SMI analysis of May ad spend reports another record level of year-on-year growth with total ad spend soaring 70.8% off the bottom of the Covid market 12 months ago. However lockdowns around Australia this week show how fragile the recovery might be if Covid is allowed to get another grip.

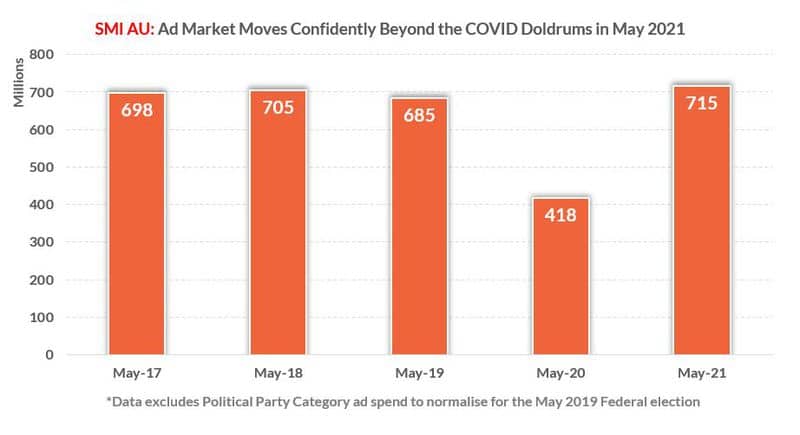

SMI notes the growth sees the Australian ad market move above pre-Covid ad spend for the first time. The May 2021 total represents a 4.5% (or $30.7 million) increase in May 2019 ad spend.

SMI AU/NZ managing director Jane Ractliffe said the May data represented the fourth consecutive month of ad spend growth in Australia, with the May 2021 total the highest May total seen since 2016.

“This level of growth is clearly unprecedented and it’s safe to say that none of us will ever see such extraordinary levels of growth again with SMI showing there was about $300 million in extra media investment coming into the market compared to May last year,” she said.

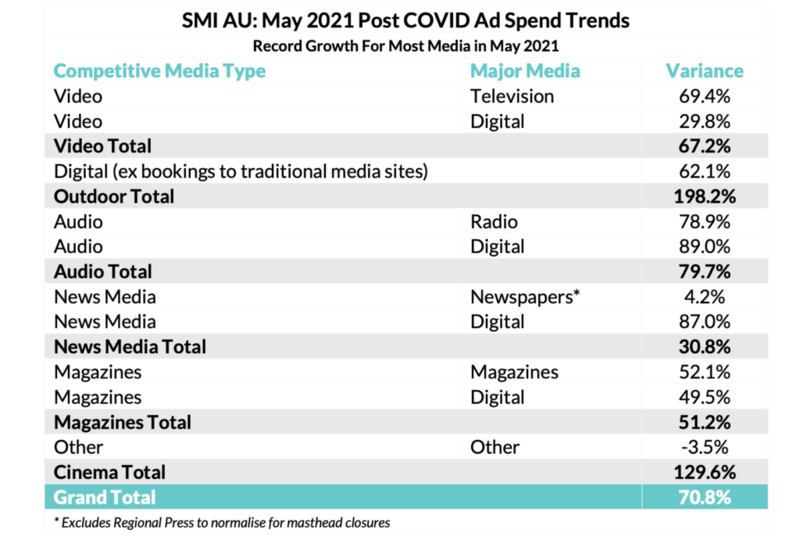

“We’re now seeing all major media reporting growth in May – with TV and Digital back to pre-Covid levels – so it’s really quite a remarkable turnaround given the disastrous results reported at this time last year.”

Ractliffe said the stronger ad demand will continue in June with SMI’s Forward Pacings data showing the value of confirmed June ad spend (ex Digital) is already 36.4% above that reported in June 2021.

“This month we’ve seen Outdoor lead the recovery by reporting a 198% increase in year-on-year growth and that trend is continuing into June as we can already see Outdoor’s ad spend is 90% above that reported in June 2020,” Ractliffe said.

“In Australia the total May Outdoor ad spend is just $6 million below the pre-Covid May 2019 totals, while in NZ the Outdoor media has already exceeded its May 2019 total.”

The Outdoor sector will be sweating on Covid numbers across the next few days as state governments will use the numbers as guidance on whether to allow people out of their homes and back to daily commutes.

SMI’s data shows there are many Product Categories also reporting levels of media investment well beyond that seen in May 2019, with for example the key Retail, Food/Produce/Dairy, Insurance and Restaurants categories all growing their media budgets above May 2019 levels.

Ractliffe believed one of the most encouraging signs was the fact the Travel category emerged as the fastest growing in May, with total Travel bookings jumping by $31.3 million from May 2020 levels.

“The media investment by Travel advertisers went from $4 million in May 2020 to $36.3 million this month, and that total is not far off from the $44 million spent in May 2019 so you can see the category’s ad spend is quickly recovering to the point where it’s been restored as the market’s sixth largest category this month,” she said.

Among other key SMI ad spend trends for May was the emergence of the Social Media sector as Digital’s second largest for the first time, while in Outdoor the Programmatic Outdoor sector broke through the $1 million/month revenue mark for the first time.

The stronger May results have now pushed Australian ad spend this calendar year up 20.1% on last year while the financial year-to-date results have now also turned positive, up 2.9%.