Global ad market strengthens despite Brexit vote

Australian advertising market remains in positive growth in 2016 at +3.2%

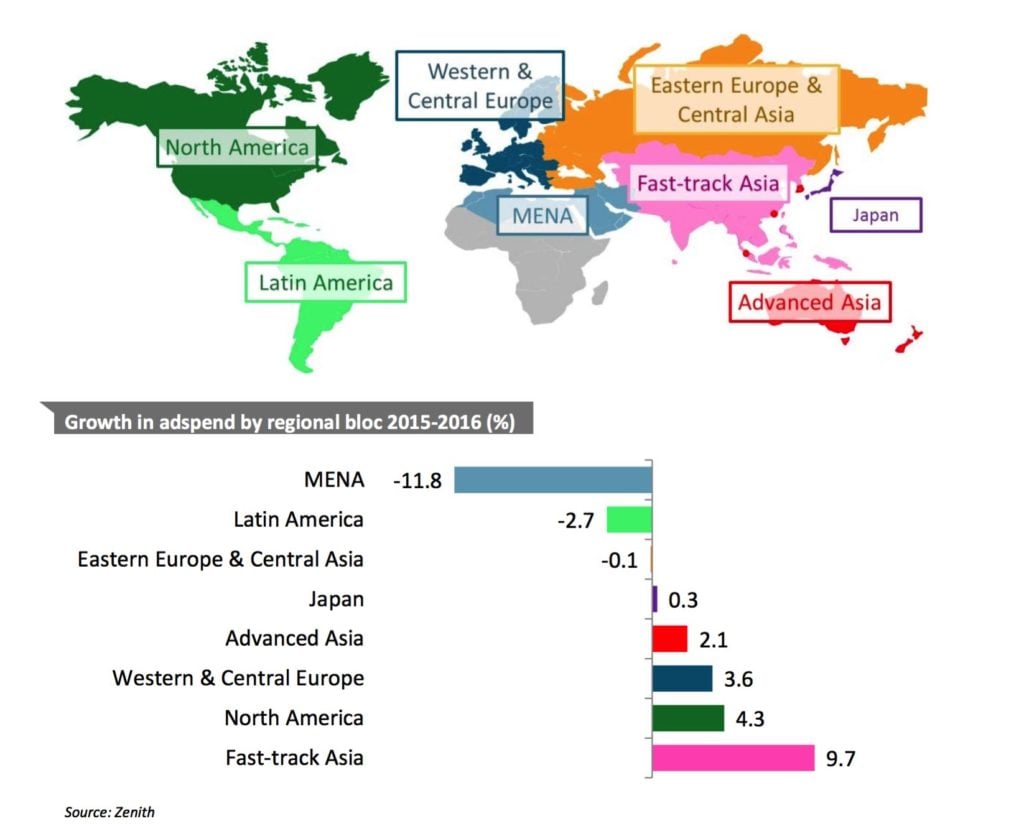

c Garon SGlobal advertising expenditure will grow 4.4% this year to reach US$539b, ahead of the 4.1% previously forecast in June, according to Zenith’s new advertising expenditure forecasts. Advertising expenditure will then expand by 4.5% in 2017 and 4.6% in 2018 – up from the previous growth forecasts for both years, which were 4.3% and 4.4% respectively. By 2018 global advertising expenditure will total US$589b, US$4b more than forecast in June.

“The global ad market has strengthened over the past few months, thanks mainly to the resilient US consumer,” said Jonathan Barnard, head of forecasting at Zenith. “So far any impact from the vote for Brexit has been limited, and confined to the UK. We expect the global ad market to strengthen further in 2017 and 2018.”

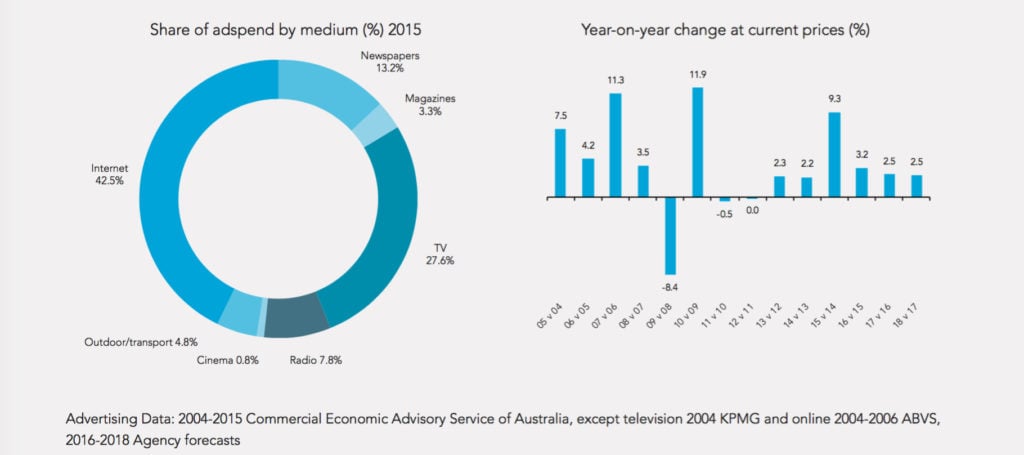

Meanwhile Zenith reports the Australian advertising market remains in positive growth in 2016 at 3.2% off the back of the exceptional increase of 9.3% in 2015. The growth trend continues, although with less intensity, due to the continual structural shift of spend from traditional media of print and now TV into digital formats and environments.

Digital advertising will grow 14.8% in 2016, offsetting declines of 15.2% in print and 4.9% in TV. Radio and OOH continue to have modest growth in 2016.

Along with the shift of spending into digital, the advertising market is being impacted by a lacklustre Australian economy, which is forecast to grow only 2.5% in 2016. Interest rates, which were already at the lowest point ever in Australia, dropped again in August in an attempt to stimulate the economy.

The early Federal election, called in May for the first weekend in July, put the brakes on advertising spending in May and June, with many businesses holding off on committing to advertising campaigns until the election result was resolved. This election campaign was particularly long, having been called eight weeks before the election date. While political advertising has increased year-on-year, the long election campaign has contributed to other categories declining in spend over the second quarter of the year.

Retail, auto, entertainment & leisure and finance/insurance categories are all back year-on-year. However, other categories are increasing including travel, FMCG, beverages and gambling. Now the election is resolved many of the categories with declines will increase spending in the second half of the year.