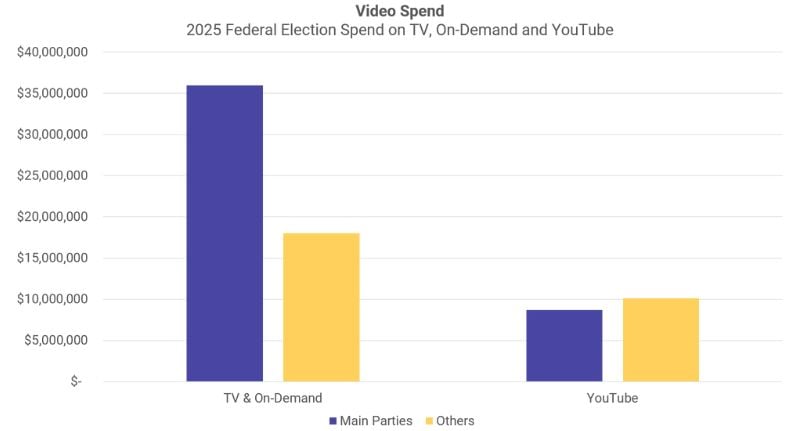

Television remains the undisputed king of election advertising in Australia, with parties spending more than $54 million on linear and broadcast video-on-demand services (7Plus, 9Now, 10Play, SBS On Demand, and Binge/Kayo) over five weeks of campaigning in the 2025 Federal Election.

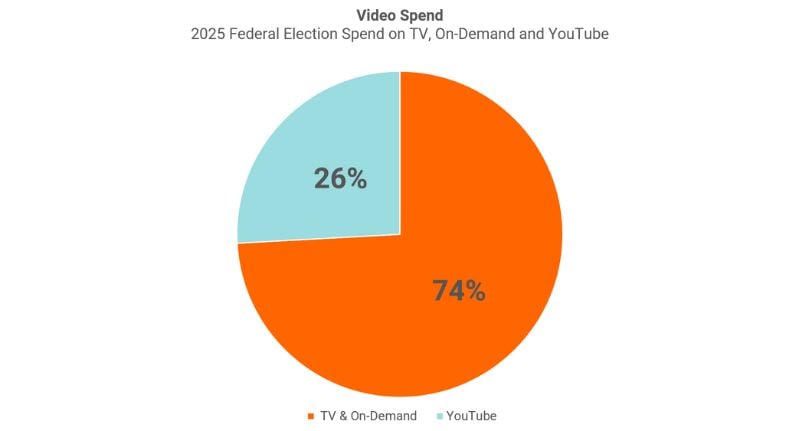

According to video measurement firm Adgile, television platforms accounted for a significant 74% of all video revenue during the campaign.

“No matter how you cut it, television remains the most powerful channel for reaching voters at scale,” said Shaun Lohman, Founder and Managing Director at Adgile, told Mediaweek.

Topping the political ad spend leaderboard was Clive Palmer’s Trumpet of Patriots with $24.1 million, followed closely by Labor at $24 million and the Coalition at $20.7 million.

The Greens committed a more modest $4 million to their campaign push.

YouTube surges, targeting becomes central

Despite television’s dominance, YouTube saw a significant $17 million in political ad investment, largely from minor parties and independents seeking precise, tactical reach.

The platform’s role is increasingly complementary to traditional media, with campaigns deploying a hybrid strategy across both environments.

:While YouTube delivered speed and precision through hyper-targeting, it was TV and BVOD that drove lasting message impact and broad-scale engagement,” Lohman said.

“Rather than simply running these channels in parallel, the most effective campaigns used each platform for what it does best, YouTube for rapid, tactical deployment, and TV/BVOD for reach, resonance, and reinforcement. Success came from understanding how to use them together, not just that they should be”.

Labor and Coalition ‘spent smarter’ … not just louder

Although Palmer’s campaign was the most visible in terms of spend, Adgile’s data reveals that Labor and the Coalition delivered greater media efficiency through smarter targeting and higher-quality creative.

“Palmer may have made noise, but Labor and the Coalition made impact,” Lohman said. “Our data shows that their investment in TV, both linear and addressable BVOD, achieved significantly higher levels of audience retention and geo-targeted cut-through. In short, they spent smarter.”

A key differentiator this election was the surge in variant creatives, many of them hyperlocal and seat-specific, across digital video platforms.

“We saw thousands of creative variants, many of them seat-specific, across YouTube and BVOD,” Lohman added.

“These weren’t just minor tweaks. Parties were tailoring messages down to local issues, candidate match-ups, and even voter sentiment signals. In marginal seats like Deakin and Ryan, creative executions were sharply different from those seen in safe electorates. Our data shows this level of granularity drove up viewer engagement and completion rates significantly.”

Labor leads with early messaging as pre-poll shifts timing

The timing of spend also marked a strategic shift, particularly by Labor, who frontloaded their campaign with policy messaging from week one. This contrasted sharply with the Coalition, who held back early and unleashed a burst of policy ads later in the campaign.

“Adgile’s day-by-day pacing data confirms the Liberals held back early, reserving much of their spend and policy messaging for the final weeks,” Lohman said. “In a campaign where pre-poll voting accounted for a significant share of ballots, that strategy came with risk.”

“Our data shows their major policy pushes didn’t hit until weeks three and four, giving them limited time to land with voters amidst a very noisy environment. While this approach may have reduced early wastage, it likely came at the cost of diminished influence when many had already cast their vote.”

Real-time campaign intelligence redefines political advertising

One of the most dramatic evolutions in 2025 was how campaigns managed and adapted their ad spend in real time, using live insights to make immediate adjustments.

“In previous elections, advertisers were flying blind for days or even weeks,” Lohman said. “This time, Adgile’s real-time dashboards gave strategists live visibility into what was occurring, where, when, and even against whom.”

“That level of intelligence meant spend could be redirected across electorates within hours, not days. Creative messaging could be adjusted in real time based on what voters were actually seeing in each seat, allowing teams to double down where they were winning, and course-correct where they weren’t.”

Legacy metrics are out. Smart video measurement is in.

The 2025 Federal Election marks a defining moment in how political campaigns approach advertising. The convergence of high-reach traditional media with sophisticated, real-time targeting across digital channels signals a new era for political media buyers.

“Fundamentally, the speed and precision of modern election campaigns means that legacy measurement is now obsolete,” Lohman said.

As digital and traditional media blend ever more seamlessly, the 2025 campaign has served as a case study in how to maximise message impact at scale, an insight every brand and advertiser can learn from.