Australia’s advertising market has stepped up its strong Covid recovery by creating history in June after delivering the largest month of ad spend ever recorded in a first half period since data analytics firm SMI started tracking the spend.

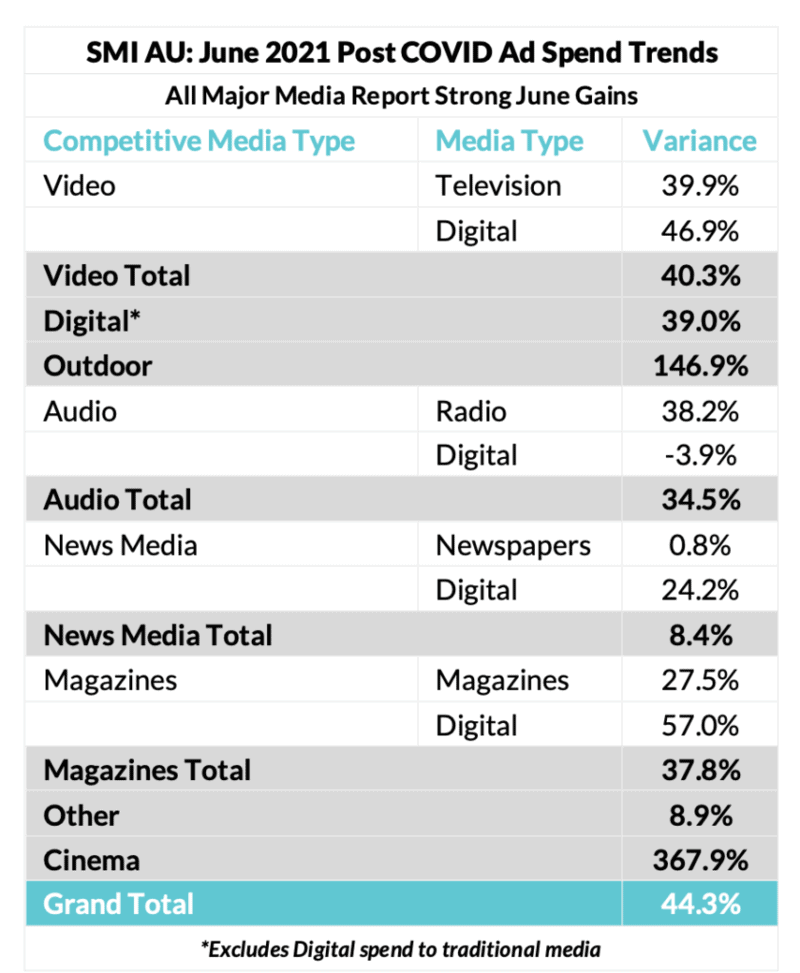

Total bookings soared 44.3% year-on-year in June to $754 million and all major media benefited from the market surge and the digital media reported a record June result.

SMI AU/NZ managing director Jane Ractliffe said SMI has never seen the level of ad spend achieved in June 2021 for any month in the January to June period since the collection of ad payment data began in 2009.

“It’s simply an incredible accomplishment to have achieved such a level of ad spend when the market is still in recovery mode. Who would have even thought this could be possible a year ago?’’ Ractliffe said.

“And what’s even better is that strong market figures like these provides certainty that this advertising recovery is sustainable despite the uncertainties we now are learning to live within this new COVID world.”

Ractliffe said SMI’s forward pacings data also underscored the stronger level of continuing demand with the value of contracted August ad spend now 83% of last year’s total, up from 44% in the interim June report. Similarly, the value of September bookings has lifted to 38% of last year’s total from 29% two weeks ago.

Ad demand for July is also already strongly in positive territory, although that’s also being driven in large part by the Tokyo Olympics broadcast.

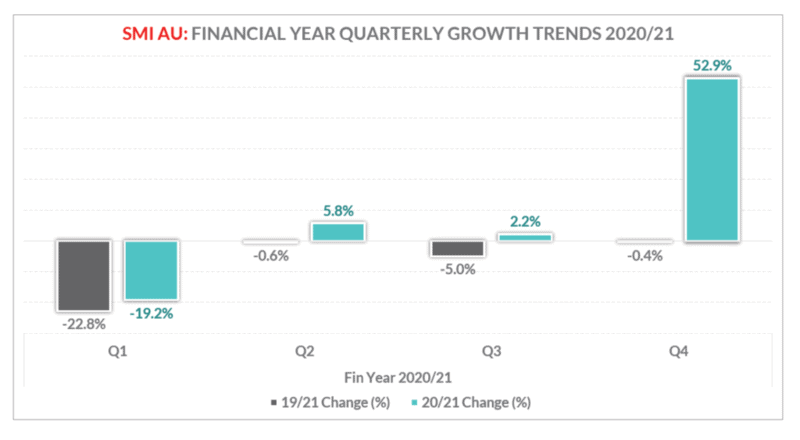

Ractliffe said the huge June result was the third consecutive month in which ad spend recorded year-on-year growth of more than 40%, and as a result, June quarter bookings were now up 53% on the same quarter a year ago.

“Given the despair felt across the industry last year when the market simply crashed in the June quarter as the full brunt of the COVID crisis was felt, it’s quite phenomenal that a year later we can see total bookings for the quarter are just $9 million (or -0.4%) below the last ‘normal’ pre-COVID equivalent quarter in June 2019,” she said.

For the first six months of the year Australian national marketer ad spend has grown 25% above the same time last year, with TV bookings also up 25% (and just $44 million shy of the 2019 total), outdoor spend up 22.2% and radio demand lifted 20.2%.

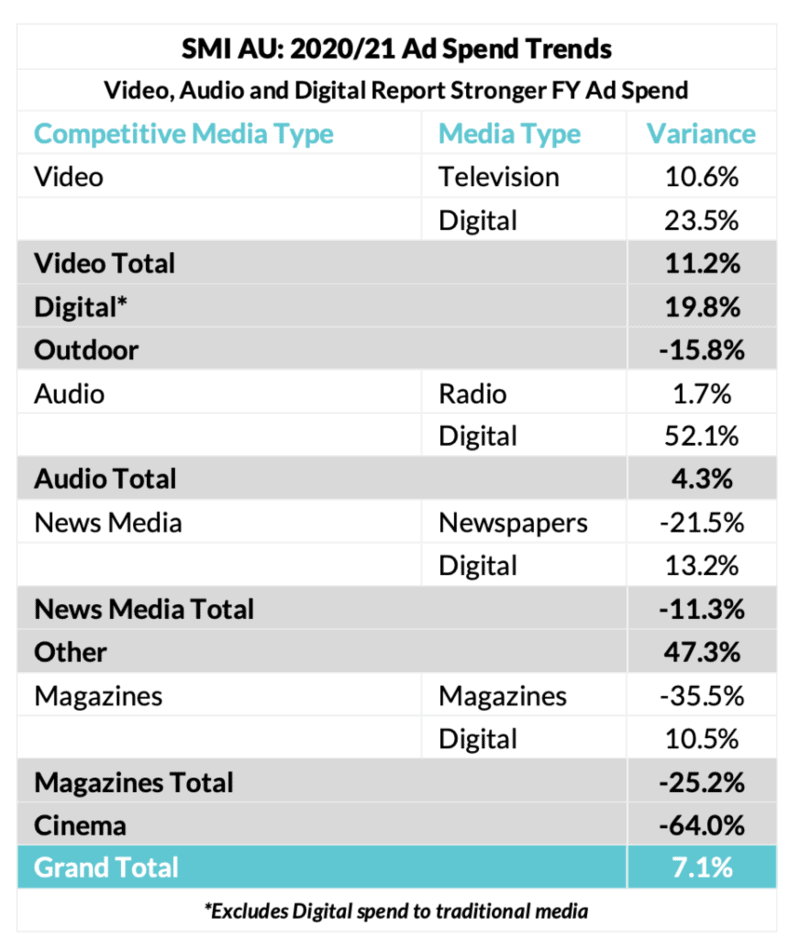

This stronger six month period also pulled the financial year results into positive territory with the total up 7.1% (representing just over $500 million) from the year-ago period.

“It’s obviously been an incredibly challenging financial year for all media, with SMI showing the total market back by 6.4% in the first half of the year (July to December) but then the market switched into recovery mode as demand soared and the value of bookings jumped 25%,” said Ractliffe.

“The SMI data highlights the size of the swing back to growth with ad spend falling more than $250 million in the first half of the financial year, but then jumping by more than $750 million in the following six months.”

Top photo: The first week of August sees out of home signs across Australia feature and profile missing people as part of National Missing Persons Week. Outdoor sector ad spend improved in Q4 of FY 2020/21.

See also: SMI May – Record YOY growth pushes ad demand above pre-Covid levels