Long before the first medals were contested at Milano Cortina, QMS was quietly laying the groundwork for this Winter Games moment: expanding its digital footprint, pressure-testing live capabilities during Paris, and preparing for a step-change in what out-of-home could deliver at scale.

Now, with the Winter Games underway, QMS Chief Sales Officer Tim Murphy said that preparation is coming into focus, amplified by the company’s new ownership under Nine Entertainment.

Speaking to Mediaweek, Murphy said the Nine partnership is unlocking a level of capability the Australian market has not previously seen.

“We’ll be able to do things that no one in the Australian media landscape has done in the past.”

For Murphy, Milano Cortina is not a starting point but a convergence – where Paris learnings, expanded digital assets, and Nine’s scale, data and advertiser relationships are now being activated in real time.

A moment years in the making

Murphy traces the current strategy directly back to Paris 2024, which he describes as the proving ground for both QMS and its advertising partners.

“First, we’ve significantly expanded our asset portfolio since Paris. So there’s 50% of the locations in New South Wales alone, for example, that are new sites, new locations to the network on the back of QMS’s commercial and development momentum and growth.”

As the official outdoor media partner of the Australian Olympic and Paralympic Teams, QMS has again deployed a dedicated Games Network for Milano Cortina, now reaching an estimated 77% of metropolitan Australians.

But scale was only part of the Paris lesson.

“I think everyone learned a lot through Paris. We adapted as we went through the process, really, really well, with respect to the brands involved. But I think we’ve learned a lot from that, and we’re now putting that into practice again for Milano Cortina.”

That learning curve has translated into returning advertisers who now understand how to extract value from live, context-driven DOOH.

“I also think brands, returning brands in particular, such as Allianz, Samsung, and Visa, have a strong appreciation for the opportunity and the platform it provides.”

One of the clearest evolutions since Paris is QMS’ speed to market – a capability Murphy says fundamentally changes how brands can behave during major global events.

“We can live with any breaking news across our network within 20 minutes of any news breaking. And the brands are benefiting from that.”

That responsiveness has reshaped creative behaviour on both sides.

“So we’re getting better at what we do, and the brands are getting better at how they use the platform as well.”

Nine changes the equation

For Murphy, Nine Entertainment’s acquisition of QMS represents a structural shift rather than a simple change of ownership – one that repositions out-of-home as a core growth engine within a scaled, data-led media business.

Nine’s $850 million acquisition of QMS from Quadrant Private Equity values the business at around 6.5x forecast CY26 EBITDA, with QMS expected to deliver approximately $105 million in EBITDA in 2026.

More than 80% of QMS’ revenue is contracted through to December 2028, providing long-dated earnings visibility at a time when premium digital inventory is increasingly in demand.

“It’s something that we’re incredibly excited about,” Murphy said.

Under Quadrant’s ownership, around $300 million was invested in upgrading and digitising QMS’s national asset base.

Today, digital formats account for the vast majority of revenue, with operating margins of roughly 26% on a pre-AASB16 basis. It’s a profile that aligns closely with Nine’s push to grow digital advertising revenue.

Murphy said the strategic fit goes well beyond balance sheet strength.

“It’s incredibly exciting, I think, for all stakeholders within the industry that you’ve got a scaled, data-driven, solution-focused Australian media company that presents a really interesting opportunity for agencies and advertisers.”

From a market perspective, the deal embeds QMS within a broader advertising ecosystem spanning television, streaming, publishing, audio, first-party data and advanced measurement, allowing out-of-home to be planned and activated as part of a genuinely cross-platform solution.

“We’re incredibly excited by having the power of Nine behind us and to continue to, I suppose, grow and invest in what we do from an out-of-home point of view.”

Nine has said the acquisition deepens its exposure to high-growth digital advertising, with digital growth businesses expected to contribute more than 60% of group revenue from FY27, up from around 45% in FY25.

Within that mix, QMS brings scale, reach, and immediacy, particularly during live, culturally resonant moments such as the Olympic and Paralympic Games.

Murphy said the response from agencies and clients has been swift.

“To be able to bring that together in how we shape solutions for the market is something that we’re really, really enthusiastic to explore over the coming months. The response from the market, the clients, has been overwhelmingly positive.”

“So that’s really encouraging for all of us here at QMS and no doubt the team at Nine as well.”

The effectiveness case is already proven

Murphy said advertiser confidence in the Winter Games network continues to be anchored in neuroscience-backed effectiveness data – particularly research conducted during Paris that examined how the brain responds to dynamic, contextually relevant out-of-home advertising.

QMS recently partnered with Neuro-Insight to measure long-term memory encoding (LTME), a key indicator of whether advertising is being stored in the brain in a way that influences future behaviour.

Unlike traditional recall metrics, LTME tracks the strength of subconscious memory formation, widely regarded as a leading predictor of brand choice and sales impact.

“So statistics show at least 20% to 25% in greater long-term memory encoding. We have a strong awareness of how to run editorial content and news content with advertising to make a significant impact on attention and effectiveness,” Murphy said.

The Paris analysis found that campaigns running on the QMS Games Network delivered a 22% increase in long-term memory encoding compared with non-Games campaigns. Brands placed adjacent to live editorial content – including medal moments, breaking news and real-time competition updates – recorded a further uplift, taking total gains to around 24%.

Paris delivered a 24% uplift in long-term memory encoding for brands appearing alongside live editorial content – results Murphy says are now reinforcing investment decisions during Milano Cortina.

“And so I think the proof in the pudding is that we’ve got these advertisers who are returning and investing significantly to be associated with the games and our platform,” he said.

From a trade perspective, the findings validated the idea that out-of-home performs best when it behaves like a live media channel – combining scale with immediacy, relevance and editorial context, rather than operating as a static broadcast medium.

That effectiveness story is now resonating beyond traditional Olympic advertisers.

“So that’s a huge driver for these advertisers to return and for new ones also to come on board, like Griffith University, for example, which has come onto the network for the first time.”

Built with partners, not just inventory

Murphy is clear that the performance QMS delivers during the Winter Games is engineered well before the opening ceremony – and sustained through relentless execution once competition is live.

For QMS, that work begins months out, with agencies and advertisers brought into the process early to understand what the Games environment can deliver and how to use it effectively.

“I think probably one of the key elements is we spend time with the agencies and the advertisers involved in the lead-up to the games with our creative and our strategy teams, talking about what the opportunity presents, showcasing what great can look like and working really closely with them,” Murphy said.

That preparation is then backed by operational muscle once the Games begin. During Paris, QMS ran a six-week live digital network that served more than 81,000 pieces of dynamic content across its national inventory, requiring constant creative refreshes, editorial alignment, and rapid responses to live sport moments.

“We have 24-hour, around-the-clock teams working on Winter Games packaging for partner clients, working with them to ensure their creative and messaging are as current and contextually relevant as possible,” Murphy said.

“So, we’ve got a really committed group who are working very closely with these brands and agencies associated with delivering these campaigns or delivering this opportunity.”

Education, Murphy said, is a deliberate part of that investment – particularly as brands move from static out-of-home thinking to live, editorially responsive execution.

“We put a huge amount of onus and energy around these partners, a huge amount of education in the lead-up to ensure that they make the absolute most of it.”

From a trade perspective, that approach reflects a broader shift in how premium DOOH is sold: less as inventory, more as a managed, high-attention environment that requires planning, collaboration, and real-time decision-making.

A medium hitting its stride

Murphy said the market response to QMS’ Winter Games network reflects how far out-of-home has evolved, particularly as digitisation has transformed the channel’s flexibility and creative potential.

“Well, I think there’s a growing appreciation for the medium and the role that it plays today in that it is a largely digitised platform allowing for incredibly dynamic, flexible, and creative storytelling, flexible, creative, and incredibly contextually relevant messaging. And at scale.”

That appreciation is reflected in spending.

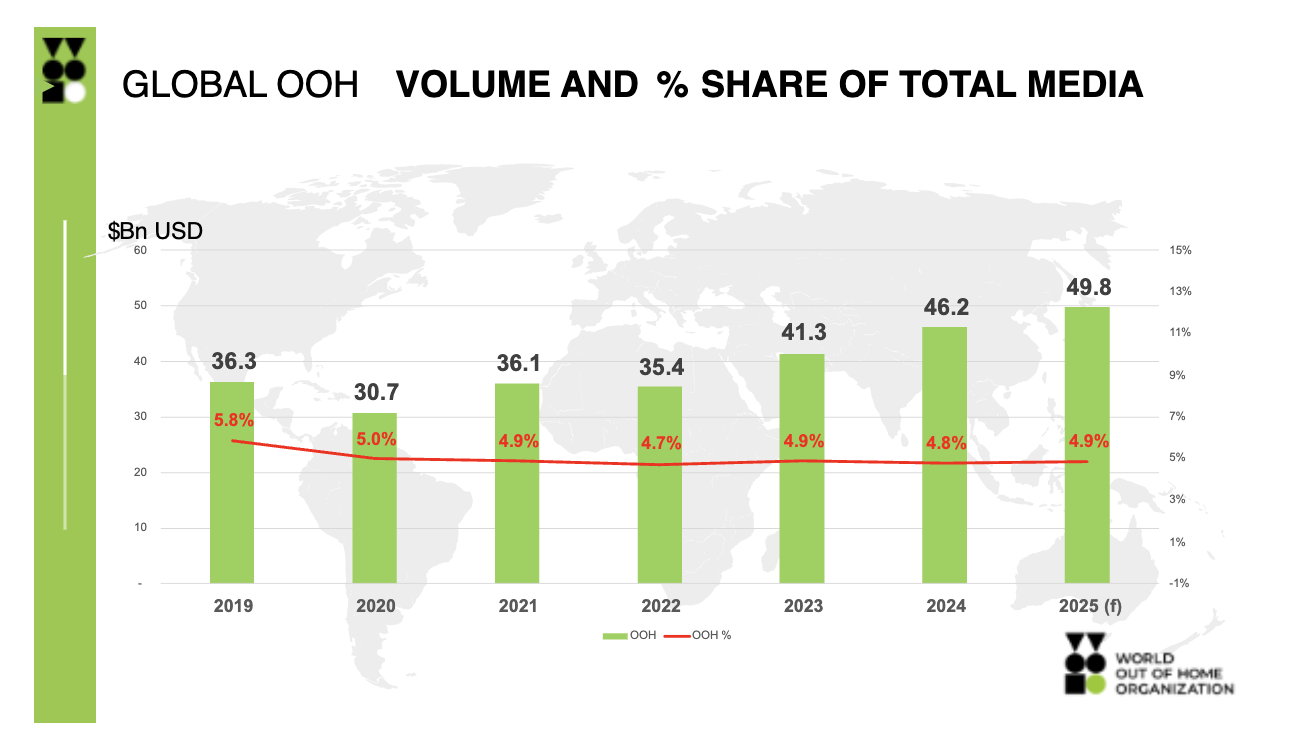

According to the Outdoor Media Association, digital now accounts for more than three-quarters of Australia’s total out-of-home revenue, with the channel delivering double-digit annual growth as agencies increasingly plan it alongside video, audio and data-led digital media.

Murphy said demand is deepening at the top end of the market.

“We’ve got incredible interest and intent for buying from Australia’s biggest advertisers, more so than ever, because of the appreciation for QMS and the entire sector’s growth.”

And the trajectory, he said, remains firmly upward as operators continue to invest in digital infrastructure, data and measurement.

“The growth will continue, you know, as we continue to invest in the platforms and people. There’s a fantastic buying demand for really high-quality, valuable assets across Metro and regional Australia, and that will only continue.”

FOMO… without exclusion

For major advertisers, Murphy said out-of-home has become a foundational part of the media mix.

“If you look at the major brands in Australia, they all have a media strategy that includes, and in a significant way, out-of-home.”

At the same time, digitisation and programmatic access have broadened the category well beyond large brand budgets, opening the channel to a new tier of advertisers.

“You’ve also got this incredible portfolio of small and medium-sized direct businesses that now understand that they can access out-of-home media,” Murphy said.

“So whether it be through programmatic avenues or due to the digitisation of our networks, they can access out-of-home in really specific ways to drive really, really good outcomes themselves.”

That dual dynamic, dominance at the top end, accessibility at the long tail, is now shaping how the market thinks about out-of-home’s role.

“So I think if you create FOMO, you’re winning,” Murphy said.

“But I think we’re also making the medium more accessible to more advertisers, brands, and clients through ongoing digitisation and greater flexibility in how we deliver and offer it to the market.”

“So there’s no need for FOMO, because everybody can get access out-of-home just in different ways.”

The trade takeaway

As Milano Cortina unfolds, Murphy sees the Games as a live demonstration of a strategy years in the making, one where scale, speed, data, neuroscience and creative execution converge, now amplified by Nine’s backing.

For advertisers, the signal is clear: digital out-of-home isn’t testing its credentials anymore.

It’s executing at full throttle.