The latest insights from ThinkTV are aimed to help a particular sector.

2020 sent shock waves through the economy as all businesses scrambled to deal with the unexpected. With financial assistance from governments starting to wind-down amongst a post-Covid recovery, more businesses will be turning to financial service companies to continue their recovery where investment funds are required.

But not just business, many Australians will need to revisit their financial plans as they adjust to what a lost 2020 for many means.

ThinkTV is engaging with finance marketers on how they can best connect with audiences to drive positive business outcomes and, ultimately, growth.

“Under the cover of Covid, there have actually been quite a lot of changes to financial services,” ThinkTV CEO Kim Portrate told Mediaweek. “Open banking for example has made it easier for more people to move around. There are more new financial services businesses setting up and they are doing some really great things.

“This is a big industry that is changing and it is important we update them with opportunities television offers.”

ThinkTV CEO Kim Portrate at the Future of TV Advertising event earlier in 2021

Portrate noted that in financial services brand is so important. “There is much research that has been done looking at this. Research from Les Binet and Peter Field into marketing effectiveness has estimated the split is about 80/20 in financial services – with 80% of marketing ideally being focussed on the brand.

“What we also know from work we and others have done is that an emotional authentic connection around a brand is very much the right place to start.” Again, Binet and Field concluded, emotional advertising works best, even for highly researched purchases like financial services.

“A lot of performance-based marketing banks are doing may not be serving them very well.

“Given the changes in recent times, financial services businesses need to hit a really broad audience and reach as many people as they possibly can. A lot of the banks and financial services businesses speak to their own customers over and over. That may be via re-targeting or EDMs, but unless you increase the size of the whole pond you are actually still fishing in the same pond.”

Portrate noted that brands in other categories have struggled with growth for that reason too.

In the finance category specifically, emotion is super important and is a big influencer. Portrate: “Soliciting some kind of emotion is going to deliver a better business impact.”

TV spend leads to best ROI

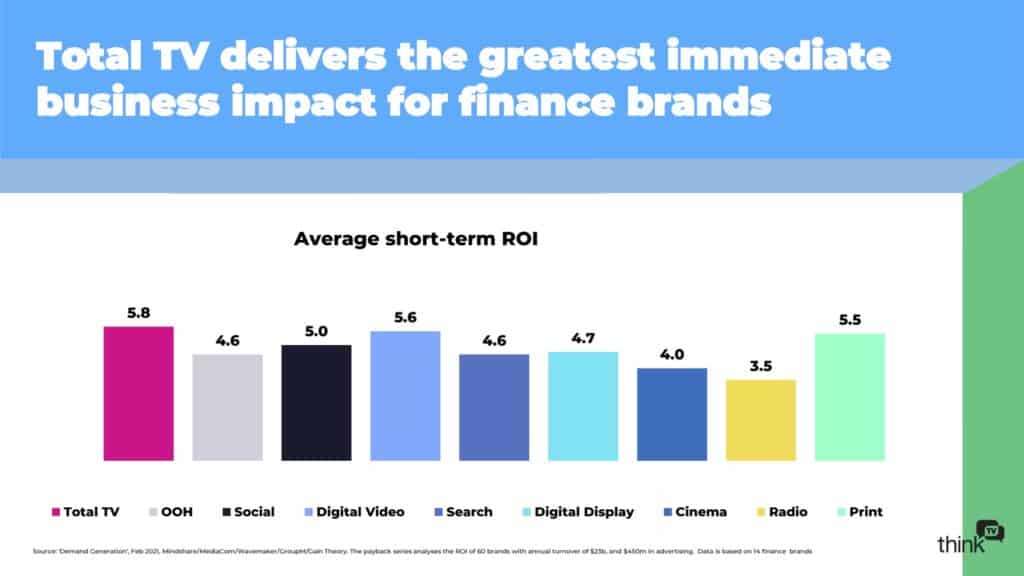

Portrate continued: “We have some analysis of econometric models and return on investment and it turns out TV is actually a workhorse. We have quantifiable numbers around what TV does for financial services brands specifically from a return on investment.”

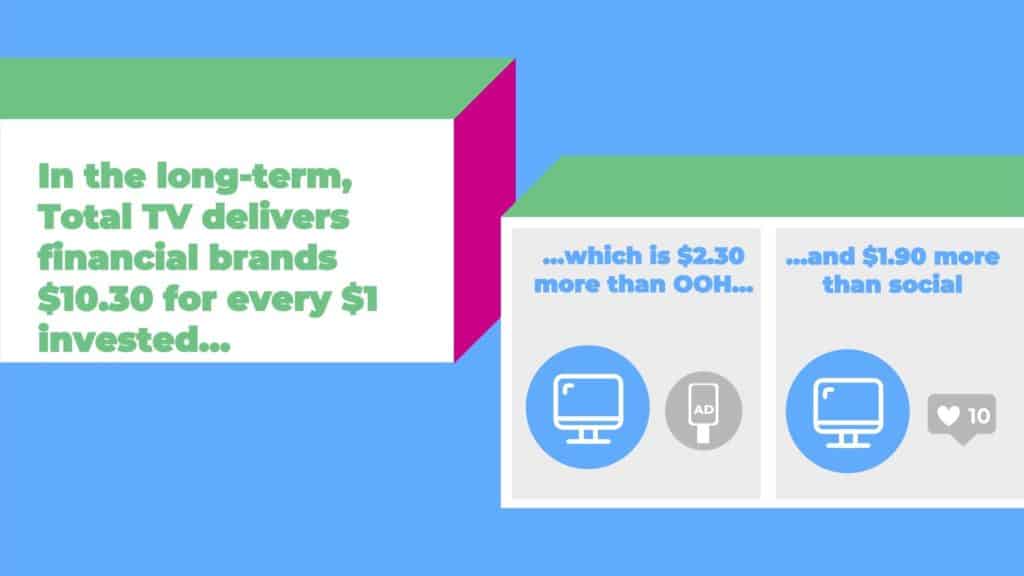

That data from the analysis of the ad spend of major Australian advertisers indicates that for every dollar spent in short term campaigns on TV the average return is $5.80. The numbers look even better longer term – $10.30 for every dollar spent.

TV numbers and targets

“Reach leads you to a broad target and broad target leads you to a better business impact.” Portrate reminded Mediaweek that an investment across total TV [FTA and BVOD] reaches 85% of Australians every week.

ThinkTV has a definite view about changing ad spend habits too.

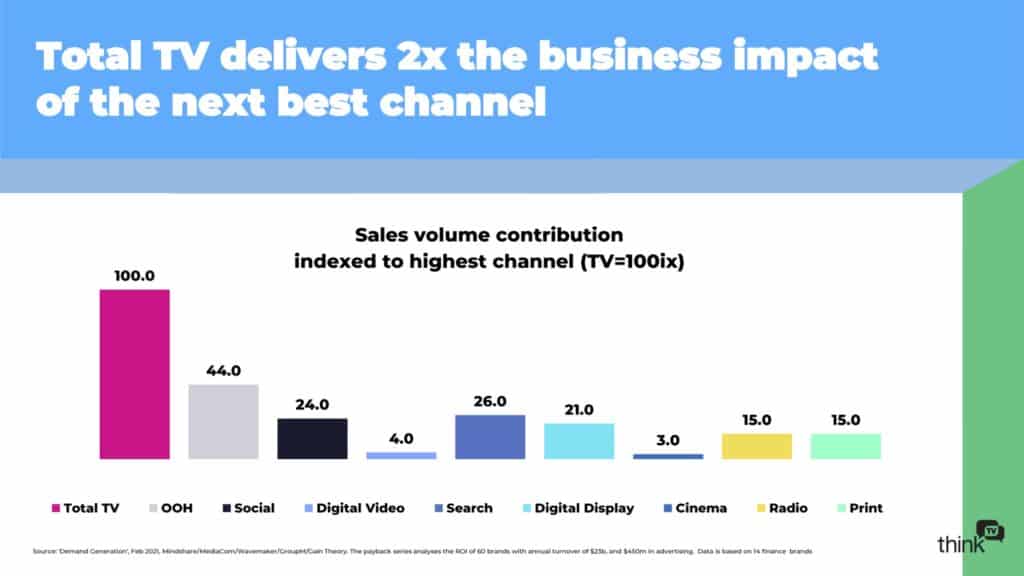

“Our view is that financial services underspend with television and are over-spending in others,” Portrate said. “We think the percentage of their budget spend needs to change. When you look at the impact of TV on short term campaigns you see TV is very strong, as is print.

“If you look at out-of-home it tends to get a lot of traction from financial services and arguably that is undeserved.” Data analysed as part of The Payback Series research indicated a total TV spend has twice the impact of an OOH spend.

On the money: winning share in the competitive finance market

In a special ThinkTV webinar, hear from Lendi CMO Zara Cobb on how the innovative mortgage broker is working to become a household name and the marketing levers the brand has pulled to establish its presence in a cluttered market.

Also joining the webinar, Bankwest’s Haylee Felton, Nimble’s Oonagh Flanagan and AANA’s John Broome as they discuss the best ways for finance marketers to support their brand amid ongoing changing consumer behaviour.

See also: Broadcasters unveil new research that reveals how ad spend triggers demand