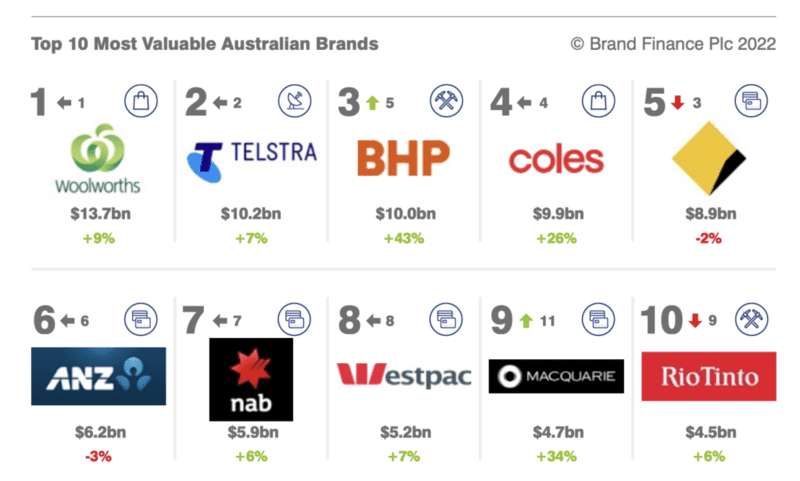

• Woolworths most valuable brand for 3rd consecutive year, up 9% to AU$13.7 billion in Brand Finance Australia 100

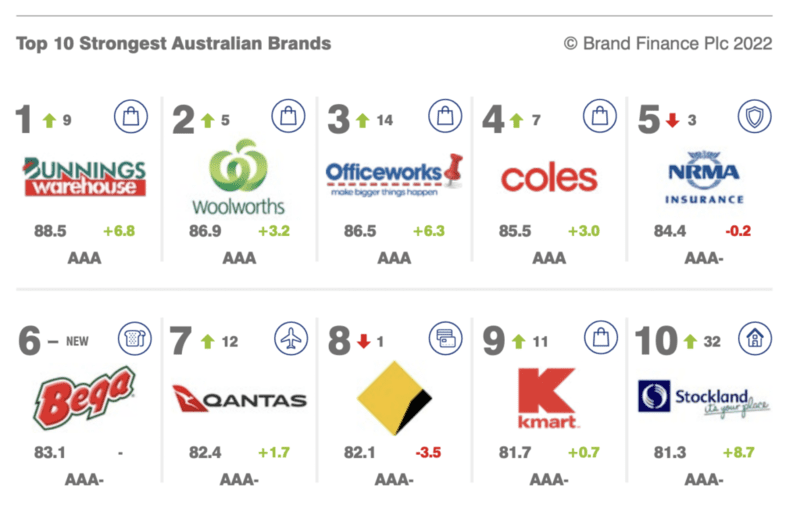

• Bunnings becomes nation’s strongest brand, scoring 88.5 out of 100

• Challenges for big 4 banks, while Macquarie bucks industry trends with 34% growth

• Reputation dent for telecoms brands despite 10% cumulative brand value increase

• Flight Centre up 68% as leisure and tourism brands begin recovery from pandemic

The total value of Australia’s top 100 brands has risen by 11% to reach AU$161billion, according to a new report published today. Sixty-six of the brands in the Brand Finance Australia 100 2022 ranking saw an increase in brand value, while 22 dropped, 2 remained stable, and 10 new brands entered the ranking. All major industries in Australia have risen in terms of total brand value, including banking (up 7%), mining (up 27%), telecoms (up 10%), and retail (up 15%).

The retail sector remains the most valuable in the ranking for the second consecutive year, with a cumulative brand value of AU$40.4 billion. Accounting for 25% of the nation’s total brand value, Australian retailers have enjoyed a brand value growth of 15%, outperforming other key players in telecoms and banking.

Australia’s biggest supermarket chain, Woolworths has maintained its spot as the most valuable brand in Australia for the third consecutive year, following a 9% boost to its brand value to reach AU$13.7 billion. Holding a 33% market share, Woolworths has been pivotal in keeping the supply chain going throughout the pandemic.

Woolworths’ main competitor, Coles, held on to its 4th spot in the ranking, enjoying a 26% brand value increase to AU$9.9 billion. Over the last year, Coles has continued to demonstrate flexibility and innovation in the face of unprecedented demand from shoppers who stocked up on essential items ahead of local lockdowns.

Officeworks (up 45% to AU$473 million) and Harvey Norman (up 5% to AU$3.7 billion) have enjoyed a year-on-year brand value increase as home improvements and maintenance spend increased following two-thirds of the Australian workforce transitioning to remote working during lockdowns last year.

Brand Finance Australia 100: Bunnings Australia’s strongest brand

Bunnings has leapt 8 spots to become Australia’s strongest brand, with a Brand Strength Index (BSI) score of 88.5 out of 100 (up 7 points) and a corresponding AAA brand strength rating. Over the last year, Bunnings has remained top-of-mind for Australian consumers by continuing to provide essential household and trade goods as well as spurring the country’s vaccination programme by setting up pop-up vaccination clinics in remote areas.

Woolworths’ brand strength has improved by +3.2 points to reach a BSI score of 86.9 out of 100 and a corresponding AAA brand strength rating. Over the last year, the brand has gained in favour with consumers, who consider Woolworths an industry-leading brand in terms of reconsideration, and quality.

Similarly, Officeworks has become a household name for most Australians looking for office supplies while working from home, improving its BSI score by +6.3 points to reach 86.5 out of 100 and a corresponding AAA brand strength rating.

Qantas has re-entered the top 10 strongest Australian brands, jumping 5 spots to 7th position. The airline brand currently holds a BSI score of 82.4 out of 100 and a corresponding AAA-brand strength rating, indicating a strong recovery from the sector-wide standstill caused by the pandemic.

Qantas’ recovery is a testament to the iconic brand’s enduring strength that fortified the business against the impact of the pandemic, but also ensured it was well placed to take advantage of the recovery in the airline sector.

Mixed results for banking brands

With an overall brand value growth of 7%, Australian banks appear to be on the slow road to recovery following an 11% loss in 2021. However, as traditional banking brands are increasingly challenged by smaller emerging brands pushing into digitalisation, negative customer perceptions of quality and innovation have driven down brand strength across the big 4.

Commonwealth Bank (brand value down 2% to AU$8.9 billion) has dropped from third to fifth most valuable brand in the Brand Finance Australia 100 2022 ranking. The last year has also seen Commonwealth Bank lose its mantle as the nation’s strongest, dropping down to eighth position, but remaining the strongest banking brand.

Telecoms face challenges

Following a devastating 16% cumulative brand value loss in 2021, Australian telecoms brands may be slowly turning the tide. This year, telecoms brands in the Brand Finance Australia 100 2022 ranking have enjoyed an overall growth of 10%, with new entrant, Vodafone (brand value AU$409 million), also entering the ranking in 78th position. While this growth has been insufficient to return to pre-pandemic levels, the sector has benefitted from a more stable outlook and reduced perceptions of risk overall.

Nevertheless, Telstra has held on to its spot as the second most valuable brand in the Brand Finance Australia 100 2022 ranking, behind Woolworths.

See also: TikTok named world’s fastest-growing brand in Brand Finance Global 500 2022 Report