News Corp chief executive Robert Thomson has reported financial results for the three months ended September 30, 2023, the first quarter of financial year 2024.

“We had a sterling start to the new fiscal year, with rising revenues and increased profitability despite difficult economic conditions in some of our markets,” Thomson said this morning on the earnings call.

“Our first quarter revenues were slightly higher at $2.5 billion, while our profitability rose 4%, marking the second consecutive quarter of profit growth.

“Our positive performance in the quarter follows the three most profitable years since the creation of the new News Corp.”

News Corp Q1, 2024

News Corp questions market valuation

Thompson continued: “In our view, these results certainly highlight the disparity between the value of our company and our share price, which we believe does not reflect our present profitability, yet alone the potential of our incomparable, growing businesses.”

AI to exploit premium content

Thomson also pointed to a new profit centre. “We are actively working to make the most of our premium content for AI and are engaged in advanced discussions that we expect to bring significant revenue to the company in return for the authorised use of our peerless content. Our quest is to maximise value for all investors, so we are assiduously reviewing our structure.”

First Quarter Highlights

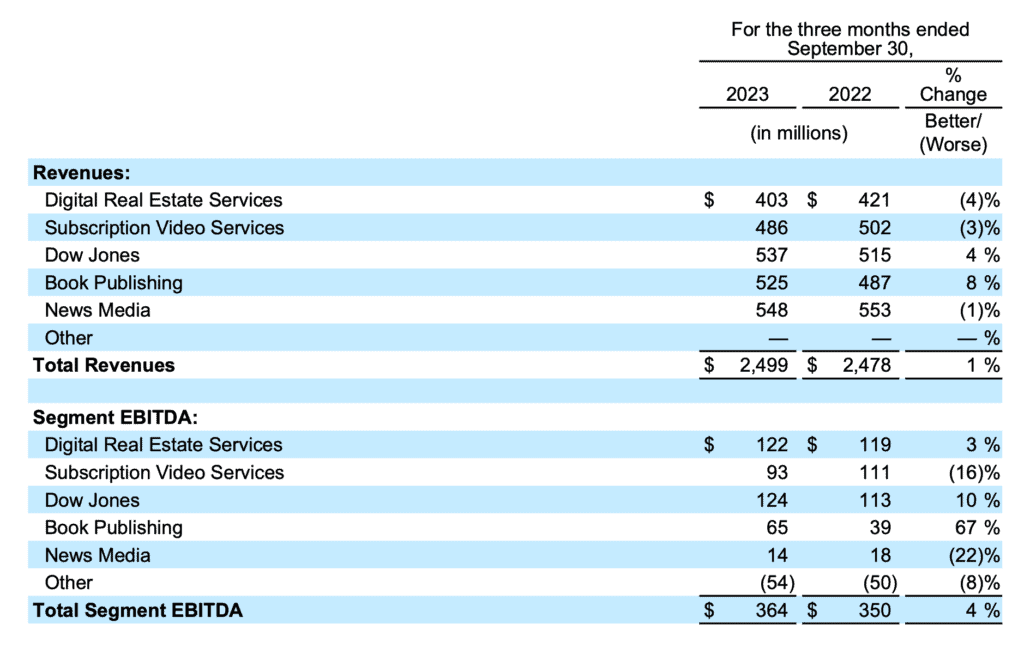

News Corp reported fiscal 2024 first quarter total revenues of $2.50 billion, a 1% increase compared to $2.48 billion in the prior year period, primarily driven by increased physical book sales and improved returns at the book publishing segment resulting from the absence of Amazon’s reset in the prior year and higher revenues at the Dow Jones segment due to robust growth in its professional information business.

The increase was partly offset by lower revenues at the digital real estate services segment due to continued challenging housing market conditions in the US, a $14 million negative impact from foreign currency fluctuations and lower advertising revenues at the News Media segment.

Digital Real Estate Services

Revenues in the quarter decreased $18 million, or 4%, compared to the prior year, reflecting an $11 million, or 2%, negative impact from foreign currency fluctuations. Segment EBITDA in the quarter increased $3 million, or 3%, compared to the prior year, primarily due to higher revenues at REA Group and cost savings initiatives at Move, which were largely offset by lower revenues at Move and a $5 million, or 4%, negative impact from foreign currency fluctuations. Adjusted Revenues and Adjusted Segment EBITDA (as defined in Note 2) decreased 2% and increased 8%, respectively.

In the quarter, revenues at REA Group increased $9 million, or 4%, to $261 million, driven by higher Australian residential revenues due to price increases, increased depth penetration and an increase in national listings, as well as $3 million, or 25%, of higher revenues from REA India. The increase was partly offset by an $11 million, or 4%, negative impact from foreign currency fluctuations and $4 million of lower financial services revenues due to a decrease in settlement activity. Australian national residential buy listing volumes in the quarter increased 1% compared to the prior year, with listings in Sydney and Melbourne up 16% and 14%, respectively.

Patrick Delany at Foxtel 2024 Upfront

Subscription Video Services

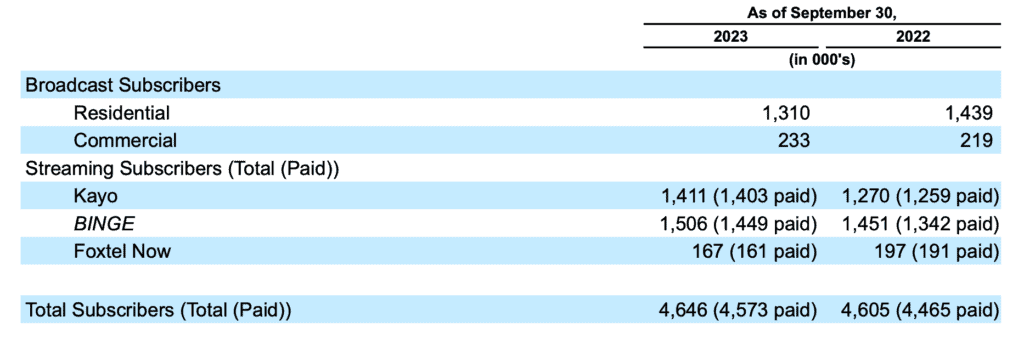

Revenues of $486 million in the quarter decreased $16 million, or 3%, compared with the prior year, due to a $21 million, or 4%, negative impact from foreign currency fluctuations. Adjusted revenues of $507 million increased 1% compared to the prior year. Higher revenues from Kayo and BINGE, driven by increases in both volume and pricing, were partially offset by the impact from fewer residential broadcast subscribers.

Foxtel Group streaming subscription revenues represented approximately 30% of total circulation and subscription revenues in the quarter, as compared to 25% in the prior year.

As of September 30, 2023, Foxtel’s total closing paid subscribers were nearly 4.6 million, a 2% increase compared to the prior year, primarily due to the growth in streaming subscribers driven by Kayo and Binge, partially offset by fewer residential broadcast subscribers. Broadcast subscriber churn in the quarter improved to 11.4%, compared to 14.2% in the prior year. Broadcast ARPU for the quarter increased 3% year-over-year to A$85 (US$56).

Dow Jones

Revenues in the quarter increased $22 million, or 4%, compared to the prior year, driven by growth in circulation and subscription revenues led by growth in professional information business products. Digital revenues at Dow Jones in the quarter represented 81% of total revenues compared to 79% in the prior year. Adjusted Revenues increased 3%.

Circulation and subscription revenues increased $22 million, or 5%, including a $4 million, or 1%, positive impact from foreign currency fluctuations. Circulation revenues increased 1%, primarily due to the continued growth in digital-only subscriptions, which was helped as a result of bundling, partially offset by lower print volume. Digital circulation revenues accounted for 70% of circulation revenues for the quarter, compared to 68% in the prior year.

During the first quarter, total average subscriptions to Dow Jones’ consumer products reached 5.3 million, an 8% increase compared to the prior year. Digital-only subscriptions to Dow Jones’ consumer products grew 12%. Total subscriptions to The Wall Street Journal grew 6% compared to the prior year, to 4.0 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 10% to over 3.4 million average subscriptions in the quarter, and represented 87% of total Wall Street Journal subscriptions.

Advertising revenues decreased $3 million, or 3%, primarily due to 6% and 2% declines in print and digital advertising revenues, respectively. Digital advertising accounted for 66% of total advertising revenues in the quarter, compared to 65% in the prior year.

News Media: Australian ad revenue slips, sub dollars lift

Revenues in the quarter decreased $5 million, or 1%, as compared to the prior year, primarily driven by lower advertising revenues, partially offset by the $7 million, or 1%, positive impact from foreign currency fluctuations and higher circulation and subscription revenues.

Revenues at News Corp Australia decreased 7%, driven by a 5% negative impact from foreign currency fluctuations and lower advertising revenues, while News UK increased 3% driven by the 7% positive impact from foreign currency fluctuations. Adjusted Revenues for the segment decreased 2% compared to the prior year.

Circulation and subscription revenues increased $6 million, or 2%, compared to the prior year, primarily due to a $5 million, or 2%, positive impact from foreign currency fluctuations, price increases and digital subscriber growth, partially offset by lower print volumes.

Advertising revenues decreased $10 million, or 5%, compared to the prior year, primarily due to lower print and digital advertising at News Corp Australia, lower print advertising at News UK and a decline in traffic at some mastheads due to platform-related changes. The decline was partially offset by a $2 million, or 1%, positive impact from foreign currency fluctuations.

News UK also incurred one-time costs pertaining to the proposed combination of print operations with DMG Media which, pending regulatory approval, is expected to provide long-term savings. The decrease was partially offset by lower production costs at News UK, driven by lower volume.

News Media subscription revenues

Digital revenues represented 37% of News Media segment revenues in the quarter, compared to 36% in the prior year, and represented 35% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarized below:

• Closing digital subscribers at News Corp Australia as of September 30, 2023 were 1,049,000 (937,000 for news mastheads), compared to 1,012,000 (929,000 for news mastheads) in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers, including the Times Literary Supplement, as of September 30, 2023 were 572,000, compared to 532,000 in the prior year (Source: Internal data). The previously disclosed methodology change resulted in a 59,000 and 64,000 increase to the closing digital subscriber number at September 30, 2023 and 2022, respectively

• The Sun’s digital offering reached 134 million global monthly unique users in September 2023 (Source: Meta Pixel; prior year comparable statistic unavailable)

• New York Post’s digital network reached 127 million unique users in September 2023, compared to 151 million in the prior year (Source: Google Analytics)