Southern Cross Media Group Limited, the parent company of Southern Cross Austereo (SCA), has reported strong results for the financial year with the company reporting an underlying net profit after tax of $27.4 million, up 38.4% on the 2021 financial year.

Audio audiences also improved, and revenue grew as television improved its margins after SCA’s affiliation switch to Network 10.

See More: SCA posts 38.4% profit and rise in audio audiences in its full-year results

Mediaweek caught up with SCA CEO and managing director, Grant Blackley, to discuss the results.

Blackley said that a number of things contributed to the strong result which he said showed the inherent health and resilience of radio.

“Our radio performance has improved with audience increases across the board. We’ve seen a commensurate rise in revenue for all of our radio and on-demand products, and are very pleased by that. The maturity of LiSTNR – which only launched just over 18 months ago – has been a key factor, as it is now at a point where we have 850,000 signed-in known users. That’s an accolade to all of our teams, for the enormous effort and expertise that they have displayed in the broadening of premium content that we now enjoy on that platform.

“In TV, we transitioned from the Nine Network to the 10 Network, which meant that we did have fewer ratings and less revenue, but to be able to achieve a neutral earnings outcome of $30 million in EBITA is an exceptional effort. One that makes us very pleased to actually retain the asset as we move forward.

“There has been an enormous amount of challenges across the market in the last 12 months from state lockdowns, major national events such as floods, the war in Ukraine and big supply chain issues affecting all of our advertisers. We are pleased to come through that to post a net profit of 38%.”

The message to shareholders

Blackley said that the message to shareholders was that SCA didn’t waste time during the pandemic, with the company re-inventing itself in that time.

“We’ve now completed the full digitization of our entire suite of studios and offices. Being fit for the future with a maturing platforming in LiSTNR that sits in the middle of our business. We are controlling our own destiny moving forward. Many people and many platforms have not effectively done that as successfully as what you’re seeing occurring within the audio sector, and certainly at SCA.”

The future of LiSTNR at SCA

When asked about the future importance of SCA’s digital platform, LiSTNR, Blackley said that the product sits in the middle of the business

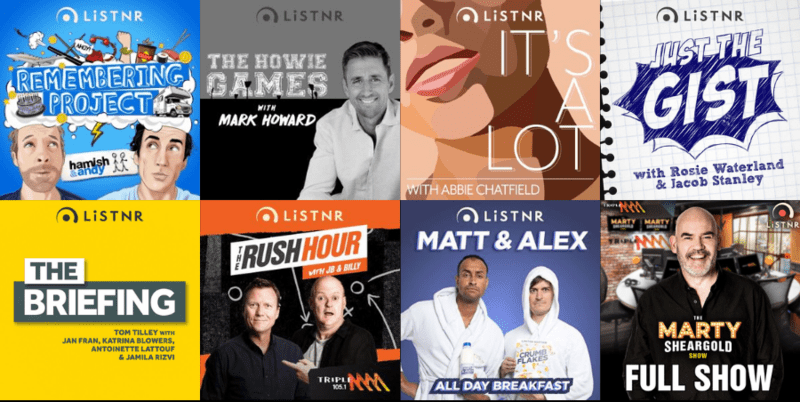

“It is the conduit between our audio products and our audience. It does encompass our 99 radio stations that have successfully transitioned from a broadcast one-to-many model to a one-to-one live streaming model. We’ve got 109 podcasts that are effectively premium by nature. We have 25 new music stations we’ve launched, and we’ve got an increasing depth of news and information. We picked up the streaming rights for the AFL, NRL and Cricket Australia.

“The last room in the house of LiSTNR is the development and build of our international room and within that, we’re seeing more premium global content producers migrate towards LiSTNR. LiSTNR is our future, LiSTNR is at the centre of the business, and LiSTNR is scaling. To that end, I think all goes well for SCA because of the successful deployment of this product.”

The future of TV at SCA

This result follows SCA’s decision not to sell off its TV division, which Blackley said followed the realisation that it was not the right move for investors.

“TV represents about 20% of our earnings profile. We have done an enormous amount with TV to make it a very simple light touch model. We have outsourced all of the back-end activities. What we do best in trying to be the best affiliate in the world in broadcast TV, is actually selling it – and we sell it exceptionally well. We have the highest power ratio of revenue to audience out of any of the broadcasters in TV.

“TV is producing $30 million of earnings. We transitioned from Nine to 10 and maintained that level of earnings. Whilst we did have a range of interests in terms of acquiring either part or all of the product of TV, the value that was presented didn’t live up to the expectations that we felt appropriate. We felt that it was in our shareholder’s interest to retain our TV assets. We use about $10 million a year of in-kind marketing support that we effectively afford across at no cash cost to the company each year, for the promotion of a product like LiSTNR or our radio networks.”

SCA’s dividend payout

SCA will pay a fully franked dividend of 4.75 cents per share, representing 85% of NPAT excluding significant items. This is at the top end of SCA’s policy to pay dividends of 65% to 85% of NPAT. The dividend will be paid on 4 October 2022. The Board will also resume the current on-market share buy-back after the release of these results.

Blackley said that this was a reflection that it is almost business as usual following Covid-19.

“We resumed dividends in the second half of the last fiscal year and paid out five cents at that point in time. We’re now declaring 9.25 cents, which is an improvement from the prior year. We think that’s a good use of capital for our shareholders, and a good return to our shareholders having a fully franked dividend, with quite a high dividend yield being afforded to that. We are confident to resume dividends ad we have paid at the upper end of the scale because we have very strong cash flow and quite low debt.”