Seven in ten advertisers and agencies using retail media have increased their investment in the last twelve months, according to the IAB Australia Retail Media State of the Nation 2025 Report.

The report, now in its third year, draws from data gathered in an industry survey conducted in June 2025 across 161 senior advertising decision makers across retailers, media agencies, agency trading desks, creative agencies and advertiser brands.

Of the buy side respondents, 66% were from advertising agencies and 34% from brands. Information was also collected from 19 retailers with a retail media offering in place.

The findings cement retail media advertising as an integral part of holistic media planning.

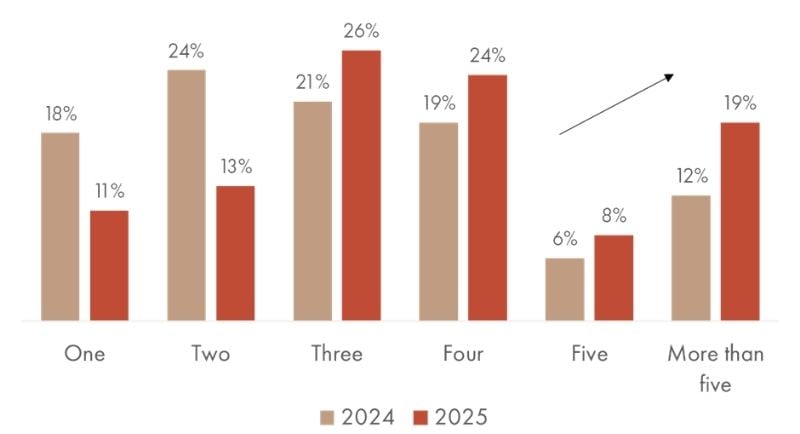

According to the report, 77% of advertisers and agencies work with three or more retail media networks, up from 58% last year.

Number of retail partners media agencies and advertiser are working with

However, as the sector scales, brands and agencies are seeking more transparency and consistency, along with better data access, consistent metrics and unified measurement frameworks across retail networks.

The Report found that investment in retail media activity now comes from a mix of fully reallocated budgets (35%) and new budgets (19%).

Brands reported increasingly shifting their spend away from trade marketing and traditional media advertising, while agencies were reallocating budget from social media and digital display budgets.

Advertisers continue to express frustrations with lack of clear, standardised performance metrics across networks. ROAS was identified as the most important metric sought by 78% of agencies and brands, while incremental sales measurement was the second at 71%.

The leading barriers to investment in retail media were found to be demonstrating ROI (38% of brand advertisers) and measurement and reporting limitations (30% of agencies).

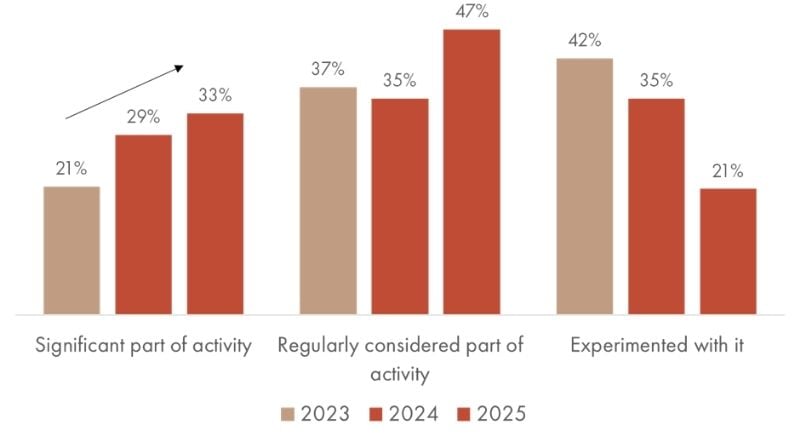

Use and consideration of retail media advertising amongst agencies using retail media advertising

“Retail media is gaining momentum, but we’re now at a pivotal stage where structure and collaboration are essential,” Gai Le Roy, CEO of IAB Australia, said.

“To fully unlock the potential of this channel, the industry needs shared frameworks, clear measurement principles and greater transparency across networks.

“As we’ve seen in other maturing digital channels, establishing consistency is what allows innovation to scale. That’s where the IAB and its members can play a critical role.”

Lachlan Brahe, Chair of the IAB Australia Retail Media Council and Commercial Director at Epsilon, said: “Moving into its third year, this report demonstrates growth and enthusiasm for retail media whilst reminding us where we, collectively, need to lift our game.

“With Retail Media becoming a staple for brands, there remain challenges for advertisers to navigate and adapt to fragmented systems and metrics.

“Further education is essential to support advertisers in understanding how best to leverage new formats and channels to achieve objectives and to compare performance across networks.”

IAB Australia Retail Media State of the Nation report’s additional findings:

• Retail media is no longer confined to major supermarkets and marketplaces, with financial services and tech companies, as well as loyalty platforms entering the space.

• Retailers are diversifying their media offerings and formats, with 85% seeking to enhance their measurement offering over the next twelve months, and 77% looking to expand the ad products and channels offered.

• The predominant objective for retail media activities is increasing sales according to 83% of agencies and advertisers, while 76% cite increasing purchase intent or action. By contrast retailers reported they believe influencing customers across the entire purchase funnel is the top opportunity.

• Agency planning and strategy teams are restructuring to integrate retail media, while retailers are hiring additional resources.

• On-site search or sponsored products are the most used retail media advertising products, increasing 21 points this year, with on-site display and in-store digital signage also highly used. Off-site extensions powered by retailer data has increased by 19 points.

IAB Australia’s Retail Media Council includes members from Adobe, Afterpay, Amazon, Aus Venue Co, Broadsign, Cartology, Coles, Criteo, David Jones, Diageo, Endeavour Group, Google, WPP Media, Hatched, Hearts & Science, Involved Media, Kinesso, MarsUnited, Meta, Metcash, Microsoft, Moloco, Monks, OMD, oOh!media, Publicis Groupe, PubMatic, Scentre Group, TechMedia, The Trade Desk, TWCM Health, Uber, Uncommon People, Vudoo, WooliesX, Yahoo, Zenith, and Zitcha.