The latest edition of the ThinkTV Payback Series is being released at the Future of TV Advertising conference in Sydney.

The Australian-first study analysed the campaign performance of 60 brands with a collective annual turnover of $23 billion and an annual media spend of $450 million and has found TV generates demand for businesses in both the short and long-term.

The latest edition of The Payback Series was conducted in partnership with Professor Peter Danaher, Head of the Monash University Department of Marketing and Professor of Marketing and Econometrics, GroupM and global marketing effectiveness consultancy Gain Theory.

The TV advertising conference, of which ThinkTV is the presenting partner, includes key sessions on the content pipeline and the power of BVOD.

Sales executives from FTA broadcasters Seven, Nine and 10 are taking part, plus Foxtel and the CEOs of OzTAM and ThinkTV. Media agencies and major brands are also on some of the panels and in the audience.

Key findings of the research include:

ThinkTV: Investment generates the greatest ROI in the long term

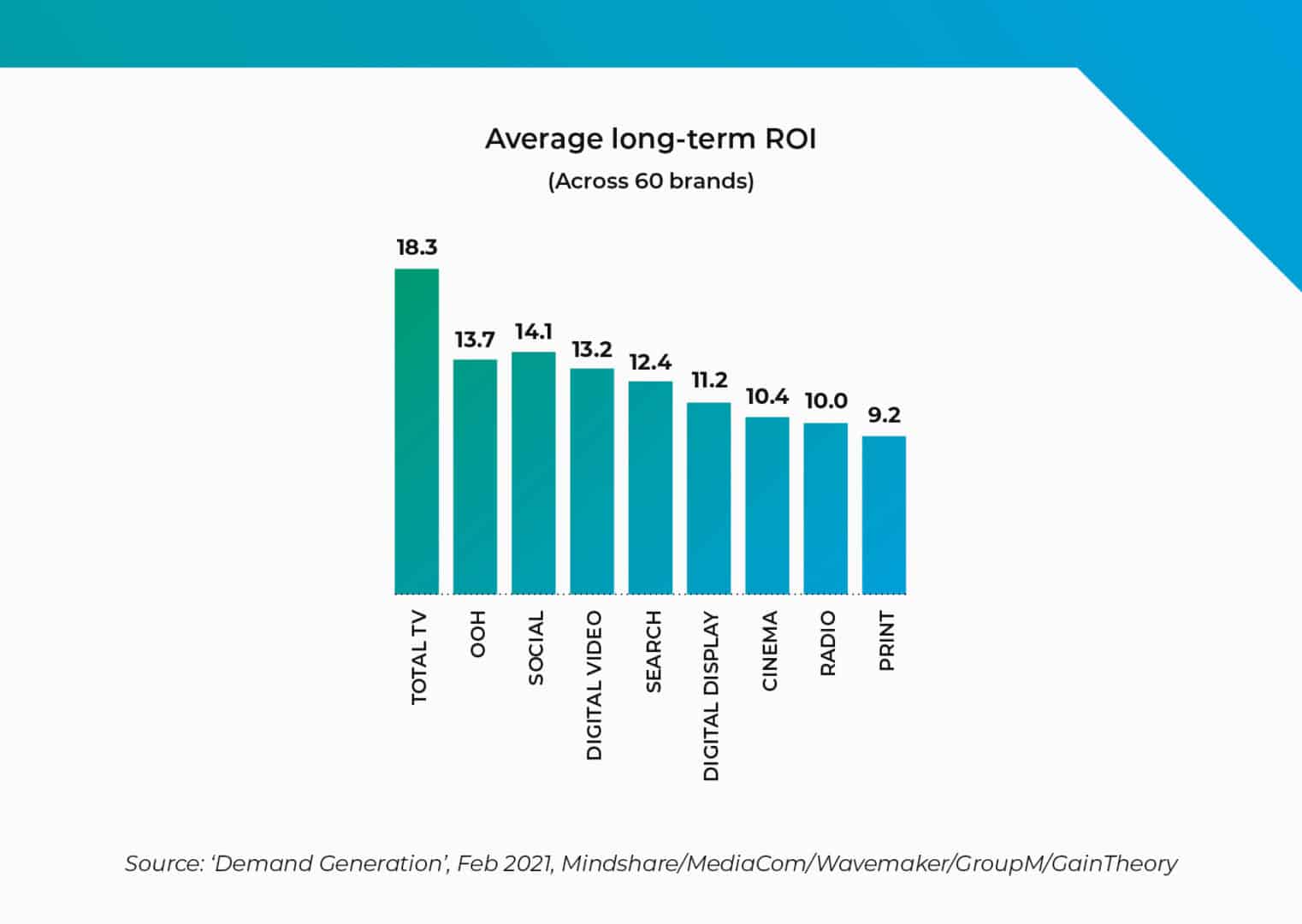

Across the 60 brands in the study, for every dollar spent, the average return on investment (ROI) for total TV was $18.30.

Returns for every dollar spent on other channels:

$14.10 for social (Facebook)

$13.70 for out-of-home

$13.20 for digital video

$12.40 for search

Cinema, radio and print were at the lower end of media analysed, close to $10 each.

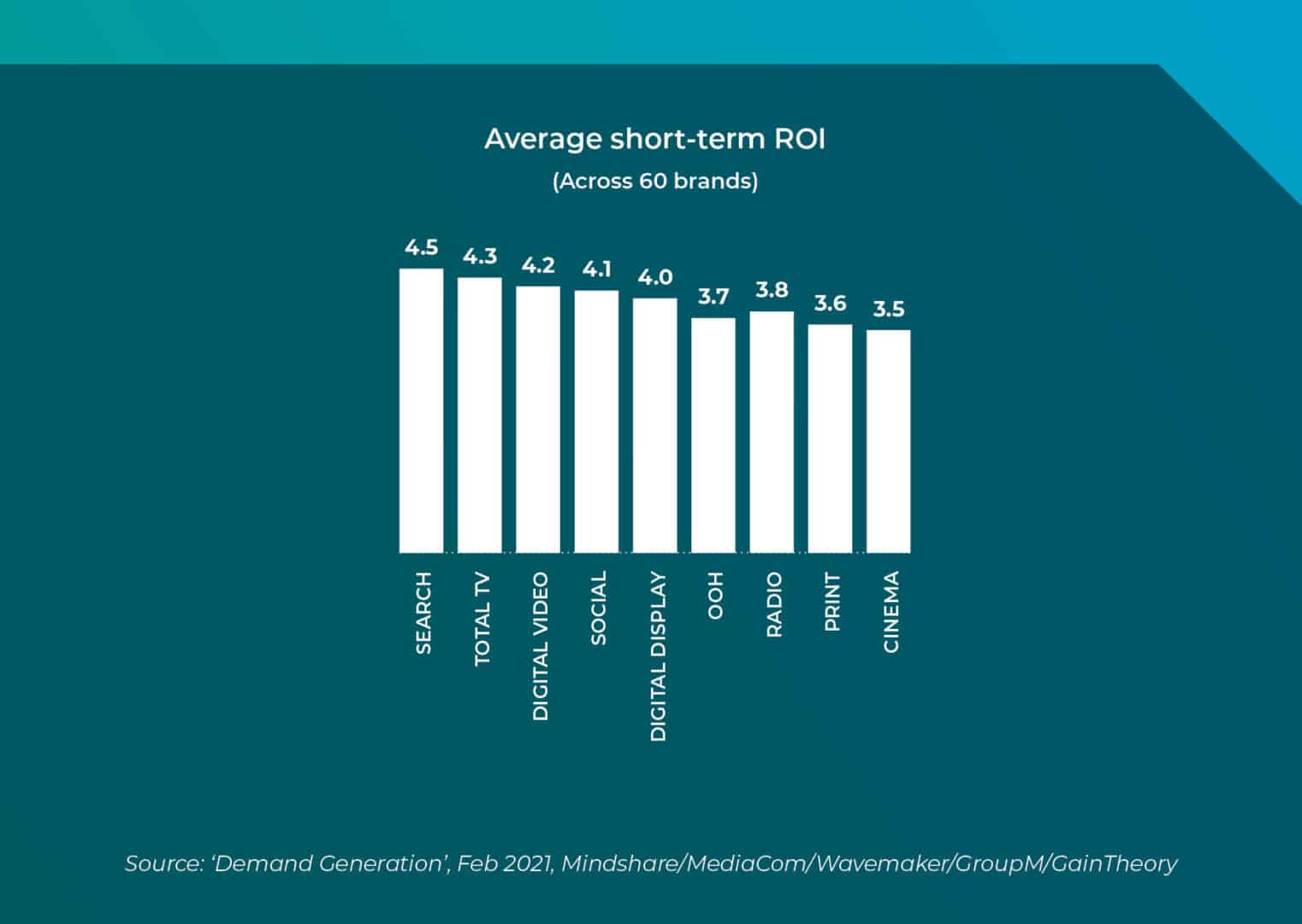

ThinkTV: Also generates strong ROI in the short term

For a period of less than three months, total TV delivered ROI of $4.30 for every dollar spent indicating an ability to drive growth over a shorter window.

TV produces more media-driven incremental sales

The research indexed all media channels, but found TV was three times better at driving incremental sales than any other channel. Out of home, print and cinema were at the bottom of this ranking.

TV is the top driver of search

While Search led the short term rankings, TV is fundamental to the sales demand derived from search with total TV contributing 18% towards the sales impact. In comparison, digital channels contributed 11% and other channels contribute just 6% towards search’s sales impact in the short term.

TV makes other media platforms more effective

Total TV has the strongest synergistic effect in multichannel campaigns increasing the effectiveness of social (Facebook) by 6.02%, search by 7.13% and display by 5.28%.

Professor Danaher said: “TV’s strength in driving business impact over the longer-term is well established, however, this research shows that with its broad reach, high levels of attention and time spent viewing, the platform also initiates a strong demand-response from the very first exposure. The findings confirm TV is a powerful medium for driving sales demand over any timeframe.”

The large-scale study utilised econometric modelling across three years of campaigns to examine how media contributes to business demand generation across a number of sectors including automotive, retail, FMCG, financial services, travel, government and utilities. Nine different media channels were analysed: total TV, radio, out-of-home, search, print, social (Facebook), cinema, social video and digital display.

ThinkTV CEO Kim Portrate said: “2020 tested marketer’s agility with sales windows opening and closing and market conditions changing with little notice.

“As 2021 begins, advertisers are in need of quick sales to make up for lost time or a fast start to their quarterly sales period. This research proves TV – potentially under-allocated in marketer’s short-term campaigns – is the perfect partner to help make the most of the new year.”

ThinkTV will be releasing more insights across 2020.

See also: TV advertising outperforms ad market recording growth in first half of FY21