Monday February 8, 2021

TV advertising outperforms ad market recording growth in first half of FY21

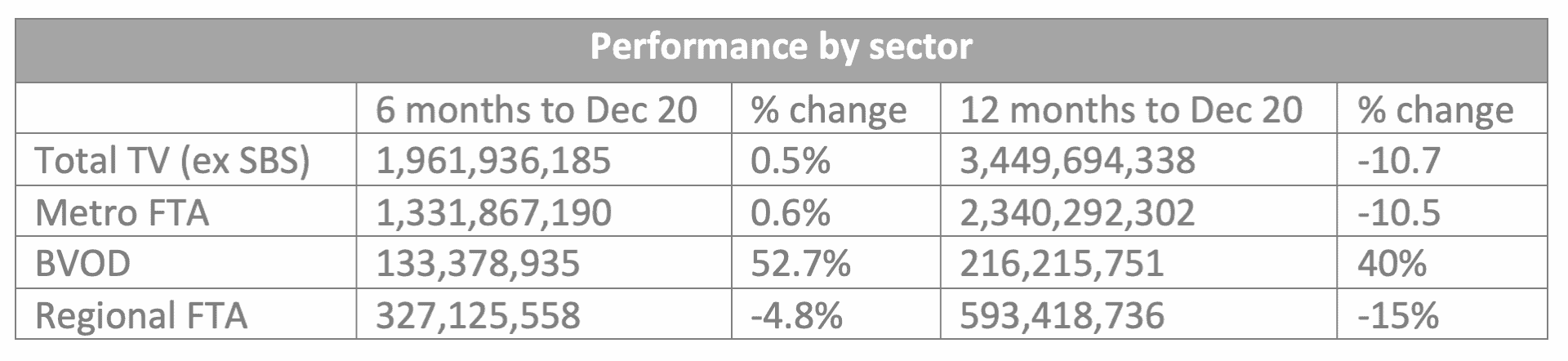

ThinkTV has announced the TV advertising revenue figures for the six and 12 months to 31 December 2020.

Faced with difficult trading and economic conditions, for the first half of FY21, the total TV market – which includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) – recorded combined revenue growth of 0.5% compared to the same period the year prior.

ThinkTV CEO Kim Portrate said: “The effect of the pandemic was felt keenly in the September quarter before the TV market finished the calendar year on a very promising note. Despite COVID-led market volatility, TV has, and continues to, play a pivotal role in communicating brand messages at scale driving business results in both the short and the long term for advertisers. Advertiser support for TV remains strong because brands know TV delivers the impact needed to drive growth.”

Kim Portrate

Seven West Media chief revenue officer Kurt Burnette told Mediaweek: “It was an incredibly tough year for Australians, Australian business and the media sector. These TV and BVOD numbers are a shining light in what has been a dark time for the sector. With TV in growth and BVOD at over 50% it surprised many, but it’s also the first time in many years that TV has outgrown the market. A healthy signal that there is a path to recovery across the board, albeit cautious.”

Kurt Burnette

10 ViacomCBS chief sales officer Rod Prosser said: “The last 12 months have demonstrated again the power of television and the impact it has to shift product, promote a message, to build a brand and most importantly, to deliver a strong return on investment.”

Growing consumption of content across BVOD platforms 7Plus, 9Now, 10 Play, Kayo and Foxtel Now has been matched by continued revenue increases with BVOD up 52.7% for the six months to 31 December 2020.

While Nine had the biggest FTA ad shares across the year just ahead of Seven, 7plus has the edge in the growing BVOD space. 10 was able to report revenue growth year-on-year.

Burnette: “The total TV numbers also clearly show that in the absence of other mediums, TV and BVOD is categorically proven to deliver results. Those that were able to advertise and then use TV and BVOD saw incredible results and returns.”

Portrate added: “BVOD revenue is performing exceptionally, in line with incredible audience growth. Post COVID, the medium has established a new baseline for viewership with more than 1.6 million hours of BVOD content being consumed every week with more and more Australians – advertisers and consumers alike – embracing the platform.”

For the 12 months to December 2020, the TV market recorded $3.45 billion in advertising revenue, down 10.7% compared to the 12 months to December 2019. For this period, BVOD saw an increase of 40%.

TV and BVOD ‘go-to medium when it matters’

“Total TV not only drove advertising results but delivered critical messaging for the community by using the fastest, largest and most engaging environment to get Covid messages and live updates through a trusted environment in TV,” said Burnette.

“That included Federal and State messages each day to update the country live, along with important support for businesses large and small and local communities. Proving again, TV and now BVOD to be the go-to medium when it matters.”

Sponsorships and BVOD drive 10’s revenue growth

10’s Rod Prosser also told Mediaweek: “For Network 10, our year-on-year movement for December and January out-performed the market, continuing our strength and momentum of 2020 into 2021. Armed with a strong audience on broadcast and video on demand, and incredible sponsorships, we are well placed to continue our revenue growth this year.”

Rod Prosser

10 ViacomCBS national sales director Lisa Squillace added: “Leading the comeback and out-performing the market just goes to show that TV works. At 10 ViacomCBS, our content, across all distribution channels, sets the bar for audience engagement and action, leading to fantastic outcomes for our clients.”

Lisa Squillace

How Seven delivered for clients

Burnette: “For Seven we are delighted how we ended and delivered the 2020 calendar year for customers. We launched three new successful tentpole shows in Big Brother, Farmer Wants a Wife and SAS all growing by double digits on key demos and returning in 2021 to deliver more growth.

“News and Sunrise was the most-watched and trusted news services in a year that those services have never been more important. Also growing audience in a historic year was the AFL audience. The 7plus numbers outgrew the market in viewing and revenue. As a result of a dedicated focus on growing users through strategic content acquisition and improved user and advertising experience. Accelerating addressability and our DATA road maps. This combined strategy is driving record growth and market leadership. All of that will continue into the new year.

“The new year has started with a bang in delivering significant year on year growth. Our objective is to deliver effective reach and growth for brands to be able to buy in and integrate within. This week we saw Holey Moley launch with increases year on year of 33% on 25-54. The return of Home and Away and the consistent performance of the most-watched and trusted News and sunrise has seen 25-54 primetime growth for the week of 12% and outgrowing the market on BVOD.”

Total TV and Seven in strong position for 2021

Burnette: “The response to our 2021 that includes Ultimate Tag plus Dancing with the Stars and an Olympics Games to launch The Voice and SAS has been strong. There has also been huge uptake in a much-anticipated AFL season, Supercars and Horseracing across the year.

“TV and BVOD market growth for the quarter is expected to be and is trending to be, double-digit.

“That said, no one is getting carried away. It’s a long year and we’ve learned and planned to be ready for anything. It’s just great to see total TV be in such a strong position and for Seven, to be able to deliver what we said for our advertising partners and the broader financial market. Which is to deliver growth and value that can only lead to great business results.”

Mike Sneesby tells how Stan Sport settled on $10, plans to expand Nine sharing

The start of the Super Rugby 2021 season is less than two weeks away with the new Stan Sport ready to live-stream its first matches with a doubleheader on Friday February 21. With just five teams in the Australian conference, the first night will feature two games – one in Brisbane followed by another from Perth.

Stan’s Rugby launch week turned into a battle of the streaming giants. On the day before the Super Rugby AU launch, Telstra unveiled its game-changing $5 and $10 a month packages for Kayo.

See also: TV deal: How to get Kayo Sports streaming service for just $5 a month

Then the day after the Stan Sport event, Foxtel revealed it had poached the Netball competition from Nine for Fox Sports and Kayo. In doing so Foxtel revealed its strategy for going after the big sports without a FTA partner to satisfy anti-siphoning legislation. Some of the netball games will be offered free on Kayo, as can other major sporting events when the need arises.

Amongst all that, Amazon Prime created a splash with news about its deal with Swimming Australia.

How Stan was ready for sport

When Stan CEO Mike Sneesby has previously spoken to Mediaweek about the early days of Stan, he noted they had different iterations of the original business model. Sport was something that could be accommodated on those different iterations.

“As we put together the investment and the plans to launch Stan, we always had what we referred to as a multi-horizon strategy,” Sneesby said this week. “That talked to the key things we would need to achieve in the business over time.

“In what we referred to as Horizon Three, there was a world where we anticipated Stan would reach an important point of scale, profitability and positive cash flow. As a result of that we would be in a position to consider live streaming. And streaming with a product outside of entertainment which is what Stan has been best known for.

“In those early days, without specifically talking about sport, live streaming and the ability to grow our product set has always been part of the long-term strategy.”

What Stan Sport offers that others can’t

Stan has partnerships with Nine in the coverage of the two sports it has so far announced – Rugby and Grand Slam Tennis. Sneesby said Stan is the only business equipped to do what is required to deliver to consumers on FTA and a subscription platform.

“Acquiring broadcast rights and paying the money for those rights is one thing. At the end of the day, we need to put that sport in front of an audience that gives it growth and builds it over time. The model of building a sport and giving it a bigger audience creates value for us as a broadcaster and also creates value back to the sport itself. We are uniquely positioned to do that like no other business in Australia.”

Sneesby is not yet ready to reveal how many subscribers Stan Sports initially needs. “We will set ourselves a very clear target and we have done our homework on how that target is achievable. As has always been the case with Stan, we expect to be hitting those targets next year. Early indications from social media and the way consumers are reacting to the proposition as we reveal more about it, has been extremely positive.”

Testing the market to settle on the subscription price

Stan has a lot of data from existing subscribers on how they respond to content on the platform, something that has helped plan the delivery of live sport. “In bringing this product to market we have been able to settle on the price point of $10 a month. Some of our subscribers with a keen eye might have noticed several weeks over the summer many subscribers were presented with the proposition of Stan Sport at a range of different prices to test what consumers thought would be the right amount. We have chosen $10 because we know it is what consumers want.”

Stan Sport doesn’t have a shopping list of other sports its needs to add quickly, said Sneesby. “There isn’t a need to us to go and acquire a barrage of sport in order for our proposition to work. We are servicing fan bases for rugby and tennis. If opportunities come along to grow that we will look at them. The business model works. This [month] is not about launching Stan Sport, this is about launching rugby. When it comes to time for Wimbledon and Roland Garros, it will be about tennis.”

Brand opportunities and Nine partnership

Stan Sport will be completely ad-free. However, some of the integration that Nine sells for its rugby coverage will also be carried on Stan. “The sponsors that are attracted to rugby on Nine add a lot of value to the professionalism of the game. We feel comfortable if some brands are seen during our broadcast. There will be no ads though.”

To date, Stan has operated independently of Nine. But is this Nine and WWOS partnership with Stan for Rugby indicative the two will be partnering on more content in the future?

Sneesby: “One of the important things for us in launching Stan, particularly when the category was brand new, was to make sure there was a differentiation. To make sure consumers knew the difference between what was FTA TV funded through an advertising model and what was subscription television funded through subscriber payments.

“The ability we have now for live streaming, with sport or other events, naturally means there will be great opportunities. WWOS is the entire back end of the operation of this broadcast. This is probably the biggest joint initiative between Stan and Nine since we launched. In the world of live broadcasting, there is no better company in Australia than Nine. As we explore the future of live streaming on Stan you can bet Nine will be an important part of that.”

News Corp reports most profitable quarter since News & Fox split in 2013

Results highlights:

News Corp revenues were US$2.41 billion (all figures here US$), a 3% decline compared to $2.48 billion in the prior year – Adjusted Revenues increased 2% compared to the prior year.

• Dow Jones reported 43% Segment EBITDA growth, driven by record digital advertising revenues and continued growth in digital subscriptions

• Subscription Video Services Segment EBITDA grew 77% as Foxtel benefited from lower costs while reaching a record of more than 1.3 million paying OTT subscribers as of the quarter end

News Corp has reported financial results for the three months ended December 31, 2020. Commenting on the results, chief executive Robert Thomson said:

“The second quarter of fiscal 2021 was the most profitable quarter since the new News Corp was launched more than seven years ago, reflecting the ongoing digital transformation of the business. We reported the largest profits for Dow Jones since the acquisition of the company in 2007, with Segment EBITDA increasing 43 percent and traffic across the Dow Jones digital network surging 48 percent.

“There was also a 77 percent rise in Segment EBITDA at the Subscription Video Services segment, where the exponential evolution at Foxtel continued apace, with streaming customers increasing over 90 percent, rights costs reset and audiences for summer sports at unprecedented levels.”

Subscription Video Services

Revenues in the quarter increased $10 million, or 2%, compared with the prior year, reflecting a $33 million, or 7%, positive impact from foreign currency fluctuations and higher revenues from OTT products. The revenue increase was partially offset by the impact from fewer residential broadcast subscribers and an $11 million, or 2%, negative impact from lower commercial subscription revenues resulting from the ongoing restrictions on pubs, clubs and other commercial venues due to COVID-19. Adjusted Revenues decreased 5% compared to the prior year.

As of December 31, 2020, Foxtel’s total closing paid subscribers were 3.314 million, a 12% increase compared to the prior year, primarily due to the launch of Binge and the growth in Kayo subscribers, partially offset by lower residential and commercial broadcast subscribers. 2.001 million of the total closing subscribers were residential and commercial broadcast subscribers, and the remaining 1.313 million consisted of Kayo, Binge, and Foxtel Now subscribers.

As of December 31, 2020, there were 648,000 Kayo subscribers (624,000 paying), compared to 372,000 subscribers (350,000 paying) in the prior year.

Telstra’s Kim Krogh Andersen, Foxtel’s Patrick Delany, Fox Sports’ Hannah Hollis, Kayo’s Julian Ogrin and NRL’s Andrew Abdo

See also: TV deal: How to get Kayo Sports streaming service for just $5 a month

Binge, which launched in May 2020, had 468,000 subscribers (431,000 paying) as of December 31, 2020.

As of December 31, 2020, there were 265,000 Foxtel Now subscribers (258,000 paying), compared to 343,000 subscribers (334,000 paying) in the prior year.

Broadcast subscriber churn in the quarter increased to 17.5% from 16.0% in the prior year, due to fewer promotions and the roll-off of lower value subscribers. Broadcast ARPU for the quarter increased 3% to A$80 (US$58).

Segment EBITDA in the quarter increased $54 million, or 77%, compared with the prior year. The improvement reflects $35 million of lower sports programming rights and production costs, which was primarily driven by the savings from renegotiated sports rights, partially offset by the $20 million negative impact related to the deferral of costs from the fourth quarter of fiscal 2020. The Segment EBITDA improvement was also due to lower entertainment programming costs, lower overhead expenses resulting from cost reduction efforts and an $8 million positive impact from foreign currency fluctuations. Adjusted Segment EBITDA increased 66%.

News Media

Revenues in the quarter decreased $238 million, or 29%, as compared to the prior year, including a $22 million, or 3%, positive impact from foreign currency fluctuations. The decline was primarily driven by a $191 million, or 24%, impact from the divestiture of News America Marketing in May 2020. The decline also reflects weakness in the print advertising market and the $34 million, or 4%, impact from the closure or transition to digital of certain regional and community newspapers in Australia.

Within the segment, revenues at News Corp Australia and News UK declined 11% and 5%, respectively. Adjusted Revenues for the segment decreased 9% compared to the prior year.

Circulation and subscription revenues increased $12 million, or 5%, compared to the prior year, primarily due to digital subscriber growth, a $9 million, or 4%, positive impact from foreign currency fluctuations and price increases, partially offset by lower single-copy sales revenue, primarily at News UK and the New York Post.

Advertising revenues decreased $231 million, or 48%, compared to the prior year, reflecting a $191 million, or 40%, negative impact from the divestiture of News America Marketing. The remainder of the decline was driven by continued weakness in the print advertising market, exacerbated by COVID-19, and a $28 million, or 6%, negative impact related to the closure or transition to digital of certain regional and community newspapers in Australia, partially offset by a $10 million, or 2%, positive impact from foreign currency fluctuations and growth in digital advertising at the New York Post and News UK.

Digital revenues represented 31% of News Media segment revenues in the quarter, compared to 22% in the prior year, and represented 29% of the combined revenues of the newspaper mastheads. Digital subscribers and users across key properties within the News Media segment are summarised below:

• Closing digital subscribers at News Corp Australia’s mastheads as of December 31, 2020 were 738,300, compared to 566,600 in the prior year (Source: Internal data)

• The Times and Sunday Times closing digital subscribers as of December 31, 2020 were 335,000, compared to 320,000 in the prior year (Source: Internal data)

• The Sun’s digital offering reached 130 million global monthly unique users in December 2020, compared to 140 million in the prior year (Source: Google Analytics)

• New York Post’s digital network reached 141 million unique users in December 2020, compared to 95 million in the prior year (Source: Google Analytics)

Dow Jones

Revenues in the quarter increased $16 million, or 4%, compared to the prior year, primarily due to growth in circulation and subscription and digital advertising revenues, partially offset by lower print advertising revenues. Digital revenues at Dow Jones in the quarter represented 70% of total revenues compared to 64% in the prior year.

Circulation and subscription revenues increased $23 million, or 8%, including a $3 million, or 1%, positive impact from foreign currency fluctuations. Circulation revenue grew 8%, reflecting the continued strong growth in digital- only subscriptions, partially offset by lower single-copy and amenity sales related to COVID-19. Professional information business revenues grew 4%, driven by 21% growth in Risk & Compliance products, partially offset by the decline in revenues from other professional information business products. Digital circulation revenues accounted for 63% of circulation revenues for the quarter, compared to 57% in the prior year.

During the second quarter, Dow Jones saw the highest year-over-year growth in total subscriptions and digital-only subscriptions for both The Wall Street Journal and total Dow Jones’ consumer products in its history.

Today Show host Allison Langdon to undergo surgery after falling while filming a segment

Allison Langdon was rushed to hospital after injuring herself while filming the Today show on Thursday. The 41-year-old was filming on location in Burleigh Heads, Queensland, when she fell from the hydrofoil she was demonstrating.

Langdon will reportedly require knee surgery after the incident, and is set to take a “lengthy break” from hosting Today.

In a statement, Channel 9 said that Langdon had injured herself after she “fell awkwardly” from the hydrofoil.

“After nearly an hour of incident-free filming of a segment about hydrofoiling, Ally fell awkwardly as she headed back to the marina at the end of the shoot.”

“It was an unfortunate accident, and she was immediately taken to hospital.

“Both Karl and Ally had looked forward to the experience, and both had a wonderful time.

“They had a comprehensive safety induction and a thorough run-through of all aspects of hydrofoiling. As with every shoot, safety requirements, briefings and subsequent after-care, are strictly followed and prioritised.”

Allison Langdon being returned to shore. Channel 9.

Speaking on Friday morning about the incident, Today Show host Karl Stefanovic assured viewers that Langdon was OK.

“She had a bit of an accident yesterday, she’s doing fine,” he said. She hurt herself really badly. She’s in hospital this morning. She’s OK.”

Leila McKinnon, who has previously hosted Weekend Today, will be filling in for Allison Langdon while she recovers.

“So I got the call last night and I was in my pyjamas,” McKinnon said in an Instagram Story posted to the Today Show’s official account.

“Ally’s had a bit of a mishap so I quickly got changed and headed up the road.”

A hydrofoil board is a type of surfboard with a fin underneath the board that extends down into the water. The design means that the board leaves the surface of the water where a rider can surf on the board around a body of water.

TV ratings Week 6: Seven ends the Summer Survey ranked #1

The Summer TV ratings survey period which ran from Week 49 2020 to Week 6 this year wrapped on Saturday night. The climax of the TV domestic cricket season coincided with the survey end and Seven ended with a win for the night and the week with a dominant primary share as well as network leadership.

Mini golf format drifted, but started its job in Week 6

Seven ranked #1 for six nights of the week from Monday through until Saturday. The channel’s most potent weapon was the launch of Holey Moley with 983,000 watching the mini golf on Monday night. The Holey Moley audience dropped significantly across three nights as some viewers balked at committing over four hours to the new format – Tuesday was on 737,000 and Wednesday did 543,000.

While Holey Moley did stumble, it had a better launch week than My Kitchen Rules managed in the timeslot a year ago. My Kitchen Rules: The Rivals launched with 498,000 on the Sunday and then rose to 517,000 on the Monday. Tuesday’s episode plunged to 402,000 before Wednesday improved gently to 428,000.

In addition to Seven News and the return of Home and Away (545,000), Seven’s only other Week 6 program securing an audience over half a million was the Big Bash League. There were over 600,000 watching both sessions of the Grand Final on Saturday night as the Sydney Sixers were too good for the Perth Scorchers.

Grand Reunion led Nine’s week

Nine’s best Week 6 performance came on Sunday night with a combo of the Married At First Sight Grand Reunion on 865,000 and then 60 Minutes on 678,000. The second part of the MAFS catch-up was on 785,000 on Monday. Nine News and A Current Affair (651,000) both made the top 20. Travel Guides’ special Australia-only episodes screened on Tuesday and Wednesday to audiences of 639,000 and 596,000 respectively.

Amazing Race starts on half a million

10’s best for the week was the climax of I’m a Celebrity…Get Me Out of Here! with 893,000 tuned in for the announcement of the winner and 788,000 watching the start of that final episode. The primary channel’s next best was The Sunday Project pushing above 500,000 for one of its biggest ever Sunday audiences. Not far behind that crowd was the launch episode of The Amazing Race Australia on Monday with 501,000. The Tuesday and Wednesday episodes subsequently did 494,000 and 447,000.

Best on ABC and SBS: Tom Gleeson returns and Michael Mosley sleeps

ABC News made the top 20 with its Sunday and weekday bulletins. The broadcaster’s next heaviest hitter just missed the top 20 with Hard Quiz ranking #21 for the week with its return audience on 619,000. Death in Paradise, the return of Four Corners and The Weekly were all just under 600,000.

SBS had four programs that rated over 200,000 starting with The Truth About Sleep from the prolific Dr Michael Mosley on 245,000. Britain’s Most Historic Towns and Great Continental Railway Journeys were both on 213,000 with Trump’s American Carnage on 201,000.

The Summer’s hottest shows

In the first week of December, the ABC had the three biggest non-news shows in Gruen, Hard Quiz and Australian Story with each close to 650,000.

Gruen and Hard Quiz then again held that honour in the subsequent two weeks, joined by audiences close to 600,000 watching the final sessions of play for the Third Test between Australia and India on Seven.

The cricket was the most-watched non-news in Christmas Week, a few days that saw Carols in the Domain on 634,000 and Carols by Candlelight on 991,000.

The biggest audiences across the summer were for ABC’s New Year’s Eve programming with 1,628,000 watching the midnight fireworks. Seven’s audience for the Second Test that week peaked at 760,000 for the last session on day two.

10’s I’m a Celebrity…Get Me Out of Here! launch in Week 2 was one of just three programs to crack 1m or better across summer. The other was one night of Seven News Sunday.

In mid-January the Week 3 cricket audience grew to 829,000 for day four of the Third test. The five nights of I’m a Celebrity that week were all over or just under 700,000.

With the Australian Open delayed until this month, 10’s I’m a Celebrity and Seven’s cricket coverage made the biggest mark in the back half of January in Weeks 4 and 5.

Seven won eight of the 10 weeks of summer survey all people, Nine ranking #1 in the other two.

TV Ratings Survey: Sunday Week 7

Primetime News

Seven News 914,000

Nine News 901,000

ABC News 669,000

10 News First 230,000 (5pm) /278,000 (6pm)

SBS World News 179,000

Daily current affairs

Insiders 385,000

The Project 298,000 (6:30 pm)/ 403,000 (7pm)

Breakfast TV

Sunrise 240,000

Today 174,000

Weekend Breakfast 167,000

Late Night News

Nine News Late 309,000

Nine won the first night of the TV ratings survey for 2021 with the help of a strong performance from 60 minutes which featured the first pictures of Australia’s COVID vaccines being manufactured and lawyer Michael Cohen on former President Donald Trump. The show’s 761,000 viewers were down on the 778,000 the show had for its 2021 return last Sunday.

After 60 minutes Nine wasn’t done playing its Trump card with The Trump Show: Downfall having 512,000 viewers. The politics heavy combo helped Nine to a 21.2% primary share and 29.1% network share which were both the top results for the night.

Seven’s Holey Moley was the top non-news show last night with 629,000 viewers tuning in for the show’s singles night, but banker Amy Morris chose competition over romance in a strategy that paid off handsomely taking home the plaid jacket, golden putter and chance to win a $100,000 in the Grand Final. The episode was down on the 983,000 that the show had last Sunday for its premiere episode.

Amy Morris

Holey Moley was followed by Captain America: Winter Soldier which had 301,000 viewers.

On 10 The Amazing Race Australia had its highest rating episode of the year with 541,000 watching as the teams headed to North Queensland for Island week as the show bid farewell to Childhood Friends, Malaan and Tina. The show was also #1 in all key demos.

10 followed this up with a back to back of FBI: Most Wanted which had 214,000 and 124,000 viewers.

10 also had the top multichannel of the night with 10 Bold producing a 4.4% share.

The ABC’s top-rated show of the night was fan favourite Grand Designs with its House of the Year special with 506,000 viewers.

SBS took viewers to Italy with a back to back of The Last Hours of Pompeii which had a combined audience of 161,000 viewers.

Week 6-7: Friday-Sunday

| FRIDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 13.1% | 7 | 17.7% | 9 | 16.2% | 10 | 10.1% | SBS One | 5.8% |

| ABC KIDS/ ABC TV PLUS | 2.7% | 7TWO | 4.1% | GO! | 1.4% | 10 Bold | 5.7% | VICELAND | 1.9% |

| ABC ME | 0.5% | 7mate | 3.1% | GEM | 1.6% | 10 Peach | 3.0% | Food Net | 1.8% |

| ABC NEWS | 3.1% | 7flix | 2.2% | 9Life | 1.9% | 10 Shake | 0.7% | NITV | 0.5% |

| 9Rush | 1.7% | SBS World Movies | 1.3% | ||||||

| TOTAL | 19.3% | 27.1% | 22.8% | 19.5% | 11.2% | ||||

| SATURDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 16.0% | 7 | 22.8% | 9 | 14.3% | 10 | 8.3% | SBS One | 4.2% |

| ABC KIDS/ ABC TV PLUS | 3.0% | 7TWO | 3.4% | GO! | 1.2% | 10 Bold | 3.9% | VICELAND | 0.7% |

| ABC ME | 0.6% | 7mate | 5.3% | GEM | 1.4% | 10 Peach | 3.1% | Food Net | 0.9% |

| ABC NEWS | 2.1% | 7flix | 3.1% | 9Life | 1.9% | 10 Shake | 0.8% | NITV | 0.6% |

| 9Rush | 1.3% | SBS World Movies | 1.2% | ||||||

| TOTAL | 21.7% | 34.6% | 20.1% | 16.1% | 7.5% | ||||

| SUNDAY METRO | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven | Nine | 10 | SBS | |||||

| ABC | 11.6% | 7 | 20.1% | 9 | 21.2% | 10 | 12.6% | SBS One | 4.7% |

| ABC KIDS/ ABC TV PLUS | 2.4% | 7TWO | 2.1% | GO! | 2.9% | 10 Bold | 4.4% | VICELAND | 0.7% |

| ABC ME | 0.4% | 7mate | 3.7% | GEM | 2.5% | 10 Peach | 2.0% | Food Net | 1.2% |

| ABC NEWS | 2.2% | 7flix | 1.9% | 9Life | 1.5% | 10 Shake | 0.4% | NITV | 0.3% |

| 9Rush | 1.1% | SBS World Movies | 0.4% | ||||||

| TOTAL | 16.5% | 27.8% | 29.1% | 19.3% | 7.2% | ||||

| SUNDAY REGIONAL | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| ABC | Seven Affiliates | Nine Affiliates | 10 Affiliates | SBS | |||||

| ABC | 12.1% | 7 | 19.9% | 9 | 16.8% | WIN | 10.5% | SBS One | 5.2% |

| ABC KIDS/ ABC TV PLUS | 2.3% | 7TWO | 3.8% | GO! | 4.0% | WIN Bold | 4.5% | VICELAND | 0.7% |

| ABC ME | 0.9% | 7mate | 3.6% | GEM | 3.9% | WIN Peach | 2.3% | Food Net | 1.0% |

| ABC NEWS | 2.2% | 7flix (Excl. Tas/WA) | 2.3% | 9Life | 2.1% | Sky News on WIN | 1.4% | NITV | 0.4% |

| SBS Movies | 0.4% | ||||||||

| TOTAL | 17.5% | 29.6% | 26.8% | 18.7% | 7.7% | ||||

| SUNDAY METRO ALL TV | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| FTA | STV | ||||||||

| 86.9% | 13.1.% | ||||||||

All People Ratings

Friday Top 10

- Seven News Seven 904,000

- Nine News Nine 846,000

- Seven News At 6.30 Seven 845,000

- Nine News 6:30 Nine 842,000

- ABC News ABC TV 604,000

- A Current Affair Nine 583,000

- Vera (R) ABC TV 480,000

- The Chase Australia Seven 480,000

- Better Homes And Gardens Seven 473,000

- Hot Seat Nine 426,000

Saturday Top 10

- Seven News Seven 764,000

- Nine News Saturday Nine 725,000

- Seven’s Cricket: Big Bash League – Grand Final S2 Seven 640,000

- Seven’s Cricket: Big Bash League – Grand Final S1 Seven 611,000

- Seven’s Cricket: Big Bash League – Grand Final Inn Brk Seven 601,000

- Death In Paradise ABC TV 595,000

- ABC News-Sa ABC TV 553,000

- A Current Affair Nine 501,000

- Call The Midwife ABC TV 436,000

- Seven’s Cricket: Big Bash League – Grand Final Post Game Seven 398,000

Sunday FTA

- Seven News Seven 914,000

- Nine News Sunday Nine 901,000

- 60 Minutes Nine 761,000

- ABC News Sunday ABC TV 669,000

- Holey Moley Australia Seven 629,000

- The Amazing Race Australia 10 541,000

- The Trump Show: Downfall Nine 512,000

- Grand Designs: House Of The Year ABC TV 506,000

- Harrow ABC TV 478,000

- The Sunday Project 7pm 10 403,000

- Nine News: Late Edition Nine 309,000

- M- Captain America: The Winter Soldier Seven 301,000

- The Sunday Project 6.30pm 10 298,000

- 10 News First 10 278,000

- Insiders ABC TV 255,000

- Territory Cops Nine 246,000

- Weekend Sunrise Seven 240,000

- 10 News First Sun 6pm 10 230,000

- Bluey ABC Kids/ABC T Plus218,000

- FBI: Most Wanted 10 214,000

Sunday Multichannel

- Bluey ABC Kids/ABC TV Plus Us 218,000

- NCIS Ep 2 (R) 10 Bold 164,000

- NCIS (R) 10 Bold 164,000

- Peppa Pig ABC Kids/ABC TV Plus Us 149,000

- Floogals ABC Kids/ABC TV Plus Us 140,000

- Kangaroo Beach ABC Kids/ABC TV Plus Us 139,000

- Bananas In Pyjamas ABC Kids/ABC TV Plus Us 136,000

- Play School ABC Kids/ABC TV Plus Us 136,000

- Insiders ABC News 130,000

- NCIS: Los Angeles (R) 10 Bold 123,000

- Noddy Toyland Detective ABC Kids/ABC TV Plus Us 122,000

- Death In Paradise 9gem 116,000

- Border Security – Australia’s Front Line 7 Mate 115,000

- Remember The Titans 7mate 106,000

- School Of Roars ABC Kids/ABC TV Plus Us 104,000

- Go Jetters ABC Kids/ABC TV Plus Us 102,000

- ABC News Sunday ABC News 100,000

- Bluey ABC Kids/ABC TV Plus Us 99,000

- Rainbow Chicks ABC Kids/ABC TV Plus Us 99,000

- Bondi Rescue Ep 2 (R) 10 Bold 98,000

Sunday STV

- Outsiders Sky News Live 65,000

- Outsiders Sky News Live 65,000

- Live: AFLW: GWS V Adelaide Fox Footy 46,000

- Live: Ind V Eng 1st Test Day 3 Fox Cricket 40,000

- Live: AFLW: Brisbane V Gold Coast Fox Footy 38,000

- Paul Murray Live Sky News Live 38,000

- 24 Hours In Emergency Lifestyle Channel 35,000

- Live: AFLW: North Melbourne V St Kilda Fox Footy 34,000

- Love Your Garden Lifestyle Channel 33,000

- AFLW: North Melbourne V St Kilda Fox Footy 33,000

- Outback Truckers A&E 33,000

- Chris Smith Tonight Sky News Live 32,000

- Sharri Sky News Live 32,000

- Live: A-League C Coast V Western United Fox Sports 50 5 32,000

- Live: Ind V Eng 1st Test Day 3 Fox Cricket 31,000

- Selling Houses Australia Lifestyle Channel 31,000

- NCIS Fox Crime 30,000

- Selling Houses Australia Lifestyle Channel 30,000

- NCIS: New Orleans Fox Crime 30,000

- Blue Bloods Fox One 28,000

Shares all people, 6pm-midnight, Overnight (Live and AsLive), Audience numbers FTA metro, Sub TV national

Source: OzTAM and Regional TAM 2021. The Data may not be reproduced, published or communicated (electronically or in hard copy) without the prior written consent of OzTAM

Media News Roundup

Media Code

Google scrambles to strike media deals following Morrison, Frydenberg talks

Google, which has threatened to turn off its search engine in Australia, approached several major publishers with revised offers for its ‘News Showcase’ product last week following high stakes talks between Prime Minister Scott Morrison, Treasurer Josh Frydenberg and its global chief executive Sundar Pichai. But the offers, which arrived as late as Friday, contained explicit provisions allowing Google to terminate any deals it strikes if the government’s proposed digital media regulation is not revised.

Google and Australian media companies are engaged in a major standoff over the news media bargaining code, which is designed to force Google and Facebook and pay media companies to display links to their news stories. The News Showcase product has been central in Google’s strategy to seek revisions to the code, and would allow it to pay media companies for news content without being forced to pay for links.

The search advertising giant launched its News Showcase product locally last week with participation from Crikey, The Saturday Paper, The Conversation and Australian Community Media, which publishes a raft of regional titles including the Newcastle Herald, in an attempt to show the government how the product worked.

Multiple sources familiar with Google’s discussions that can’t speak publicly for confidentiality reasons, said the search giant approached multiple major outlets with offers for content following Pichai’s meeting with Morrison. Google has been speaking to a range of publishers such as News Corp, the ABC, Guardian Australia, Daily Mail Australia, and Nine Entertainment Co, which owns this masthead.

Rod Sims’ big tech fixation blinds him to Murdoch’s monopoly

As Sims recently told The Australian Financial Review, Murdoch isn’t such a “big, bad guy”. After all, he says, News Corp’s global market capitalisation is just a fraction that of Google or Facebook.

This same attitude guided Sims to green-light Murdoch’s cementing of his undisputed domination in Queensland in 2016 through the acquisition of APN Australian Regional Media’s 12 daily newspapers, 60 community titles and 30 websites.

Murdoch already owned the Brisbane Courier-Mail, Gold Coast Bulletin, Townsville Bulletin and Cairns Post, plus local papers and The Australian. What was Sims’ rationale? Readers were “increasingly reading online sources of news, where there are alternatives”.

Sims’ decision – apart from demonstrating his weak grasp of the nexus between professional local newsrooms and quality local news – had disastrous consequences. Only one of the APN dailies, the Toowoomba Chronicle, has survived.

‘Perfect solution’: Pressure ramps up on Google, Facebook

Canadian newspapers blanked out their front pages last week to demonstrate what a world without news would look like in a campaign reminiscent of the Australian media’s recent ‘Your Right to Know’ campaign.

“Imagine if the news wasn’t there,” a message on the blank front page reads. “Google and Facebook use their monopoly power to pocket 80 per cent of online advertising revenues. These corporate giants benefit from the news content produced by Canadian journalist and publishers – without paying for it.”

News Media Canada, an industry body representing Canada’s leading newspapers, has urged its parliament to regulate the digital giants, saying Australia’s approach was the “perfect solution for Canada”.

Big tech’s job spree reveals ‘imbalance’ in media industry

Prospering during COVID-19 restrictions, the titans of web search, digital advertising and internet service provision increased headcounts by 6.4 per cent as Australians increasingly relied on online tools to work, learn and shop from home.

But even as news audiences increase, publishing and broadcasting divisions have shed journalists, production crew and advertising sales people, amid accelerating structural change due to technological disruption and imbalances of market power.

Business of Media

Nine’s board narrows search for CEO as two insiders firm

Nearly three months since Nine chief executive Hugh Marks stunned staff and investors with his bombshell departure following the public revelation of his romance with a junior Nine executive, his successor is still widely expected to be one of his two senior lieutenants.

However, Fennessy is also firming as a possibility, seen as a solid candidate by some given his experience running production company Endemol Shine Australia for more than a decade.

He has a similar background to Marks, who was chief executive officer of Southern Star Group prior to joining Nine.

Initially seen as a potential “compromise” candidate — should the Nine board be split 3-3 between Janz and Sneesby — Fennessy has impressed during his interview presentations, and he is now under serious consideration for the role, The Australian has been told.

It’s understood the trio were among the “final round” of candidates presented to the Nine board last week, along with former ViacomCBS chief executive David Lynn.

Tim Worner an inside tip for Sky Channel role

There are whispers going around that Worner, who was instrumental in setting up the Racing.com joint venture between Seven and Racing Victoria a few years ago, is looking for his next challenge and has sniffed an opportunity with Sky Channel.

Sky is owned by Tabcorp and the theory goes that if Tabcorp’s wagering division gets carved out as part of some corporate M&A activity, with London’s Entain already been outed by this newspaper this week as a suitor, then Worner could emerge as either Sky’s new boss or there in some sort of executive role should it be hived off.

News Corp, Telstra dampen Foxtel deal talk

The Sydney Morning Herald and The Age revealed last year that a “blank cheque” vehicle led by US cable television industry veteran Leo Hindery approached Rupert Murdoch’s News Corp and Telstra with a US$2 billion investment proposal. But the offer was rejected.

Hindery’s special purpose acquisition company (SPAC), Trine Acquisition Corp, was on the hunt for an Australian media investment, according to sources who could not speak publicly for confidentiality reasons. But Foxtel was the only company to receive an offer, the sources said.

As recently as 2019, both Telstra and Foxtel had openly discussed the possibility of floating the pay TV company on the ASX. Telstra was widely expected to sell down its stake into any sharemarket listing, but the plans were shelved when Foxtel’s performance deteriorated.

Now amid surprising signs of a recovery, both Telstra and News Corp say they are committed to the business. “[The SPAC deal was unsuitable] because we’re very happy with our investment in Foxtel and it will always continue to be the case for all of the reasons that we highlighted,” Telstra CEO Andy Penn told this masthead. “It continues to amuse me a little bit why people don’t see that.”

ViacomCBS focused on digital growth with 10play

Jarrod Villani, a former Korda Mentha restructuring expert, said it would take up to two years for the “enormous efficiencies” of the merger of Viacom and CBS to flow through to 10 here.

He would not be drawn on whether these efficiencies would translate into redundancies, saying his focus was more on infrastructure, technology and finance systems efficiencies.

Network 10 culled a number of its news presenters, including Tim Bailey and Kerri-Anne Kennerley, in August as the free-to-air broadcaster prepared to centralise in Sydney and Melbourne the presentation of its news bulletins from across Australia.

Villani, who started as chief operating officer last Monday, leads the business with Beverley McGarvey, who is chief content officer. Their appointments followed the departure of 10 CEO Paul Anderson in June last year. In addition to 10, the company operates MTV, Nickelodeon, Nick Jr and Comedy Central.

He said the merger created “enormous efficiencies in the operating model of 10 which is of great benefit and that will take another 12 to 24 months to implement here in Australia and indeed globally, because we’re all going through it together. Obviously, the parent company itself only merged 14 months ago.”

‘Hunger games’: Bungled budget cuts, staff exodus take toll on ABC

“This is a terrible day but we will … recover from this eventually,” Anderson said on June 24.

Anderson had just unveiled his five year plan for the ABC, a strategy that involved reducing episodes of high-profile shows Australian Story and Foreign Correspondent as well as the removal of the 81-year-old flagship 7.45am radio news bulletin, which featured the 18-second version of orchestral tune Majestic Fanfare. It also included the 229 job cuts which he said was directly related to a three-year $84 million index freeze enforced by the federal government.

The job-cut-to-cost-cut strategy implemented over and over again by the ABC over the past five years has been spoken about and criticised widely. It has also raised questions about whether the public broadcaster can continue to fulfil its role with less staff.

But when looking closely at the figures two other trends emerge – the ABC has hired almost as many people as it has made redundant, and there are more people that have resigned from the organisation during the past five years than those forced to leave.

Print is a growth channel, says new industry chief

Vanessa Lyons, a former chief marketing officer with 20 years experience, has been appointed general manager of industry body ThinkNewsBrands and is enthused by the opportunity to advocate for news, saying it is the most trusted media channel.

“It’s such an extremely effective advertising channel, it delivers such brand business impact daily and quickly … the opportunity is to have people reassess their perceptions and realise it’s an effective business-generating channel for advertisers,” she said.

Commenting on the ongoing tussle between digital giants and news media over the proposed news media bargaining code, Lyons said the body was focused on advocating for transparent, fair and equitable news distribution.

“The proposed laws that force tech giants to pay for the news content they use, from our perspective, are so critical to the survival of Australian journalism and news media in Australia,” she said.

Lyons will head up ThinkNewsBrands, representing print publishers, and will work with Venessa Hunt, the head of ThinkPremiumDigital, representing digital media businesses. The two bodies are funded by News Corp, Foxtel, Foxtel Media, Seven West Media, Network Ten and Nine, the owner of The Australian Financial Review.

Federal Court flaw in defamation reforms

The journal’s Current Issues section, edited by Justice Francois Kunc of the NSW Supreme Court, also warns that “restrictive judicial attitudes” could thwart the “liberalising intent” of the new laws.

Other sceptics include former Law Council of Australia president Arthur Moses, SC, who said a basic problem would remain – that the law starts from a presumption that what a publication has said was false.

Moses also said it was vital to have the same procedures in Federal and state courts: “The last thing we need is inconsistency as to how to approach matters.”

Defamation law reform has again come into focus after recent cases involving investment venture capitalist Elaine Stead and Chinese-Australian businessman Chau Chak Wing.

News Media

Age editor Gay Alcorn ditches Twitter after death threats over coronavirus story

The Melbourne newspaper’s story traced every after-hours footstep of the COVID-positive hotel worker through Spencer Street institution Kebab Kingz (even publishing its “4.5 star” reviews on Google) and other locations.

But after Alcorn tweeted the story on Thursday, along with a tongue-in-cheek message about the worker’s “busy” social schedule, Twitter erupted in fury and abuse.

Some of the milder tweets accused The Age of “snobbery” and of blaming the worker for the outbreak. ABC News Breakfast host Michael Rowland asked: “What are you trying to get at with this story?”

After other much less printable messages, Alcorn — in two late-night tweets the same day — had had enough, announcing her break-up with Twitter: “(I) am out of here.”

Alcorn tells Diary her Twitter exit was not an overreaction, but came after the author of the controversial story, Tom Cowie, received death threats.

“People don’t have to like an article,” she says. “They can say it was awful or lacked nuance or could have been done better. But the frenzied and increasingly enraged Twitter reaction was totally disproportionate, ending with vile private messages threatening violence against a reporter — threats we take seriously.”

True crime as Stan Grant hits out at Peter FitzSimons

Previously warm relations between the pair have been up and down since their opinion page fisticuffs last year over FitzSimons’ book on Captain James Cook. Grant took to this paper’s opinion pages to label some parts of the book as “ludicrous”.

Fast forward to last week when Grant contributed a chapter to The Australian’s progressive murder mystery novel (progressive in its publication schedule, obviously not in its politics), an attempt by the boring broadsheet to liven up the silly season.

Grant set his chapter at “Fitzy and Lisa’s Australia Day barbecue at their grand house overlooking Sydney Harbour” – the home of The Sydney Morning Herald columnist and his wife, The Project presenter Lisa Wilkinson.

“What a woke leftie love-in that was: journos, actors, writers, a couple of ex-Wallabies (well it was the north shore), a few washed up politicians, even a couple of Liberals (small l of course) and a former managing director of the ABC for good measure.

“Everyone there voted yes for same-sex marriage — the year before last, they’d all tearily applauded their first gay married couple guests — they hated the Catholic Church and had cried when Kevin Rudd said sorry.”

Grant’s takedown appeared without the decency of a warning. The pair didn’t speak in the aftermath but did exchange angry texts. Both sounded nonplussed when CBD called.

“It’s fiction, it’s satire. Have a laugh. I mock myself as much as anyone else in it,” Grant said, before hastening off the phone.

“I will leave it for others to judge,” FitzSimons said before hastening off the phone.

Jacinta Price sues ABC for ‘racist’ defamation

Price, deputy mayor of Alice Springs and a Warlpiri/Celtic woman, is suing the ABC over a report that delved into an effort by nine local Aboriginal organisations to convince Coffs Harbour City Council to cancel her Mind the Gap speaking tour.

The radio report, broadcast on ABC Coffs Coast in September 2019, put the spotlight on freedom of speech by drawing national attention to the conservative politician’s staunch opposition to the idea that Australia Day should be moved to another date.

In an amended statement of claim filed in December, Price says the ABC defamed her in multiple ways, including by conveying the meaning that she “spreads racist vitriol” and intended to use her “right-wing politics” to “divide” the Aboriginal community

Price also claims the report conveyed the meaning that she “encourages the type of attitude” that once enabled atrocities against Aboriginal people, after she labelled the rejection of her Mind the Gap talk by Coffs Harbour Aboriginal community groups as “backward”.

Radio

Financial strain forced 2GB to dump Erin Molan

When her three-year contract was nearing completion towards the end of last season, network executives told Molan’s adviser, celebrity accountant Anthony Bell, in writing there was no money for a new deal.

Bell and Molan declined to comment when contacted by The Sunday Telegraph, yet the story has been confirmed from a 2GB insider

Entertainment

The Kid Laroi: Rising Sydney rap star becomes youngest to hit top spot on ARIA charts

Laroi’s release F*CK LOVE (SAVAGE) has knocked Harrison Craig’s 2013 debut, More Than A Dream, off his post. He was 18 at the time of his number one.

“Wow, this is insane,” Laroi said. “Number one in my own country means more to me than anything in the world. Thank you to everyone who has supported me and been with me through all of this. I love you all and I can’t wait to see you all again soon.”

Television

Andrew O’Keefe: Top contenders to replace The Chase game show host

The veteran game show host, now co-anchor of Seven‘s The Morning Show with Kylie Gillies, is known to have been on the lookout for a new challenge at Seven for years.

While Emdur may have hoped that opportunity would be a tonight show, he is now said to be at the top of a shortlist of contenders currently under contract to Seven who could slide in to replace O‘Keefe and solve a critical casting dilemma for the network and co-producer ITV Studios Australia.

The second top contender for the job is Sunrise weatherman Sam Mac, who was rumoured to have been in talks with Nine to jump ship last November (Nine denied) but is said to have remained at Seven after being persuaded by network bosses that a bigger presenting role would soon be in the offing.

Meanwhile Grant Denyer is now off contract at 10 after I‘m A Celebrity Get Me Out of Here wound up last week, Denyer placing as runner-up

Pilot Week still unlikely for 2021

10’s Director of Programming Daniel Monaghan tells TV Tonight, “We haven’t ruled out yet but it’s a hard year for it.

“We’d really like to return to Pilot Week this year, but given the difficulties with production at the moment.”

Pilot Week was due in 2020 until the pandemic threw those plans out. It was previously staged in 2018 and 2019 with shows such as Taboo, Trial by Kyle, Kinne Tonight and Drunk History.