“Hello f***ers.”

Ladies and gentlemen, Mark Ritson has entered the chat.

The PhD marketing megamind took to the stage at HEARD 2026 in Sydney, doing what he does best: wielding a verbal sledgehammer to crack through the industry’s polite varnish.

He was there to force marketers and radio boffins to confront a simple, uncomfortable truth.

Despite its massive reach, radio remains a criminally undervalued asset.

Ritson, who is to the marketing world what Anthony Bourdain was to the cooking world – the insider speaking like an outsider – was here to translate the “beautiful data” for us. The problem, he argued, isn’t whether audio works; it is the industry’s ongoing struggle to sell that success.

The effectiveness gap hiding in plain sight

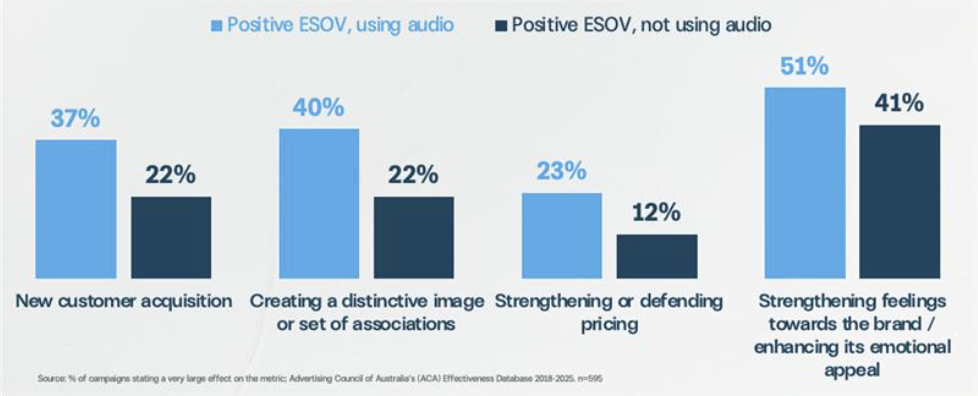

New analysis of eight years of Effie Award entries, presented at the Commercial Radio & Audio showcase, yielded a stark finding. Campaigns that include audio in their media mix are significantly more effective than those that exclude it.

The research, drawn from the Advertising Council of Australia’s Effectiveness Database and spanning 595 entries between 2018 and 2025, was analysed by independent consultant Rob Brittain.

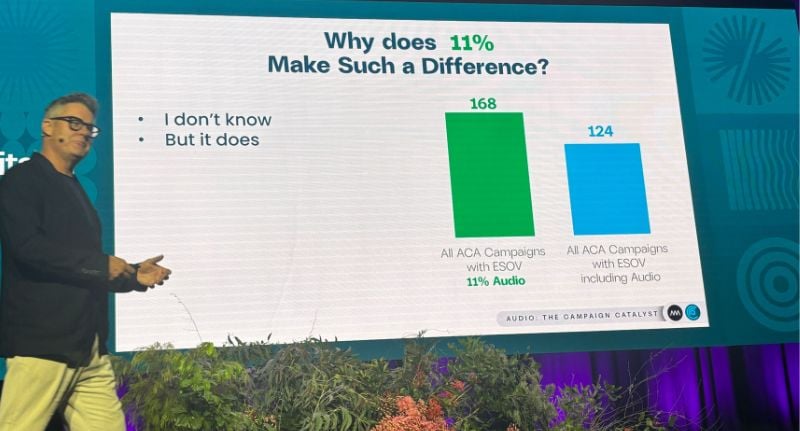

Among the strongest-performing campaigns, audio accounted for an average of 11% of total media spend when brands achieved an excess share of voice.

Crucially, the impact extended well beyond its spend.

Campaigns using audio delivered nearly double the impact for new customer acquisition – 37% compared to 22%. Brand distinctiveness rose to 40% (versus 22%), price insensitivity improved to 23% (from 12%), and emotional appeal reached 51% compared to 41%.

But, for some reason, the industry just isn’t joining the dots.

The narrative problem

For Ritson, the disconnect stems from perception.

“First of all, it’s a hard case to make, not because radio doesn’t do the business,” he told Mediaweek.

“Why is audio a tough business to sell, even though it’s got the numbers and the effectiveness data? I think there’s a hangover of traditionalism that unfairly surrounds the medium.”

He pointed out that industry events often use an image of a 1930s radio to represent the medium – a symptom of a misconception that ignores the fact that modern radio is a digital, growing force. Unlike video or display, audio also suffers from being intangible.

“You like to see s**t on the little phone or the big screen,” Ritson said.

“But the theatre of the mind closes down when we talk to clients because they want a big image.” That inherent strength has, paradoxically, become a commercial weakness.

Heavy lifting without the credit

The data suggests audio is quietly powering campaign success, particularly in brand building. Ritson argued that radio’s contribution is often invisible because its impact unfolds over time.

“Radio has a lot of power as a mass-market, long-term force,” he said.

“Media that do that have struggled to show that, but just because you can’t immediately see the ROI doesn’t mean it isn’t significant. Other channels get the glory when audio is doing the heavy lifting in the background.”

Lizzie Young CRA Heard. Source: Mediaweek

The 11% benchmark

For Commercial Radio & Audio CEO Lizzy Young, the implications are both validating and confronting.

“We’ve got this incredibly resilient audience, yet our revenue is quite underdone,” Young told Mediaweek. “That’s our problem to solve, and we’re taking it seriously.”

The Effie data provided a clear commercial benchmark. If the most effective campaigns allocate approximately 11% to audio, then radio should expect a similar share.

Currently, it isn’t hitting that mark.

Young argued the gap isn’t about performance, but about how the industry positions itself against video, which marketers often think of first.

A turning point for audio

For years, radio has leaned on reach and cost efficiency. However, effectiveness data now provide evidence that audio strengthens every other part of a campaign.

The challenge, as Ritson and Young made clear, isn’t proving radio works. It’s convincing the market to act on the evidence. As Young put it, the next phase is about making it easier for brands to invest.

If HEARD 2026 marked a turning point, it wasn’t because radio suddenly became more effective. It was because the industry finally had the evidence to prove that radio isn’t underperforming – it’s underclaimed.