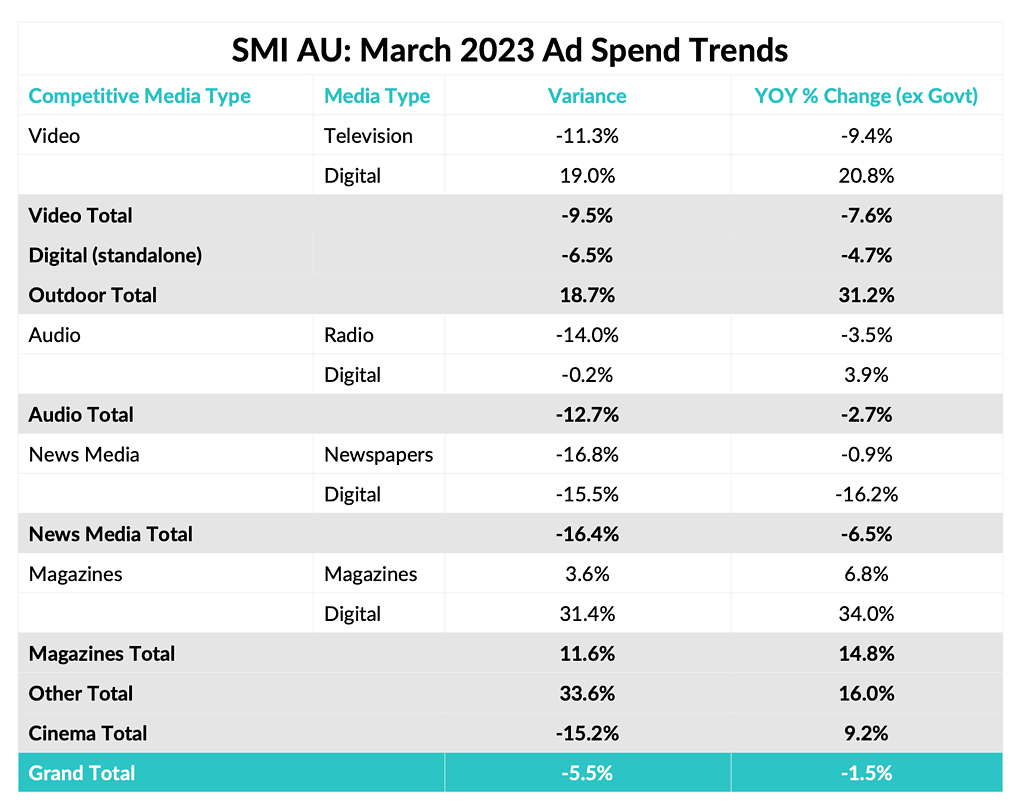

Australia’s ad market continues to feel the impact of last year’s record-breaking period, with SMI’s results for March showing an underlying dip in advertising revenue of 1.5% once the abnormal level of Government category ad spend is removed. With the Government ad spend included, the top-line figures show a year-on-year decline of 5.5%.

The Government category continues to impact the SMI ad spend figures given the huge increases in ad spend last year due to Covid and pre-Federal election advertising expenditure ahead of the May poll.

As a result the category’s ad spend reduced by 52.7% in March (taking $31 million from the market) and for the March quarter the category’s decline is 47.5% (removing $73.5 million from the market).

SMI AU/NZ managing director Jane Ractliffe said all media have been badly affected by the trend, with Government ad spend to Digital media falling 31% in March while for TV the decline is 54.7%; the Outdoor decline is 65% but most affected is Radio where the fall in this category’s ad spend is 70.3%.

“When we remove the impact of Government ad spend we can see Digital revenues are back just 4.7%; TV bookings are back 9.4% (and if you include BVOD that declines further to -7.4%) and for Radio the 14% decline falls to -3.5% ex Government and then -2.7% with Digital Audio included,” she said.

“It’s likely we’ve never before seen a single category have such a profound impact on the market, either positively or negatively, but Covid was a one-off global event and we are clearly still experiencing its effect in the ad market.”

Despite the lower Government bookings, Outdoor delivered the best result among all media in March with total bookings lifting a healthy 18.5% (and by 31.2% with Government removed).

On the positive side, while Government ad spend retreated SMI is seeing very strong growth from its traditionally largest product categories with Retail ad spend up 18.2%, Automotive Brand bookings up 11.7% and Travel ad spend growing 32.9%.

“The underlying strength of the market is evident in the fact that even with Government ad spend included the value of ad spend from the ten largest categories has grown 0.1% in March, highlighting the fact that the lower ad demand is mostly coming from the smaller product categories,” Ractliffe said.

SMI’s March quarter data was also impacted by the decline in Government spend which had pushed the prior year period to a record high.

As a result this quarter demand was down 5.1% but again, with Government category spend excluded, that decline is a much lesser 1.6%.

Ractliffe said the Retail, Automotive Brand, Travel and Communications product categories have all shown strong demand over the last three months with their combined spend up 13%, led by Travel with an increase of 34%.

Outdoor spend increased by 13.7% in the quarter and Cinema lifted 16.9% while printed Magazines were up 9.9%. Digital was flat with a 0.5% decline, however, within Digital, BVOD spend was up 15.4% and online Magazines showed a very strong 47.2% gain.

Despite the huge impact of Government spending, over the nine months of the financial year SMI continues to report a record level of ad spend with the total up by 1.1% (or $72.8 million) over the same nine months last year.

See Also: SMI February 2023: YOY decline due to Govt ad spend, Outdoor & Cinema climb