Running a TV sales network was a relative walk in the park compared to the challenges broadcasters have faced in the past couple of years…and that is before you factor in the impact of COVID-19.

Network 10 chief sales officer Rod Prosser told Mediaweek chasing the revenue is now being done without staples of the business. “The face-to-face meetings that salespeople have always enjoyed, and are a critical part of doing business, whether it be pitching or just meeting over a cup of coffee, are gone. Our sales team has really put it into fifth gear how they are communicating with clients. The biggest shift for us is around communications.

“It has been really lovely to see the whole market respond so well in terms of how we all communicate. Initially it was a big step for us in terms of the style of meeting and how we were communicating via video conference or phone.

“Luckily for us we had set up our sales and ad tech so it could be online and in homes. We have quite a robust tech system, which dates from pre-COVID, which allows salespeople to transact from home. The impact from the lockdown didn’t halt the process of any revenue flow.

“The biggest challenge is how we adapt to the current market which is under pressure in terms of revenue. We have benefitted from taking a really proactive approach in market.”

UpClose at Home

10’s Julia Morris and her network colleagues

Part of that proactive approach this week was the UpClose at Home virtual event. The video presentation started with Julia Morris hosting via Zoom and throwing to 10 colleagues including Osher Günsberg, Tom Gleisner, Jock Zonfrillo, Dr Chris Brown, Jonathan LaPaglia and I’m a Celebrity winner Miguel Maestre.

Chief content officer and EVP Beverley McGarvey and Rod Prosser then took over, steering the presentation through audience growth highlights, an update on the schedule and ending with a sneak peek at Bachelor in Paradise.

Impact of schedule changes on revenue

Beverley McGarvey and Rod Prosser

When asked about what the altered 2020 primary channel schedule means for revenue, Prosser echoed the thoughts of his boss Bev McGarvey reported here yesterday. “We have been pretty lucky without being overly optimistic. The biggest shift was the year’s second cycle of Survivor. That presented a challenge, but the upside of the changes is that we now have Junior MasterChef in the back half.” Prosser said there had already been interest from advertisers and brands off the back of bigger audience for MasterChef this season.

“Survivor will be back next year for sure, giving us longer to sell it. As we still have The Bachelor and The Masked Singer franchises too, we don’t feel like we have been hugely impacted. Financially of course this quarter will be tough, but that is something every other business is going through.”

Prosser said that regarding the departure of George, Gary and Matt from MasterChef, some clients initially questioned the move. “Everyone questions change. Those judges were a big part of the show, but we had always said the MasterChef brand was bigger than any of the people in it. We were quite confident the product was going to be strong regardless of the judges because for viewers it is very much about the cooking and the contestants. Of course the judges are critical to the format, and we have nailed that.

“We have seen some clients that questioned the changes and downgraded their spend coming back and asking to be involved.”

Prosser maintains he and the 10 team never had any doubt that MasterChef 2020 would be a strong season. “We thought many would come for episode one – it was a great episode and people stayed. We are subsequently overdelivering for our sponsors as the numbers have exceeded the audience expectation we sold it off.”

The Living Room dramas off camera would not have helped revenue in the Friday night timeslot, although Prosser said judging how big the impact was is difficult in the COVID-19 environment. “The program has a very strong place commercially for us because the format lends itself to integration and it is really important to the schedule. We will be pleased when it comes back.”

The single biggest negative impact this year has been the cancellation of the Australian Grand Prix in March. “It was called off for the right reasons of course, but we had a lot of revenue tied into that weekend. Some of it stayed, but a lot of it didn’t. If the race had gone ahead we would have been up in Q1 in both dollars and revenue share.”

Making sure new channel is distinct

Did 10 drop a clue to its new multichannel during the presentation? The channel also showed an MTV slide

The 10 sales team has done some modelling around what the new third multichannel will mean to the business. “It is a viable and sensible thing for us to do. A new channel will lift our overall commercial audience share and therefore improve our revenue share.” Prosser said the H2 channel launch was important to get some audience traction before 10 talks to agency groups for the 2021 negotiations.

McGarvey and her chief sales officer are well aware that unless the new channel is different to anything else that is being played it could struggle. “We also have to be careful that putting extra product on the network doesn’t cannibalise the revenue from other channels. It has taken us to this point to feel really confident this is the right product and the right channel to go to market with.”

VOZ delay and 10 Play impact

While labelling the delay of the arrival of VOZ disappointing, Prosser explained: “What it has done is allow us to spend the right amount of time in making sure that it is market ready and the market understands exactly what it can deliver and the metrics and methodology.”

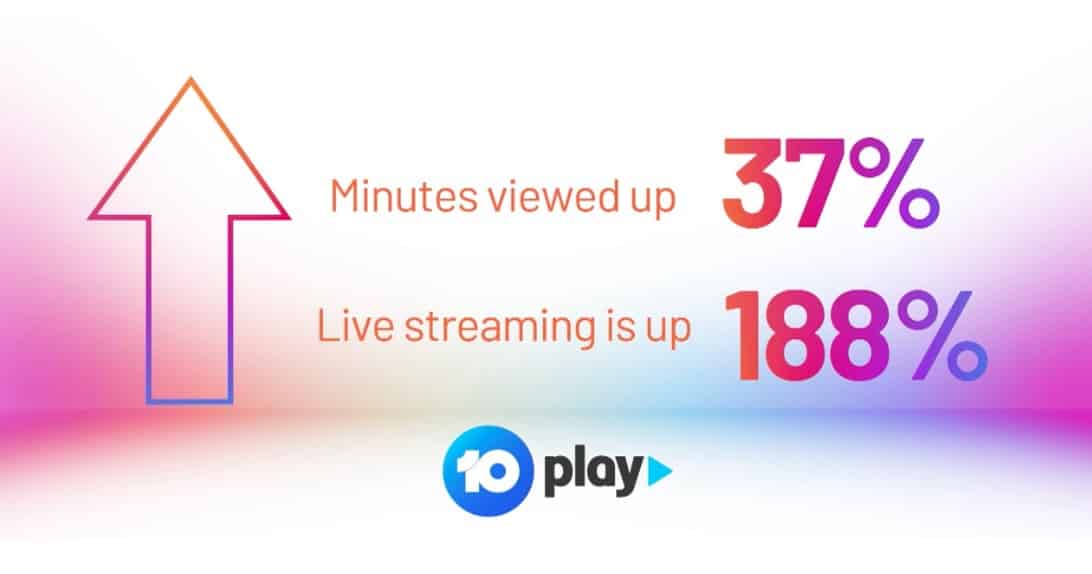

10 Play has delivered ViacomCBS significant revenue growth month-to-month and year-to-year. Prosser: “The platform has also weathered the COVID-19 storm to date. From a tech standpoint is a much better experience for viewers and advertisers. We will continue to invest in it because it is an important part of our AVOD strategy.”

—

Top Photo: Rod Prosser