News Corp has reported financial results for the three months ended March 31, 2021. Highlights were continued growth of subscription revenues. At Foxtel both Kayo and Binge climbed significantly year-on-year.

Australian newspaper ad revenues were down, but subscription numbers to the various mastheads continued to climb. The company also reported an impact from the closure of a number of regional newspapers.

Commenting on the results, News Corporation chief executive Robert Thomson (pictured) said:

“The financial year is on a trajectory to be the most profitable since our reincarnation in 2013. This highlights the transformed character of the company, with improved revenue performance and a 23 percent increase in profitability in the third quarter.

“The results vindicate the strategy of simplifying the asset mix, vigorously pursuing digitization, slimming the cost base, and investing in three growth areas — Digital Real Estate Services, Dow Jones and Book Publishing — which collectively generated 55 percent segment EBITDA growth in the third quarter.

“At Dow Jones, digital revenues reached 74 percent of the total, with digital advertising growing by a robust 30 percent and The Wall Street Journal subscriptions setting record after record. And at Book Publishing, revenues rose 19 percent, thanks to a valuable backlist and faster digital growth.

“Foxtel’s resurgence during the pandemic reflected the enduring value of its broadcast offering, the rapid growth of streaming services, and a relentless focus on costs, all of which contributed to a 34 percent surge in Segment EBITDA.

“We have reached historic deals with Google and Facebook, and continue our international campaign to reset the terms of trade for premium journalism. The cooperation in recent weeks with the Google team has certainly been productive and we look forward to further engagement with Facebook. These landmark agreements have meaningfully and materially changed the media landscape.”

Revenues were $2.34 billion, a 3% increase compared to $2.27 billion in the prior year, driven by the continued strong momentum across News Corp’s key growth pillars.

Net income was $96 million compared to a net loss of $(1) billion in the prior year, which included non-cash impairment charges of $1.1 billion.

Subscription Video Services

Revenues in the quarter increased $61 million [all figures US$], or 13%, compared with the prior year, reflecting a $79 million, or 17%, positive impact from foreign currency fluctuations and higher revenues from Kayo and Binge. The revenue increase was partially offset by the impact from fewer residential broadcast subscribers and a $7 million negative impact from lower commercial subscription revenues primarily resulting from lower occupancy at hotels due to ongoing national travel restrictions related to Covid-19. Adjusted Revenues decreased 4% compared to the prior year.

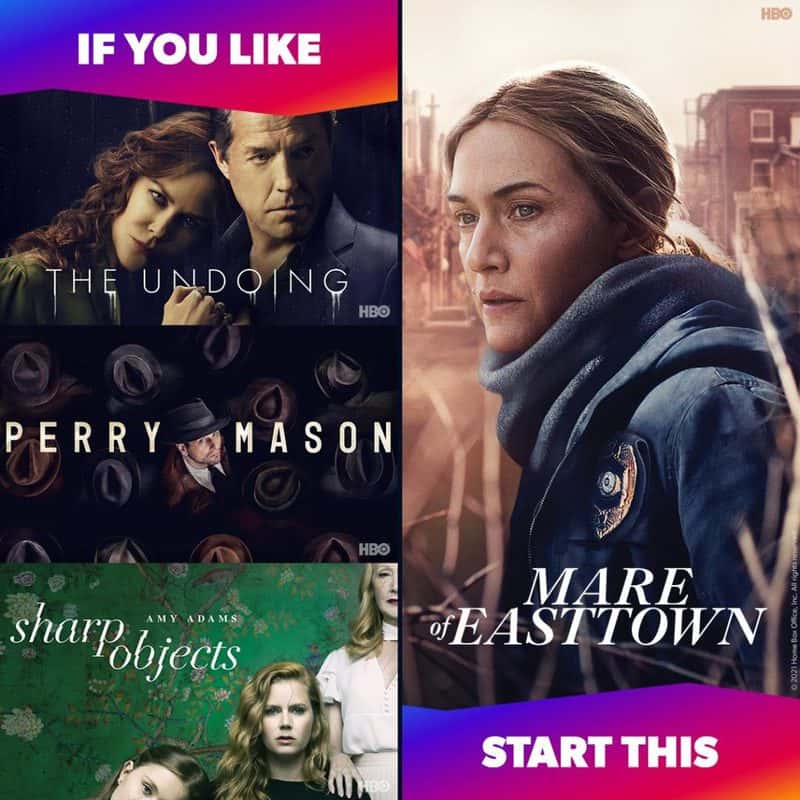

Some of Binge’s most popular dramas

As of March 31, 2021, Foxtel’s total closing paid subscribers were 3.541 million, a 21% increase compared to the prior year, primarily due to the launch of Binge and the growth in Kayo subscribers, partially offset by lower residential and commercial broadcast subscribers. 1.946 million of the total closing subscribers were residential and commercial broadcast subscribers, and the remaining 1.595 million consisted of Kayo, Binge and Foxtel Now subscribers.

As of March 31, 2021, there were 914,000 Kayo subscribers (851,000 paying), compared to 444,000 subscribers (408,000 paying) in the prior year.

Binge, which launched in May 2020, had 679,000 subscribers (516,000 paying) as of March 31, 2021.

As of March 31, 2021, there were 238,000 Foxtel Now subscribers (228,000 paying), compared to 338,000 subscribers (317,000 paying) in the prior year.

Broadcast subscriber churn in the quarter increased to 20.1% from 17.5% in the prior year, due to fewer promotions and the roll-off of lower value subscribers. Broadcast ARPU for the quarter increased 2% to A$80 (US$62).

Segment EBITDA in the quarter increased $23 million, or 34%, compared with the prior year. The improvement was primarily driven by $22 million of lower sports programming rights and production costs, which reflects the savings from renegotiated sports rights. The Segment EBITDA improvement was also due to a $14 million positive impact from foreign currency fluctuations as well as lower transmission, marketing and employee costs, partially offset by the increased investment in OTT products. Adjusted Segment EBITDA increased 13%.

Dow Jones

Revenues in the quarter increased $24 million, or 6%, compared to the prior year, primarily due to growth in circulation and subscription and digital advertising revenues, partially offset by lower print advertising revenues. Digital revenues at Dow Jones in the quarter represented 74% of total revenues compared to 68% in the prior year. Adjusted Revenues increased 5% compared to the prior year.

Circulation and subscription revenues increased $26 million, or 9%, including a $4 million, or 2%, positive impact from foreign currency fluctuations. Circulation revenue grew 8%, reflecting the continued strong growth in digital-only subscriptions, partially offset by lower single-copy and amenity sales related to Covid-19. Professional information business revenues grew 9%, driven by 24% growth in Risk & Compliance products. Digital circulation revenues accounted for 64% of circulation revenues for the quarter, compared to 58% in the prior year.

During the third quarter, Dow Jones saw the highest year-over-year increase in total subscriptions and digital-only subscriptions for both The Wall Street Journal and total Dow Jones’ consumer products in its history.

Total subscriptions to Dow Jones’ consumer products reached a record 4.27 million average subscriptions for the quarter, a 19% increase compared to the prior year, of which digital-only subscriptions grew 29%. Total subscriptions to The Wall Street Journal grew 21% compared to the prior year, to a record 3.38 million average subscriptions in the quarter. Digital-only subscriptions to The Wall Street Journal grew 29% to 2.63 million average subscriptions in the quarter, and represented 78% of total Wall Street Journal subscriptions.

Advertising revenues increased $1 million, or 1%, primarily due to 30% growth in digital advertising revenues, the fastest year-over-year growth in a decade, driven by continued strength in direct display sales and improvement across most categories, most notably financial services. Digital advertising accounted for 61% of total advertising revenues in the quarter, compared to 48% in the prior year. The growth was partially offset by a 25% decline in print advertising revenues, driven by continued general market weakness and lower print volume across The Wall Street Journal and Barron’s due to Covid-19.

Segment EBITDA for the quarter increased $31 million, or 61%, primarily due to higher revenues, as discussed above, and lower costs related to lower print volume and other discretionary cost savings, partially offset by higher compensation costs. Adjusted Segment EBITDA increased 59%.

News Media

Revenues in the quarter decreased $183 million, or 25%, as compared to the prior year, including a $55 million, or 7%, positive impact from foreign currency fluctuations. The decline was primarily driven by a $199 million, or 27%, impact from the divestiture of News America Marketing in May 2020.

The decline also reflects weakness in the print advertising market and the $28 million, or 4%, impact from the closure or transition to digital of certain regional and community newspapers in Australia. Within the segment, revenues at News Corp Australia and News UK both increased 2%. Adjusted Revenues for the segment decreased 7% compared to the prior year.

Circulation and subscription revenues increased $32 million, or 13%, compared to the prior year, primarily due to a $26 million, or 10%, positive impact from foreign currency fluctuations, digital subscriber growth and price increases, partially offset by lower single-copy sales revenue, primarily at News UK.

Advertising revenues decreased $215 million, or 50%, compared to the prior year, reflecting a $199 million, or 47%, negative impact from the divestiture of News America Marketing. The remainder of the decline was driven by continued weakness in the print advertising market, exacerbated by Covid-19, and a $23 million, or 5%, negative impact related to the closure or transition to digital of certain regional and community newspapers in Australia, partially offset by a $22 million, or 6%, positive impact from foreign currency fluctuations and growth in digital advertising at the New York Post.

In the quarter, Segment EBITDA decreased $16 million, or 67%, compared to the prior year, reflecting a $24 million negative impact from the divestiture of News America Marketing. The decline was partially offset by higher cost savings at News UK and News Corp Australia, as well as an improvement at the New York Post. Adjusted Segment EBITDA increased by $5 million.

Digital revenues represented 30% of News Media segment revenues in the quarter, compared to 19% in the prior year, and represented 28% of the combined revenues of the newspaper mastheads. News Corp digital subscribers and users across key properties within the News Media segment are summarized below:

Closing digital subscribers at News Corp Australia’s mastheads as of March 31, 2021 were 760,000, compared to 613,300 in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers as of March 31, 2021 were 354,000, compared to 345,000 in the prior year (Source: Internal data)

• The Sun’s digital offering reached 119 million global monthly unique users in March 2021, compared to 164 million in the prior year (Source: Google Analytics)

• New York Post’s digital network reached 139 million unique users in March 2021, compared to 199 million in the prior year (Source: Google Analytics)

See also: Q2 2021 – News Corp reports most profitable quarter since News & Fox split in 2013