ThinkTV has announced the Total TV advertising revenue figures for the six months to June 30, 2019, and the 12 months to June 30, 2019.

The total TV market, which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD), recorded combined revenues of $4.1 billion for the year to June 2019, which was down 4.1% compared to the same period to June 2018.

In the June half, TV advertising revenues were $1.9 billion, a decrease of 3.6% when compared to the same period ending June 2018.

Mediaweek spoke to two networks sales chiefs – Seven’s Kurt Burnette and 10’s Rod Prosser – who said, while admitting the figures weren’t great, there was much to be optimistic about for the remainder of the calendar year.

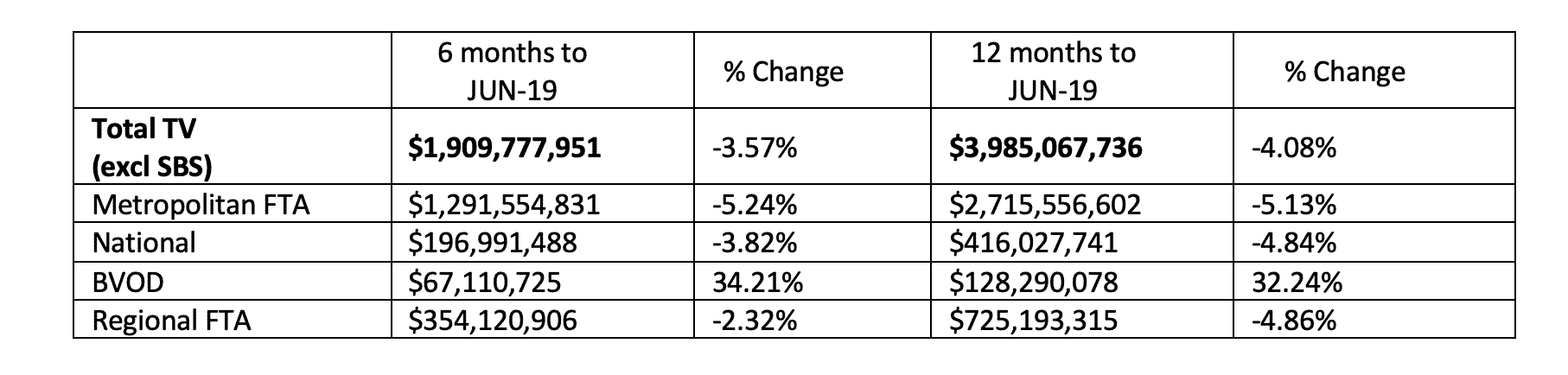

Performance by sector is provided in the following table:

The record-breaking performance of BVOD platforms 7Plus, 9Now, 10 Play and Foxtel Now continues, translating into record revenue growth with BVOD revenues up 34.2% to $67.1 million for the six months to June 30, 2019. BVOD revenue for the total financial year was $128.3 million, up 32.2% year-on-year.

ThinkTV CEO Kim Portrate said: “The advertising market is feeling the effect of decreased consumer and business confidence as well as global political uncertainty and these results reflect this. Yet, despite a dip in revenues in-line with broader market performance, TV saw an investment of almost $2 billion for the past six months and more than $4 billion for the full year. And what an impressive result for BVOD which continues to attract advertisers as well as audiences hungry to consume high-quality content on the device of their choosing.

“These figures confirm TV’s continued effectiveness for Australian marketers, and the industry is committed to further enhancing this performance. The growth of BVOD and the forthcoming launch of Virtual Australia (VOZ) are two such examples of this commitment.”

Network 10’s chief sales officer Rod Prosser said: “There’s no doubt that the advertising market is challenged at the moment, but TV has proven its resilience time and time again. It continues to be the most effective medium out there, providing the broadest reach.

“We’re looking at a stronger second half with some of Australia’s biggest shows. Australian Survivor is having its best season ever and The Bachelor Australia is continuing to deliver the goods. Gogglebox and The Bachelorette are still to come as well as two of the biggest new shows of the year – The Masked Singer Australia and The Amazing Race Australia. Not to mention, our biggest run home in sport ever with the Rugby World Cup 2019, the 2019 Melbourne Cup Carnival plus the Australian MotoGP and our Supercars coverage.

“We’re also seeing incredible audience growth in BVOD which is having its biggest year ever, opening up more opportunities for advertisers to creatively engage audiences. TV has become an ecosystem of platforms now and looking at it holistically, we’re optimistic about the market for the rest of the year.”

Seven chief revenue officer Kurt Burnette told Mediaweek:

“Nobody is particularly happy about the overall result, but in the context of the rest of the market we are relatively pleased. However the phenomenal growth of BVOD is some good news.

“We could be in for a tough quarter ahead, but it certainly feels like there could be a lot of activity from September onwards this year.”

Burnette said Seven was able to grow its revenue share during the financial year. “And with no Commonwealth Games or Winter Olympics that is a good result.”

When mentioning key growth areas, Burnette pointed to pharmaceuticals, travel and automotive. “The tech companies are also very active at present – Google and Amazon and the like.”

Burnette said there will continue to be enormous upside for BVOD. “The growth in viewing is still in the order of 30-40% and that is not stopping anytime soon. Our data indicates we are getting some new viewers who are watching BVOD only.”

Mark Frain, MCN CEO, told Mediaweek: “Post the election, we’ve seen forward momentum, with longer booking cycles providing significant interest in the back quarter of the year. The summer season, in particular tent poles like Fox Cricket, look strong as we expect the retail sector to drive campaigns harder and earlier this year. Financial institutions in particular are also back spending, with multiple bookings seen across the financial sector as consumer sentiment sees an upward lift. Positivity across the category will be bolstered by the ongoing progress of BVOD, which is becoming the fastest-growing part of television. Interest in the likes of Kayo Sport has been significant these last few months and there are no signs of it slowing down.”

—

Top Photo: ThinkTV CEO Kim Portrate with TV chiefs at a recent function – Tim Worner, Paul Anderson, Hugh Marks and Patrick Delany