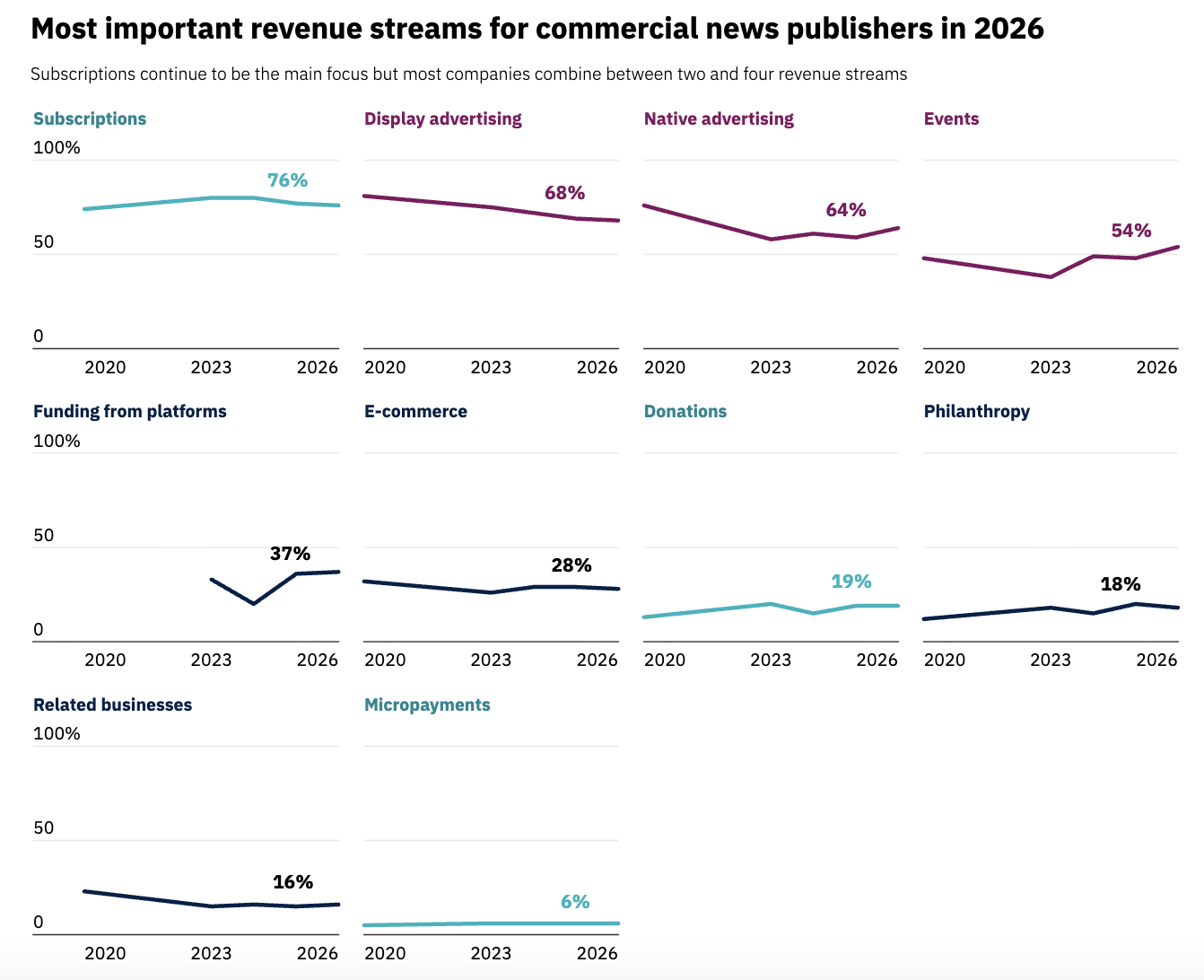

Subscriptions and memberships will remain the single most important revenue stream for news publishers in 2026, as the industry doubles down on paid content, branded advertising and live experiences to offset sliding platform traffic and growing AI disruption.

New data from the Reuters Institute for the Study of Journalism shows 76% of commercial publishers say paid content will be their primary focus in the year ahead, well ahead of native and brand advertising (64%) and face-to-face events (54%).

The message from publishers is blunt: direct relationships now matter more than reach, scale or legacy distribution.

For brands and advertisers, that shift is already reshaping where premium news organisations are investing time, talent and inventory.

Publishers confident in business, less so in journalism

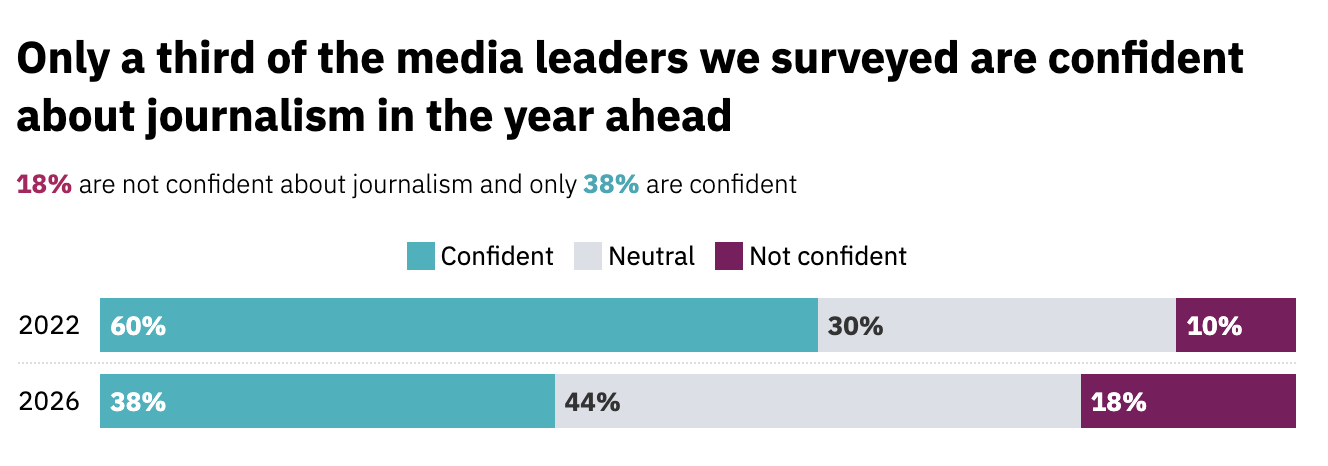

The findings are drawn from a strategic survey of 280 editors, CEOs and digital leaders across 51 countries and territories, and they reveal a widening gap between confidence in journalism and confidence in business models.

Just 38% of respondents say they are confident about the prospects for journalism in the year ahead, down 22 percentage points compared with four years ago.

Concerns centre on politically motivated attacks on journalism and sharp declines in digital traffic.

Another key element is the loss of the United States Agency for International Development (USAID) funding for independent media.

USAID has historically funded independent journalism, media training, and press freedom initiatives, particularly in developing or fragile democracies.

When that funding disappears, it often hits independent and investigative outlets first, especially those without strong commercial or subscription bases.

By contrast, 53% say they are confident about their own business prospects, broadly unchanged year on year.

Upmarket, subscription-led publishers with strong direct traffic see a path to sustainability, while organisations still reliant on advertising, print and platform referrals remain significantly more exposed.

Search and social retreat, video surges

Publishers are bracing for further erosion of platform-driven traffic. Respondents expect referrals from search engines to fall by more than 40% over the next three years.

Data from analytics firm Chartbeat shows Google search traffic to hundreds of news sites has already begun to dip, with lifestyle publishers particularly affected by the rollout of AI-powered search overviews.

That decline follows steep declines in referrals from Facebook (down 43% over the past three years) and X (down 46%).

In response, publishers are rapidly reshuffling off-platform priorities.

YouTube now tops the list, with a net focus score of +74, sharply higher than last year. TikTok (+56) and Instagram (+41) also rank as key priorities, alongside efforts to navigate distribution via AI platforms such as ChatGPT, Gemini and Perplexity (+61).

Google Discover remains important but volatile (+19), while newsletter platforms such as Substack register modest growth (+8). Traditional Google SEO (-25), Facebook (-23), and X (-52) are being actively deprioritised.

A scene from the series ‘The Newsroom’.

What publishers will make more, and less, of

Editorial investment is shifting just as decisively.

Publishers plan to increase the output of original investigations and on-the-ground reporting, showing a +91 percentage-point gap between those planning to do more and those planning to do less. Contextual analysis and explanation follow at +82, with human stories at +72.

At the same time, formats most vulnerable to AI commoditisation are being wound back. Service journalism (-42), evergreen content (-32) and general news (-38) are all set for reduced emphasis.

Video (+79) and audio, including podcasts (+71), are the clear growth areas, with relatively less investment flowing into text-based output.

Where the money is moving next

Beyond subscriptions, publishers are signalling renewed appetite for advertiser-led revenue.

Native and brand advertising is now a priority for 64% of respondents, driven in part by stronger budgets tied to short-form video.

Events have also regained momentum.

More than half of publishers (54%) now rank online and in-person events as a key revenue focus, reflecting a push to build stronger communities and diversify income beyond digital alone.

The fastest-growing opportunity, however, sits with platform payments.

More than a third of publishers (37%) now see licensing deals or other arrangements that force platforms to pay for content as a major growth lever. Interest in platform funding has almost doubled over the past two years, fuelled by large deals from some AI companies, even as concerns about overreliance on big tech persist.

What it means for advertisers

For brands, the direction of travel is clear.

Publishers are concentrating investment where they believe defensible value will sit: paid relationships, premium video and audio environments, events, and platforms that reward context, personality and trust over raw scale.

Legacy social networks and search-led reach are losing strategic weight, while creator-adjacent formats and AI-aware distribution models move centre stage.

Advertisers looking to stay aligned with premium news brands will increasingly find them there.