When SCA delivered its FY23 results this month, new chief executive John Kelly explained how market conditions had impacted the result. While audio revenue was steady, the big handbrake on profits was the television performance. With Nine and Seven offering a one-stop buying solution, marketers wishing to purchase programming on 10 and the multichannels or 10 Play must deal with both Paramount for metro markets and then SCA for regional.

Kelly talked to Mediaweek about a single sales solution the company is working on. He also spoke about plans to rebrand the business and the outlook for LiSTNR.

John Kelly

SCA: The difference between TV and audio results

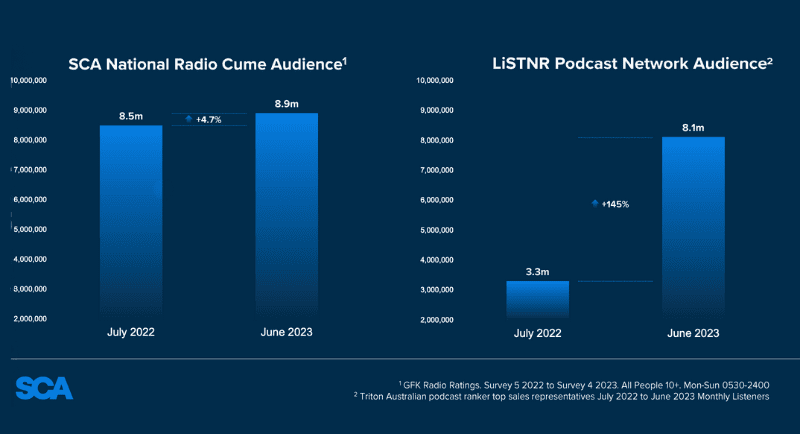

John Kelly: “Ex-TV, the audio performance, whether it be broadcast or digital, was solid. In a difficult market we have managed to increase our audience across national Australia to 9m people. Our metro audience has increased to 6.2m.

“We have also increased share, particularly 25-54. Digital audio has grown by 36%. We have brought forwarded our guidance for LiSTNR breakeven by one year to the end of 2024.

“TV unfortunately was the drag on the result.”

SCA EBITDA by divisions

Broadcast radio $92.2m (FY22 $103.8m)

Digital audio Loss $15.2m (FY22 $22.2m)

Television $18.7m (FY22 $29.8m)

SCA audience growth

What is the plan for the TV business?

“In the past we ran a sale process and the result was we thought we would be best placed to continue to run that [TV] asset ourselves. In the last six months the market has faced headwinds. In terms of our major affiliate partner 10, we have been disadvantaged that the other two commercial networks – Nine and Seven – have had a single sell. People wanting to buy the overall audience have to buy metro through 10 and then regionally through SCA.

“That is something we are looking to address and it is one of the reasons why we only extended our affiliation agreement by six months. We are working with 10 in earnest to try and provide a one-stop shop to agencies and national advertisers. That is something we will achieve in the coming months.”

Kelly was not able to reveal more details about how a new affiliation deal might look. Except to say, “A new affiliation deal needs to look better than the current one.”

LiSTNR profits soon

“We expect to be making a profit out of LiSTNR in FY25. LiSTNR grew 36% in FY23, and we expect to grow similar levels in FY24.

“LiSTNR is now the single vehicle for the distribution of our audio content. Everyone talks about how the BVOD moment for TV created a renaissance for the TV business. We think a renaissance for audio is coming out of the digital audio space.

“What we are seeing, particularly in the past three or four months, notwithstanding the challenging market conditions, is some really big advertisers doing digital audio-only buys.

“We think digital audio will be a significant contributor in the years ahead. LiSTNR has only been going for a little over two years.

“We are growing something we feel will be highly profitable in the years ahead.”

LiSTNER strategy

Kelly said he was happy with the way SCA implemented the strategy behind LiSTNR. “We want it to be the ultimate destination for all Australians for audio. It carries all our broadcast audio content and we have 800 podcasts on the platform. Five hundred of them are partner podcasts from the best studios in the world including Wondery, Sirius FM and many local partners including Schwarz Media and Diamantina Media.

“It’s about keeping high CPMs and capturing more revenue from the overall market.”

Outlook: Better time ahead

“We have given guidance, like other media companies have, that we expect better times in the second half from January 2024 onwards. From a margin perspective we continue to look at our cost base. We have identified that in addition to our 2% reduction in costs last year, we will deliver cost savings through a cost-out program of $12-15m. Between $5-7m will be realised in FY24. That will improve our bottom line.

“In relation to LiSTNR we have spent the most significant part of its capex spend, also in relation to our sales systems and also to the refurbishment of Sydney and Melbourne. Capex came down by 30% to $19m this year and we expect it to fall into the future.”

Renaming SCA?

Kelly noted the company is not stepping back from Grant Blackley’s idea to rename the business overall to LiSTNR. “It makes sense that when we hit appropriate milestones we will consider the corporate name. We are not there yet though before we have to consider that at board level.”

The new CEO and his vision

“Grant and I are great mates and we worked together guiding this business. I am not Grant, and a very different person to him in many ways. We need to be highly accountable to what we are getting out of our sales teams, our content teams and technology teams.

“But very much like Grant, I am very optimistic about our future. Our journey and our strategy is all about getting hold of growth engines where there will be increased consumption.”

Kelly said he has been working his way around the country visiting SCA offices in his new role including Central Coast, Newcastle, Wagga and Orange. “I will be visiting about 30 markets in the coming months to talk about our vision and our new value set, reaching out to 1600 hearts and minds across 60 markets. We will continue to improve our performance and to deliver for our shareholders.”

Content king and major markets

“Dave Cameron [chief content officer] and I have a very close relationship and he worked for me as the GM of Melbourne for some time.” When asked about improving some of the shares at Triple M in Sydney and Melbourne, and at 2Day in Sydney, Kelly replied: “We are the #1 network 25-54 across males and females. We are happy with that, but we want to increase our share in that demographic.”

“Melbourne is now the biggest radio market by revenue in the country and a place where we perform very well with Fox. We are delighted with what that team do and deliver in terms of audience and revenue.

“We continue to work on our Sydney result and 2Day FM. We are seeing continued growth with the audience rising 55% since Hughesy, Ed and Erin started.” Kelly said they need to work on monetising that audience growth, which has not yet been reflected in the revenue.

See also:

SCA posts underlying EBITDA of $77.2M in full-year results

Succession in the real world: Why SCA’s Grant Blackley is handing over to John Kelly