Wednesday December 17, 2025

Radio’s 2025 winners and losers

If there was one unifying theme across Australia’s 2025 radio ratings, it was this: habit beats hype.

From Sydney to Perth, the winners were stations that knew exactly who they were and stuck to it, while brands chasing reinvention or short-term spikes struggled to convert flashes of momentum into year-long gains.

Talk continued to punch above its weight – 2GB in Sydney and 3AW in Melbourne proved that fewer listeners, listening longer, still wins the share game – while music brands split cleanly between scale and loyalty.

smoothfm and Nova dominated reach where predictability paid off, while Triple M franchises quietly cleaned up on time spent listening in Brisbane and Adelaide.

The flip side was brutal.

KIIS underperformed, 2Day FM continued its slide, and several stations found that mid-year surges don’t count for much if they fade by Survey 7.

The 2025 takeaway was clear: in a fragmented audio landscape, clarity, consistency and habit were the real growth strategies.

Everything else was just, well, noise.

The Sydney market

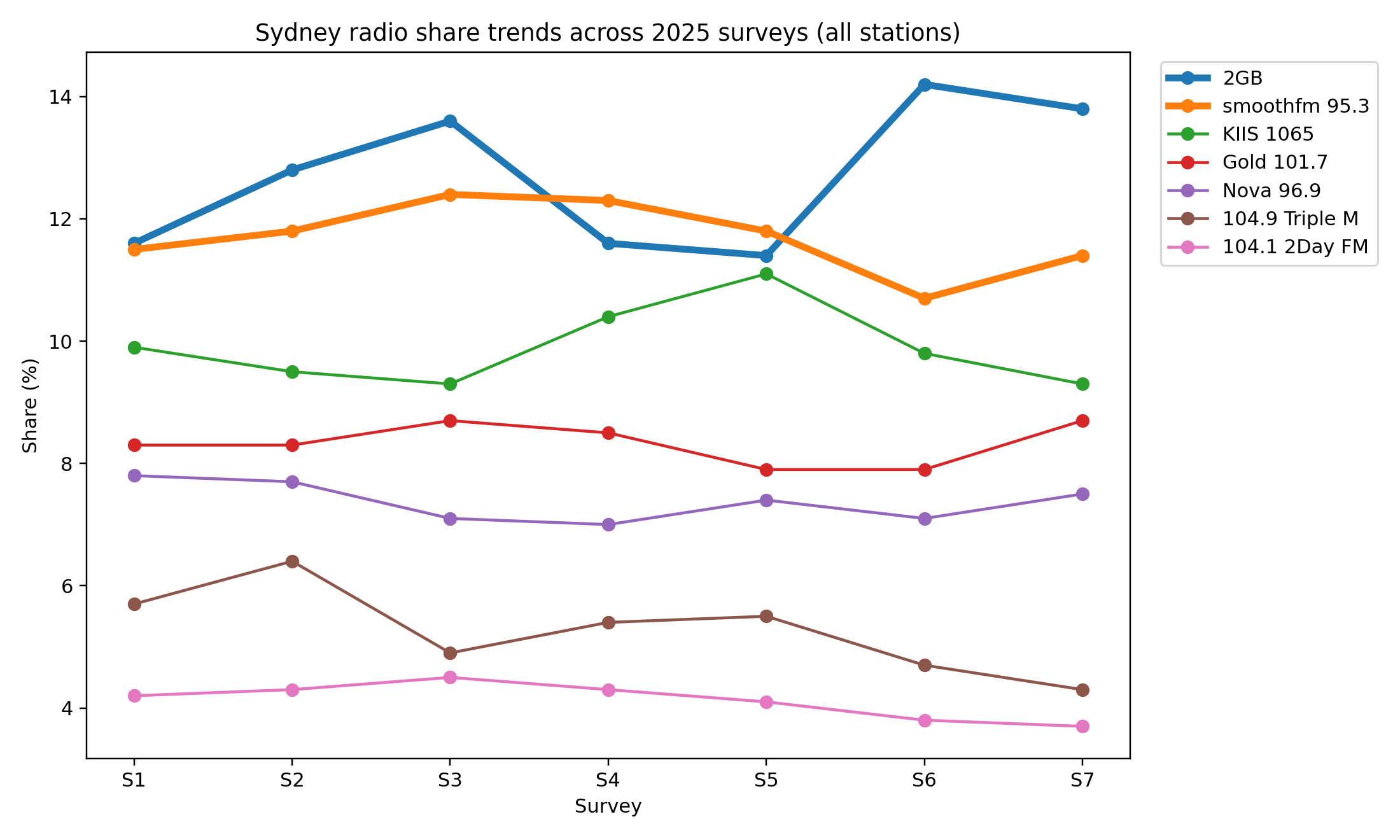

Sydney’s radio market in 2025 split neatly into winners who consolidated power and brands that simply couldn’t arrest decline.

Across seven surveys, 2GB controlled the share narrative, smoothfm 95.3 owned reach, KIIS 1065 flashed moments of momentum without fully converting, and 2Day FM slid deeper into irrelevance.

2GB was the year’s most consistent share performer, finishing #1 in five of seven surveys and peaking at a market-leading 14.2% in Survey 6.

While its cume softened across the first half of the year – dropping from 689,000 in Survey 1 to 646,000 in Survey 5 – the station rebounded late, closing 2025 at 672,000.

The story here wasn’t growth, but loyalty: fewer listeners overall, staying longer, driving share dominance in a fragmented market.

2GB’s Ben Fordham

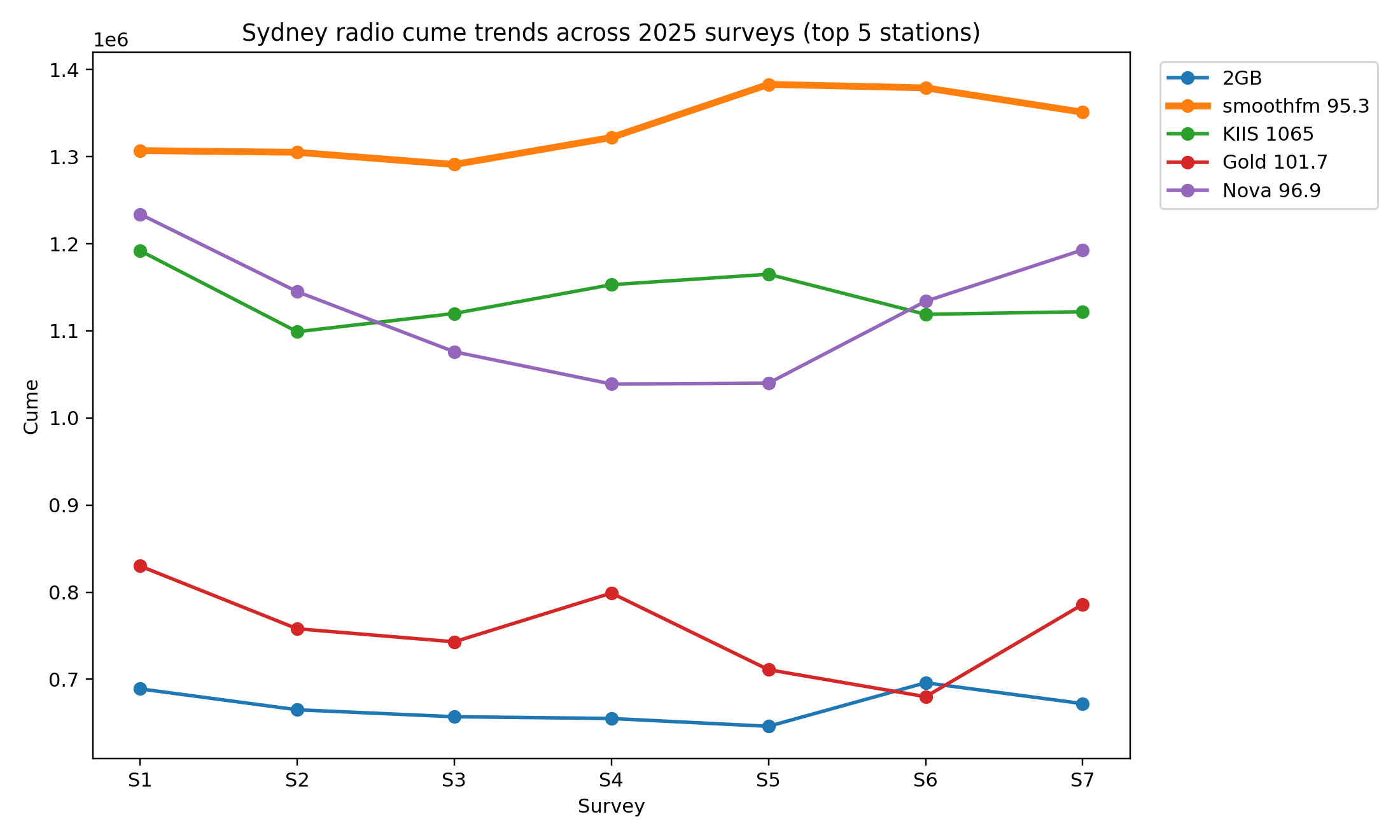

If 2GB won on engagement, smoothfm 95.3 won on sheer scale.

Smooth topped cume in every single survey, finishing the year with 1.35 million listeners, up 44,000 year-on-year – the only major Sydney station to post net growth across 2025.

Its share held stubbornly in double digits all year, peaking at 12.4% in Survey 3.

In a year where most stations ‘ reach leaked, smoothfm benefited from predictable programming and an ageing-but-faithful audience that showed up every survey, every time.

KIIS 1065 had a more uneven year, but not an uninteresting one.

Share climbed sharply mid-year, hitting 10.4% in Survey 4 and 11.1% in Survey 5, before drifting back below 10 by year’s end.

Cume followed a similar arc -dipping early, then rebounding to 1.165 million in Survey 5, before settling at 1.122 million in Survey 7.

KIIS clearly found traction mid-cycle, but couldn’t sustain it long enough to challenge smooth on reach or 2GB on consistency.

2Day FM’s Jimmy & Nath with Emma Breakfast Show

At the other end of the dial, 2Day FM’s 2025 was brutal.

Share slid from 4.2% in Survey 1 to 3.7% by Survey 7, while cume fell a sharp 118,000 listeners across the year.

There was no meaningful recovery point, no sustained spike – just a steady erosion that left the station well behind even its FM peers.

In a market increasingly rewarding habit and brand clarity, 2Day struggled to give listeners a reason to stay.

Winner: smoothfm 95.3

If 2025 was about holding your ground, smoothfm didn’t just hold, it grew.

The station topped cume in every single survey, finished the year with 1.35 million listeners, and was the only major Sydney station to post net audience growth. Double-digit share all year sealed it.

In a volatile market, smooth was the safest bet on the dial.

Loser: 104.1 2Day FM

There’s no soft way to land this. 2Day FM bled listeners and share all year, finishing 2025 down 118,000 in cume and sliding to 3.7% share.

No rebound surveys, no momentum spike – just steady decline. In a market that rewarded clarity and consistency, 2Day never found either.

The Melbourne market

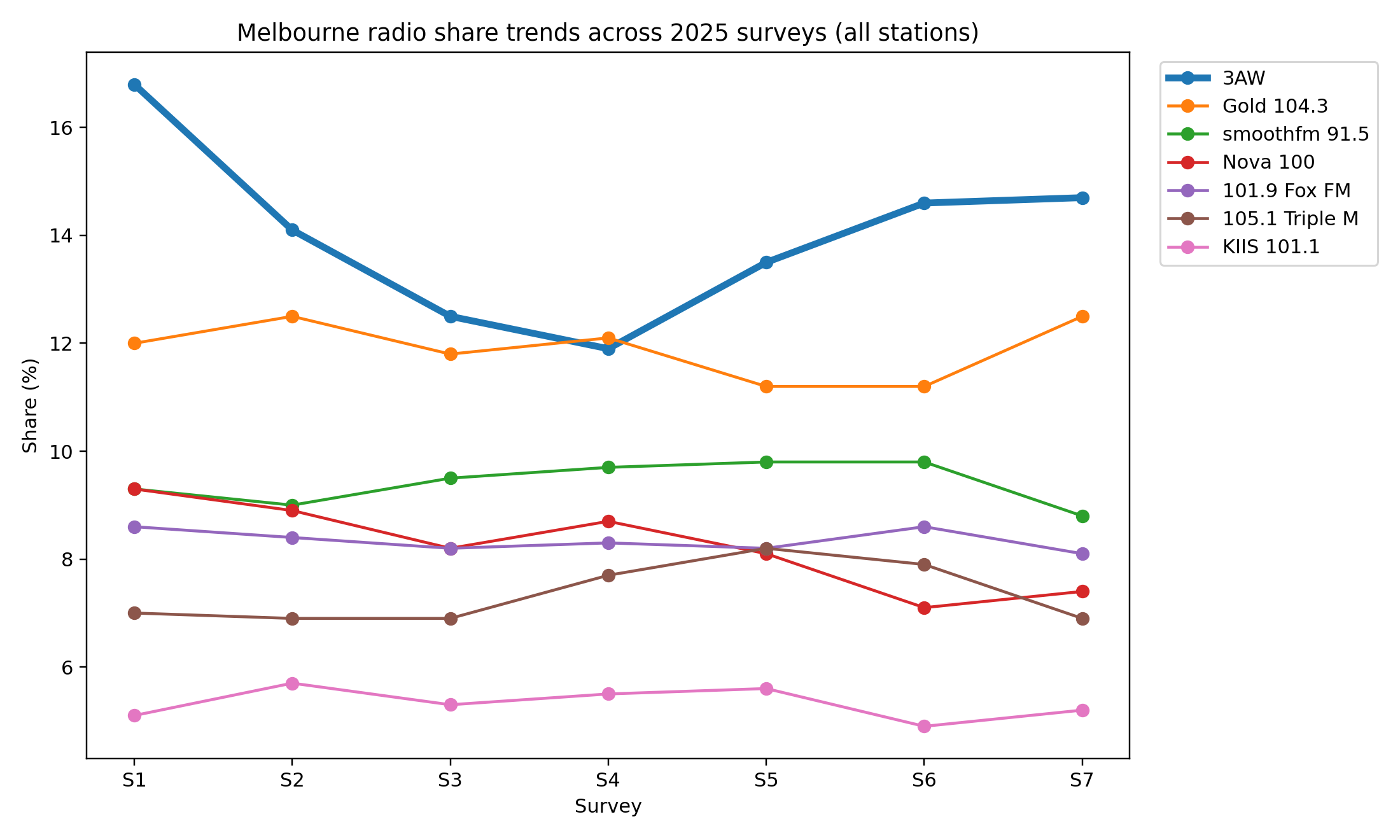

Melbourne’s radio market in 2025 remained firmly 3AW’s to lose.

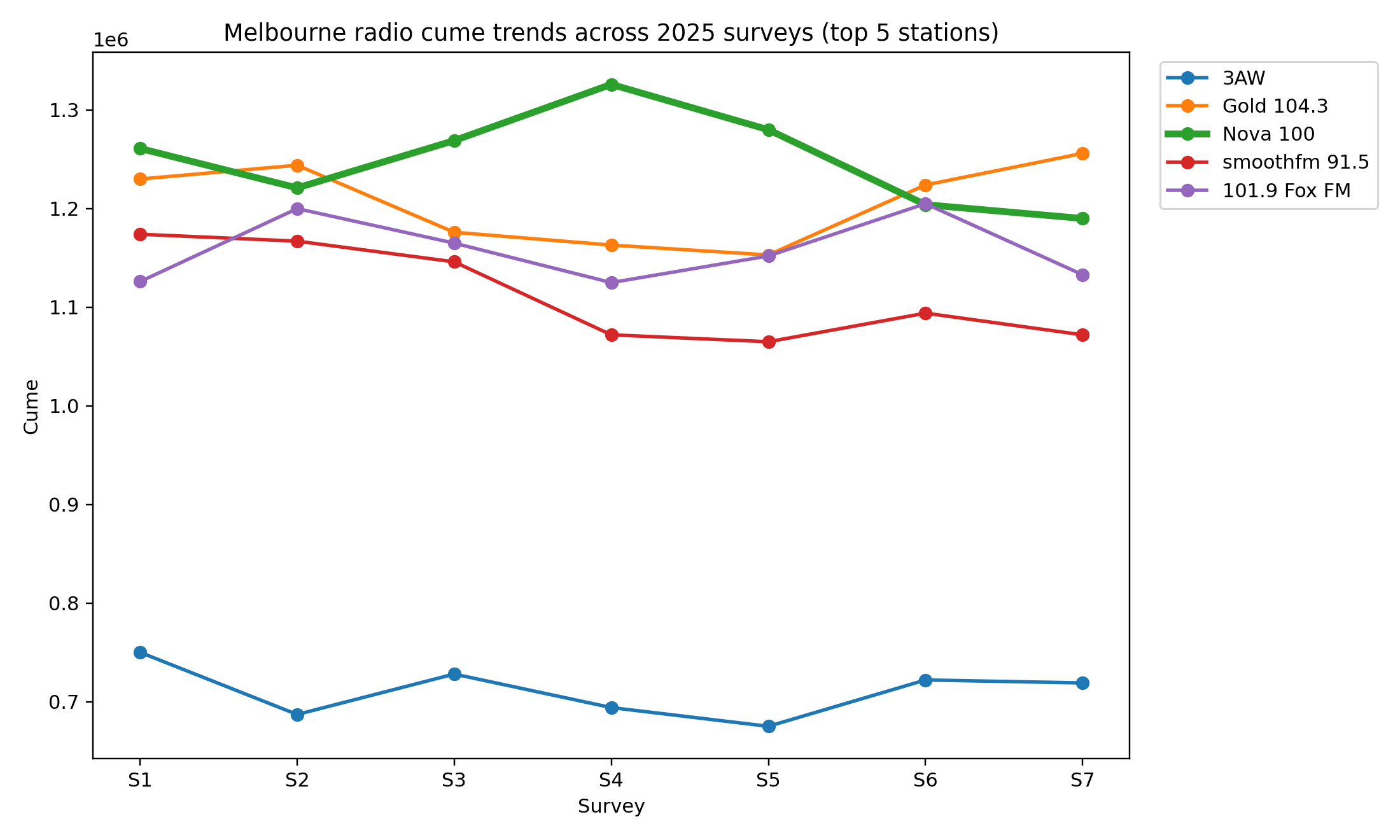

The station topped share in six of seven surveys, finishing the year on 14.7%, and reasserted its dominance after a mid-year dip. While its cume softened overall – sliding from 750,000 in Survey 1 to 719,000 by Survey 7 – 3AW’s strength lay in engagement, not reach.

Fewer listeners, staying longer, delivered another year of clear market leadership.

Below talk, the contest was tighter. Gold 104.3 emerged as the year’s most reliable music performer, winning share in Survey 4 and finishing 2025 on 12.5%, equal to its Survey 2 peak.

More importantly, Gold posted net cume growth, rising from 1.23 million to 1.256 million, making it one of the few major Melbourne stations to end the year up on reach.

In a volatile music landscape, Gold quietly did what many others couldn’t – hold an audience and add scale.

Gold 104.3’s Christian O’Connell

Nova 100 remained Melbourne’s reach powerhouse, claiming the #1 cume position in four surveys and setting the year’s high-water mark with 1.326 million listeners in Survey 4.

But that scale proved difficult to sustain.

By Survey 7, Nova’s cume had slipped to 1.19 million, and share fell from 9.3% in Survey 1 to 7.4% at year’s end, underscoring the challenge of converting broad reach into consistent listening.

For KIIS 101.1, 2025 was another year of underperformance.

Share hovered stubbornly in the mid-5s, finishing at 5.2%, while cume declined by 75,000 listeners across the year.

Despite small mid-year lifts, KIIS never found the momentum required to challenge Melbourne’s established FM brands in any sustained way.

KIIS 101.1’s Kyle and Jackie O

Triple M, meanwhile, was the quiet improver. While it remained well off the top tier in share, the station delivered the strongest cume growth in the market, lifting from 778,000 in Survey 1 to 816,000 by Survey 7.

It wasn’t enough to shift the competitive order, but in a year where many brands went backwards, Triple M at least moved in the right direction.

Winner: 3AW

Once again, 3AW proved Melbourne is still a talk town.

The station claimed the #1 share position in six of seven surveys, finishing 2025 on 14.7%, well clear of the field. While cume edged down across the year, loyalty more than made up for it.

Loser: KIIS 101.1

For KIIS, 2025 was another year stuck in neutral.

Share remained anchored around the mid-5s, closing at 5.2%, while cume fell by 75,000 listeners year-on-year.

There were no breakout surveys, no sustained momentum – just incremental drift in a market that increasingly rewarded clarity and consistency.

The Brisbane market

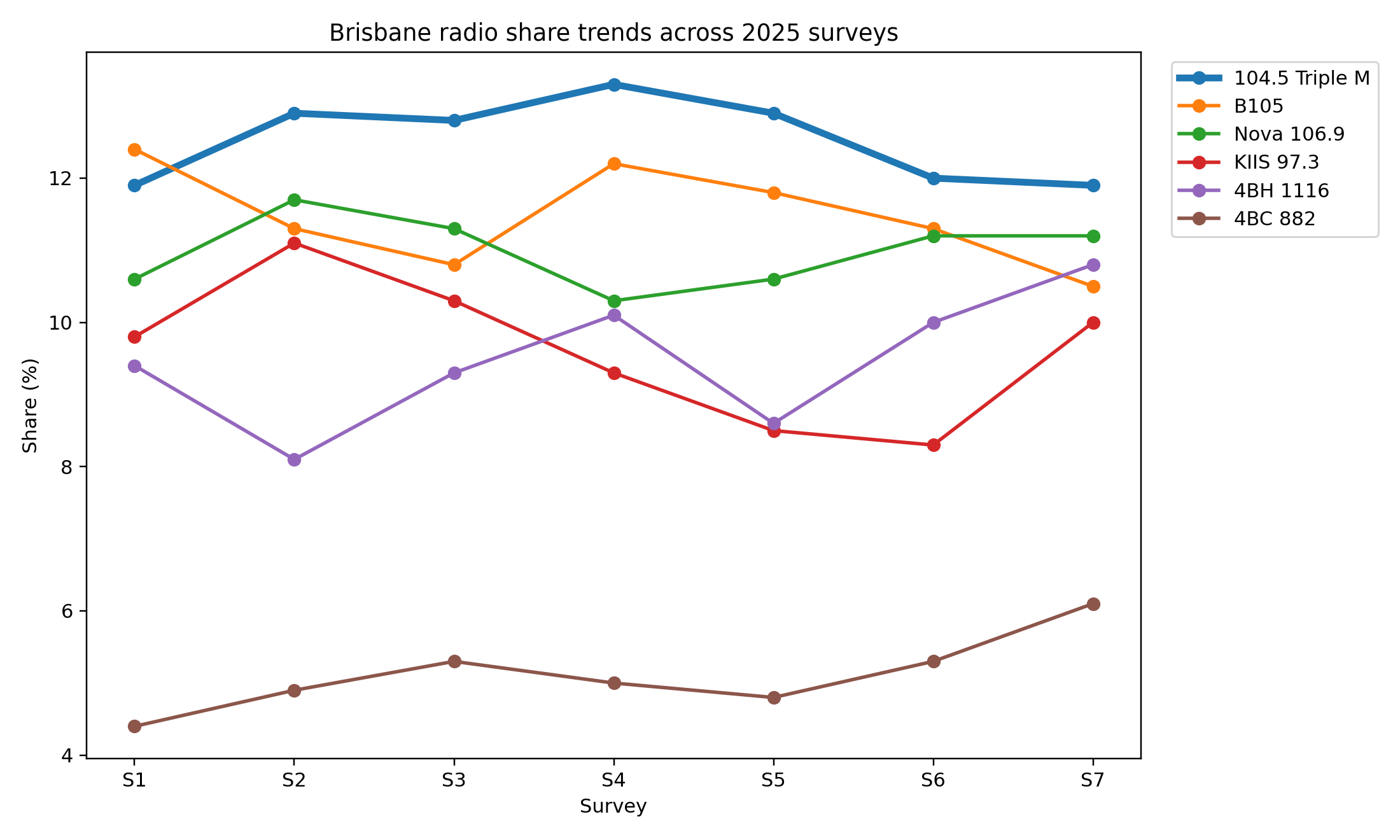

Brisbane’s radio market in 2025 was defined by share dominance at the top and a surprisingly competitive chase underneath.

Across seven surveys, 104.5 Triple M emerged as the clear share leader, finishing #1 in six of seven surveys and peaking at 13.3% in Survey 4.

While its cume eased slightly across the year, Triple M’s strength was loyalty – a stable audience listening longer, more often, and delivering the year’s most consistent performance.

In reach terms, the picture was more fragmented. Nova 106.9 and B105 split cume leadership throughout the year, with Nova leading early surveys and B105 finishing strongest.

Nova began 2025 as Brisbane’s largest station, topping cume in the first three surveys, but gradually ceded ground, ending the year at 613,000.

B105, by contrast, quietly consolidated, closing 2025 on 631,000, slightly above where it started – a rare outcome in a market where most brands went backwards.

KIIS 97.3’s Robin, Kip, and Corey

KIIS 97.3 struggled to find sustained momentum.

Despite a strong Survey 2 spike in both share and cume, the station faded mid-year before a modest recovery in Survey 7. It finished 2025 broadly flat on reach and well off the pace on share, unable to translate short-term lifts into structural gains.

Further down the dial, 4BH was one of the year’s more interesting improvers.

While its share remained modest, it steadily climbed across the back half of the year, finishing at 10.8% in Survey 7 and posting net cume growth – one of the few Brisbane stations to do so.

By contrast, the loser of the year was KIIS, which ended 2025 largely where it began, but with fewer clear strategic wins than its rivals.

Winner: 104.5 Triple M

Triple M owned Brisbane in 2025. It finished #1 on share in six of seven surveys, never dropped below 11.9%, and peaked at 13.3% mid-year.

While cume softened slightly, audience loyalty more than made up for it.

Loser: KIIS 97.3

KIIS couldn’t convert opportunity into momentum.

After a promising early-year spike, share slid back to the low-to-mid 8s before a late lift, finishing 2025 broadly flat.

Cume ended almost where it started, but without any sustained run of leadership or growth. In a market rewarding clarity and consistency, KIIS spent the year treading water.

The Perth market

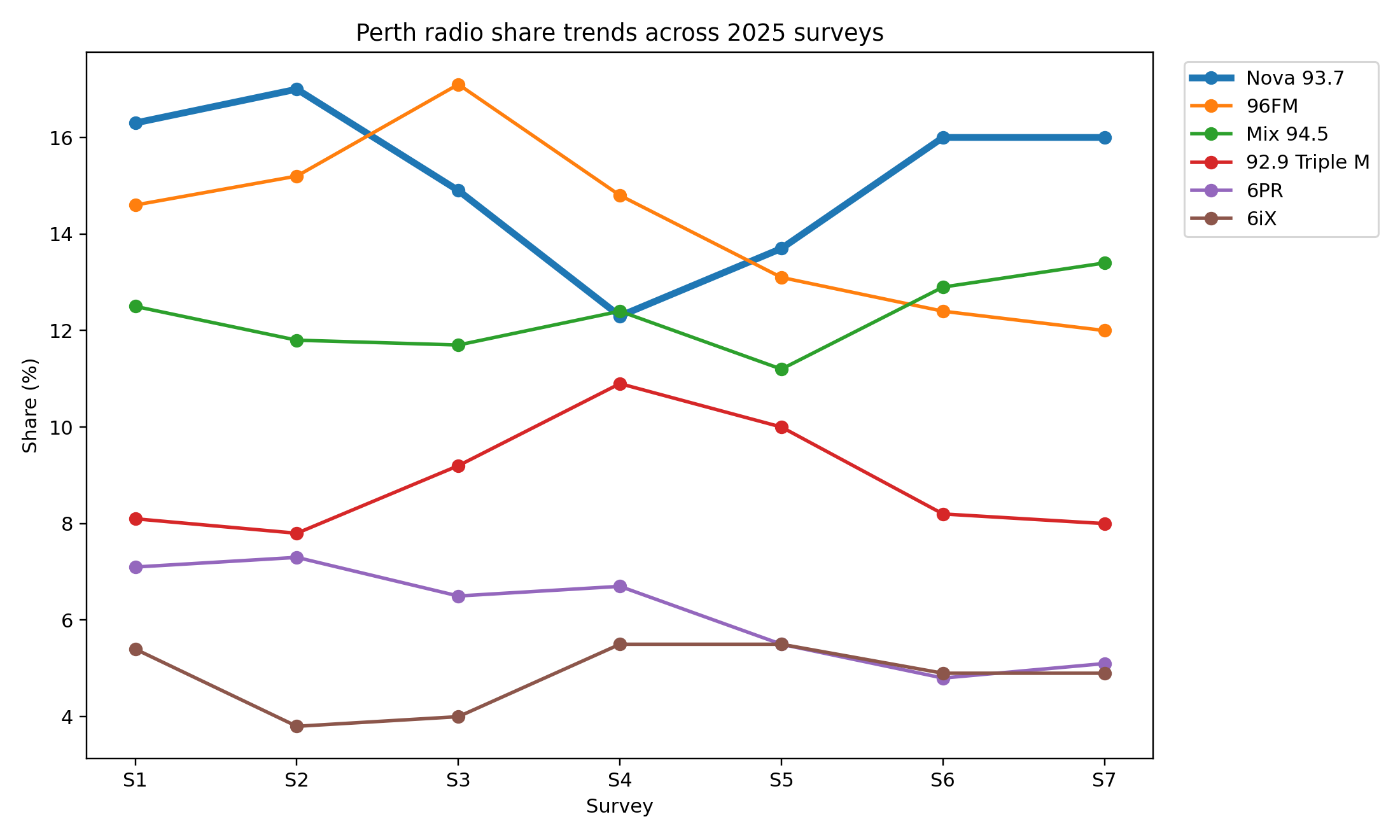

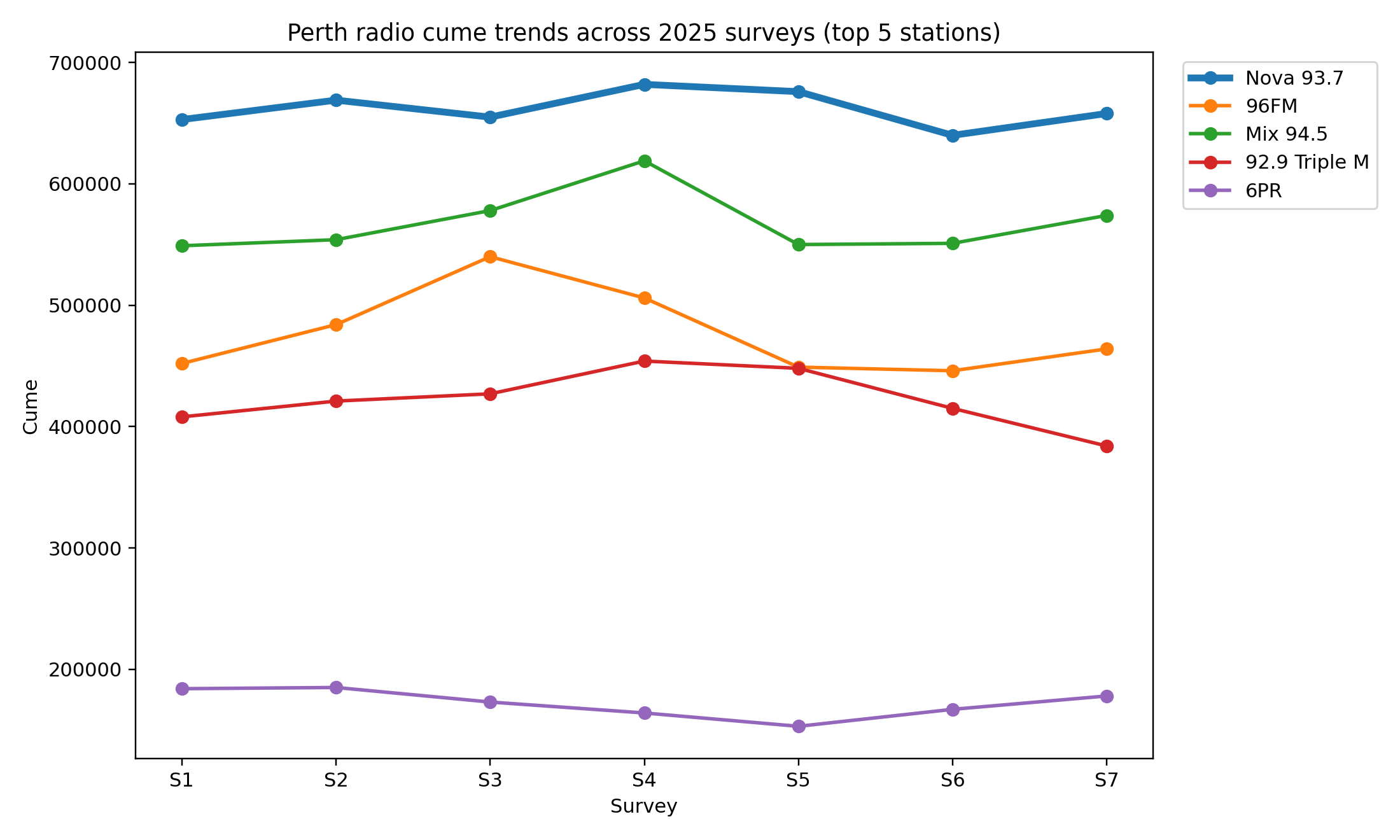

Perth’s radio market in 2025 was defined by Nova 93.7’s sustained dominance and a competitive second tier that reshuffled throughout the year.

Nova finished #1 on share in the majority of surveys and owned reach almost end-to-end, peaking at 682,000 listeners in Survey 4 – the highest cume recorded in the market this year.

96FM was the most credible challenger, briefly overtaking Nova on share mid-year and delivering the strongest single-survey share result of 2025 at 17.1% in Survey 3.

But that momentum faded as the year progressed, with both share and cume softening into the back half, leaving the station firmly in second place overall.

Mix 94.5 quietly emerged as the year’s growth story.

While it never topped share or cume, Mix was the only major FM music station to post meaningful net audience growth, adding 25,000 listeners across the year and finishing on 574,000. In a mature market, that upward curve stood out.

Nova 93.7’s Nathan, Nat & Shaun

Below the music pack, Triple M and 6PR struggled for traction.

Triple M’s mid-year surge proved temporary, while 6PR continued to lose relevance on both share and reach despite a modest late recovery.

In contrast, Nova’s ability to balance mass reach with consistent listening left little doubt about the pecking order.

Winner: Nova 93.7

Nova didn’t just win Perth – it owned it. The station topped share in five of seven surveys, led cume in six, and closed the year back at 16% share with 658,000 listeners.

Even when 96FM briefly surged mid-year, Nova quickly reasserted control.

Loser: 92.9 Triple M

Triple M struggled to hold momentum.

After a promising climb to 10.9% share in Survey 4, both share and cume trended down, finishing the year with 384,000 listeners, down 24,000 on Survey 1.

The brand never collapsed, but it never converted its mid-year gains into a sustained position either.

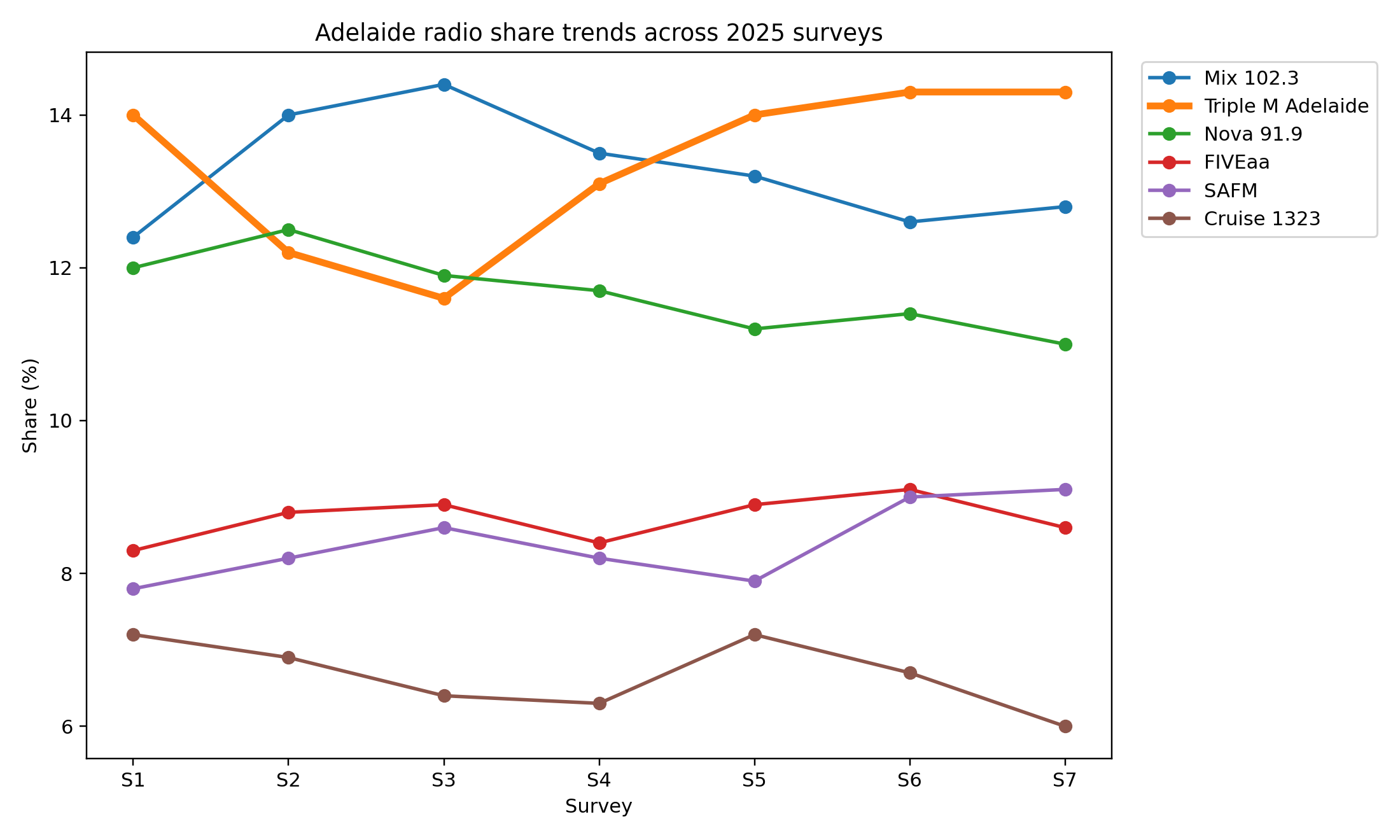

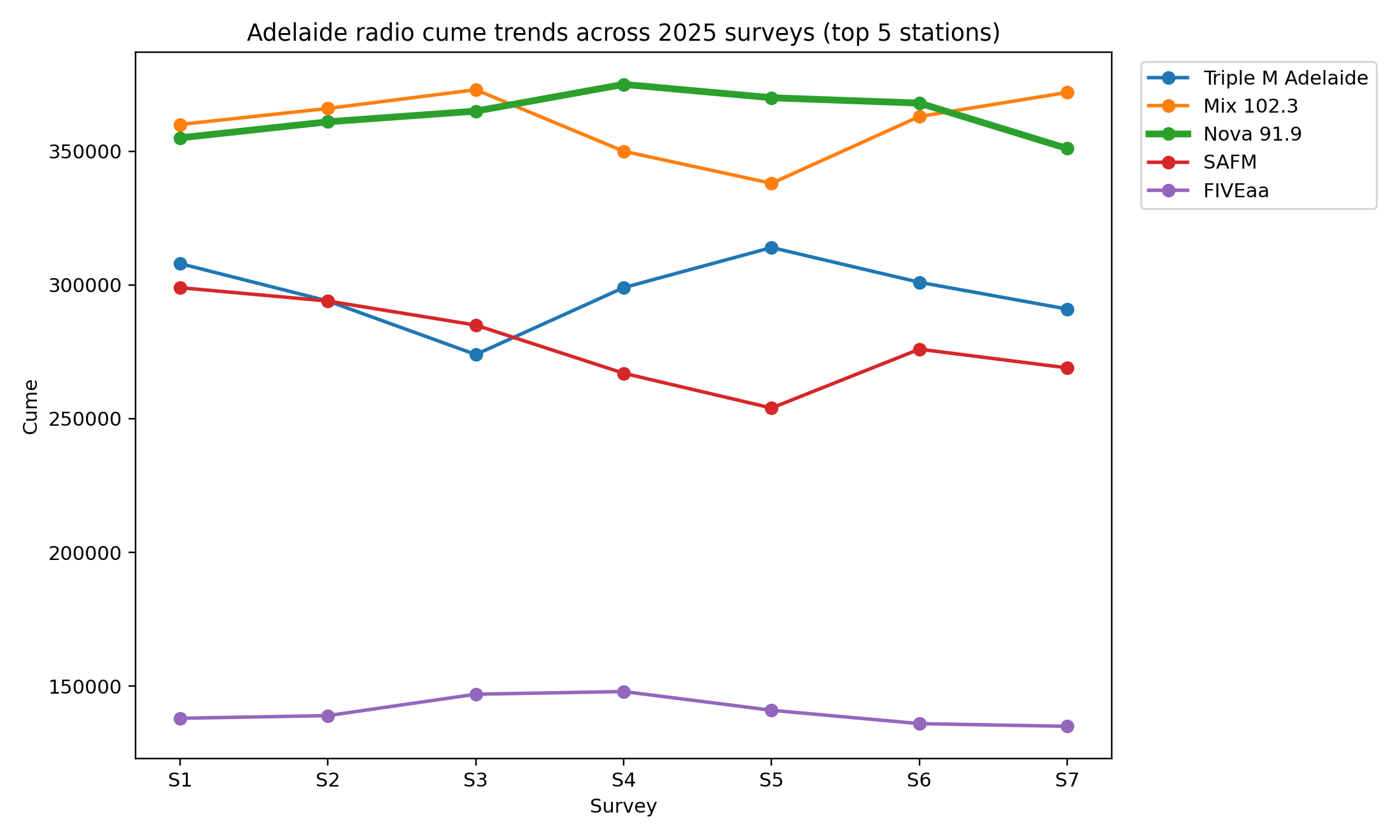

The Adelaide market

Adelaide’s radio market in 2025 split neatly between share leadership and reach leadership. Triple M Adelaide emerged as the year’s dominant share performer, gradually overtaking Mix and tightening its grip from Survey 5 onwards.

Its late-year consistency – two straight surveys above 14% – cemented its position as the city’s most listened-to station by time spent listening.

Mix 102.3 remained the early-year pace-setter, winning share in three consecutive surveys and finishing as the only major station to post net cume growth across the year.

While its share eased slightly in the back half, Mix ended 2025 with 372,000 listeners, reinforcing its role as Adelaide’s broad-appeal music brand.

In reach terms, Nova 91.9 was Adelaide’s cume powerhouse, leading audience in five of seven surveys and peaking at 375,000 in Survey 4.

Triple M Adelaide’s Breakfast with Roo, Ditts & Loz

However, its share slowly drifted downward, highlighting the challenge of converting scale into deeper listening as competition intensified.

Further down the dial, FIVEaa and SAFM traded modest gains and losses, but neither meaningfully shifted the competitive order.

The net result was a market that rewarded consistency over reinvention – with Triple M’s late-year momentum proving decisive.

Winner: Triple M Adelaide

Triple M finished 2025 as Adelaide’s most powerful station on share.

It claimed the top spot in four of seven surveys, dominated the back half of the year, and closed with 14.3% share in both Survey 6 and Survey 7.

While cume softened slightly, audience loyalty clearly strengthened – and in Adelaide, that mattered more.

Loser: SAFM

SAFM struggled to hold reach as the year wore on. Despite modest share improvement late in the year, cume fell sharply from 299,000 in Survey 1 to 269,000 by Survey 7.

The station finished stronger on share than it started, but not strongly enough to offset sustained audience erosion.

Consistency still wins

By the end of Survey 7, the scoreboard told a simple story. The stations that respected habit were rewarded, and those that mistook noise for momentum were not.

In a year obsessed with change, the safest bet turned out to be discipline: know your audience, serve them relentlessly, and resist the urge to chase every new idea. In radio, 2025 proved that consistency is not boring. It is still the hardest thing to beat.

Sorry isn’t good enough: Trump launches $10bn legal attack on BBC

Donald Trump has filed a lawsuit against the BBC, seeking up to $10bn in damages over the broadcaster’s editing of a speech he delivered to supporters in Washington on 6 January 2021, shortly before they stormed the US Capitol.

In a complaint filed on Monday evening in the US District Court for the Southern District of Florida, the US president alleged the BBC “intentionally, maliciously, and deceptively” edited his remarks in an episode of Panorama broadcast just over a year ago.

Trump is seeking $5bn in damages on two counts – alleging the BBC defamed him and that it violated Florida’s Deceptive and Unfair Trade Practices Act.

The Panorama edit at the centre of the case

The lawsuit centres on a Panorama episode that used excerpts from Trump’s January 6 speech delivered almost an hour apart.

The edited sequence suggested Trump told the crowd: “We’re going to walk down to the Capitol and I’ll be there with you, and we fight. We fight like hell.”

The BBC has previously acknowledged the edit was an “error of judgment” and apologised to Trump. However, it has consistently maintained that there is no legal basis for a defamation claim.

The broadcaster did not immediately respond to a request for comment on the lawsuit.

BBC director general Tim Davie

Senior BBC resignations followed editorial crisis

The lawsuit follows a period of significant turmoil at the BBC.

Last month, BBC director general Tim Davie and BBC News chief Deborah Turness resigned amid a broader editorial crisis. Their departures came after allegations of “serious and systemic problems” in the BBC’s coverage of issues including Trump, Gaza and trans issues.

Those claims were made by Michael Prescott, a PR executive and former independent external adviser to the BBC’s editorial guidelines and standards committee. Prescott’s memo to the BBC board was later leaked to the UK’s The Daily Telegraph.

Jurisdiction questions and election timing

Trump’s legal action has raised questions about jurisdiction.

The case was filed in Florida despite BBC iPlayer and BBC One not being available in the United States, and despite the Panorama episode never airing there.

Trump’s lawsuit argues that the Florida court has jurisdiction because the BBC is “engaged in substantial and not isolated business activities” in the state, citing the BBC’s website and BritBox, the streaming service it operates in several markets, including the US.

A spokesperson for Trump’s legal team claimed the edits, which aired a week before the 2024 presidential election, amounted to a deliberate political intervention.

“The BBC has a long pattern of deceiving its audience in coverage of President Trump, all in service of its own leftist political agenda,” the spokesperson said.

“President Trump’s powerhouse lawsuit is holding the BBC accountable for its defamation and reckless election interference just as he has held other fake news mainstream media responsible for their wrongdoing.”

Trump had flagged the lawsuit earlier on Monday, telling reporters at the Oval Office:

“In a little while, you’ll be seeing I’m suing the BBC for putting words in my mouth. Literally, they put words in my mouth. They had me saying things that I never said coming out.”

George Stephanopoulos

Part of a broader legal campaign against media companies

Trump’s action against the BBC extends a legal strategy he has increasingly deployed against major media organisations.

Since his re-election last November, Trump has secured several high-profile settlements in the US. ABC, owned by Disney, agreed to pay $15m to resolve a defamation lawsuit stemming from comments made by anchor George Stephanopoulos.

In July, Trump also reached a $16m settlement with Paramount, the parent company of CBS News, over what he alleged was false editing of a pre-election interview with Democratic presidential candidate Kamala Harris.

His lawsuit against the BBC marks the most significant attempt yet to take that campaign beyond US borders.

Podcast Ranker: November’s audience shake-up hits sport hardest

November’s Triton Podcast Ranker showed how quickly listening behaviour can shift.

While the top of the chart remained largely intact, significant listener gains and losses across the Top 300 reshaped positioning beneath the surface, revealing a clear split between lifestyle growth, cooling news cycles and the familiar rise-and-fall rhythm of sport and true crime.

At the very top, Hamish & Andy remained #1 – but even the market leader wasn’t immune to audience softening.

Hamish & Andy hold #1 as Top 5 audiences fluctuate

Hamish & Andy retained the top spot in November with 842,414 listeners, down from 881,262 in October – a loss of 38,848 listeners month-on-month.

The show remained comfortably ahead of the field, but the drop underscored a broader trend playing out across the upper ranks.

The most significant positional change inside the Top 5 came at #2 and #3.

Mamamia Out Loud rose to #2 after growing its audience from 622,695 to 655,915, adding 33,220 listeners.

That lift allowed it to overtake ABC News Top Stories, which slipped to #3 after falling from 783,353 listeners in October to 645,709 in November, a loss of 137,644 listeners.

Shameless held #4 despite a 21,994 listener decline, dropping from 532,029 to 510,035, while Sky News Australia Update remained at #5 after losing 21,468 listeners, finishing November on 461,512.

The November Top 5 now reads:

- Hamish & Andy

- Mamamia Out Loud

- ABC News Top Stories

- Shameless

- Sky News Australia Update

The composition stayed the same, but the momentum underneath it shifted decisively.

News cools, lifestyle consolidates

Audience losses for ABC News Top Stories, AM and other daily news podcasts point to post-October fatigue after an intense news cycle.

While still large in absolute terms, several news brands experienced softer November numbers amid increased competition and easing urgency.

Lifestyle titles, by contrast, proved more resilient.

Mamamia’s growth was incremental rather than explosive, but enough to change ranking order – reinforcing that steady audience accumulation can be as powerful as headline spikes.

Live radio shows remain volatile

Live radio programs again featured prominently across the Ranker, though November highlighted how uneven that performance can be.

The Kyle & Jackie O Show slipped two places, falling from #15 to #17, with listeners edging down from 273,953 to 270,386 – a loss of 3,567 listeners.

Others, however, experienced dramatic upside.

The month’s biggest story: Fitzy & Wippa’s breakout surge

The most striking result in November came from Fitzy & Wippa with Kate Ritchie, which delivered the largest combined ranking and audience jump on the board.

The Nova breakfast show surged from #129 in October to #26 in November, climbing 103 positions.

Its audience jumped from 52,055 listeners to 222,899, a gain of 170,844 listeners in a single month.

The result reinforced live radio’s capacity for rapid podcast growth when distribution, promotion and listener demand align.

Big risers: momentum stories across the Ranker

Beyond the headline moves, November produced a series of sharp climbs driven by seasonality, format strength and topical relevance.

• AFL Trade Radio (+100) delivered the clearest seasonal spike, with trade-period interest translating into a massive ranking jump.

• Alva Beach: Death At The Door (+75) surged on the back of true-crime momentum and word-of-mouth.

• On Purpose with Jay Shetty (+11) continued to grow locally, underlining the power of evergreen global brands.

• Straight Talk with Mark Bouris (+31) gained ground as economic and business-focused content cut through.

• ABC Rewind (+37) and The Economy, Stupid (+52) highlighted the ABC’s success with repackaged and policy-driven content.

There was also a broader lift across multiple ABC titles, including Late Night Live, Life Matters and PM, suggesting network-level discovery rather than isolated gains.

Sharp fallers: where seasonality caught up

Several notable declines reflected the other side of that volatility.

• SEN Breakfast (-23) and Whateley (-32) corrected after strong October performances.

• Triple M Rocks Footy NRL (-29) fell as the NRL season wound down.

• The Mushroom Cook (-56) and The Mushroom Trial: Say Grace (-49) cooled following earlier court-driven interest.

• Hack (-50) recorded one of its sharpest monthly dips, while AM (-16) softened but remained a major player.

The middle ground: quiet but meaningful movement

Some of November’s most instructive shifts sat outside the extremes.

I Catch Killers with Gary Jubelin rose modestly (+3), continuing its steady progression as a durable true-crime franchise. The Imperfects (+2) and Happy Hour with Lucy & Nikki (+3) continued incremental growth, reinforcing their appeal as consistent, advertiser-friendly lifestyle brands.

Meanwhile, Dan Does Footy (-9) highlighted the vulnerability of personality-driven sports podcasts once the season wraps.

What November shows

November’s Ranker reinforced several underlying truths about the Australian podcast market.

Seasonality remains a dominant force, particularly for sport and court-driven true crime.

News podcasts remain powerful but are exposed to cycle fatigue, while lifestyle and evergreen formats continue to consolidate quietly. At a network level, the ABC’s breadth is proving as valuable as its tentpoles.

The rankings may look familiar. The audience behaviour beneath them is shifting… fast.

The campaigns that actually made people laugh in 2025

Comedy is one of the hardest things to get right in advertising, and one of the easiest to get wrong, according to Australian creatives.

These are the campaigns from 2025 that didn’t play it safe, didn’t chase jury approval and actually made people laugh.

Town Square ECD Brendan Day said DiDi’s ‘Yes, I DiDi’ instantly came to mind because it was “absurd” and “fun”.

“It’s heartening to know that work like this is getting made,” he told Mediaweek.

“It was one of those rare moments where friends who couldn’t care less about advertising send you something, just going ‘WTF?’

“For a challenger brand like this needing to cut through, it’s doing exactly what it needs to.”

Yango managing partner Nick Murdoch agreed, saying he “can’t think of a more entertaining ad.”

“I must have watched it back 20 times. The character is unique, memorable and just plain outrageous, and the content pulls you in,” he said.

“It’s brilliantly targeted for the younger, cost-conscious, urban types, as well as those seeking convenient, affordable rides.

“The alignment to an adventurous night out is something that almost all 20-somethings can relate to.”

DDB creative director Rebecca Morriss said Reese’s ‘Don’t Eat Lava’ made her giggle because of its “absolute commitment to stupidity.”

“It takes a single, dumb premise, lava looks delicious, and executes it with the scale, drama and production values of a blockbuster,” she said.

“That contrast is what makes it so funny, the joke never winks or apologises. It simply leans all the way in.

“The performances are perfectly pitched. They are frantic, earnest and almost heroic in their obsession with something obviously lethal. Who doesn’t love a granny so determined to eat lava that she nearly drives her mobility scooter into it?”

Today the Brave creative partner, Vince Osmond, agreed.

“We’re in a moment when humour in advertising feels like an endangered species,” he said.

“Everything’s so earnest, so careful, so obsessed with meaning.

“Reese’s ‘Don’t Eat Lava’ reminds us that silliness, pushed to the absolute brink of ridiculousness, is a creative superpower. The world deserves more of this.”

M+C Saatchi Group ANZ senior creative Bryce Waters said there were a few standouts.

“The Booze Maths work out of NZ, the David and Dave ad for the Super Bowl, and a personal favourite of mine for Liquid Death that encouraged people to drink on the job,” he said.

“But few stood out to me as much as EA Skate X: Drop In by the Uncommon crew. It’s definitely not laugh-out-loud funny… but as someone who’s spent many years on crutches or nursing broken bones, it made me take notice.

“Maybe it’s nostalgia – it could also be getting spat on in the first three seconds, the decks stuck in walls, the (un)broken bones and teeth being ejected onto the floor, or the fact that the jokes were only really meant for skaters.”

oOh!media head of creative Josh Gurgiel called Sure’s sniffable campaign “the most gloriously unhinged OOH moment of 2025.”

“Had they merely plastered obscenely cheeky call to actions like ‘Smell this bunda’ and ‘Sniff these meatballs’ on giant billboards across the UK, that would have been enough,” he said.

“It weaponises humour to cut through the clutter, turning a functional product into a shareable cultural moment.

“It blurs the line between ad and activation, inviting the public to participate (if they dare) whilst landing its core message irrespective of active engagement.”

Havas Host head of strategy Phil Pickering named Andrex’s ‘First school poo’ as his top pick.

“Thankfully, they took the mindset they actually needed. A child’s. And that led to a one-minute fart and poo joke, which I am absolutely here for,” he said.

“It is great to see a brand known for cute puppies, and not what actually happens behind the toilet door, finally embrace the truth of the category and lean into it without apology.

“It is simple, it is silly, and it is exactly the kind of creative decision a real audience will reward.”

BMF group creative director David Roberts said Motion Sickness’ ‘Straight to the heart’ made him laugh out loud because it was “cheeky and persuasive.”

“The most stupidly literal yet genius answer to a brief, which I assume was something like: shift people’s mindset from hanging out in inner-Auckland suburbs to the CBD. The solution? Don’t shift the mindset – shift their bodies,” he said.

“A free taxi service that’s anti-digital and pro-spontaneity. No app. No algorithm. Just the ancient art of throwing your hand in the air and maintaining unblinking eye contact.

“The sing-along infomercial to launch the service is sharply strategic and gloriously dumb – perfect casting, seagull sound effects and the mind-blowing suggestion to buy a jacket.”

Those That Do chief doer Ben Walker said Uber’s ‘You can’t do that if you’re driving’ was funny because it tapped into the universal truth that we’re all more chaotic than we admit.

“The humour comes from holding up a mirror to the little private behaviours we normally hide,” he said.

“What makes it especially funny is the contrast between the seriousness of driving and the absolute nonsense people get up to when they’re freed from it.

“The campaign plays with that tension beautifully. It’s surprising, self-deprecating and instantly relatable.”

Vonnimedia managing director Veronica Cremen said challenger brands often struggle to punch up without looking bitter, but Google “threaded that needle perfectly.”

“Associating Apple’s greatest strength, reliability, as its greatest weakness, alluding to boredom and ‘vanilla’, is an entertaining and refreshing strategy,” she said.

“It’s a clever reversal of the old Apple versus Windows dynamic, with Google now playing the creative provocateur to Apple’s establishment cool.

“Even die-hard iPhone users are engaging. Even I did. That’s rare. It signals genuine cultural cut-through, which is a bold, risky play that lands exactly as intended.”

Thinkerbell founder Adam Ferrier chose the Astronomer response with Gwenyth Paltrow.

“The scale, the speed, the cleverness and sheer audacity to turn their moral shit show into a global brand-building showcase within a week is beyond comparison,” he said.

“Any data workflow company using Apache Workflow is not going to have ‘funny’ ad as a key KPI, but the use of humour in their response saved the company’s hide and got the global conversation back onto what they do, rather than the dodgy behaviours of its senior executives.

“It was marketing brilliance and genuinely funny.”

Toyota refreshes HiLux platform with loyalty-led campaign

Toyota Australia has unveiled the next phase of its long-running HiLux brand platform with a new campaign developed by Saatchi & Saatchi Australia, marking the arrival of the updated HiLux model.

The campaign continues the ‘Don’t send a ute to do a HiLux job’ positioning, which Toyota has used to reinforce the vehicle’s durability and relevance to Australian drivers across work and lifestyle use.

The updated HiLux features refreshed styling, upgraded technology and enhanced capability. Toyota says the model has been designed in Australia with local conditions and expectations in mind, while maintaining the durability the nameplate is known for.

At the centre of the campaign is a hero film that uses humour to explore loyalty. In the execution, dozens of dogs abandon their owners’ vehicles and jump into the tray of the new HiLux, positioning the ute as the ultimate object of allegiance.

Vin Naidoo, Chief Marketing Officer at Toyota Australia, said the campaign was designed to reflect the emotional connection Australians have with the HiLux brand.

“In Australia’s heart, one name stands tall – HiLux. It’s tough, loyal, and ready for anything, just like man’s best friend,” Naidoo said. “We know customers are going to be impressed with the styling and technology updates, and that the HiLux will continue to be an iconic Australian ute.”

Mandie van der Merwe, Chief Creative Officer at Saatchi & Saatchi Australia, said the work aimed to celebrate that loyalty in a light-hearted way.

“HiLux has earned a unique kind of loyalty in Australia. It’s not just a ute. Its dependability has earned it a reputation as a part of people’s lives,” van der Merwe said.

Media for the campaign is being handled by Spark Foundry Australia, with activity rolling out across summer. The schedule spans television, out-of-home, digital, radio, in-store, and social channels, with further extensions planned.

The campaign marks the latest chapter in Toyota’s long-term investment in the HiLux brand, which has been part of Australian motoring culture for more than 50 years.

Credits:

Client – Toyota Motor Corporation Australia

Senior Manager, Marketing Operations: Anthony Nobile

Manager, Communications – Commercial & Brand: Kylie Graham

Senior Brand Specialist: Kellie Burmeister

Agency – Saatchi & Saatchi Australia

Chief Creative Officers: Dave Bowman, Mandie van der Merwe, Avish Gordhan

Creative Director: Piero Ruzzene

Creative: Rosita Rawnsley-Mason, David Govier

Head of Design: Tod Duke-Yonge

Integrated Designer: Sophie Whitehead

National Director of Production: Michael Demosthenous

Senior Integrated Producer: Esta Lau

Chief Client Officer: Ben Court

Executive Planning Director: Joe Heath

Group Business Director: Zoe Kypros

Senior Business Director: Melanie Bunn

Business Manager: Charlotte Brasington

Business Executive: Georgie Menzies

Media – Spark Foundry Australia

TV Production Credits

Production Company – Finch

Director: Christopher Riggert

Managing Director / Executive Producer – Corey Esse

Executive Producer – Nick Simkins

Producer: Caroline David

DOP: Sam Chiplin

Casting – Felicity Byrne

Editorial- Offline – Arc

Editor: Jack Hutchings

Post-Production – Alt VFX

VFX Director/Founder: Col Renshaw

Post-Production Producer: Celeste Fairlie

Sound – Sonar

Stills production credits

Production Company – Photoplay

Photographer – Michael Corridore

Executive Producer – Alison Lydiard

Producer – Amanda Moore

Retouching – Prodigious

The Travel Corporation overhauls marketing, names Havas global AOR and Publicis for Contiki

The Travel Corporation has launched a major global marketing reset, appointing Havas as its first-ever global agency of record and naming Publicis Australia as global creative partner for Contiki following a competitive, holding-company-level pitch.

The move signals a decisive break from TTC’s historically in-house marketing model, replacing it with a consolidated agency structure designed to scale across its portfolio of travel brands – including Trafalgar, Uniworld and Contiki – as the group accelerates its post-acquisition transformation.

From in-house control to global scale

The review, managed by The AAR Group, saw Havas and Publicis Australia emerge from the final stage of the pitch to take on central roles across TTC’s global marketing ecosystem.

Under the new model, Havas becomes TTC’s primary strategic partner, spanning creative, media and content production, while Publicis Australia takes on the role of global creative agency for Contiki, covering brand strategy, creative, social and digital transformation. Publicis Production Australia will handle production for the youth travel brand.

The shift is a cornerstone of TTC’s broader strategic overhaul following its 2024 acquisition by asset management firm Apollo – and reflects a push to move faster, work smarter and compete harder in an increasingly complex global travel market.

A $30m media footprint – with more to come

The newly appointed agencies have been tasked with driving growth across multiple TTC brands, each with distinct audiences and ambitions: Trafalgar in guided travel, Uniworld in luxury river cruising, and Contiki in youth travel.

TTC currently spends a combined US$30m a year on media, with significant additional investment planned through to 2029 – giving the new partners both scale and runway.

Contiki resets for its next generation

For Contiki, the appointment of Publicis Australia marks a creative reset as the brand looks to stay culturally relevant while expanding globally.

Maria Parisi, Director of Acquisition and Retention at Contiki, said the partnership was about evolution without losing identity.

“Contiki is entering its next chapter, and we’re thrilled to partner with Publicis Australia as our global creative agency. Their deep understanding of youth culture, global scale through Publicis Groupe and creative ambition make them the right partner to help us continue evolving the Contiki brand for a new generation of travellers, while staying true to the spirit that has defined us for more than 60 years.”

Havas at the centre of TTC’s transformation play

For Havas, the win places the network at the heart of TTC’s long-term growth strategy.

Duncan Robertson, Open Age Chief Customer Officer at The Travel Corporation, said the decision came down to balancing scale without flattening brand nuance.

“2026 marks an important chapter in TTC’s more than 100-year history, as we embark on a bold strategic transformation and reimagine how our brands connect with millions of travellers worldwide,” Robertson said.

“In Havas, we have found the ideal partner to deliver the scale, capability and innovation required to compete in an increasingly complex travel market and achieve our ambitious growth goals.

“More than anyone else, Havas showed real empathy and recognised the nuances of our unique brands – demonstrating an ability to deliver cross-brand efficiency while respecting the strategic and executional differences between each.”

‘A pivotal moment’ for travel marketing

Tamara Greene, Chief Client Officer, Global Brands at Havas Creative Network, framed the appointment as a timely play in a category undergoing rapid change.

“What an exciting opportunity The Travel Corporation is for an agency network,” Greene said.

“The travel industry is on a journey of disruption and innovation. Partnering with TTC on these great brands – each with its own unique challenges and opportunities – is a real privilege. We are very thankful that TTC have placed their faith in Havas at such a pivotal moment for them.”

Beyond the pitch result, TTC’s decision reflects a broader shift underway across global travel brands: fewer partners, clearer accountability, deeper integration – and agency models built for scale, data and long-term investment rather than campaign-by-campaign execution.

Kids might not doomscroll, but they might be gaming with predators

Australia’s under-16 social media ban may be reshaping how young people spend time online, but it has not removed them from digital risk.

Teenagers are not simply bypassing the ban. Many are already using platforms and other digital spaces not included in the ban’s checklist, some of which experts argue may be far more dangerous.

One of the most overlooked areas of exposure is gaming. While often viewed as separate from social media, gaming can expose teens to harmful content, cyberbullying in multiplayer and battle royale formats, and heightened risks of predatory online behaviour, particularly when younger players interact with older demographics.

Roblox has rolled out certain age-restriction features, including built-in facial recognition, designed to prevent minors from chatting with adults and to comply with the intent of the ban loosely.

However, even with these facial recognition technologies, questions remain about their reliability.

There are also many other gaming platforms and communication tools that could see increased use as a result of the ban.

Although they are often discussed together, gaming and social media are not treated the same way under the legislation.

Algorithms vs live chat

Tech expert and commentator Trevor Long said the legislation has failed to keep teenagers off social platforms and may be pushing attention towards gaming environments where different, and in some cases more serious, harms exist.

“In this case, they’ve explicitly separated them at the legislative level. Gaming has had a clear exemption from the start,” Long told Mediaweek.

Trevor Long

Long added that expectations of the ban’s effectiveness were low from the outset, mainly due to weaknesses in age verification.

He also acknowledged the risks associated with both social media and gaming but stressed that they are fundamentally different.

“They’re very different risk profiles,” he said.

On social media, the risk is being sucked into algorithms, going down rabbit holes, and being exposed to negative commentary on personal content.

In gaming environments, the concern is less about content feeds and more about who children are interacting with.

“In online gaming, the primary risk is predators. There’s some bullying risk, but the main concern is how easily predators can target children. That’s the risk the eSafety Commissioner often raises,” Long said.

That distinction, he argues, should change how policymakers approach regulation.

Why addiction may be the wrong focus

While addiction is frequently cited as a reason for tighter platform controls, Long is sceptical that it should be the driving force behind gaming regulation.

“My personal view is that this has been a very structured campaign under the banner of ‘let kids be kids.’ In this situation, we need to let parents be parents,” he said.

“If your child is addicted to gaming, you need to get them off games. If they’re addicted to their phone, you need to get them off their phone.”

Rather than broad bans, Long believes simple and targeted safeguards could significantly improve child safety in gaming environments.

“The absolute bare minimum should be that kids can only talk to kids, like the Roblox model,” he said. “That’s a strong example of how gaming safety could work and would significantly improve protections.”

Discord and chatbots the new meta?

One unintended consequence of the social media ban is the likelihood that children will migrate to platforms with fewer protections and less oversight.

“The most urgent one is Discord,” Long said. “It’s a cesspool of chat groups and conversations.”

The free communication app is closely tied to gaming culture, having been built primarily for that purpose.

Without parental intervention, it can expose young users to not-safe-for-work content or communication with unknown adults.

“It does have benefits for some communities, but the potential for harm is enormous. It can enable bullying and predatory behaviour,” Long said.

“There’s no algorithm, but it can still function as a rabbit hole of groups. It needs stronger monitoring, if not inclusion in regulation.”

AI-powered chatbots and tools have also been left out of the regulatory conversation, despite growing concerns about their impact on young users.

“Should kids have access to chatbots? Maybe not. But they’re nowhere near being part of this regulation,” he said.

ACCC sues HelloFresh and Youfoodz over alleged misleading subscription cancellations

The ACCC has commenced Federal Court proceedings today against HelloFresh and Youfoodz, accusing the meal-kit giants of misleading tens of thousands of Australians about how easy it was to cancel their subscriptions – and charging them anyway.

The regulator alleges the companies, both owned by Germany-based HelloFresh SE, breached Australian Consumer Law by telling new customers they could cancel online before a cut-off time, when in reality many were still charged for – and received – their first delivery unless they spoke directly with customer service.

The case lands squarely in the middle of growing regulatory scrutiny of subscription models, particularly those that promise frictionless sign-ups while burying the exits.

‘Confusing and unclear’ cancellation practices

According to the ACCC, HelloFresh and Youfoodz promoted subscription cancellation as simple and fully digital across their websites and apps.

But for many consumers, that promise didn’t match reality.

HelloFresh is alleged to have engaged in the conduct between 1 January 2023 and 14 March 2025, during which time 62,061 customers were charged despite cancelling before the first delivery cut-off.

Youfoodz allegedly did the same between 1 October 2022 and 22 November 2024, affecting 39,408 customers.

“We’ve brought these two cases because we allege that HelloFresh’s and Youfoodz’s conduct involved a suite of confusing and unclear subscription practices in breach of Australia’s consumer laws,” ACCC Commissioner Luke Woodward said.

“Despite what HelloFresh and Youfoodz represented to new Australian subscribers, tens of thousands of consumers were charged for their first order, even though they cancelled their subscription before the cut-off date.”

Easy in, hard out

The ACCC claims that while signing up for both services was quick and seamless, cancelling the first delivery often wasn’t.

In many cases, consumers could stop the first delivery – and avoid being charged – only by contacting a customer service representative directly.

The regulator also alleges that HelloFresh required consumers to enter payment details to view and select meals from the full menu, despite representing that they would not be charged unless meals were selected.

In practice, the ACCC claims that clicking through to the meal selection screens triggered an ongoing subscription and a charge for the first delivery – even if no meals were chosen.

“In the case of HelloFresh, many consumers had not even selected meals but were unknowingly subscribed and charged regardless,” Woodward said.

“Traders must clearly communicate when consumers are signing up for a subscription, as well as how they can cancel and avoid being charged.”

Allegations specific to Youfoodz

In Youfoodz’s case, the ACCC also alleges that some consumers who attempted to cancel via their online account settings were told their first delivery had been cancelled and that they would not be charged, when in fact the delivery could not be cancelled that way.

Those customers were still charged and received their meals.

The regulator argues that this messaging further contributed to consumer confusion and financial harm.

Consumer experiences underpinning the case

The ACCC’s proceedings draw on individual consumer experiences, including that of a HelloFresh customer who entered payment details on their phone to view the menu, then decided not to proceed.

Unbeknownst to them, the ACCC alleges, saving payment details had already triggered a subscription.

The consumer only became aware after receiving a PayPal notification for the charge and struggled to contact the company while experiencing financial distress.

In another example, a Youfoodz customer cancelled their subscription online within minutes of viewing the menu, only to later receive a text confirming delivery and payment. After multiple calls, they were eventually offered a 50 per cent refund.

Enforcement priorities sharpen

The ACCC says subscription practices, particularly in the digital economy and supermarket and retail sectors, are firmly in its sights.

“Businesses using confusing and complicated subscription cancellation policies are a matter of significant public concern and, where there is evidence of breaches of the Australian Consumer Law and consumer harm, the ACCC will take enforcement action when appropriate,” Woodward said.

The regulator is also urging consumers to carefully review subscription terms when purchasing gifts during the festive season.

Consumer and fair trading issues in the digital economy are among the ACCC’s 2025–26 Enforcement Priorities.

What the ACCC is seeking

The ACCC is seeking penalties, compensation orders for affected consumers, declarations, publication orders, compliance programs and costs.

HelloFresh and Youfoodz had not responded to requests for comment at the time of publication.

AACTA doubles down on star power and strategy for 2026

AACTA has unveiled a major new wave of programming for the 2026 AACTA Festival, stacking international star power with deeper industry conversations as it positions the event as both a cultural showcase and a serious screen-sector convening point.

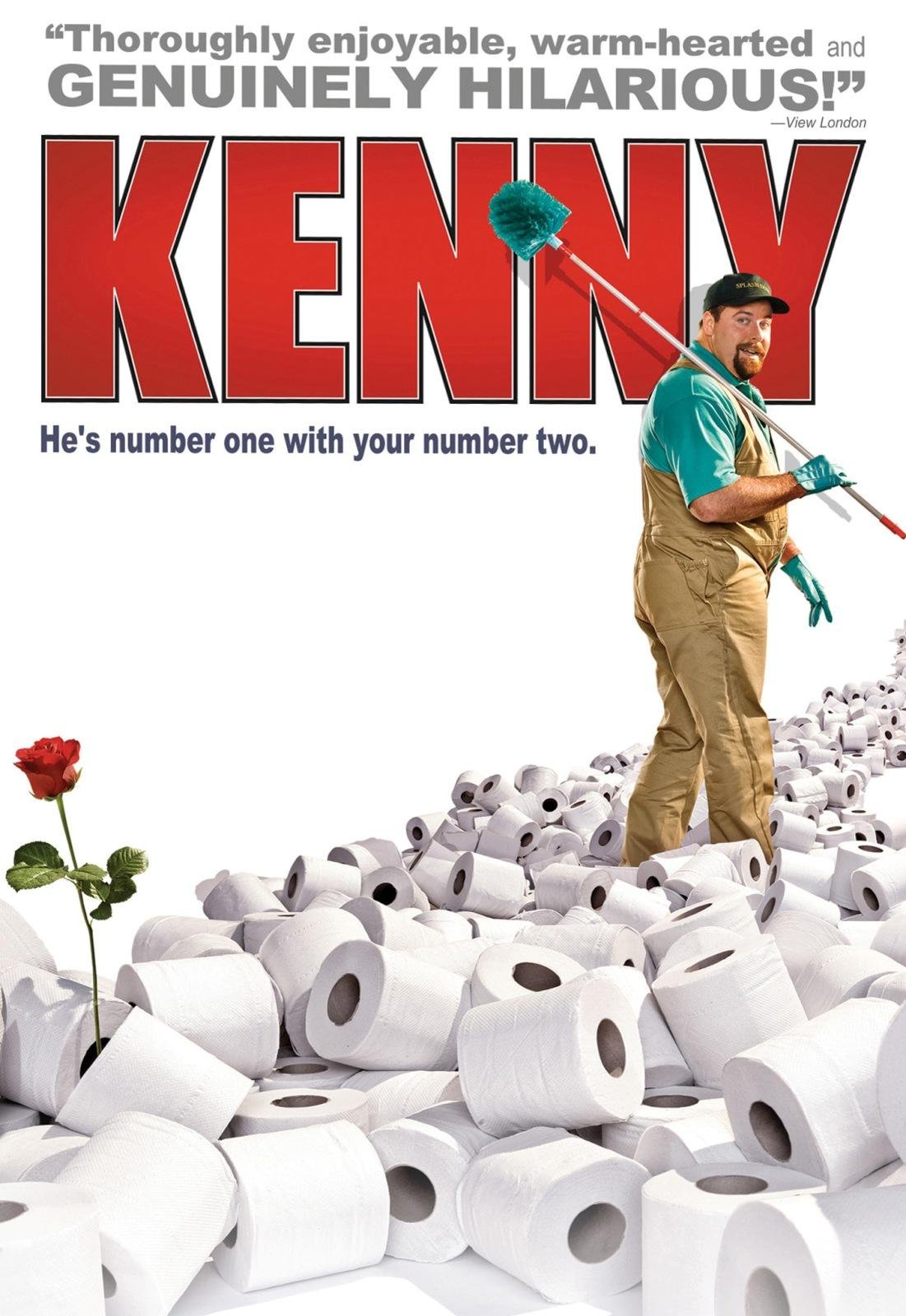

Running from 4-8 February 2026 at HOTA, Home of the Arts on the Gold Coast, the expanded lineup adds names including Yerin Ha, Phoebe Tonkin, Dichen Lachman, Baz Luhrmann, Danny and Michael Philippou, Shane Jacobson and Adam Liaw, alongside milestone screenings, world premieres and career-focused panels.

The announcement also confirms Causeway Films’ Kristina Ceyton and Samantha Jennings as recipients of the 2026 AACTA Byron Kennedy Award, underlining the Festival’s dual mission: celebrating global-facing Australian success while investing in the future of local storytelling.

Yerin Ha in Bridgerton

Bridgerton, Severance and the global moment

One of the most high-profile additions is Ha, who will appear at the Festival following her casting as the new leading lady in Bridgerton.

Her appearance reflects AACTA’s growing emphasis on Australian talent breaking through on the world stage.

That global lens continues with Lachman, who will join the Festival from Los Angeles to discuss her breakout role in Severance, and Tonkin, who will attend the world premiere of Two Years Later, further cementing the Festival’s reputation as a launchpad rather than a retrospective.

At the blockbuster end, Luhrmann will join the Australian premiere of EPiC: Elvis Presley In Concert, bringing red-carpet energy and creative context to one of the Festival’s most anticipated events.

Dichen Lachman in Severance

Celebrating legacy and momentum

AACTA’s 2026 program also leans into nostalgia and continuity, most notably with a 20th anniversary screening of Kenny, attended by Jacobson and director Clayton Jacobson, celebrating one of Australia’s most enduring screen characters.

Meanwhile, Danny and Michael Philippou return to chart their journey from the rough-edged chaos of RackaRacka to the global impact of their feature filmmaking, reinforcing AACTA’s interest in creators who have built audiences outside traditional pathways.

The Festival will also spotlight mainstream television culture, including a special I’m A Celebrity…Get Me Out of Here! conversation, alongside Feelgood TV, featuring Liaw and producer Kylie Washington, exploring why comfort viewing continues to resonate.

Causeway Films and fearless filmmaking

The awarding of the 2026 AACTA Byron Kennedy Award to Kristina Ceyton and Samantha Jennings places Causeway Films firmly at the centre of the Festival’s industry narrative.

From The Babadook and The Nightingale to Talk to Me and Bring Her Back, Causeway’s body of work represents one of Australia’s most successful global production runs.

Bring Her Back leads this year’s feature nominations with 16 nods across major categories.

Festival audiences will hear directly from the duo in Fearless Filmmaking with Ceyton and Jennings fronting an in-depth session exploring creative risk, instinct and global reach, scheduled for Saturday 7 February.

Careers, access and the next generation

Beyond headline talent, AACTA continues to broaden its professional offering.

The Screen Careers Expo, presented by Essential Screen Skills, returns with new panels including Navigating the Screen Industry as an Actor, Networking 101, Life on Set, and Hands-On Futures, alongside a Live Feature Story Development Panel presented by Screenworks.

The Festival has also reinstated its $50 AACTA membership offer, giving new members discounted access to Festival and Awards events, a move designed to lower barriers for emerging creatives and early-career professionals.

AACTA’s ambition grows

With five days of screenings, panels, workshops, masterclasses and awards ceremonies, the 2026 AACTA Festival is shaping up as one of the organisation’s most expansive editions yet.

By combining global-facing talent, industry recognition, and practical career pathways, AACTA is signalling that the Festival is no longer just a celebration of screen culture, but a strategic touchpoint for where Australian film and television is heading next.

GenAI video: Disney buys the future, brands fumble the present

Just last week, pundits and US media executives were scrambling to make sense of the Warner Bros. Discovery takeover bids. Netflix versus Paramount in an all-new Battle of the Network Stars.

The thing is, another and possibly even more significant shift was happening quietly in the background of that Game of Thrones-style duel.

Reports confirm that Disney has invested heavily in OpenAI and is integrating its IP with Sora. A billion dollars worth.

That’s not just a deal. That’s a declaration of intent. The Mouse House has decided to build a walled AI video garden.

This move signals a bizarre split in the creative world. In one corner, independent creators are mastering these tools to win festivals. In the other, major corporations are using the same tech and inadvertently terrifying their customers.

If the last few weeks have taught us anything, it’s that there’s a right way to use AI and a very, very wrong way, first, to the creators who have been lauded.

The festival circuit: Where craft meets code

While Hollywood executives were busy calling in the lawyers on the WBD sale, some competitive and creative innovation was happening on the ground in Melbourne. The recent TBWA Disrupt AI Film Festival (DAIFF) offered a glimpse of what happens when you treat AI as a view-finder rather than a cost-cutter.

The festival’s theme, ‘Humans and Their Tools,’ championed the old-fashioned value of storytelling above all. The Grand Prix winner, Pete Majarich, took home the top prize for his film Black Box. It proves that AI works best to amplify human vision, not replace it.

Pete Majarich’s ‘Black Box’ took home the top prize at TBWA’s Disrupt AI Film Festival, proving the human touch is still king.

Similarly, Australian creators like Ed Holmes and Pixel Juice are finding success by rejecting realism entirely. Queen of the Skies embraces a glitch aesthetic to create a steampunk storybook world that feels like a moving painting.

‘Queen of the Skies’, created by Pixel Juice, is a stylised storybook world rather than mimicking reality.

Other celebrated examples circling the industry show just how far the technology has come when it is unshackled from the corporate mandate to ‘sell product.’ Or maybe it’s selling with permission. Created by AI Candy, Mirakl‘s Santa Quits has been applauded by other agencies at least.

Independent creators are pushing boundaries to bring imaginative worlds to life with cinematic quality and genuine heart.

These creators succeed because they use the tech to stretch the imagination. But big brands seem intent on using it as a gimmick or just plain saving money.

The tale of two Cokes

The beverage giant offers a painful case study in the ‘AI learning curve.’ Coca-Cola has now had two bites at this cherry with wildly different results.

In 2023, they released Masterpiece. Critics applauded the spot, which used AI to transition between famous artworks. It worked because it was about artificial style and magic.

Coca-Cola’s 2023 ‘Masterpiece’ was a hit because the AI usage matched the artistic concept.

But for Christmas 2024 and now 2025, they tried to replicate reality. They commissioned AI remakes of their iconic ‘Holidays Are Coming’ truck ads.

Coca-Cola’s second attempt at an AI Christmas ad has faced the same ‘soulless’ accusations as the first.

The result was technically impressive yet emotionally vacuous. Audiences immediately spotted the AI shimmer. They noticed the gliding wheels and the dead-eyed crowds. By trying to automate a piece of cultural heritage that relies on nostalgia, Coke broke the emotional contract with its audience.

They proved that while you can prompt a machine to generate red trucks, you cannot prompt it to generate warmth.

The Golden Arches miss the mark

If Coke failed by being too nostalgic without permission to use AI, McDonald’s failed by being just plain cynical.

In a move that bafflingly misread the room, McDonald’s Netherlands released, and then swiftly pulled, an AI-generated spot titled The Most Terrible Time of the Year.

McDonald’s Netherlands scrapped this AI campaign after viewers found the cynical tone and uncanny visuals off-putting.

The ad depicted Christmas disasters rendered in a slightly unsettling, hyper-real style. The issue wasn’t just the visuals. It was the vibe.

Using a cold, calculating machine to satirise human holiday stress felt dystopian. It stripped the humour of its humanity.

Disney enters the chat

This brings us back to last week’s bombshell, the deal between Disney and OpenAI. Arguably, Disney has scrutinised developments in the world of AI-generated video and learned something.

Partnering with OpenAI could ensure their version of AI video is controlled, high-fidelity and, crucially, proprietary.

The new three-year licensing deal lets users generate videos using Sora, OpenAI’s short-form AI video platform, with more than 200 Disney, Marvel, Star Wars and Pixar characters.

And then, a curated selection of these videos will be available to stream on Disney+. Now that democratises film-making!

While the rest of the media world is distracted by who will end up owning HBO, Disney is quietly ensuring it owns the engine that will power the next decade of content. They realise that fighting the technology is futile.

Instead, they plan to own the model that runs it.

Will it work?

Really, nobody knows. Legit nobody. We are currently sitting in a strange transition period.

When an indie creator like Pete Majarich uses AI, we applaud the creativity because we see the human intent.

When a billion-dollar conglomerate uses it to photocopy a beloved memory, we see a budget line item. And a fail.

The lesson for 2026 is clear.

Use AI to dream up new worlds, not to replicate the old ones cheaply.

Main Image: AI-generated Disney doodling

Australian Idol returns in 2026

Australian Idol will return in 2026, with Seven confirming a new season of the long-running talent format for its free-to-air network and streaming platform 7plus.

The series will once again see everyday Australians step onto the Idol stage in the hope of launching a music career, as the show continues its revival run following its return to Seven in recent years.

The upcoming season will feature judges Marcia Hines, Amy Shark and Kyle Sandilands, who will search nationwide for performers with vocal ability, stage presence and commercial appeal.

Seven said the 2026 season will continue the show’s focus on undiscovered talent, with auditions held across the country and stories centred on contestants from a wide range of backgrounds.

A preview clip released by Seven features 23-year-old Central Coast landscaper Kalani, whose understated audition earns praise from judge Amy Shark ahead of the 2026 season.

Australian Idol is scheduled to air on Seven and 7plus in 2026.

Media

Bondi victim slams ABC over ‘bias’

As The Australian’s Steve Jackson details, Victoria Teplitsky was speaking about her 86-year-old father, who was shot while trying to escape the gunmen during a Hanukkah gathering and later underwent surgery.

Media fog descends after Bondi attack

Crikey’s Daanyal Saeed reports that rumours of a second shooting in nearby Dover Heights began circulating on social media and among witnesses, despite no official confirmation.

The claim was quickly amplified, with Channel Seven repeating it on air while flagging it as unverified.

Fashion Critical drops mask

The Daily Telegraph’s Zara Powell reports that, with 136,000 followers, the Gundagai-born commentator has built her brand on sharp red-carpet critiques and strict privacy, never discussing her identity beyond her posts.

Celebrity chef calls out years of abuse after Bondi attack

His Surry Hills bakery, Avner’s, has copped hate mail, verbal attacks and broken windows since opening last year. The incidents, he says, are not occasional flare-ups but a near-constant backdrop.

BBC funding model put back on the table

According to the BBC’s Katie Razzall and Steven McIntosh, a public consultation has been launched, inviting views on whether the BBC should be allowed to run ads or introduce a premium subscription tier for certain content.

Radio

Howard Stern locks in SiriusXM future

According to The Hollywood Reporter’s Alex Weprin and Caitlin Huston, the announcement came straight from Stern himself, who told listeners he had found a way to balance more free time with staying behind the microphone.