Ebiquity is a global provider of media investment analysis that is not always welcome at the table by agencies who can be on the receiving end of advice about their ad media planning.

The company boasts over 500 media specialists working for brand owners to drive efficiency and effectiveness from their media spend, with the aim of eliminating wastage and creating value.

Ebiquity recently appointed Ilda Jamison as managing director Australia and New Zealand. Former leaders of the business in this market include Richard Basil-Jones (who later went into a global role) and Peter Cornelius.

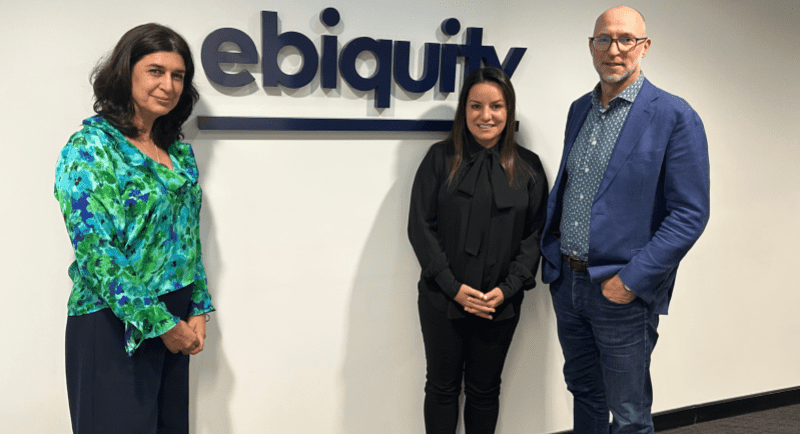

Visiting Jamison at the Australian HQ last week was group chief executive Nick Waters who caught up with her and Singapore-based Leela Nair, managing director of Ebiquity APAC, who was also visiting.

Waters also spent time with Mediaweek editor-in-chief James Manning.

Waters is no stranger to agencies and media spend

I have spent my entire career with agencies. I spent 18 years with WPP followed by 10 years with Aegis which became Dentsu Aegis. During my WPP career I grew up through Mindshare, including time spent running Mindshare Asia Pacific, which had Australia in the remit.

I then went back to the UK, which is my home, and ran mindshare for Europe, Middle East, Africa. I was doing that when I was hired to come back to Asia to run Aegis Media Asia Pacific, which also had Australia in my remit. That’s when things started getting interesting because Aegis had just acquired Mitchell Communication Group [from Harold Mitchell].

Dentsu then acquired Aegis and I was asked to merge the assets across Asia, excluding Japan. I did that for nine years, then in 2019 returned to London as chairman of the Dentsu UK business.

[During his time based in Asia, Singapore was the regional HQ Waters worked out of.]

Ebiquity global chief executive Nick Waters

Relationship between Ebiquity and media agencies

Our role is to help brand owners ensure they are getting visibility in the marketplace with what they’re buying, that they’re getting both efficient and effective media.

We’re independent and we take no revenues from any part of the supply chain, except for the brand owners. The agencies sometimes don’t respond well if we advise a client that [the agency] could be doing a better job.

Sometimes they say let’s work together to do a better job. Having been an agency manager for all those years, I understand what it takes to run an agency, I understand the value they can bring to clients with their store of knowledge, their innovation, their expertise.

At times a brand owner does need reassurance that the agency is doing a good job. Ebiquity always wants to be a constructive player in the market.

There are players in our space that perhaps lack integrity, and they go and deliberately cause problems in the relationship between a client and agency, I think that is irresponsible. We will never do that.

Our starting point is if a relationship is breaking down between an agency and a client we ask how can we help this relationship improve? Sometimes it doesn’t and the business goes up for pitch.

Ebiquity’s business model

It’s fair to say that Ebiquity built its credentials in the broadcast market. It historically found it difficult to bring the same value proposition to the digital market, simply on the grounds that the broadcast market has a finite supply, a certain amount of money coming in chasing that supply, and there’s a price-quality equation.

The digital market is completely different. There’s almost an infinite supply. You can keep buying impressions for as long as you want. There’s no market record of how much money is coming in. There’s no market price except for an auction.

To try and apply the same price-quality equation in the digital market is flawed. We take a different approach, which is to provide visibility to clients across everything that they’re buying in the digital arena. Clients have parameters against a set of metrics, which will typically be things like invalid traffic, brand safety, viewability, long tail blocklists…we typically find a client has maybe 10 to 12 of these principles that they want measured. We ingest all our digital buying data and show them how much of their spend is falling outside their own parameters, their own tolerance levels.

Then we sit down with the agency groups and say we’re seeing a certain amount of spend outside the client’s tolerance for this metric. We ask how do they think they can improve that and we work constructively with agencies. How can they do better, can we minimize that wastage?

Ebiquity’s A team (above and main): ANZ MD Ilda Jamison, global CEO Nick Waters and Asia Pacific MD Leela Nair

Staying on its own turf

We won’t do any media planning or buying. We don’t do strategy. But what we do is sit in with a client. We ask what are your objectives? We then ask the agency what are they going to aim for or commit to against those objectives?

We won’t do media planning or strategy for them, but we will review the outcomes of media plans and strategy. Agencies have responded in different ways to that. There have been some agencies that have gone, this is great, finally, someone’s measuring us on what we want to be measured on – outputs and value creation. Other agencies are going whoa, hold on, does that mean you’re trying to do media planning? So we then have to go and talk.

How big does a brand need to be to call in Ebiquity?

I don’t think it needs to be a particularly big brand at all. We can find value in a million dollars of ad spend. In many ways we can find a bit more value in smaller spends. A $1 million advertiser might get less attention from senior experienced people than a $40 million one. There’s greater scope for a proportion of that media investment to not be invested as well as it could be.

Business focus in Australia & New Zealand

It’s time for us to follow the global trend and bring much more value to our clients in the digital market. Australia is about 65% digital. Our business is overweight broadcast and we need to grow that digital segment by bringing value propositions to clients there.

Our new MD here Ilda Jamison is a digital native. It’s time to re-energise the business, blow some dust off it, and get it moving faster

Outlook: Short-term flexibility in ad spend

From about September of last year conversations with clients started to focus on inflation, not so much media inflation as consumer price inflation, and rising interest rates. At that time the question in the market was will there be a downturn in Q4 or maybe a downturn in Q1.

The market remains stable. What we’re seeing is advertisers not slashing budgets. It’s business as usual, but marketers are building much short-term flexibility into budgets. Proportionately money is being reduced into long-term brand building and increased into short-term performance media, which of course, can be cut at much shorter notice.

If you over-invest at the bottom of the purchase funnel, you fundamentally start to weaken your brand. You have to keep investing in brand building. With performance marketing, you’re harvesting at the bottom of the purchase funnel, and you’re not bringing new customers in or creating that new engagement with the brand. If you weaken the brand, it takes a lot more investment to strengthen it again.

Our advice to clients is always, if you can, continue with brand-building activity because it’s better in the long term.

Keeping an eye on trends

We’ve seen in the last 12 months in the United States a real explosion of media investment into connected television. It lacks measurement and money is flowing into it, in a sort of blindfold, and that’s a problem for advertisers. There’s limited measurement, you’re getting bundled pricing, you get no ability to cap frequency so we are investigating that for clients.

We are also looking deeper into retail media. Amazon has built a $10 billion advertising business, Walmart signed a deal with The Trade Desk. Many others are building ad sales businesses and in Australia Woolies and Coles are doing that too. All retailers have understood the monetisation opportunity of their digital real estate. But what are advertisers finding difficult there, what are they struggling with? We’ve been speaking to some of our FMCG clients to understand what they find difficult in that space.

Also influencer marketing is such a big thing but there is so little science around it. Marketers spend a lot of money on influencers in China, or key opinion leaders as they’re called, and we have developed an interesting solution. That’s going well, and we’ve started to develop that in Southeast Asia, in Europe as well, and we have started talking to some clients in Australia.

Paid search is another area we’re looking at to see if an AI solution can improve the outcomes of paid search. We’ve got a test product up in the UK on that.