-secret final hole, The Tomb of Nefer-Tee-Tee, was the final hurdle where Mark would compete against pro-golfer, Montana Strauss and drone-pilot, Jayden Lawson.

Each player had to putt through the sphinx onto the rotating pyramids and then onto the green with a 100-ft shot at a hole-in-one. Trading shots, Montana had three very near misses, Jayden came close on his putts, but on the third round Mark hit an outstanding putt which saw his ball sink the hole and win him the $100,000.

Read more: Holey Moley Grand Final: Garbo Mark Duncan wins $100,000

Stan to reveal the RuPaul’s Drag Race Down Under queens at Sydney’s Gay and Lesbian Mardi Gras

Stan has announced that it will be premiering the Stan Original Series RuPaul’s Drag Race Down Under queens at this year’s Sydney Gay and Lesbian Mardi Gras Parade.

The 8-part first ever local version of the global hit series will see the local drag queens compete to be the first Down Under Drag Race Superstar. The highly anticipated local version of the most awarded reality competition show in history will be hosted by RuPaul, with co-judge and Drag Race veteran Michelle Visage by his side.

The competitors of RuPaul’s Drag Race Down Under represent the diverse backgrounds and different styles of drag in Australia and New Zealand. Stan Original Series will challenge the queens to put on their own unique spin when serving looks on the runway, competing in mini and maxi challenges, throwing shade and/or sharing heartfelt moments, and of course, doing whatever it takes to win the “lip-sync for your life” battles.

The Sydney Gay and Lesbian Mardi Gras remains one of the world’s largest and most-loved LGBTQI+ celebrations – and on parade night, Stan will reveal all of this season’s queens and will celebrate with the community by participating with its very own Drag Race float. In line with the show’s themes, Stan’s float spreads the message of love and being the best version of yourself. One of Ru’s most iconic sayings is “If you can’t love yourself, how in the hell are you gonna love somebody else?”

Stan’s Chief Content Officer, Nick Forward said: “Mardi Gras celebrates and captures the imagination of Australians, with its colourful explosion of pride and self-expression. We look forward to our partnership with Mardi Gras and being part of parade night to launch our local queens and celebrate with everyone.”

Mardi Gras CEO, Albert Kruger: “Drag Race is so much more than dips, glamour, and gags. Drag Race has been pioneering queer voices and providing a platform for queer stories in the mainstream for over 10 years. That sort of visibility goes so far in helping foster understanding and acceptance of LGBTQI+ people all over the world.

“We’re very excited to be helping announce the local queens at Mardi Gras, and showing the rest of the world the talent we have Down Under.”

As the home of RuPaul’s Drag Race in Australia, and now the home of Drag Race Down Under, Stan has built an extensive catalogue of LGBTQI+ programming over the past 6 years. On platform, Stan will continue to highlight some of its new and most popular LGBTQI+ themed shows and films, including the brand-new Australian film My First Summer, smash-hit series It’s A Sin, multiple Emmy award-winning series Will & Grace, the sequel to ground-breaking drama series The L Word Generation Q, Josh Thomas’s Everything’s Gonna Be Okay and critically acclaimed series Work In Progress and Vida.

Stan also has an extensive catalogue of the Drag Race franchise including: RuPaul’s Drag Race, RuPaul’s Drag Race UK, RuPaul’s Drag Race All Stars, Canada’s Drag Race and Drag Race Holland.

The Stan Original Series RuPaul’s Drag Race Down Under will premiere in 2021, only on Stan.

Box Office: Anime film Demon Slayer dominates weekend

The Australian box office has seen a surge of 19% this weekend off the back of a big opening weekend from the anime film Demon Slayer -Kimetsu no Yaiba- The Movie: Mugen Train, with the box office making a total of $5.64m.

The other new entry to the top five this week was Boss Level which features Australian actors Mel Gibson and Naomi Watts.

The two films to drop out of the top five over the weekend were Detective Chinatown 3 (three weeks and $965,547) and The Croods: A New Age (10 weeks and $21.06m).

#1 Demon Slayer -Kimetsu no Yaiba- The Movie: Mugen Train $1,863,296

The anime film had a large release of 201 screens over the weekend and backed it up with an average of $9,270.

#2 The Little Things $968,703

The crime thriller had an average of $3,497 in its second week of release on 277 screens. The film now has a total of $3.15m.

#3 The Dry $435,720

The Dry continues to edge close to the $20m and in the process knocking off Strictly Ballroom to join the top 10 local films of all-time. It’s total now sits at $18.83m after averaging $1,424 on 306 screens over the weekend.

#4 Boss Level $409,303

The action film about a former soldier stuck in a time loop averaged $1,705 on 240 screens in its first week of release.

#5 Penguin Bloom $291,899

The Aussie drama averaged $960 on 304 screens, with its total now at $6.82m.

TV Ratings Survey: Monday Week 10

Primetime News

Seven News 984,000 (6 pm)/986,000 (6:30 pm)

Nine News is 959,000 (6 pm)/931,000 (6:30 pm)

ABC News 725,000

10 News First 339,000(5 pm)/203,000 (6pm)

SBS World News 148,000 (6:30 pm)/128,000 (7 pm)

Daily current affairs

A Current Affair 729,000

7:30 620,000

The Project 248,000 (6:30 pm)/429,000 (7 pm)

The Drum 203,000

Breakfast TV

Sunrise 222,000

Today 190,000

News Breakfast 189,000

Late Night News

Nine News Late Edition 124,000

The Latest 93,000

ABC Late News 68,000

World News Late 54,000

Nine had the #1 primary share for the 22nd night in a row with 27.2% and was also the top network share with 34.3%.

Married at First Sight threw its first dinner party of the year and served up a healthy dose of drama for the 1.02m that tuned in which was the highest rating entertainment show of 2021.

This was up on last Monday’s premiere episode of 964,000. The show was also #1 in all key demos last night.

This was followed by the first episode of Under Investigation with Liz Hayes which had 755,000.

In the premiere episode, Hayes’ forensic team searched for new clues and new lines of inquiry in the case of Victoria’s “High Country Mystery” – the disappearance of elderly lovers Russell Hill and Carol Clay from a remote alpine campsite.

Read more: Liz Hayes on Under Investigation: Nine’s new genre of TV

On Seven 319,000 tuned in to watch nine-year-old Janie Carroll putt her way into history as the world’s first Holey Moley Junior Champion.

In this special edition of Holey Moley, the eight junior golfers took the putts while their adult caddies took the hits on the obstacles.

A nine-hole champion on the junior Gold Coast circuit, Janie outplayed eight-year-old Oscar and nine-year-old Aahan in the grand final putt off on Uranus to clinch the golden putter, plaid jacket and a massive $10,000 golf shopping spree.

This was followed by 9-1-1 with 240,000 and then The Rookie with 178,000.

On 10 the Amazing Race Australia had 495,000 which was down on last Monday’s 508,000.

The latest leg of the Race was a non-elimination episode as the teams were in the Sunshine Coast as The Cowboys were handed a First Class Pass as Chris and Aleisha who were handed the Sabotage, while Stan and Wayne were given the Salvage.

233,000 tuned in for Hughesy We Have a Problem as the show featured Becky Lucas, Nazeem Hussain, Nath Valvo and Kate Langbroek and discussed how to get employees back into the office.

The Project had 248,000 and 429,000 as the panel covered the recommendations of the aged care royal commission, and Trump hinting at a presidential run in 2024.

The ABC’s current affairs lineup was spearheaded by 7:30 with 620,000 as Laura Tingle talked to Malcolm Turnbull after a serving Cabinet minister was named in an anonymous letter relating to a historic rape allegation.

7:30 was followed by Australian Story (654,000), Four Corners (549,000), Media Watch (469,000), and The Pacific: In the Wake of Captain Cook (253,000).

On SBS the top rating show for the evening was The Architecture The Railways Built which had 162,000.

Week 10: Monday

| MONDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 14.1% | 7 | 15.3% | 9 | 27.2% | 10 | 9.6% | SBS One | 3.9% |

| ABC KIDS/ ABC TV PLUS | 2.2% | 7TWO | 3.7% | GO! | 1.7% | 10 Bold | 4.3% | VICELAND | 1.5% |

| ABC ME | 0.2% | 7mate | 3.9% | GEM | 2.2% | 10 Peach | 2.4% | Food Net | 0.7% |

| ABC NEWS | 1.9% | 7flix | 1.2% | 9Life | 1.9% | 10 Shake | 0.4% | NITV | 0.1% |

| 9Rush | 1.2% | SBS World Movies | 0.4% | ||||||

| TOTAL | 18.4% | 24.0% | 34.3% | 16.8% | 6.5% | ||||

| MONDAY REGIONAL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | |||||

| ABC | 14.9% | 7 | 18.0% | 9 | 21.7% | WIN | 7.8% | SBS One | 4.2% |

| ABC KIDS/ ABC TV PLUS | 2.1% | 7TWO | 4.8% | GO! | 2.4% | WIN Bold | 5.4% | VICELAND | 1.3% |

| ABC ME | 0.6% | 7mate | 4.0% | GEM | 3.6% | WIN Peach | 2.8% | Food Net | 0.6% |

| ABC NEWS | 1.3% | 7flix (Excl. Tas/WA) | 1.2% | 9Life | 1.6% | Sky News on WIN | 1.3% | NITV | 0.1% |

| SBS Movies | 0.7% | ||||||||

| TOTAL | 19.0% | 28.1% | 29.3% | 17.3% | 7.0% | ||||

| MONDAY METRO ALL TV | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FTA | STV | ||||||||

| 89.7% | 10.3.% | ||||||||

Monday FTA

- Married At First Sight Nine 1,020,000

- Seven News At 6.30 Seven 986,000

- Seven News Seven 984,000

- Nine News Nine 959,000

- Nine News 6:30 Nine 931,000

- Under Investigation Nine 755,000

- A Current Affair Nine 729,000

- ABC News ABC TV 725,000

- Australian Story ABC TV 654,000

- 7.30 ABC TV 620,000

- Four Corners ABC TV 549,000

- The Chase Australia Seven 533,000

- Home And Away Seven 514,000

- The Amazing Race Australia 10 495,000

- Media Watch ABC TV 469,000

- Hot Seat Nine 440,000

- The Project 7pm 10 429,000

- The Chase Australia-5pm Seven 355,000

- 10 News First 10 339,000

- Holey Moley Australia Seven 319,000

Demo Top Five

16 – 39 Top Five

- Married At First Sight Nine 264,000

- Under Investigation Nine 138,000

- The Amazing Race Australia 10 120,000

- Seven News At 6.30 Seven 117,000

- Nine News Nine 104,000

18 – 49 Top Five

- Married At First Sight Nine 444,000

- Under Investigation Nine 246,000

- Seven News At 6.30 Seven 220,000

- The Amazing Race Australia 10 216,000

- Nine News Nine 202,000

25 – 54 Top Five

- Married At First Sight Nine 509,000

- Under Investigation Nine 291,000

- Seven News At 6.30 Seven 271,000

- Nine News 6:30 Nine 261,000

- Nine News Nine 257,000

Monday Multichannel

- Bluey ABC Kids/ABC TV Plus 176,000

- NCIS (R) 10 Bold 166,000

- NCIS Ep 2 (R) 10 Bold 146,000

- Bluey ABC Kids/ABC TV Plus 142,000

- M- Aquaman 7mate 136,000

- Kangaroo Beach ABC Kids/ABC TV Plus 134,000

- Peppa Pig ABC Kids/ABC TV Plus 128,000

- Doc Martin 7TWO 127,000

- NCIS Ep 3 (R) 10 Bold 127,000

- Kiri And Lou ABC Kids/ABC TV Plus 126,000

- Peppa Pig ABC Kids/ABC TV Plus 118,000

- Foyle’s War 7TWO 117,000

- Ben And Holly’s Little Kingdom ABC Kids/ABC TV Plus 114,000

- The Adventures Of Paddington ABC Kids/ABC TV Plus 113,000

- Neighbours 10 Peach 111,000

- Rusty Rivets ABC Kids/ABC TV Plus 106,000

- Go Jetters ABC Kids/ABC TV Plus 105,000

- Brave Bunnies ABC Kids/ABC TV Plus 103,000

- Love Monster ABC Kids/ABC TV Plus 101,000

- NCIS Late Encore 10 Bold 100,000

Monday STV

- The Bolt Report Sky News Live 72,000

- Alan Jones Sky News Live 71,000

- Paul Murray Live Sky News Live 68,000

- Credlin Sky News Live 65,000

- Last Week Tonight With John Oliver FOX8 39,000

- PML Later Sky News Live 39,000

- The Kenny Report Sky News Live 35,000

- Family Guy FOX8 34,000

- First Edition Sky News Live 32,000

- The Walking Dead FOX SHOWCASE 31,000

- Blue Bloods FOX One 31,000

- Family Guy FOX8 30,000

- Antiques Roadshow Lifestyle Channel 30,000

- The Walking Dead FOX SHOWCASE 30,000

- AM Agenda Sky News Live 29,000

- Rio Bravo FOX Classics 29,000

- Escape To The Country Lifestyle Channel 29,000

- Blue Bloods FOX One 29,000

- The Big Bang Theory FOX Funny 27,000

- Live: 78th Annual Golden Globe Awards FOX Arena 27,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2021. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Media Code

ACCC says some are ‘overreading’ last-minute changes to Media Code

ACCC chairman Rod Sims said some were “overreading” amendments made just before the law was finally passed. They allow Facebook and Google to avoid the code if the treasurer is satisfied they are doing sufficient deals with Australian media companies. However, they can be forced back into the code and after two months available for negotiation, face compulsory arbitration.

Business of Media

Digital tops ad market for first time as Australian Open drags TV down

Overall advertising spending dropped in January following the Australian Open’s three-week delay, which hit TV broadcaster Nine and halted the market’s recovery in the fourth quarter of 2020.

Media agency ad spend dropped 7.3 per cent compared to January 2020 as the metropolitan TV market reported a 5.3 per cent fall in bookings due to the Australian Open delay, which hit Nine Network’s first-quarter TV schedule, according to Standard Media Index.

Nine board upheaval as former Fairfax director resigns

Nine director Patrick Allaway confirmed his resignation in an ASX statement on Monday after The Sydney Morning Herald and The Age told Allaway and the company the mastheads were publishing a story about his intention to step down. The resignation follows months of tensions at board level over governance and transparency and a report in the masthead revealing an investigation into deputy chairman Nick Falloon over allegations he misused a corporate golf club membership.

These factors appear to have accelerated Allaway’s resignation. The former investment banker and Bank of Queensland chairman told close associates he intended to resign as a Nine director weeks ago, according to three people familiar with the conversations.

Neo-Nazi leader filmed repeatedly punching security guard at Channel Nine building

Thomas Sewell, one of the leaders of the neo-Nazi group National Socialist Network, was filmed assaulting the guard on Monday afternoon after he and another man came to the network’s offices in Melbourne before its tabloid current affairs program aired a segment about the group.

Footage of the assault, posted online and seen by Guardian Australia, shows the security guard ushering Sewell and the other man, who is holding a camera, out of the building.

The second man uses a racial slur against the security guard, who is black. He appears to put his hand over the camera. The video then shows Sewell strike the guard a number of times as the guard falls to the ground.

News Brands

ABC Media Watch host Paul Barry and reporter Louise Milligan in Twitter spat

The exchange began when Media Watch host Paul Barry was criticised by an audience member on Twitter for lacking female representation in a segment on the Parliament House rape allegations.

Barry quickly defended himself, saying he quoted both news.com.au journalist Samantha Maiden and The Guardian’s Katherine Murphy, and had reached out to ABC journalist Louise Milligan for further comment to which she “didn’t reply”.

Milligan, however, responded by saying she never received the request, calling out Barry’s behaviour as “poor form”.

Entertainment

TV Ratings: Golden Globes Crater, Headed for Multi-Year Low

Fast national ratings — which aren’t fully time zone-adjusted and not entirely accurate — show NBC’s broadcast averaging just 5.42 million viewers and a 1.2 rating in the key ad demographic of adults 18-49. Both are down more than 60 percent from the preliminary figures from last year (14.76 million and 3.8).

The 2020 Golden Globes, which aired in early January and had an NFL playoff game as a lead-in, averaged 18.33 million viewers and a 4.7 in the 18-49 demographic in the finals.