The Swedish-based digital magazine aggregator Readly held its Annual General Meeting in Stockholm Tuesday. The news was mixed for investors.

The good news is the company has a product much loved by people who sample it. Subscriber revenue is growing as are the returns to the publishers of over 7,000 magazines and newspapers which sit on the Readly platform.

But making a profit has so far eluded the platform. After offering entry-level prices, Readly moves to lift prices to improve the bottom line.

The bad news for Australian customers is that in an effort to grow revenues, Readly is increasing its price in Australia. The former price of $9.99 monthly is now $11.99. Existing subscribers get the old price for another two months before the increase takes effect. New subscribers must pay the new price immediately.

Readly costs more, but still a bargain

There are two bits of good news associated with the price rise. New subscribers get two months free to explore the service before they start paying the monthly fee. And, perhaps more importantly, Readly is still a bargain at the higher price.

Not just because it compares well with other international markets like the UK where subscribers pay £10 monthly. (You don’t need to know the finer points of exchange rates to understand that $12 is a lot cheaper than £10.)

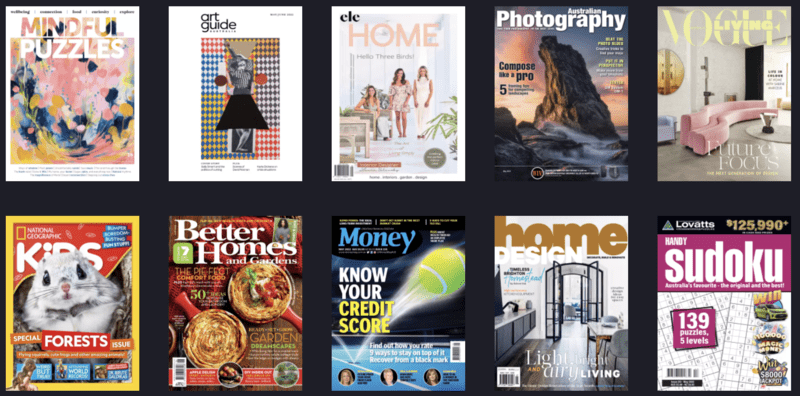

Subscribers get access to the complete digitised versions of around 7,500 magazines and newspapers. In the past year, the platform added 2,500 magazines and over 300 daily newspapers.

For publishers being part of the Readly platform offers another revenue stream from people they may not capture with the print product. Publishers also get to see their product featured on a global newsstand.

Because the magazines on Readly are exact reproductions of the print product, a critical attraction for subscribers, publishers also get the ads displayed to the digital audience.

Australian publishers have jumped on the Readly offer in the decade since it launched. You will find most of the Are Media titles on the platform, as are News Corp Australia magazines, plus publications from nextmedia and Lovatts Media.

Recently Universal Magazines joined the platform, with Readly claiming they were the last of the major Australian magazine publishers to jump on board.

Getting newspapers onto the platform has been a little harder. No News Corp or Nine Entertainment titles on the books, yet. From the UK, The Guardian and The Observer have been available for some time. There are several other national tabloids available and a big cross-section of regional newspapers from across the UK. But like Australia, no News UK newspapers yet.

Mark Fletcher

Retailer’s view on magazines going digital

Magazine retailers understandably are wary of the trend to digital. Newsagency proprietor, director of the newsXpress newsagency marketing group and industry blogger Mark Fletcher told Mediaweek:

“There is no point about any of us being angry about developments like this. Everybody is doing what they need to do to walk forward through change.

“Newsagents are doing that in stores with the way they allocate space to magazines, publishers are doing it by finding different ways to connect with their communities and they are finding different models for making money.

“[Things like Readly] are now a fact of life. I have two wishes when you ask me about what magazine publishers are doing.

Retailers want higher cover prices

“One would be a wish for more transparency, and that goes for newspaper publishers as well as magazine publishers. And I mean more transparency about what their trajectory is. The other wish is for them to have a look at their cover prices. The cover price is the sole determinant of what the retailer makes. We get 25% of the cover price. The deliberate holding back of cover price changes, and by that, I mean increases, is reducing in real terms what newsagents make.

“That is problematic for the newsagent’s channel, but also for publishers too, because newsagents will lose interest.”

When asked if higher magazine prices might mean the sale of few magazine copies, Fletcher replied: “Publishers would say yes. Several newsagents told me recently it would be great if they could set their own price.

“I think back to 15 years ago with newspapers. Before News Corp and then Fairfax realised they could increase their cover price without dramatically hurting their sales. They resisted and only had very small cover price increases. More recently they have started to bigger increases and it is not worsening their trajectory.

“The trajectory is still not great, but it is not worsening it. There are some magazines where their loyal shoppers will pay more.

“If you look at titles like The Australian Women’s Weekly or Better Homes and Gardens, an increase in the cover price wouldn’t hurt their sales.

“We are at a point where newsagents will deal with it and won’t complain too much. But they also won’t engage the way they used to.”

Mark Fletcher on selling magazines

Fletcher noted he runs four newsagencies and one of them doesn’t sell magazines. “The most recent agency I got is in Glenferrie Road, Malvern. That shop does $400,000 a year in magazine sales – a very significant part of the business. What is happening in-store is that we are seeing magazine sales growth and it’s coming from outside of the top 100 titles.

“The interest in special interest titles is amazing. We stock the big weeklies and monthlies of course, but it is the speciality titles that we can stock and it’s something that makes us different to the supermarkets.

“But it means that Are Direct, which used to be Gordon and Gotch, are better with their distribution.

“The distribution business always seemed to be starved of capital. There was not an infrastructure for the efficient allocation and distribution of magazines.”

Fletcher added: “They would say that is not true. But to me the evidence suggests it never had what it really needed.”

Niche magazine audiences are passionate about print

Fletcher gave as an example a customer with a niche interest in a particular type of train. “A customer should be able to go online and see which newsagent gets that magazine. As a retailer I should be able to go in and in seconds order a new title. Instead I have to navigate a manual process that assumes that I am not an expert at what I am doing. Retailers ask themselves, why should they bother?”

When it comes to customers wanting a specialist title, Fletcher noted there are people who will travel an hour to get what they want. “I didn’t think that in 2022 that would be the case.”

Retailers need to get good service to encourage them to keep a wider range of titles and to give them the display they deserve. Fletcher is always travelling and poking around newsagents and magazine sections and he noted some big retailers are not giving titles the space and range they once had.

It’s not a problem unique to Australia of course, with Fletcher noting innovation in the magazine space is lacking in most markets.

Is there still a place for magazines at retail? “There is, but not at levels we’ve seen in the past.”