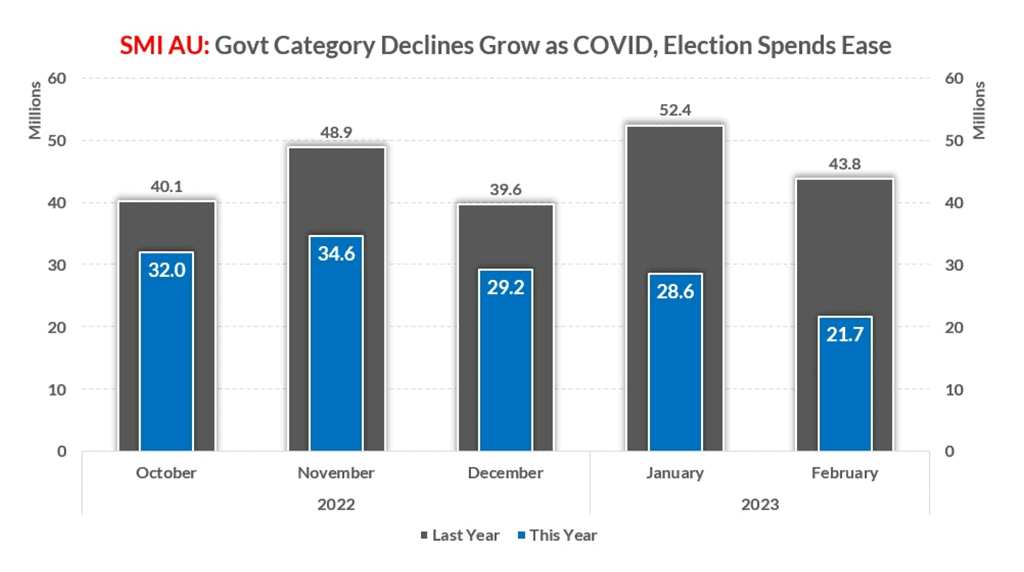

Australia’s media agency market reported lower ad demand in February against the record high delivered in the same month in 2023. The change is mostly due to a 50% fall in Government category ad spend that has pushed the market back 8.6%, reports SMI.

When Government category bookings are removed the underlying decline is 5.5%, continuing the market impact seen over recent months as last year’s abnormal levels of Government category ad spend return to pre-COVID levels.

This month SMI has added market demand in February 2022 due to the broadcast of the Beijing Winter Olympics.

SMI AU/NZ managing director Jane Ractliffe said the normalisation of Government category ad spend was having a material impact on the ad market, and this month the category’s total has more than halved since February 2022.

“Australia’s ad market received an abnormal boost from record high levels of Government category ad spend throughout 2022 and that’s now a key reason why we’re seeing softer demand this year,” she said.

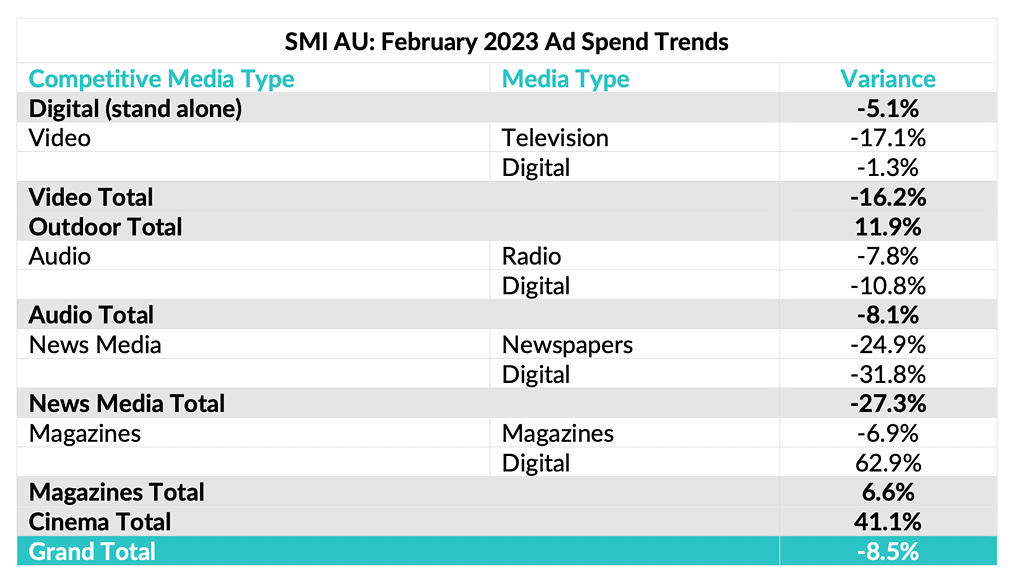

“It’s having a huge impact with, for example, Radio’s decline of 7.8% in February transforming into growth of 0.4% when Government category ad spend is excluded. And the trend will continue until May as the extra Covid-related Government ad spend was further amplified ahead of last year’s federal election.’’

SMI reports growth in Cinema and Outdoor

With Government category ad spend excluded SMI is reporting good results in February for the Outdoor media (+17.9% YOY) and Cinema (+50.9% YOY) but TV was mostly impacted by last year’s Olympics broadcast.

Ractliffe added it was also important to recognise the unusual size of last year’s February ad spend total, as it was more than $30 million larger than the next strongest February month in 2019 and more than 10%, or $60.5 million, above the February 2021 total.

“This trend of huge prior year months will also continue into March as the market reported yet another record high for that month with the total up 12.1% on the March 2021 total and 4.1% higher than the previous record March set in 2019,” she said.

While the Government category dragged the market backwards, there were some growth categories in February with Automotive Brand advertisers returning to growth (+6.5%) and Travel continuing to rebuild, up 10.3%.

The market remains strong over the eight months of the financial year with total bookings still in record territory, having lifted 1.5% on the same period last year.

So far this year each of the three largest product categories are reporting higher ad spend – Retail has grown 6.6%, Auto Brand is up 16.9% and Insurance has grown 7% – while Travel has emerged as the sixth largest category after delivering an 80% increase in ad spend.

Main image: Avatar was still helping drive box office growth in February

See also:

SMI January 2023 ad spend: Digital video, cinema & magazines best performers