Australia’s media agency advertising market has received a strong boost from the Matilda’s performance in the FIFA Women’s World Cup, reports Standard Media Index (SMI).

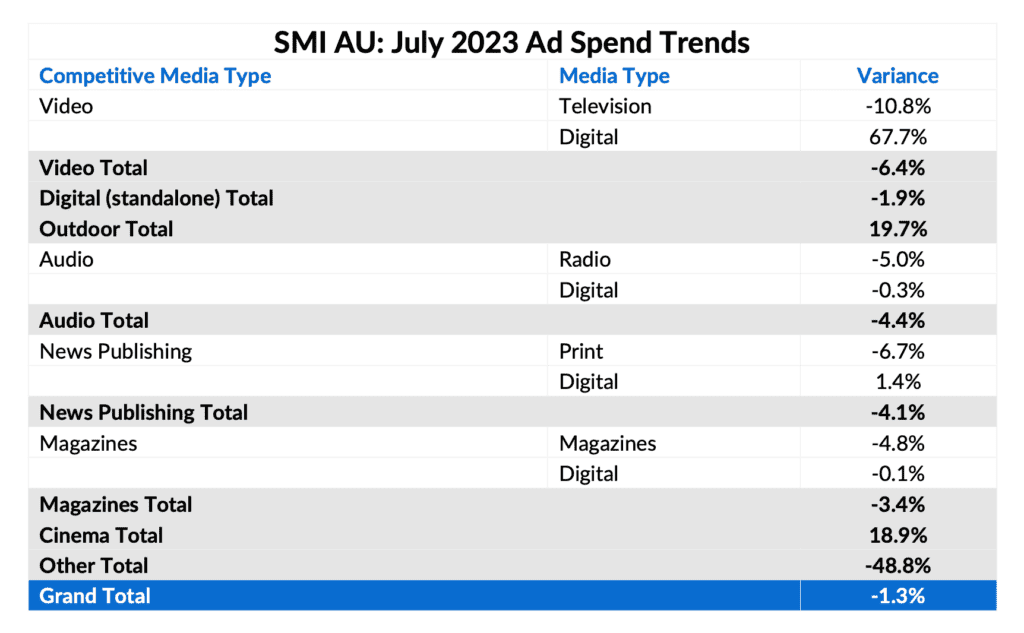

An examination of the media spend by Australia’s largest media agencies shows huge growth in TV streaming ad spend. That investment in the sport helped secure a stable July 2023 result, with bookings down just 1.3% from the July 2022 record result.

Helping drive the July 2023 result was demand for outdoor and cinema. SMI reports outdoor bookings were up 19.7% with cinema growing 18.9% of the back of interest in the blockbuster hits Barbie and Oppenheimer.

SMI AU/NZ managing director Jane Ractliffe said the month was notable for the impact of the FIFA Women’s World Cup despite the fact only 10 days of the event fell in July.

“The fastest growing media sector in July was video sites – which includes ad spend for all the TV streaming services – and we saw the value of its ad revenues up by 58.6% in July, mostly due to huge increases in demand for those streaming services focused on sport,” she said.

“Within the advertiser market we saw that advertising by sports-related groups surged in July with SMI’s sports category the fastest growing of any with total bookings up 205% year-on-year. Most of that extra revenue was directed to outdoor media.”

SMI also reported demand for metro press (+2.3% YOY) and metro radio (steady YOY). All outdoor sectors reported the biggest moves, led by the largest lift from posters where ad spend climbed 33% YOY.

SMI: Impact of government ad spend

Ractliffe continued: “The market is continuing to show strong resilience given the record level of ad spend in July 2022. That result was driven by the huge increase in government bookings and with that removed the underlying market is reporting growth of 0.5%.”

Also down was the largest category, retail, falling 10.6%. That dip was partly offset by increases from the automotive brand sector (+16.5%) and toiletries/cosmetics advertisers (+33.7%).

Ractliffe noted the market was also reporting solid results for the first seven months of the calendar year with total ad spend back just 2.8% on the record period reported last year.

With government and political party bookings removed, the market is up 0.3% on the same seven months last year.

See also SMI June 2023: Outdoor shines as ad spend recovers, Travel and Automotive also up