On Friday (Australian time) News Corp released its Fiscal 2024 (FY24) First Quarter (Q1) Earnings for the period ending 30 September 2023, giving insight into the highlights for the Foxtel Group.

See Also: News Corp Q1 2024: Group profitability strong with growth and challenges in Australia

Foxtel Group Highlights

• Foxtel Group adjusted revenue grew 2% year-on-year, representing the seventh consecutive quarter of year-on-year growth.

Subscription Video Services Segment Highlights

• Adjusted Q1 Revenues for the Subscription Video Services segment increased 1% compared to the prior year.

• Adjusted Q1 Segment EBITDA decreased 13% compared to the prior year.

Key Foxtel Group Subscriber Metrics

• Total Foxtel Group subscribers of 4.646 million (4.573 million paid, up 2% on prior corresponding period), primarily due to growth in streaming subscribers to Kayo and BINGE.

• Total streaming subscribers, including Kayo Sports, BINGE and Foxtel Now reached 3.084 million (3.013 million paid, up 8% year-on-year), up 6% year-on-year

– Streaming subscribers represented 67% of the Foxtel Group’s total subscribers (64% in Q1 FY23)

– Kayo Sports reached 1.411 million subscribers (1.403 million paid), up 11%

– BINGE reached 1.506 million subscribers (1.449 million paid), up 4%

– Foxtel Now reached 167,000 subscribers (161,000 paid), down 15%

• Foxtel residential and commercial broadcast subscribers were 1.543 million, down 7%

– Foxtel Residential subscribers declined 9% to 1.310 million

– Broadcast ARPU rose 3% to A$85+ (for the three months ended 30 September 2023, year-on-year), through a continued focus on Foxtel’s premium brand positioning

– Residential churn improved year-on-year to11.4%, down from 14.2%

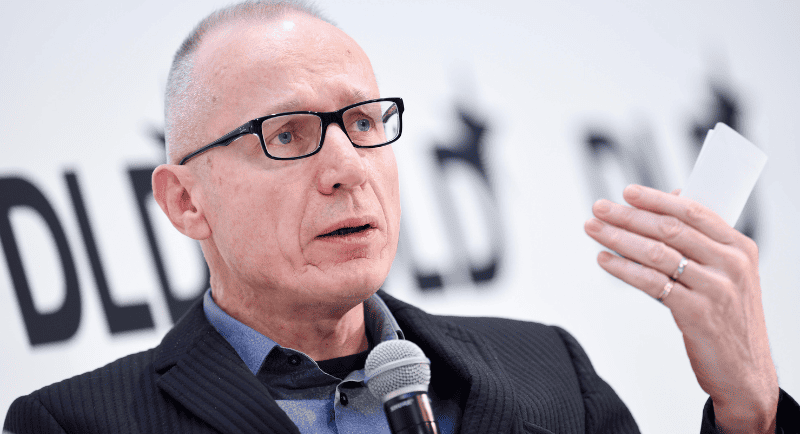

Speaking about the Foxtel Group at the Investor Briefing, News Corp chief executive Robert Thomson said: “At Subscription Video Services, revenues were up in constant currency – for the seventh consecutive quarter. As expected, the decline in EBITDA was mainly due to sports rights costs and forex fluctuations, but we have no doubt that our streaming strategy has been successful at a time when other companies in other markets are struggling.”

He continued, saying that: “Overall, paid streaming subscriptions rose eight percent on the same quarter last year, while Broadcast churn was down from 14.2 percent to 11.4 percent, showing that the two products are undoubtedly complementary. But the team at Foxtel Group is far from complacent, and so we are on the cusp of launching our new streaming aggregation product, Hubbl, which will greatly simplify the search for fascinating entertainment and sports, from our own companies and from those of our cherished partners, to the benefit of all, in particular, to the benefit of viewers.”

Robert Thomson

News Corp CFO Susan Panuccio added: “Revenues for the quarter were $486 million, down approximately three percent compared to the prior year on a reported basis due to foreign currency headwinds. Importantly, on an adjusted basis, revenues rose one percent versus the prior year, the seventh consecutive quarter of growth.

“Streaming revenues accounted for 30 percent of circulation and subscription revenues, versus 25 percent in the prior year and again more than offset broadcast revenue declines benefiting from both a year-over-year increase in subscribers and price rises at Kayo and BINGE.

“Total closing paid subscribers across the Foxtel Group reached almost 4.6 million at quarter end, up two percent year-over-year.

“Total paid streaming subscribers were three million, increasing eight percent versus the prior year, although declining sequentially impacted by less output at BINGE related to the strikes in Hollywood as well as typical seasonality at Kayo due to the end of the Winter sports codes in September.

“Foxtel ended the quarter with over 1.3 million residential broadcast subscribers, down nine percent year-over-year. Broadcast churn continued to improve, down 280 basis points year-over- year to 11.4 percent, while Broadcast ARPU rose three percent to over A$85, helped in part by a price rise for non-platinum subscribers implemented in July.

“Segment EBITDA in the quarter of $93 million was down 16 percent versus the prior year driven by contractual price escalators in Foxtel’s sports rights agreements. Adjusted Segment EBITDA declined 13 percent

“We completed the debt refinancing in the first quarter, which included securing a new A$1.2 billion credit facility. As we said last quarter, given the improved performance and the completion of the refinancing, this provides a pathway for repayment of our shareholder loans.”