Global ad market growth projections have been upgraded for the first time in over a year, with new data from WARC forecasting advertising spend will rise 7.4% to $1.17 trillion in 2025. The figure is 1.2 percentage points higher than June’s outlook, buoyed by a second quarter windfall for social media platforms.

The WARC Global Ad Forecast Q3 2025 now predicts global ad spend will accelerate a further 8.1% next year, reaching $1.27 trillion, before growing 7.1% in 2027 to $1.36 trillion – double the size of the market in 2020.

James McDonald, director of data, intelligence and forecasting at WARC, said: “Global ad spend is growing rapidly, with digital-first platforms capturing almost all the new money. Despite economic headwinds, including disruption to global trade and reduced purchasing power among consumers, brands are doubling down on Meta, Alphabet and Amazon, while emerging players like TikTok are growing fast but from smaller bases.”

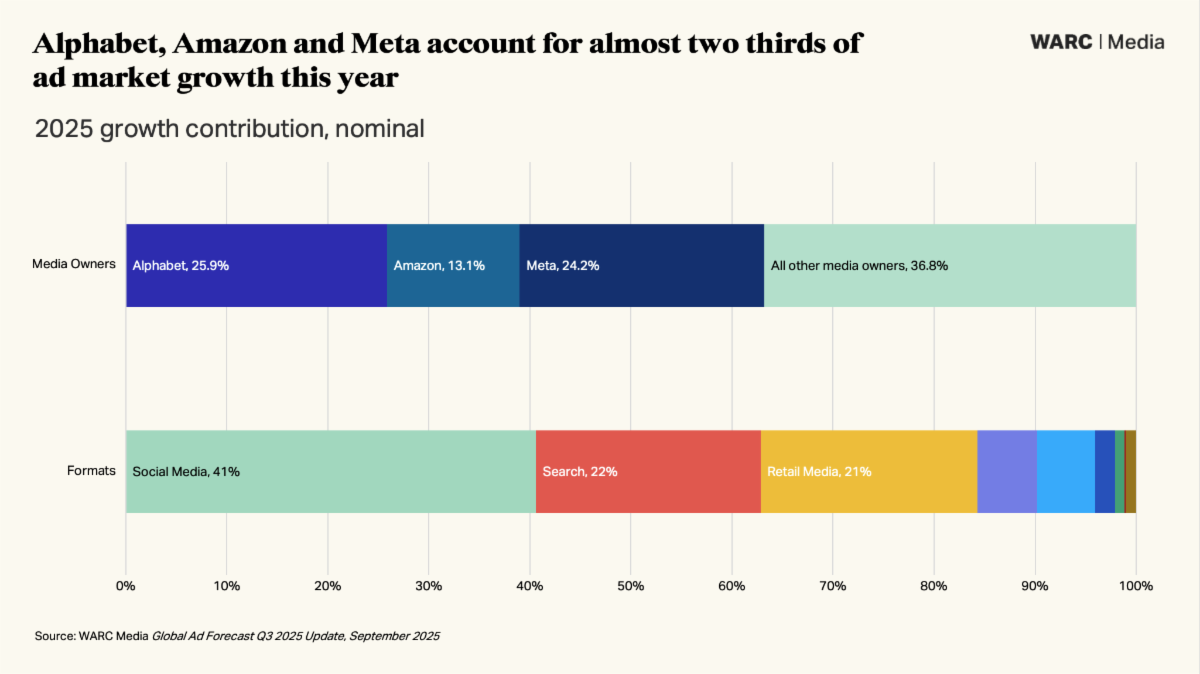

Online platforms dominate growth

WARC’s report found nine in ten incremental ad dollars this year are going to online-only platforms. Social media accounts for the largest share of new spend (40.6%), followed by non-retail search (22.2%) and retail media (21.5%).

Together, Alphabet, Amazon and Meta will take 55.8% of all ad spend outside China in 2025 – worth $524.4 billion – with their combined share forecast to top 60% by 2030.

Social media advertising alone is set to rise 14.9% this year to $306.4 billion, or more than a quarter of all global spend. Within this, Meta is expected to attract $184.1 billion – 60.1% of the social media market and 15.7% of global ad spend. Instagram is forecast to grow faster than Facebook, while TikTok continues to expand share at an average of 21.6% annually through to 2027.

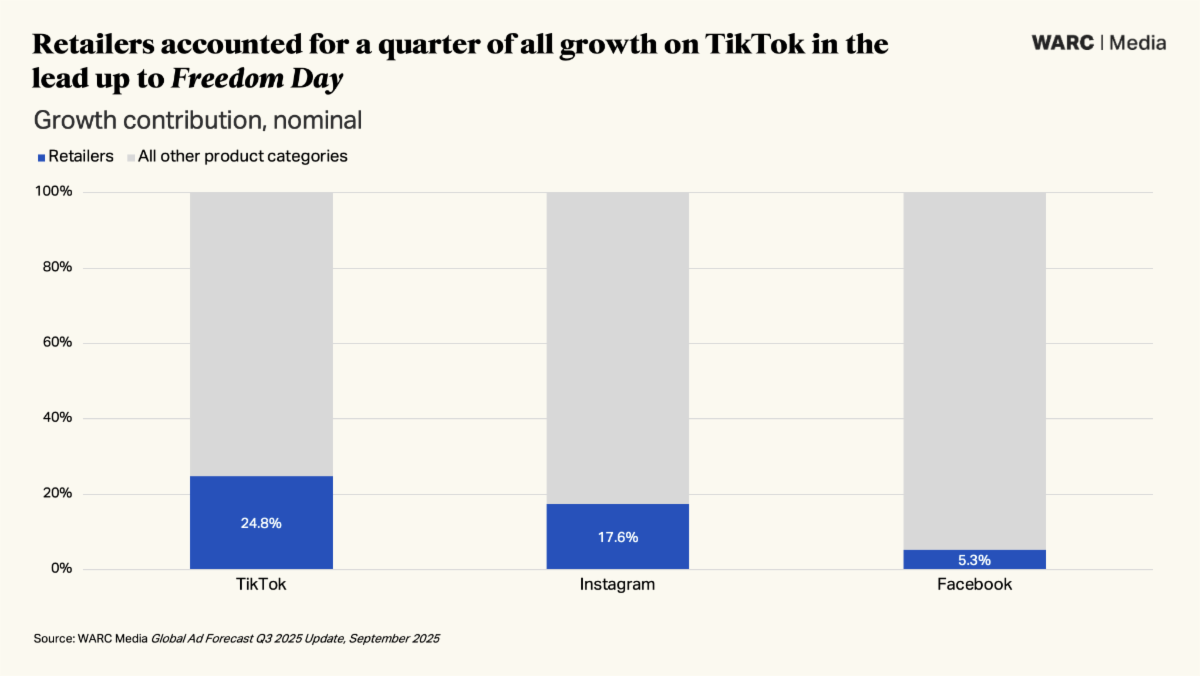

Retailers and tech drive Q2 windfall

The upgrade to WARC’s forecast follows stronger-than-expected performance in the second quarter of 2025. Pure play internet advertising rose 14% to $205.1 billion, accounting for 72% of total spend. Social media outpaced expectations, growing 20.2% in the quarter – $4.9 billion more than anticipated.

Retailers drove much of this uplift, increasing spend by 18.8% on Instagram and 56.8% on TikTok in the lead up to new US trade tariffs on “Freedom Day”. Technology and electronics brands also significantly lifted spend across Instagram (+$501 million) and TikTok (+$484 million).

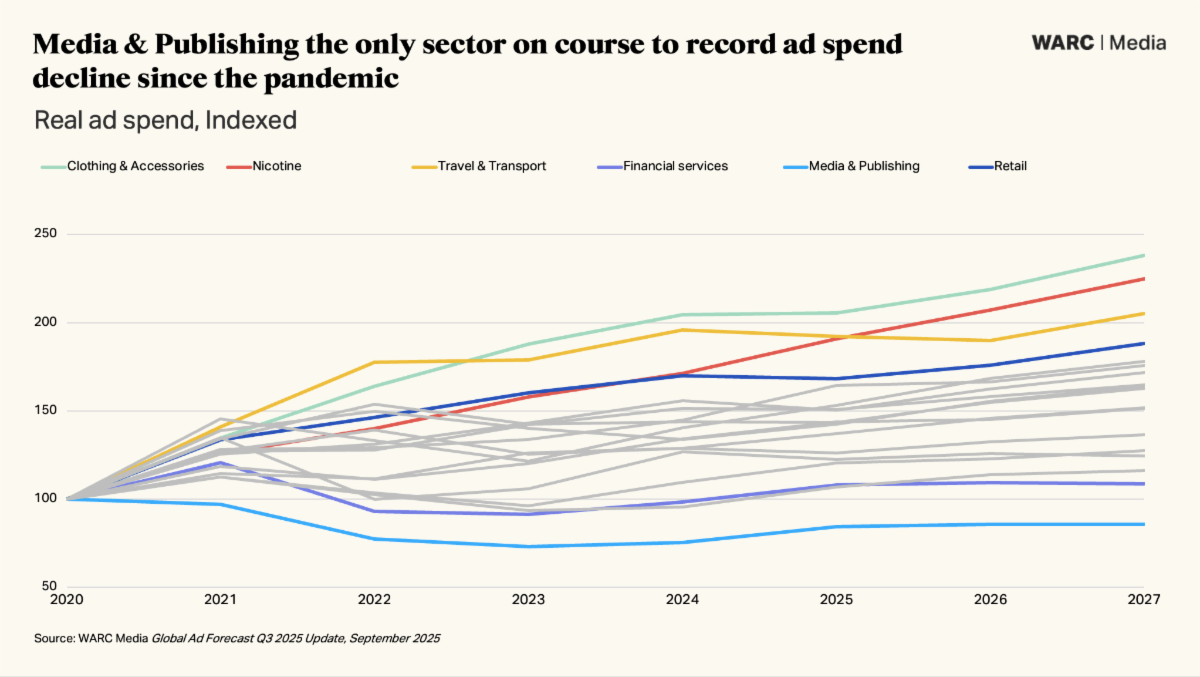

Post-pandemic shifts

The report highlights the shifting media mix since 2020, with clothing, travel and nicotine brands more than doubling investment since the pandemic. In contrast, media and publishing is the only sector on track for a real-terms decline by 2027.

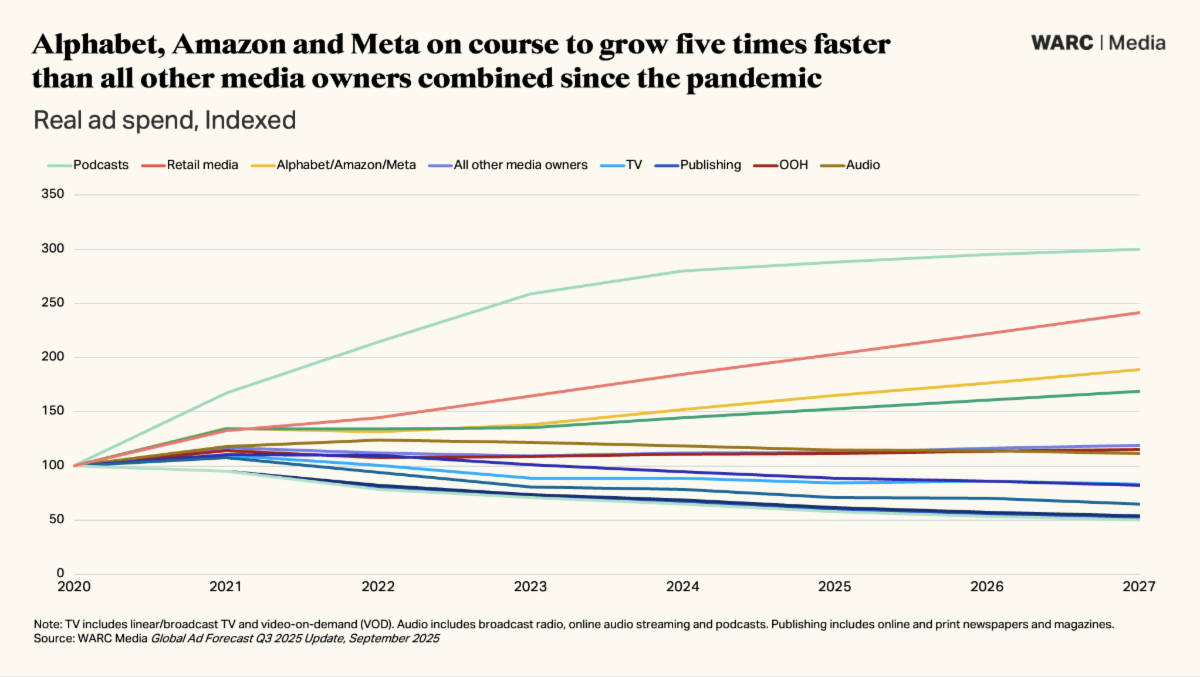

Traditional formats remain under pressure, with magazines (-49.9%), newspapers (-45.8%), broadcast TV (-35.2%) and radio (-25.7%) all recording declines since 2020. Digital channels, led by retail media, online audio and video-on-demand, continue to expand.

By 2027, Amazon’s ad revenue is projected to be three times higher than in 2020, while Alphabet is expected to be up two-thirds and Meta close to double. Combined, the three companies are forecast to grow almost five times faster than all other media owners over the period.

Top image: James McDonald