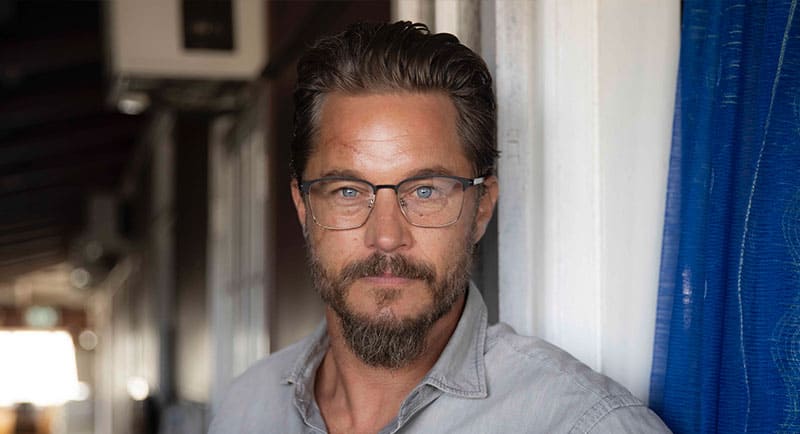

Following Nine’s first-half result released this week, Nine Entertainment chief executive Mike Sneesby spoke with Mediaweek about some of the bright spots on the television and streaming side of the business.

Nine’s content spend

Costs at Nine were up year-on-year. A significant line on the balance sheet was a spend of $82m on TV and streaming original content. “All of our content costs across Nine and Stan are bringing revenue growth,” said Sneesby. “You can’t look at a cost line in isolation without realising it is delivering an audience. We think it is an exceptional result in a tough market to be able to deliver on a strategy of content investment.

“There is a real opportunity to change the revenue share paradigm in the marketplace. January SMI data indicated a 52% revenue share for us in television and that is a significant outcome.”

Married at First Sight

Long content tail

A spend on content has ramifications for the business past the financial year the cost is incurred. “In a [previous] world where the FTA networks were in structural decline with no opportunities to offset falling revenues you only had one strategic option in that world and that was to reduce costs and manage your EBITDA.

“Our paradigm has completely shifted and Married at First Sight is a great example of that. Some of the episodes are attracting close to 700,000 people on 9Now alone. In today’s day and age that is [equivalent to] a commercial main channel FTA network in primetime.

“9Now is at a point of important scale. When you invest in your own programming you start to create a destination that people engage with. Having the confidence, knowledge, and data to back up our investments allow us to build substantial destinations that are differentiated and will have strong and defensible positions.

“With content, we have shifted a lot of the focus to owned or co-owned formats. A very large percentage of our formats are run in primetime and are owned or co-owned and some are also being run overseas. Those include Love Triangle and Parental Guidance.

“That gives us greater control of the IP over the long term and we have the opportunity for additional revenues from international markets.”

9Now audience growth

When asked about the implications for the fast-growing 9New audiences, Sneesby replied: “It’s hard to compare live TV and BVOD audiences, but as a broad statement we can say we have a greater yield per audience basis out of 9Now. There are multiple ways of how people can buy inventory on 9Now.

“What is really exciting about the success of the strategy is when we deliver an audience of 600,000+ on an episode of MAFS on 9Now the audience conversion in commercial demos is far greater than what we get on linear TV. It is almost like delivering 1m on FTA TV when you look at the conversion.”

Strongest start ever

In the H1 FY2023 results Nine alluded to its strongest start ever to a calendar year in OzTAM history. Sneesby confirmed that refers to audience share 25-54 so far in 2023.

The Olympic network

Nine hasn’t wasted any time on its Olympic countdown with the first event less than 18 months away.

“It is a short road to the Paris Olympics for a television business from a production point of view and from taking it to market. We certainly have our skates on and there is a fair bit happening.”

After two past Olympics failed to attract significant paywall audiences (Foxtel tried with London 20212 and Seven experimented during Rio 2016), Sneesby said things will be different in 2024.

“What I would firstly say is Nine has an absolute commitment to deliver the biggest events from the Olympic Games live and free across our platforms. The broadest set of platforms that any media company has ever had before. How we schedule sports across Stan and other platforms is yet to be finalised.

“There has not been an Olympic Games that has been distributed by a media company with the breadth of platform like Nine has.”

See also: “It will be absolutely huge”: Mike Sneesby on Nine’s Olympic Games deal

Stan: Staying ad-free

Sneesby was adamant during the analysts’ call this week that the Nine’s streaming service was being positioned as a “clean and premium” platform.

“In 2015 when we launched it was just a couple of months ahead of the Netflix launch. There was positive sentiment from Australian audiences who were seeing premium scripted content distributed without ads for the first time. With ads on FTA and subscription TV, there had not been anything like an ad-free proposition in the Australian market. The positive sentiment we got out of that has been forgotten.

“It is easy to think about running ads for incremental revenue, but with that revenue comes confusion and damage to the consumer experience. We will be keeping a very close eye on what is happening at market. Nine is no stranger to advertising – the technology team and the ad teams at Nine have the greatest understanding of digital advertising in this market. There is no lack of capability to run advertising if we thought it made strategic sense.”

Black Snow: One of Stan’s recent hit originals

Stan’s growth potential

When Stan launched eight years ago, Mike Sneesby talked about a potential customer base of 5m. At 2.6m, is there still room for growth?

“There is every upside for Stan. The strategy has been very sound. We have been through Covid where growth accelerated and then it slowed off the back of that. Stan is very unique in terms of its position and profitability over a number of years. Other services are still looking to generate scale and get to profitability to make their businesses sustainable.”

Room for Foxtel and Stan?

Can the Australian market sustain two major indies – streaming platforms not part of global content networks?

“I have always said the market will sustain as many players that can efficiently deliver a premium differentiated content line-up. The number of players is driven by the actions of those businesses themselves. That is the reason Stan has shifted so heavily into originals that have been exceptional as subscription drivers and de-risked supply of content from third-party providers.”