Southern Cross Austereo (SCA) boss John Kelly has added fuel to speculation that Nine Entertainment Co. (NEC) could be gearing up to make an offer they can’t refuse.

Speculation is building, initially reported by The Australian, that Nine is gearing up to buy SCA with some of the $3 billion dollars it received by selling its Domain divestment.

When asked by Mediaweek if SCA was for sale, Kelly responded: “I’m not going to answer that question directly, but what I would say is that we have been saying for some time now, we as a company and certainly our board believe in media consolidation. So that by its very nature means if it was of the right offer for our shareholders and it made sense, then we’d consider it.”

Too many licenses

If NEC decides to pursue an acquisition of SCA, one of the first hurdles it would face is a set of long-standing media ownership laws that limit how many radio stations a company can control in any one market.

Under the Broadcasting Services Act, no person or entity is allowed to control more than two commercial radio licences within a single licence area – whether that’s metropolitan Sydney or regional South Australia.

The rule exists to maintain a level of media diversity and prevent monopolies in local radio markets.

For NEC, this means that before it could fold SCA’s Hit and Triple M networks, and the digital audio platform LiSTNR, into its portfolio, it would first need to offload its own network of talkback radio stations: 2GB in Sydney, 3AW in Melbourne, 4BC in Brisbane and 6PR in Perth.

SCA currently operates 99 stations nationally across a mix of metro and regional markets, while Nine controls five talk-based AM licences.

Any consolidation of the two would immediately trigger compliance issues in major cities, forcing Nine to divest its talk stations to avoid breaching the two-licence-per-market rule.

Talk about timing

Over the past few years, SCA has undergone a deliberate transformation, one that now even Kelly agrees appears to be paying off.

“So our job over the past three or four years has been to transform our company to be very much digitally focused and the best audio company in Australia,” he said.

“You know, we’ve done that now.”

With a leaner operating model, a sharper digital strategy, and a renewed focus on LiSTNR as its growth engine, SCA has repositioned itself as more than just a traditional radio business.

“I think some of the things that we’ve done, certain players are recognising that, including potentially NEC.”

SCA posts full-year results

Kelly is right – that deliberate transformation does indeed appear to be paying off.

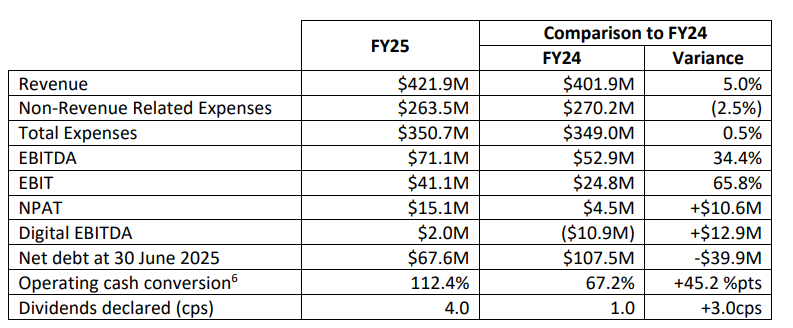

According to SCA’s full-year results to 30 June 2025, it reported a total revenue of $421.9 million, a 5% increase year-on-year, while EBITDA jumped 34% to $71.1 million.

Net profit after tax surged to $15.1 million, up from just $4.5 million the previous year.

A major highlight was the performance of SCA’s digital division, which generated $45.1 million in revenue, up nearly 29%, driven by growth across its LiSTNR platform, which posted a $2 million EBITDA profit after a $10.9 million loss in the prior year.

SCA also paid down $40 million in debt, reducing its net debt to $67.6 million, and rewarded shareholders with a fully-franked 4-cent dividend, a marked increase from last year’s 1-cent payout.

And the future is looking just as bright.

Looking ahead to FY26, the company is forecasting revenue in the range of $435 million to $440 million and EBITDA between $78 million and $83 million.

It also expects to maintain strong cost control, with total expenses forecast to remain below $270 million.

“You know, not many companies are out there giving the level of guidance we are for FY26,” Kelly said.

“That’s because we’re feeling pretty confident about where we are as a company, with broadcast, digital, cost-based, in every part of our strategy. We’ve spent a lot of money, in a very open way, on LiSTNR and our audio ecosystem – everything from ad tech to our app to content. A lot of that’s now done.

“So it’s not so much about dollar investment moving forward; it’s more about investing in live and local content – new, fresh content,” he said.