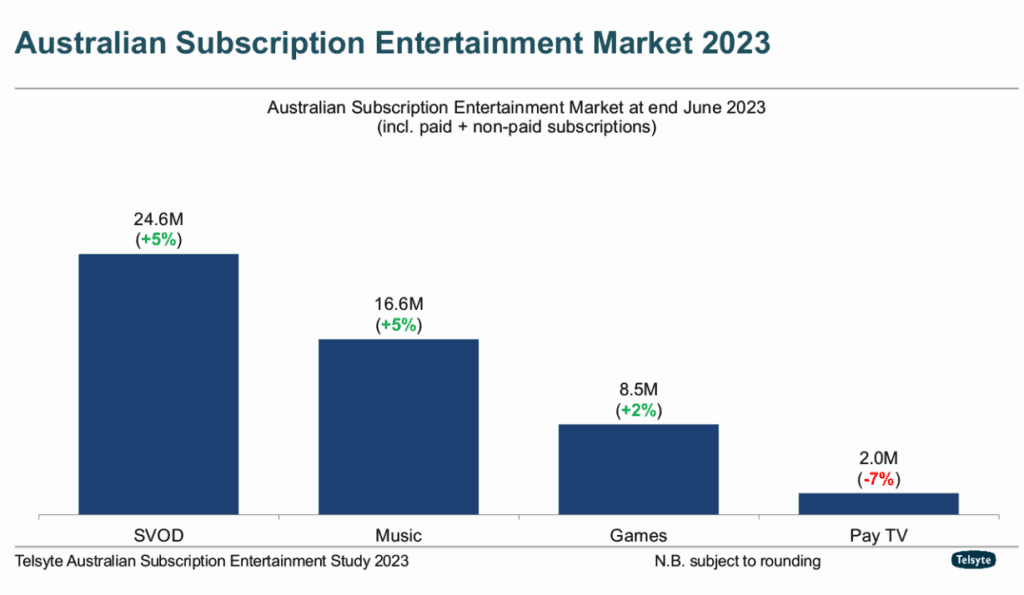

The annual Telsyte report on paid entertainment streaming services has reported an annual slowdown. The survey includes video, music and gaming services. However, when looking at just streaming on-demand video (SVOD), the numbers were up year-on-year.

Telsyte has noted the decline in total numbers reflects the rising cost of living.

The total number of subscription services in Australia increased by 3% to 49.9 million in June 2023. This growth rate is lower than the double-digit increase from the previous year.

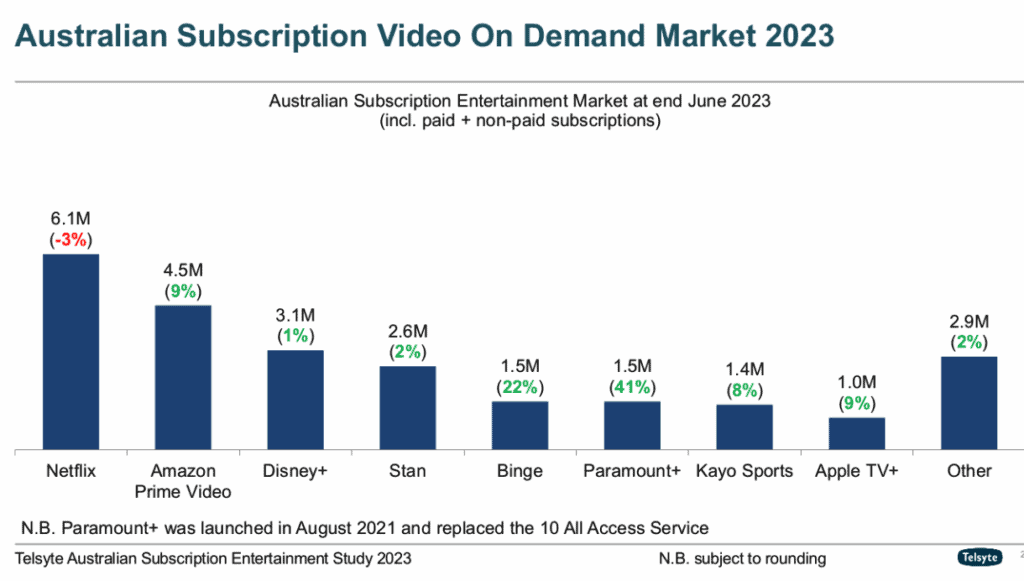

As video competition heats up, Netflix drops

Telsyte reported the SVOD segment continued to be the largest and most competitive in the subscription entertainment market, with the number of services reaching 24.6m in June 2023, up by 5% year-on-year. The average number of SVOD subscriptions per household rose to 3.4, with 39% of subscribing households taking three or more services.

While Netflix remains the market leader, Telsyte reported it has experienced its first YOY decline while all other services reported growth. Things that weighed down the Netflix result were the crackdown on account sharing and the introduction of an ad-supported tier.

Prime Video sits at #2 and is closing the gap between it and market leader Netflix. Paramount+ is the fastest-growing platform.

Despite the dip, the study found Netflix (6.1 million) remained the top SVOD service at the end of June 23, followed by Amazon Prime Video (4.5 million), Disney+ (3.1 million), Stan (2.6 million), Binge (1.5 million), Paramount+ (1.5 million), Kayo Sports (1.4 million) and Apple TV+ (1.0 million).

Although Optus Sport is not broken out on the Telsyte graphic, it reported the home of football had 885,000 subscribers at June 30, 2023. That pre-dates the start of the FIFA Women’s World Cup and the start of the new Premier League season, both events that would have boosted sub numbers.

See also: Everything you ever wanted to know about Optus Sport…except audience numbers!

Telsyte doesn’t include Foxtel numbers either which it categorises as a pay-TV service. At June 30, the Foxtel group reported total customer numbers of 4.723m, with 1.341m Foxtel domestic subscribers plus a total of 3.058m streaming customers combined for Binge, Kayo Sports and Foxtel Now.

See also: Foxtel Group reports 4.6m subscribers as Kayo and Binge streaming growth outpaces broadcast decline

Switching to save

Just under half, 48%, reported they are likely to switch between services to save money. Just under 30% claimed they find it difficult to unsubscribe a service.

Telsyte growth forecast

Telsyte estimates the total number of SVOD subscriptions could reach over 30m by June 2027, driven by a new content boom, growth in multiple subscriptions, new market entrants and more ad-supported plans across services.

SVOD market revenue is estimated at $2.7b for FY2023, a 14% year-on-year increase driven by subscription cost rises and an increase in service adoption.

“Profits, partnerships, and more aggressive behaviour. There’s going to be increasing competition to win people over from other platforms,” Telsyte managing director, Foad Fadaghi, said.

“Paid SVOD services as a category exhibits strong retention and near recession-proof characteristics, as other significant spending areas become household budgeting priorities.”

Price increase expectation

Telsyte reported over half (51%) of SVOD users are expecting the price of streaming video services to increase this year and have adjusted their SVOD budget accordingly. Among those willing to pay for streaming video services, the average monthly budget has increased by 7% from a year ago to over $36. The increase is similarly in line with the average CPI inflation recorded in 2023.

Streaming account sharing crackdown

The study indicates 1 in 3 (32%) SVOD subscribers share their services. Among those sharing services, half (50%) share with others who live in different households.

The majority (>80%) intend to share services for as long as they can, and the top reason for sharing is to save money (55%). However, 48% of Australians claim they will stop sharing altogether if they are required to pay to share these services.

Only a small percentage (7%) of new Netflix users claimed they cancelled because of new sharing rules.

BVOD and FAST: Watching ads is OK

More than 60% of people not subscribing to an SVOD service believe there is enough video content from free services to stop them paying for additional.

Telsyte reports that most BVOD platforms – 7Plus, 9Now, 10Play, ABC iView and SBS On Demand – have more than 10m subscribers each.

Nearly 5m Australians claim they have used free and ad-supported streaming TV (FAST) services, or services that offer FAST channels in the last 12 months.

According to Telsyte’s research, there are more than 1m non-sport SVOD subscriptions subsidised by advertisements as of June 2023.

Support for local content remains strong

Australian content remains a strong hook for viewers. In the past year, 66% of Australians claimed to have watched local content on SVOD platforms, with 60% wanting to see more.

A third of Australians said they are more likely to subscribe to an SVOD service that invests in local film and TV production.

Last King of the Cross helped grow Paramount+ numbers in the past year