A report from WARC has found that global advertising spending is set to decline in 2023 despite an 8.3% rise this year.

The Ad Spend Outlook 2022/23: Impacts of The Economic Slowdown report found that ad spending saw a boost due to notable events in the second half of 2022, including the US midterm elections and the men’s FIFA World Cup in Qatar in November.

However, in 2023 market growth is projected to run into a significant fall to 2.6%, due to investments being stalled by slowing economic growth and third-party cookie blocking across the web.

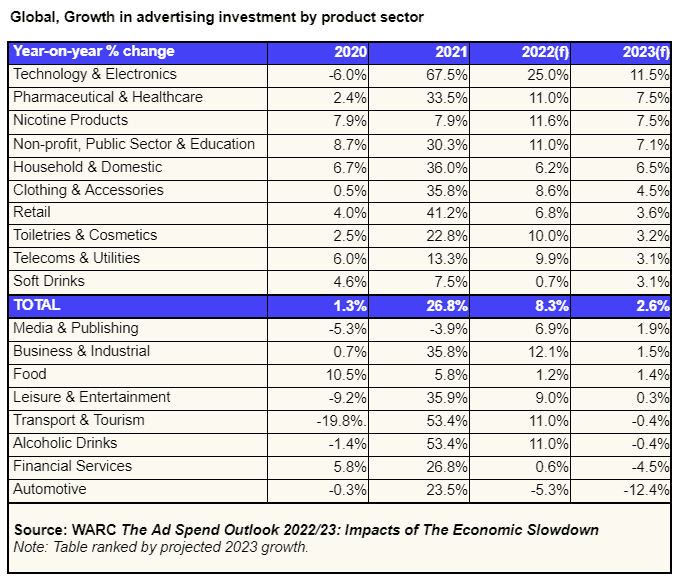

Of the 18 product sectors monitored by WARC, all bar automotive are on course to increase advertising spend this year. Only four sectors are expected to cut spend in 2023; transport & tourism (-0.4%), alcoholic drinks (-1.1%), financial services (-4.5%) and automotive (-12.4%).

Advertising spend in the video streaming sector is set to grow faster than the total ad market this year (+8.4%) and next year (+7.0%). Within this, the advertising-funded video on demand (AVOD) sector – which includes the likes of Hulu, Amazon Prime Video and YouTube – is expected to rise 8.0% this year and then a further 7.6% in 2023 to reach a value of almost $65bn.

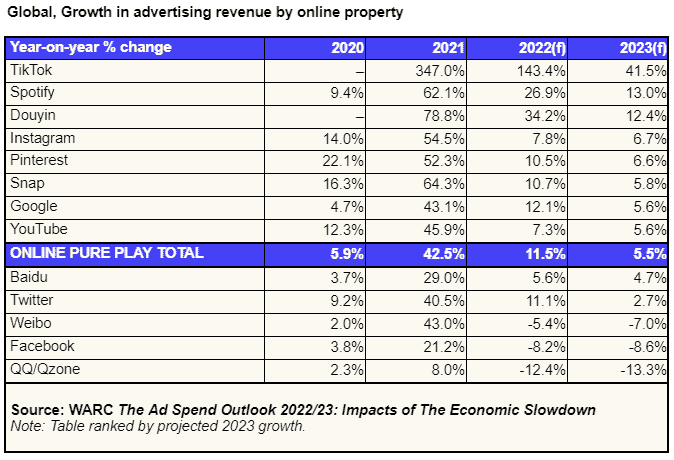

Aside from the social media players, YouTube’s fortunes have also proven vulnerable to privacy changes on Apple devices; WARC believes that YouTube’s advertising revenue will rise 7.3% this year (compared to a 45.9% in 2021), but that its growth will then ease to 5.6% in 2023. This would give the company 39.4% of the global AVOD market, a declining share (down 0.9pp from 2021) as competition heats up with the introduction of advertising to Disney+ and Netflix later this year.

James McDonald, director of data, intelligence and forecasting at WARC, and author of the research, says: “With the growth rate of global output now set to halve and acute supply-side pressures fanning inflation, the economic slowdown has removed close to $90bn from global ad market growth prospects this year and next.”

The reduction is forecast to hit almost $90billion in growth potential, with the projections based on data from 100 advertising markets globally, amounting to a downgrade of 4.3 percentage points to 2022 growth and 5.7 percentage points to the prospects of 2023.

Streaming services however are set to grow faster than the total ad market in 2022, despite evidence emerging of saturation of the streaming market. The report claims that new entrants will be forced to fight over existing advertising spending, which could hinder the overall growth of streaming operators.

McDonald said: “Brands are still spending as the Covid recovery continues, and global ad trade remains on course to top $1trn in value by 2025. Platforms with rich sources of first-party data – most notably Amazon, Google and Apple – are well placed to weather future headwinds by offering measured performance in a climate where return on investment becomes paramount.”