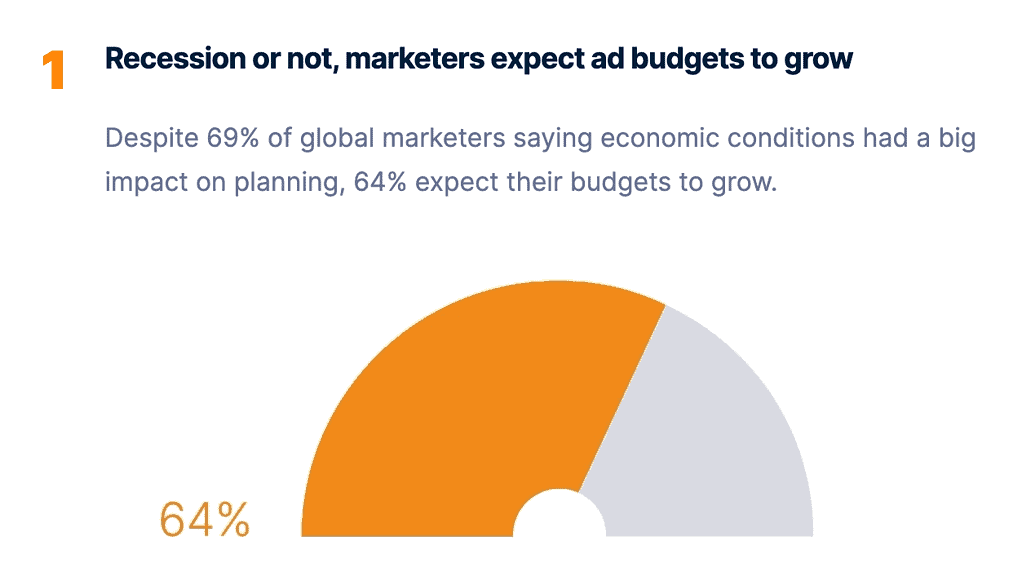

A global Nielsen survey of almost 2000 marketers indicates they expect their budgets to grow despite economic factors and the challenges of digital ROI measurement.

The margin was narrowly in favour of those forecasting a bigger spend – 56%.

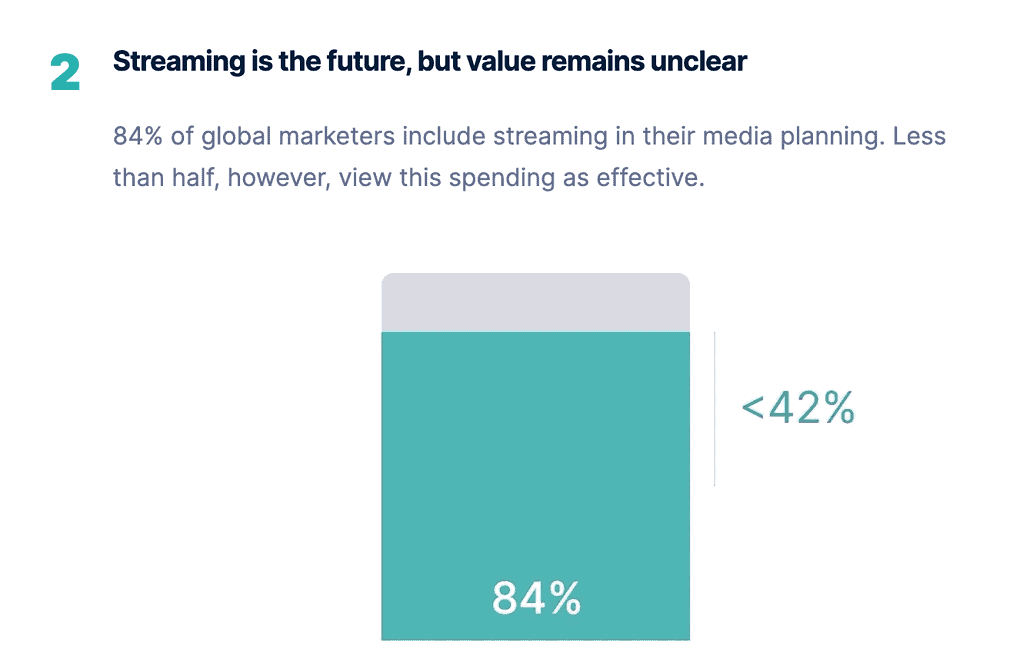

APAC’s marketers embrace streaming channels, but…

This week Nielsen released its 2023 Annual Marketing Report. One major finding was that 85% of APAC’s marketers now include streaming channels in their media mix. However, the survey reported that just 41% view that marketing investment was listed as “extremely, or very effective”.

The survey was conducted in December 2022 and the nearly 2000 responses indicated that brands in every country bar one were likely to increase their marketing spend year-on-year.

The one country that bucked the trend was Myanmar.

Australia falls within the APAC region for the survey. Separate data for Australia is not available. However, Nielsen noted Australia was one of five APAC countries that significantly increased their ad spend across social media last year. Indonesian marketers increased their social budgets most YOY – up 195%.

The increase in overall marketing spend comes as brands acknowledged the economy would have an extreme or severe impact on their planning for 2023.

The Nielsen 2023 Annual Marketing Report surveyed marketers on planned media spend, audience data, media mix inclusive of streaming, cross-media measurement challenges, and measurement technology.

Television remains a focus for marketers with 34% of marketers reporting allocating 40%-59% of their budgets to connected TV (CTV). Some 17% of the surveyed marketers reported shifting 60%-79% to CTV.

Measurement data critical to spend

APAC marketers noted the importance of knowing who engages with the devices and channels that carry their ads.

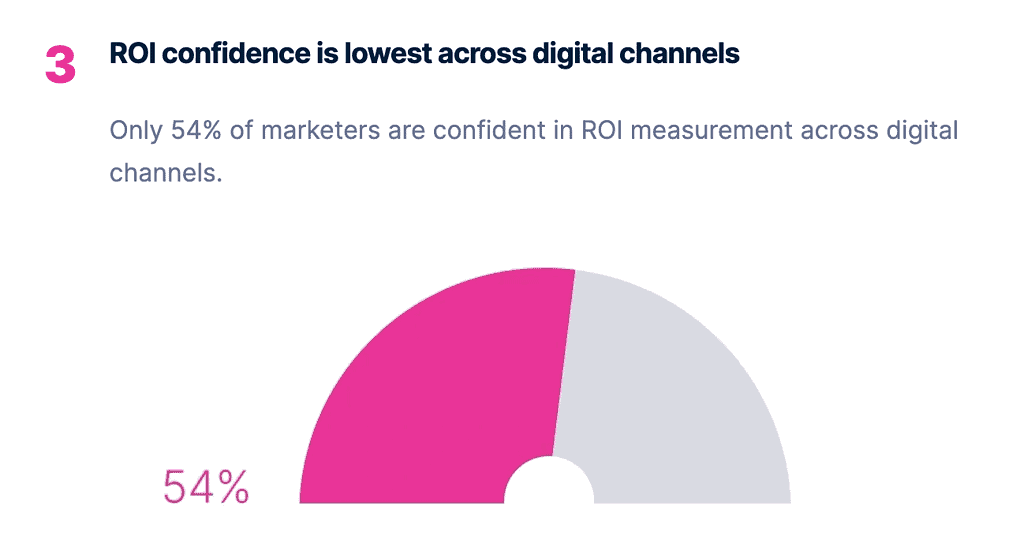

Over two-thirds (68%) acknowledged the importance of comparable measurement across channels. When it comes to individual channels, confidence in ROI measurement in our region is at 45%, with confidence in podcast and native advertising measurement ROI both at 38%.

When it comes to understanding complete consumer journeys (full-funnel) across all media, the survey found ROI measurement confidence is 47%. That figure is below the global average of 54%.

Regarding the lower confidence in measurement, Nielsen noted the different methodologies for linear and digital measurement. Marketers said the frequent use of multiple measurement solutions was a factor in their lack of confidence.

On average, 60% of marketers across APAC use multiple measurement solutions to arrive at cross-media measurement, with 13% leveraging four to five.

Investment in martech to drop in APAC

The report notes that in addition to using less of their martech spend in recent years, marketers are planning to pull back on additional investment in 2023. Despite expected increased ad budgets, 24% of marketers, on average, plan to reduce the investment in martech, with 12% planning cuts of 150% or more.

The biggest planned reductions are in Asia-Pacific, with 33% of marketers in our region planning to reduce their investment by 250% or more. Conversely, marketers in North America, plan the largest increases in martech investment, with 60% to spend more.

Nielsen leaders comment

Nielsen managing director, Pacific, Monique Perry, said: “This report shows that marketers across the Pacific region can see that streaming channels are playing an ever-increasing role in ad strategy. However, this is hindered by a lack of true cross media measurement and low confidence when it comes to assessing the ROI on these investments.”

Nielsen executive director, commercial growth and product strategy, Pacific, Jonathan Betts, added: “Marketers know that to deliver the business impact they’re tasked with achieving, they need to identify the right audiences and engage with them. Today’s multi-screen world means that identifying and measuring who and how they’ve engaged with their customers is more complex than ever. The job of media measurement, and what Nielsen is focused on, is providing accurate and simple person-level reporting into the audiences that a brand is engaging with.”

Key findings

Click here to download a copy of Nielsen’s Annual Marketing Report

See also:

GroupM media and advertising forecasts total market growth of 3.4% in 2023

Magna Global Forecast finds Australia’s advertising economy will reach $23.5 billion in 2023