Mediaweek has partnered with Nielsen and its Ad Intel product to analyse the top 20 advertisers ranked by spend for the 2023 financial year.

We also analyse the data to probe the companies that make up the top 50.

These are the advertisers who help fund the majority of content that is presented to consumers on ad-funded FTA TV, radio and publishing platforms across Australia.

Nielsen Ad Intel provides competitive advertising data. The platform enables advertisers, agencies, publishers and ad platforms to monitor ad activity across TV, audio, digital (including search and social in select markets), print, out-of-home and cinema. Ad Intel provides cross-platform advertising intelligence with actionable insights to identify prospects, analyse brand strategies and learn from past advertising campaigns to plan for the next.

The most notable change in the data this year is the absence of major government spending.

In Nielsen data for just the first half of calendar 2022, governments held three of the top four spots in terms of the biggest ad spenders. The Commonwealth Government was the biggest ad spender in the country, with the Victorian Government ranked #2 and then the NSW Government ranked #3. The messaging at the time was linked to the country looking to escape the clutches of Covid-19.

FY 2023 Nielsen Advertiser Ranking

1. Harvey Norman

2. McDonald’s Restaurants

3. Woolworths Supermarkets

4. Amazon.com

5. Reckitt Benckiser

6. Telstra Corporation

7. Stan Entertainment

8. Coles Supermarkets

9. KFC

10. Sportsbet

11. Optus

12. Chemist Warehouse

13. Google Australia

14. Hungry Jack’s

15. Toyota Motor Corporation Australia

16. Bunnings Building Supplies

17. Walt Disney Studios Motion Pictures

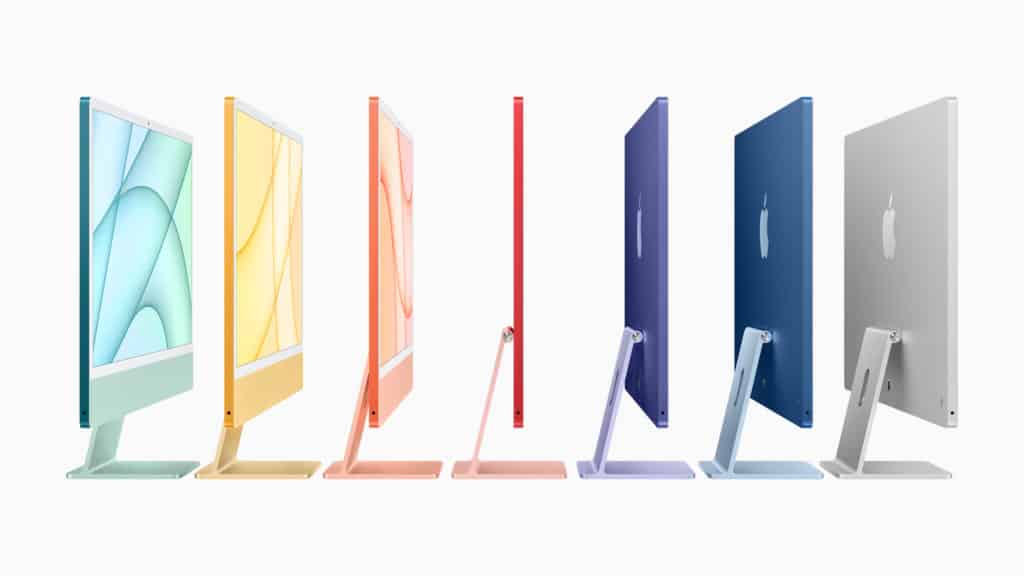

18. Apple Computers

19. Aldi Stores

20. Samsung Electronics Aust

Source: Nielsen

Retail spending lifts

The biggest advertiser in FY 2023 is again Harvey Norman. The company reported group marketing expenses in the eight countries it trades in as a percentage of total system sales revenue for the brands was 4.3% for FY23, compared to the pre-pandemic level of 5.0% in FY19. The change wasn’t enough to let McDonald’s rank #1.

More money is spent in retail advertising than anywhere else with $2,502b in FY2023, up 4% YOY. Quick service restaurants (QSR) also sit inside retail.

Other retailers in the top 20 are Woolworths, Coles, Chemist Warehouse, Bunnings and Aldi.

Retailers outside the top 20 but still in the top 50 are Myer, Ebay, Specsavers, The Good Guys and Domayne.

McDonald’s often has a piece of the action when it comes to major media event sponsorships and it’s no surprise it ranks #2 overall in the top 20. Other QSR companies ranked in order of spend in the top 50 are KFC, Hungry Jack’s, the global giant Mondelez, and Nestle.

Just missing from the top 50 was Metcash, the wholesale distribution and marketing company behind brands including IGA, Foodland, Mitre 10, Cellarbrations, and The Bottle-O.

There were two banks in the top 20 at the start of 2022, but in FY2023 there were none. The biggest spending banks in order in the top 50 for FY2023 were Westpac, Commonwealth Bank, NAB and ANZ. Suncorp was in the top 20 during 2022 but has now dropped out of the top 50.

The finance category was down 15% in the Ad Intel data to $632m where it remains the third-biggest ad category.

Amazon.com continues to be a big spender. It sits at #4 overall in the FY2023 ranking and ticks the box as an online retailer and a tech giant. Other tech players ranked in order of spend are Google Australia, Apple Computers, Samsung Electronics Australia, and Headway (an app which sits in Education & Learning category).

Makers of consumer products include Reckitt Benckiser and vaccine supplying biopharma company GlaxoSmithKline Australia made the list. The former in the top 20, the latter lower in the top 50 list.

One telco in trouble

Telcos have always been big spenders to maintain market share as they drip feed updated products to customers. Communications is the second single biggest category with an FY2023 ad spend of $890m, down 9% YOY.

Telstra remains the leader sitting at #6 in FY2023. Other telcos in the top 50 are Optus and Vodafone.

Given the brand damage done to Optus in the last 24 hours, there could be some pressure on it to increase spend to help rebuild confidence in the brand.

Nielsen Ad Intel tracks streaming wars

Stan has emerged as the biggest-spending streaming platform in a crowded market where there is a land grab underway to secure market share. Some of the Stan advertising is with parent company Nine Entertainment in the form of effective wraparounds in the company’s major metro newspapers.

A series originally pitched to Nine that became a hit for Stan

Other streamers and entertainment companies in the top 50 are Walt Disney Studios Motion Pictures, Streamotion (the Foxtel Group company that previously housed Kayo and Binge), Paramount Global and Foxtel. Market leaders Netflix and Prime Video seem to manage to lead the market without spending more than their rivals.

Gambling, auto, insurance, travel

The Entertainment and Leisure sector was down 1% YOY to $580m.

There continues to be much focus on the gambling sector and how it might be further restricted. Sportsbet is the biggest spender and sits in the top 10. The only other players to crack to the 50 are PointsBet and Ladbrokes.

The Gambling/Gaming category is ranked 12th largest with spend up just 1% YOY to $291m.

The motor vehicle category was worth $631m, up 4%. Toyota continues to be a top 20 advertiser. Others in the top 50 are Hyundai, KIA, and Mitsubishi.

Insurance grew 10% YOY to $433m with AAMI the biggest spender. It narrowly outranked NRMA Insurance. Also in the top 50 are Youi and Auto & General Holdings (home to seven insurance brands including Budget Direct).

The travel and accommodation category surged by 43% to $602m after Covid. The dominant spender is Qantas. Uber also sits in the top 50 with a spread of other advertisers a long way behind. Companies with increased spending included Flight Centre, Virgin Airlines, AirB&B, Ignite Travel and Booking.com.

The only other business in the top 50 major spenders is direct TV specialist Brand Developers Australia, the local arm of the company founded by New Zealand rich list regular Paul Meier.

See also: Brands surveyed by Nielsen expect annual marketing budgets to increase in 2023

Note: Nielsen monitors gross advertising expenditure in major media at published rate card values. While discounts are made available from some media owners, rates are not openly available. Please also note that the category and brand/product groupings figures are grouped at Nielsen’s discretion.