• Global social media ads to hit US$50b in 2019, catching up with newspapers

• Global online video to overtake radio

• Steady expansion in global ad spend in 2017, despite political risks and quadrennial comparison

• Global growth supported by continued rise of Asia and recovery in Eastern Europe

Zenith predicts global ad expenditure will grow 4.4% in both 2016 and 2017, reaching US$566 billion by the end of 2017. The 2017 forecast is down by 0.1 percentage point from the forecasts it published in September after small downgrades in Asia Pacific, which nevertheless remains one of the fastest-growing regions for ad expenditure.

Global advertising expenditure in social media will grow 72% between 2016 and 2019, rising from US$29b to US$50b, according to Zenith’s new Advertising Expenditure Forecasts, published this week. Social media advertising will account for 20% of all internet advertising in 2019, up from 16% in 2016. Social media advertising is growing at 20% a year and by 2019 will be just 1% smaller than newspaper advertising (US$50.2b for social media compared to US$50.7b for newspapers). By 2020 social media will be comfortably ahead.

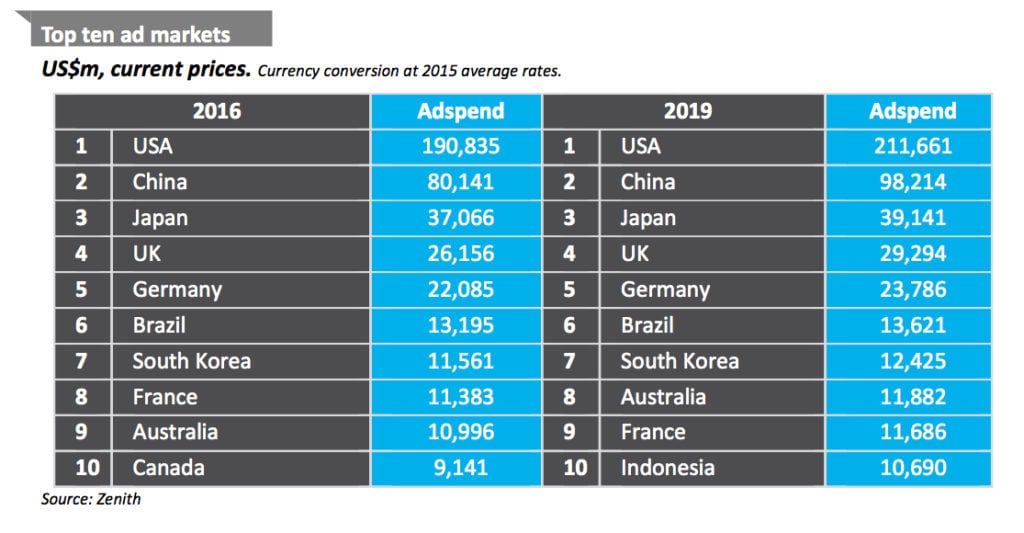

The US will be the leading contributor of new ad dollars to the global market over the next three years, making up in scale what it lacks in speed. China will come second, combining large scale and rapid growth. Between 2016 and 2019 Zenith forecasts global advertising expenditure to increase by US$73b in total. The US will contribute 28% of this extra ad expenditure and China will contribute 25%, followed by Indonesia, the UK, and India and the Philippines, which will each contribute 4%.

Five of the 10 largest contributors will be Rising Markets, and between them they will contribute 38% of new ad spend over the next three years. Overall, Zenith forecasts Rising Markets to contribute 54% of additional ad expenditure between 2016 and 2019, and to increase their share of the global market from 38% to 40%.

The top seven advertising markets will remain stable between 2016 and 2019. Australia will overtake France to take eighth place in 2019, pushing France down to ninth, while Indonesia will overtake Canada to take tenth place in 2018.

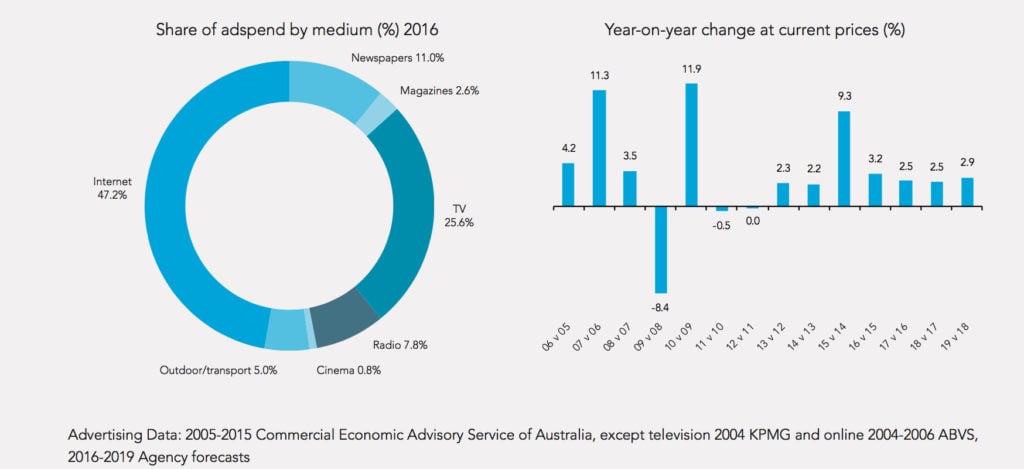

The Australian advertising market remains in positive growth in 2016 at 3.2%, off the back of the exceptional increase of 9.3% in 2015. The growth trend continues, although with less intensity, due to the continual structural shift of spend from traditional media of print and now TV into digital formats and environments. Digital advertising will grow 14.8% in 2016, offsetting declines of 15.2% in print and 4.9% in TV. Radio and OOH continue to have modest growth in 2016.

The inflation rate is forecast to be 1.3% for 2016 as a whole. Interest rates remain low (1.5%) with no sign of an increase expected for at least another 12 months. Consumer confidence fell slightly from October to November, although it is still in the positive range (101.3%) and is ahead of where it was in Q4 2015.

However, as we head into the final weeks of the year, the Westpac Consumer Sentiment Survey is reporting that people are planning to spend less this Christmas retail period than last year.

2016 advertising spend has been volatile across the year with growth changing from positive to negative month-on- month, and this inconsistency was evident across media as well with some growing in a month when everything else declined. The Olympics and a long Federal election campaign period helped to drive this volatility. Growth by category also varied: travel, food/dairy, Government and pharmaceuticals have all grown year-on-year. Retail, communications and insurance are down, while auto and finance are flat.

Zenith forecasts a slight slowing in growth to 2.5% next year, taking into account there will be no Federal election or Olympics spend injected into the market. 2018 and 2019 will continue these trends, with growth remaining below 3% a year.