Nine combines data offering across its whole business

Nine has announced the unification of data assets across its whole enterprise including 9Now, The Sydney Morning Herald, The Age, The Australian Financial Review, Domain, Pedestrian Group and CarAdvice, to create what it is calling the most powerful data ecosystem of any Australian media company.

The move sees Nine create Australia’s largest addressable marketplace, with more than 11 million IDs, aimed at providing marketers with the ability to target specific audiences at scale within a premium brand-safe environment, powered by the Adobe Audience Manager Platform.

“At Nine we have been on a journey to build the most powerful data asset of any Australian media company,” said Michael Stephenson, Nine’s Chief Sales Officer.

“In bringing together this collection of assets, we are giving the market a powerful data offering that will drive results for our clients.

“This move gives marketers the ability to target Nine’s audience segments across the most diverse range of digital media assets in Australia, and reach audiences via short-form video, long-form video and display.”

As part of this announcement Nine has rebuilt 9Tribes, its leading customer segmentation offering, which allows advertisers to target 54 unique audiences across all of Nine’s verticals and properties.

Nine has added five new verticals consisting of food, travel, automotive, luxury and property to its existing verticals of news, sport, entertainment and lifestyle.

“9Tribes has been an important part of our data offering for a number of years and we are excited to see it extending across all media assets, with clear verticals that will help marketers reach the scale of our audiences,” Stephenson said.

Nine recently deployed a new data partnership with Quantium, providing marketers with access to grocery segments across 9Now, and all of its digital media properties. This data partnership complements its existing partnerships with Equifax Marketing Services and Red Planet, which have now been rolled across the metropolitan publishing mastheads.

Nine powered ramps up advertising effectiveness with total video measurement

Nine has used Upfront 2020 to unveil its new advertising effectiveness offering, designed to ensure marketers can demonstrate a return on investment from marketing across their total video spend on the Nine ecosystem.

The new offering, which has been built out as part of the client solutions division Nine Powered, offers marketers a number of key products including the benefits of econometric modelling; real-time measurement of audience response through partnerships with leading media analytics firms Adgile Media and TVSquared; and brand health studies to track the impact of advertising on key brand perceptions.

“At Nine Powered we aim to be the home of Big Ideas that drive real results for the brands we work with,” said Liana Dubois, Nine’s director of Powered. “Over the past 12 months we have built out an effectiveness product which is unrivalled by our commercial TV counterparts and which highlights why both television and content integration is unmatched in building brands and driving long-term sustainable business growth.”

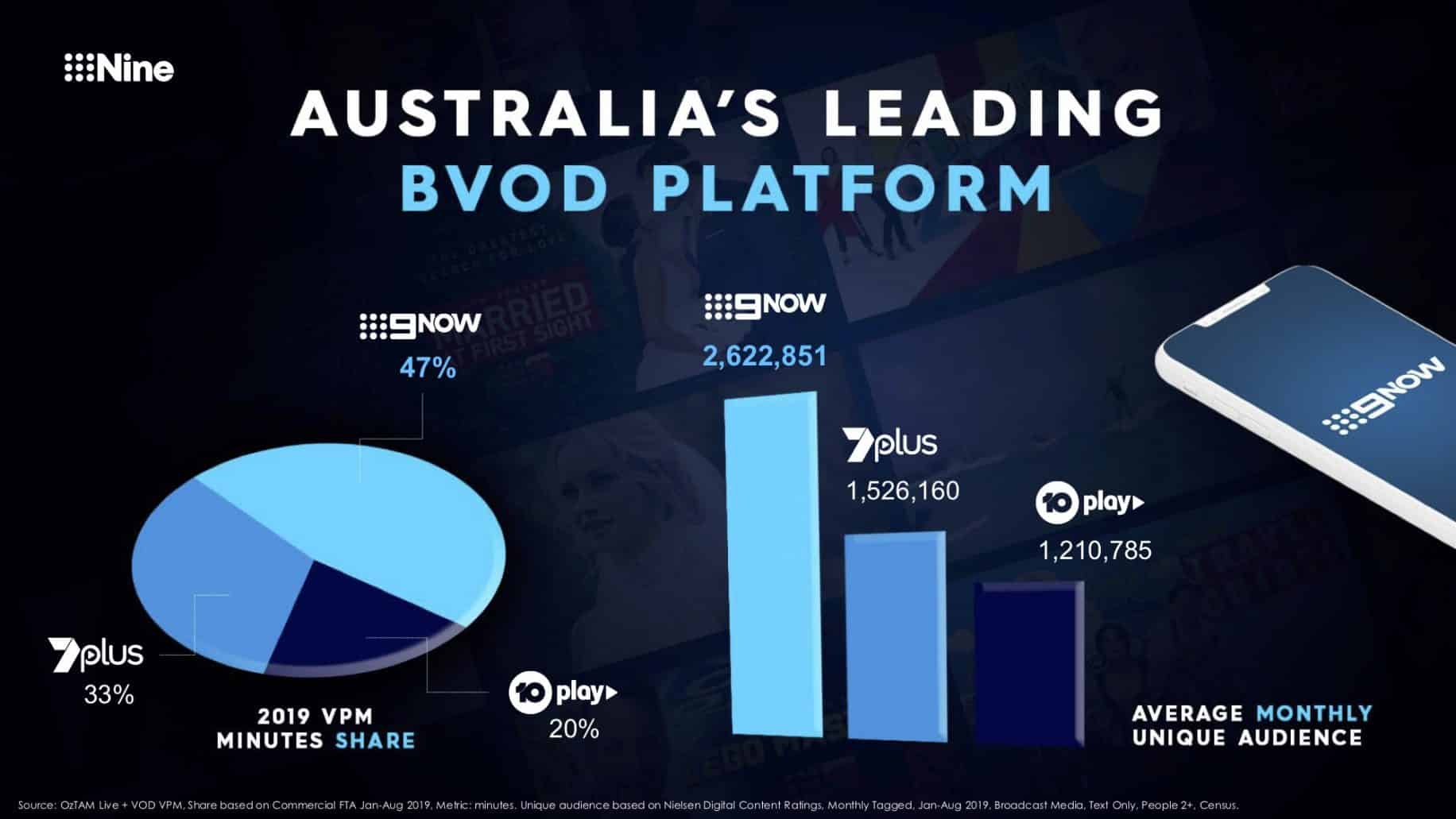

Online video: Nine moves to cost per completed view

Nine has used its 2020 Upfront to announce that it will compete more aggressively in the billion-dollar Australian online video market introducing cost per completed view on its short form and long form video products.

“From today, we will offer to price and trade all our BVOD and short form video based on a cost per completed view. You will only pay for views that have a 100 percent completion

rate,” said Michael Stephenson.

“A movement to a cost per completed view metric will create a level playing field and allow marketers to compare the real cost of advertising on Nine, Facebook and YouTube.

“Why is this so important? Advertising that is being seen for one second or sometimes not at all is not as valuable as advertising that is full screen has a 100 percent completion rate and is seen 100 percent of the time.”

Stephenson urged marketers and agencies to question the metrics of how they judge the effectiveness of their video advertising.

“It’s a complex and difficult landscape to navigate with each platform having vastly different metrics for what constitutes an ad being seeing, but at Nine advertisers who buy on a cost per completed view basis will only pay for ads that are viewed to completion”

Nine’s move to counter advertisers tempted by Olympic deals

Nine has launched its Australia 2020 initiative, which will give four brand partners the opportunity to own all of Nine’s biggest events on television next year.

The initiative will give the four brands involved in Australia 2020 the opportunity to own every magical moment of the Australian Open, Married at First Sight, The Voice, Australian Ninja Warrior, Lego Masters, State of Origin, the ICC Twenty20 World Cup, The Block and Love Island Australia.

“Australia 2020 is about giving four partners the ability to own every major format, every week of the year, on every screen, every event live in prime time and every event in the perfect time zone,” said Michael Stephenson.

“It simply doesn’t get any better. This is not 16 days of activity, this is 52 weeks of prime-time audiences and big ideas in all of Australia’s biggest shows, underpinned by a proven schedule that marketers and agencies know works.”

Nine also confirmed that for the period of the Tokyo 2020 Olympics, it would make its primary channel prime-time inventory available in 9Galaxy, its market-leading automated buying technology. This move gives certainty to advertisers throughout the Olympics by guaranteeing the delivery of audience through Nine’s leading technology.

Stephenson also announced a new demand side platform to be built by Nine, Seven, 10, Foxtel and SBS for buying groups and independent agencies.

The technology will allow agencies to buy linear TV, live streaming and on demand TV, against audience segments and demo’s, measure cross platform reach and post analyse campaigns in real time.