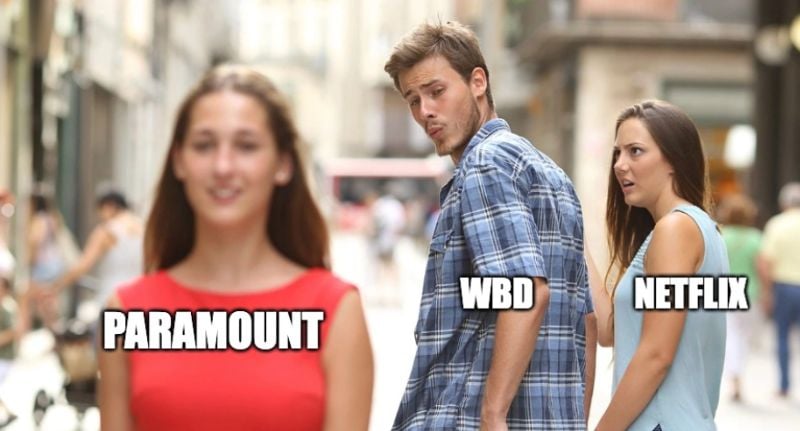

Netflix barely had time to pop the champagne before Paramount flipped the table.

A hostile, all-cash bid for Warner Bros Discovery (WBD) has reignited the takeover war – and suddenly Hollywood’s biggest deal is anything but done.

Paramount has gone directly to shareholders with an offer of $45 per share (AUD) to acquire the entire company, including its traditional television networks – a sharp escalation from the studio’s earlier, unsuccessful bids.

The proposal competes head-on with Netflix’s agreement to acquire WBD’s studio and streaming assets for around $127 billion (AUD) once debt is included.

Paramount, backed by the billionaire Ellison family, framed its offer as a cleaner and more attractive alternative.

“WBD shareholders deserve an opportunity to consider our superior all-cash offer,” David Ellison, chairman and CEO of Paramount, said.

The company described Netflix’s proposal – which excludes parts of WBD’s cable portfolio – as “inferior and uncertain”.

David Ellison

What Paramount wants that Netflix leaves behind

Unlike Netflix’s bid, which focuses on the studio and streaming operations, Paramount’s hostile offer includes WBD’s major cable networks, such as CNN, TNT, TBS and Discovery – keeping the full suite of assets under one roof.

The move would place those brands inside a company with close political ties to the Trump administration.

Larry Ellison, Paramount’s owner and a Republican megadonor, is a long-time ally of President Donald Trump, a relationship widely seen as strategically positioned for regulatory approval.

Trump has already weighed in, saying Netflix’s effort to buy WBD “could be a problem” due to competition concerns about market concentration.

Paramount’s offer represents a 139% premium over WBD’s September share price of approximately $19 (AUD), when takeover interest first ignited.

Netflix brush-off: ‘Today’s move was entirely expected’

Despite the scale of Paramount’s counterpunch, Netflix executives publicly brushed off the threat just hours after the bid landed.

According to Variety, at a UBS conference in New York, Netflix co-CEOs Ted Sarandos and Greg Peters addressed the challenge head-on.

“Today’s move was entirely expected,” Sarandos said.

“We have a deal done, and we are really happy with the deal for shareholders, for consumers, it’s a great way to create and protect jobs in the entertainment industry. We’re super confident we are going to get it across.”

Peters added that Netflix was comfortable leaving the regulatory question to authorities.

“I think we want to start by saying it’s not our position to tell the regulators how to think about this,” Peters said.

“They have to do their work and define the market the way that they do it. Clearly, they’ll do their analysis, and we’ll support them with whatever they need in that regard.

“But if we go back to the fundamentals of this deal, we are very confident that regulators should and will approve it. At the end of the day, it’s pro-consumer.”

Ted Sarandos

Why this fight matters

WBD – home to HBO, CNN, Discovery, and a catalogue spanning Looney Tunes to Harry Potter – formally opened a bidding process after Paramount began submitting quiet offers months ago.

Netflix ultimately emerged as the “preferred” buyer last week, stunning Hollywood with the proposed $127 billion (AUD) transaction.

Under Netflix’s plan, WBD will spin off parts of its business, including CNN, into a separate company, before selling its studio and streaming networks.

Paramount’s offer blows that structure apart – and puts the entire empire back on the table.

Wall Street analysts have long argued that a Paramount–WBD combination makes strategic sense, creating a traditional Hollywood counterweight to Netflix and Disney with enough scale to compete globally.

Paramount’s bid values the entire company at approximately $165 billion (AUD) – substantially higher than Netflix’s studio-focused deal.

Adding another political and financial layer: Trump’s son-in-law, Jared Kushner, is among the financial partners backing Paramount’s move, according to filings with the US Securities and Exchange Commission.

They couldn’t write a better plot twist if they tried.