There is much anticipation about the size of the audience global streaming Netflix will report later this week when it reveals its Q4 2021 financials. In a world where video is king, streaming is still the shiny new player that is attracting audiences and subscription dollars.

Video has been excelling across all its different models – from the newest free online players like Tik Tok to the high-end premium performers like Netflix and its Australian competitors Kayo, Binge and Stan.

But it is a market where advertisers have their challenges reaching the audiences.

Netflix has over 200m customers across the globe, spending on average around eight hours a week consuming some of the 450+ Netflix Originals released during 2021.

What’s hot on streaming platforms in January 2022. Clockwise from top left: Manifest on Netflix, The Tourist on Stan, BBL on Kayo and Love Me on Binge

Top of the page: After Life on Netflix

The release of the Netflix financials and audiences numbers are big deals for different parts of the industry. The dollars are impressive. From a content spend of US$13.5b in 2021 (up from $10.8b in 2020) it is booking an estimated 2021 revenue of $29b (up from $25b in 2020). Until 2020 though, the cost of those revenues (marketing, content etc) were higher than the revenues.

The production sector likes to know how the Netflix content spend is progressing to dream how much they might be able to pitch for.

Competitors – whether they be other streaming platforms or other parts of the video business including FTA broadcasters – need to keep a watch on what is happening on the world’s biggest streaming platform.

In Australia all the FTA networks are building significant free BVOD platforms. While none of them yet have tried to put a price on their content, apart from Seven’s toe in the water for the 2016 Rio Olympics, it remains a potential option into the future.

Four of the five FTA BVOD platforms are ad-supported offering different experiences for viewers. The good news for advertisers is they all offer ads that can’t be skipped.

Marketers like to keep track of the size of Netflix audiences because it gives them an idea of the size of the video audience that is difficult to reach. Not impossible though. Most SVOD viewers are also caught in the weekly FTA viewing net.

Some brands have been lucky enough to get their products into Netflix movies or TV series. Others have embarked on commercial partnerships with the streaming business tied to the release of key Netflix properties.

Netflix is believed not to charge for commercial partnerships, the size of any revenues would dwarf the importance of the subscription revenues it earns. “Being commercial-free “remains a deep part of our brand proposition,” Netflix said in 2019.

It has also been reported that Netflix chooses certain products to appear in programming can enhance that content for the audience. For example, Coke was one of the many brands that appeared in Netflix Original Stranger Things.

In Australia there are limited opportunities for advertisers to appear on streaming platforms via paid for placement. Some of the events being shown on Stan Sport offer sponsorship branding, particularly if that event is also being sown on one of the Nine FTA channels. Similarly there are branding opportunities also available for some sports programming on Paramount+ and Foxtel Group’s Kayo platform.

While it hasn’t happened in Australia yet, some of the streaming platforms in the US have ad-supported levels in addition to an ad-free pricing package. Those include Hulu basic, HBO Max with Ads, Discovery+ and NBC’s Peacock.

Ad-supported just might be a way for new and impending streaming platforms to help grow their audiences in the Australian marketplace.

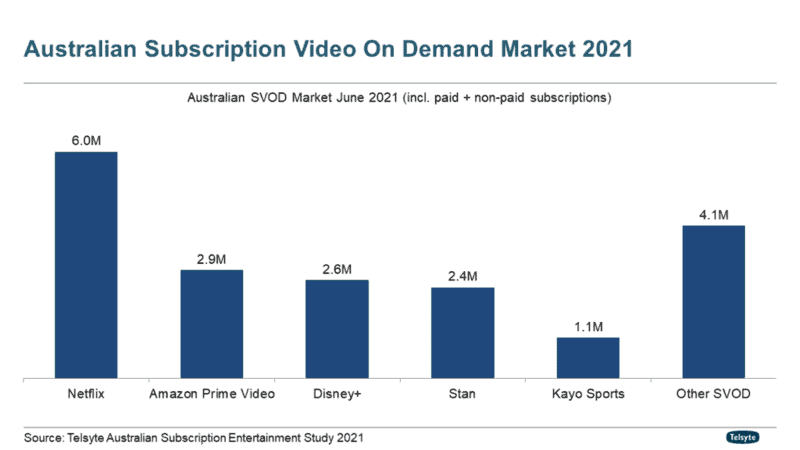

See also: Netflix reaches 6m to top SVOD rankings, Stan trailing Amazon & Disney+