Australians remain active online shoppers in high numbers as they broadening how they find and evaluate products, the IAB and Pureprofile Australian and New Zealand Commerce Report 2025 found.

The research is based on an industry survey conducted with 1,000 Australian and 850 New Zealand online shoppers aged 18 – 70 who have shopped online at least once in the last twelve months.

It examined how consumer attitudes, behaviours and expectations are influencing shopping and commerce trends in Australia and New Zealand.

The report found that while cost-of-living pressures have eased slightly, shoppers remain highly value-conscious with 72% of consumers are cutting back on non-essential items, down from 75% in 2024.

The report also identified major generational differences across online shopper behaviour and expectations, particularly around convenience, reward, sustainability and transparency, resulting in variations in how consumers discover brands and source products.

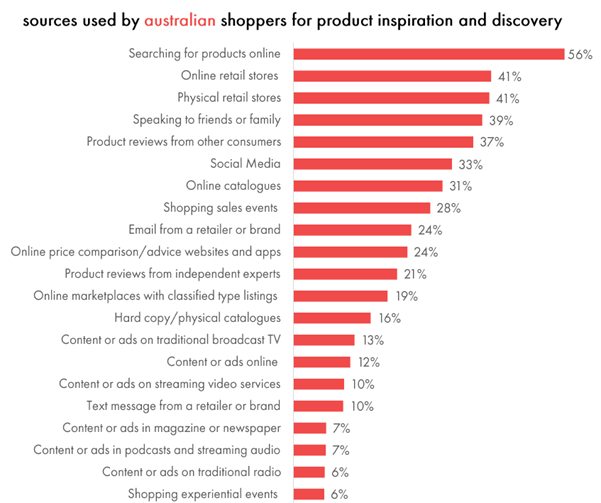

Across product discovery sources assessed, online shoppers used an average of 4.8 touchpoints, with online search, retailers own stores and content, shoppers’ personal connections, other consumers and social media being some of the most important sources.

The breadth makes it critical for marketers to consider using a multi-channel strategy and loyalty programs to deepen their engagement in the competitive market.

Search continues to be the top discovery tool overall, particularly for over 50s (64%).

For millennial and gen z online shoppers, social media and influencers are key to how they find products to buy with 75% having discovered brand information from an influencer or content creator that they follow. Retailer owned assets and content were also identified as increasingly important.

“Retailers and marketers must review their distribution and investment strategies to ensure they show up wherever their audience is seeking inspiration,” Gai Le Roy, CEO of IAB Australia, said.

“Brand discovery is now happening across a growing number of environments, from social scrolls to second-hand marketplaces.”

Martin Filz, CEO of Pureprofile, said: “People are getting smarter about how they shop. They want value, but increasingly that means something different to different groups, whether it’s free shipping, finding unique pre-loved items, or discovering a brand via a TikTok creator.

“Marketers need to stay on top of these audience behaviours and motivations to think more holistically about what value looks like and where their audiences are making those judgments.”

Transparency in data usage and consumer understanding of the data exchange is critical, according to the report.

The IAB and Pureprofile report found that while 75% of online shoppers are aware that their personal data is used for targeting advertising, 73% remain concerned about how retailers use their data.

It also found most consumers are open to sharing information when there’s a clear benefit with 93% of online shoppers saying they are willing to share personal data in exchange for tangible rewards like discounts, free delivery, loyalty points or cashback offers. However, they demand clear communication and trustworthy handling of their data.

IAB and Pureprofile’s report found:

• Free shipping thresholds (61%), easy and free returns (57%), and fast shipping (40%) rank as very important retailer offerings.

• 48% of online shoppers say real-time product availability information is very important along with 41% who rate real time delivery tracking as very important, underscoring the rising expectation for immediacy and responsiveness.

• Younger online shoppers place greater importance on retailers having fast shipping options (same-day, next-day, 2-day) with 48% of 18-29s rating fast shipping as important, compared to 40% of all online shoppers.

• There are a range of different types of loyalty programs that are identified as valuable to online shoppers. 86% of online shoppers find free to join loyalty or rewards programs valuable, with 36% finding them very valuable.

• 4 in 10 Australian online shoppers (41%) have increased buying second-hand goods over the last few years.While 48% say sustainability is a reason for this increase, saving money (74%) is the predominant motivator.

• While purchasing ethical and sustainable brands is important to 50% of shoppers, only 36% are willing to pay more, highlighting a tension between values and price sensitivity.

• Marketplaces and supermarkets dominate the retail landscape, however online stores of traditional retailers, food delivery, subscriptions and purchasing directly from social media platforms are also thriving.

This is the fifth annual Commerce Report for the Australian market and the second year for New Zealand.