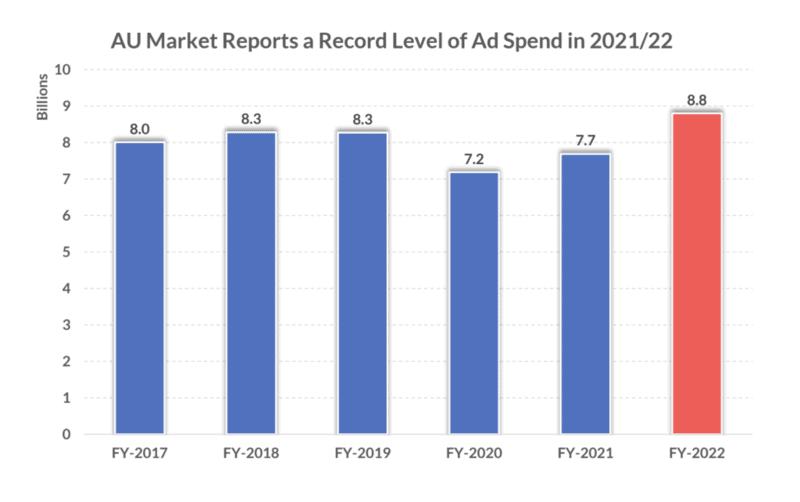

Australia’s media Agency market has emerged stronger and more confident from the Covid pandemic, with the SMI end of financial year ad spend revealing record levels of ad spend for the month of June, the June quarter and the 2021/22 financial year.

Total June ad spend lifted 0.4% from last year’s record level to a new record level of $775 million, which in turn fed into a 7.1% increase in June quarter ad spend to a record $2.26 billion (+$150m on Q2 2021) and calendar year growth of 10.6% to a record $4.2 billion.

SMI AU/NZ managing director Jane Ractliffe said that all resulted in a positive 2021/22 financial year result, with total Agency billings growing $1.1 billion over the previous FY to $8.8 billion, representing growth of 14.5%.

“The latest SMI financial year ad spend detail confirms the Australian market has moved well beyond the Covid period, with the total financial year ad spend now 6.4% or $528 million larger than in the pre-Covid 2018/19 period,” she said.

“The data also affirms the ongoing growth of Agency ad spend in Australia, with the market arguably on track to hit $9 billion in size next year, having grown by more than 35% – or by $2.3 billion – in the past ten years (since FY2011/12).”

Ractliffe said the financial year record also remained when Government category ad spend was removed to normalize the data for all Federal elections, with total growth in ad spend still up 7.4% on that basis.

Ractliffe said the SMI data proved the Australian and NZ markets were more resilient in June than their global counterparts, with NZ also reporting a small increase in June ad spend (+0.2%). In contrast, SMI’s US data has just revealed the first decline in that market in 22 months (-3% YOY); while in Canada the market fell 4% in June and in the UK the decline was 13%.

“Clearly advertisers in our region are more confident in the future than those in the northern hemisphere as they are continuing to invest strongly in their media investment,” Ractliffe said.

In Australia, the key product category trend this year has been the growth in Government ad spend, with the total growing $200 million from the previous FY to more than $550 million, overtaking the Automotive Brand category as our market’s second largest.

Another key trend has been the return of Travel category ad spend, with the total growing by 31% this financial year and continuing to lift its ranking each period. By the month of June, Travel emerged as the market’s fourth largest category, up 36.6% year-on-year.

Among the major media, standalone Digital media is reporting the strongest gains in both June and across the financial year (+10.9% and +25%). Video media grew 7.7% over the financial year, Audio ad spend lifted 11.2%, News Media ad spend lifted 3.3%; Magazine revenues have grown 5.7% and Cinema ad spend has more than doubled this financial year to $59.3 million.

“But while all the traditional media are continuing to grow their Digital-related ad spend, it’s clear the biggest change of the Covid pandemic has been the further growth of the standalone Digital media with total ad spend moving to standalone Digital since the FY 2019/20 period now just above $900 million,” Ractliffe said.

See More: SMI May 2022: Election dollars help keep May ad spend close to all-time high